Successful investors don’t follow the crowd. They look for opportunities most people ignore. Unfortunately, most investors are following the crowd. Again.

From 2000-2002, (at our previous firm) we advised clients to invest in boring industrials that had not been bid up with the technology boom. Investors in these stocks made money as technology plummeted 75%!

In 2006 and 2007, we advised clients to avoid risky financial stocks and banks. We knew that not only can home prices not continue to rise more than 3% per year that in fact they could sometime fall (and we wrote about it at the time). This helped our clients to lose less in 2008 and quickly recover, many by 2009 (while investors in indexes took until 2012 or later providing they didn’t panic and sell).

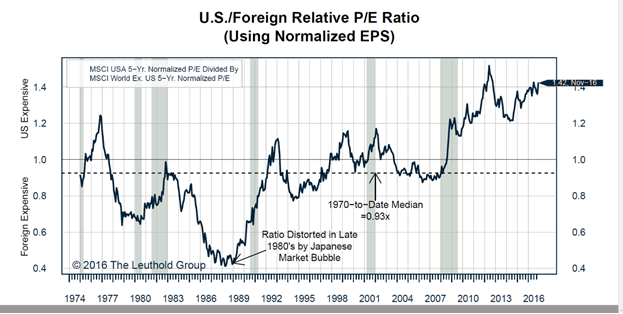

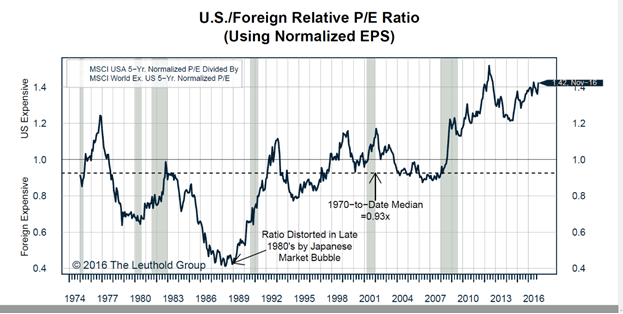

There is a lesson in this and it is that you should avoid buying overpriced stocks (like in 401k US closet index funds). Now, US stocks are about 50% more expensive than their international counterparts. This doesn’t mean ALL US stocks, but it does mean that it is not a good time to own a US index fund or a closet index fund like most investors have in their 401k plans!

This is a conundrum, because there is a lot of potential risk outside the US both in developed markets like the UK, Europe, and Japan, but also in emerging markets like China, Russia, India, and Brazil.

But investors often forget that there is no “stock market” unless you choose to participate in indexes. There is only a market of stocks or in this case, many markets of stocks (and bonds).

Great businesses exist in the US and outside of the US. Great businesses are those few select companies that we (due to Morningstar stock research) believe will generate high profits for at least two decades. You know GE, but are you familiar with the great business Asean Brown Boveri out of Switzerland? Similarly because you know Proctor and Gamble, a great business in the US, you are probably also familiar with Nestle, a great business in Switzerland that sells a variety of branded goods to the world. When my son wants a pizza, he would rather have a DiGiorno than delivery. Seriously.

Similarly you know Boeing and Lockheed Martin, great businesses in the US. Safran is a great business in France making aircraft engines, missiles, and rocket launchers.

The Morningstar stock research team, and the analysts of our favorite managers (who have skin in the game and whose first priority is to avoid losing money they can’t make back) spend a lot of their time looking at opportunities OUTSIDE of the US.

Analysts at Morningstar recently added to additional Great Businesses: Elekta AB (Sweden) and Waters Corporation (United Kingdom).

Remember, unless you are already retired, the majority of your meaningful investment experience has occurred over the last ten to twenty years. And because interest rates have been falling this entire period, active management has door worse than index investing. But during the period where interest rates rose until 1982, active managers did substantially better.

Just like we are looking at every asset class and every country to find equity, we are also doing this to find fixed income investments.

As we have stated for months, because we believe interest rates may be in an upward trend, we believe it will be harder than ever to make money in “lower risk” fixed income investments.

For this reason, we have been actively searching for ways to access the lucrative private company lending market. Because the financial crisis caused banks to “de-risk” their balance sheets, they essentially stopped lending to any but the largest companies. Which means companies with Cash Flow under $100 million typically borrow from private investors like hedge funds and venture capital firms. Many of these excellent growing companies pay interest rates of 8-9% but are very strong financiallly. And because the duration of the loans is often a year (with rolling increase in rates) interest rate risk is not a key concern.

Over the next couple of months we will be adding a couple of new strategies to client accounts to take advantage of this opportunity.