In Brief

We can predict that a new president would make changes to policy. But that doesn’t mean we can predict who will win and how the markets will react. It is predictable a Biden presidency would like higher taxes on high-income earners and corporations. What’s not predictable is whether he will have the clout to affect these changes. Moreover, it’s not predictable what other policies may have mitigating effects. Because we can’t predict this with any confidence, we don’t believe investors should make wholesale account changes.

It’s a fool’s game to try to bet who will win and exactly what will happen as a result. We prefer to stick to our knitting. A focus on solid bottom-up fundamentals is the most reliable way for long-term predictable results. At this time, fundamentals favor higher yielding bonds over safer ones. Fundamentals favor smaller companies over larger ones in the U.S. and internationally. They also favor international developed and emerging markets. The fundamentals for overpriced big-tech companies are not favorable. As always, we are happy to discuss this so that you can have a better understanding of your exposure to risk. That’s often helpful to determine if any changes are necessary. Contact us if you’d like to talk.

Contact us! Schedule a free, no-strings-attached conversation with the Global View team.

Longer Winded

Does Political Party Impact Returns?

Some clients have asked how a change in leadership could affect stock markets. Some are specifically worried that a Biden administration would raise taxes. This could cause the stock market to drop.

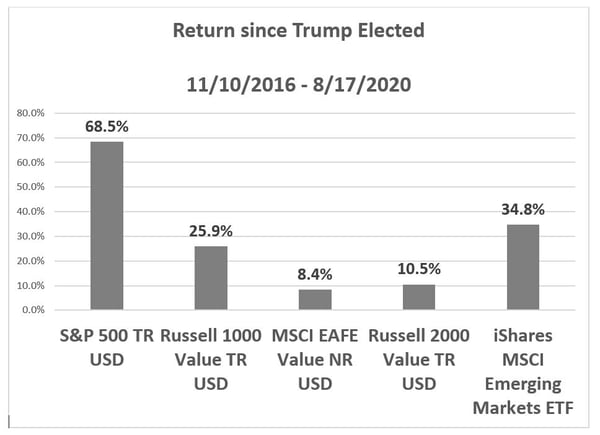

When Trump won, we had a few clients who believed his policies would cause a recession. Markets usually drop during recessions. A few clients reduced equity exposure. One went to cash. Since the president took office, the U.S. broad stock market index rose nearly 50 percent.

Please understand I’m not attributing this performance to any change in policy. It’s hard to nail down the cumulative effect of policy over time. Mitigating circumstances like monetary policy, valuations and interest rates influence the direction of the economy. The direction of the economy influences corporate earnings, which influences prices. Nonetheless, we can look to history for comparisons, however invalid.

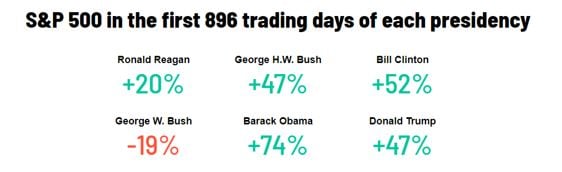

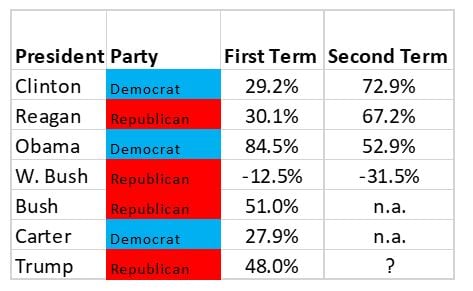

Trump’s first term performance is middle of the pack.

U.S. presidents may be elected for two terms. The only real lesson to learn from this is you didn’t want to be George W. Bush, who started and ended his presidency in recession – the first from the Dot Com bubble, which was not his doing, and the second from the Great Financial Crisis. The Great Financial Crisis was caused by banks taking excessive risk. This followed bank deregulations beginning in Clinton’s second term and continuing under Bush.

On the other hand, President Obama’s first and second term were strong. President Obama inherited a market already devastated by the Great Financial Crisis. Trump inherited a U.S. stock market that was already high on valuation metrics.

Jeremy Siegel, author of “Stocks for the Long Run,” studied this. He concluded returns after inflation were 10.6 percent p.a. after inflation for Democratic presidents and 4.8 percent for Republicans. The study covered 1952 to June 2020. Mr. Siegel believes a rollback of Trump’s tax cut would be a negative for stocks. However, Biden’s expected extra economic stimulus and stability in China would be a positive. (For more on this, click here.)

With Markets Up This Much, Should We Reduce Risk?

History teaches us that it’s a mistake to make decisions based on emotions. It’s why investors, left to their own devices, leave half of their potential returns on the table.

Remember, elections cause emotions to rise. When emotions rise, so does stock market volatility. When investors speculate who will win, it causes short-term price movements. The good news is that professional portfolio managers use this volatility to their advantage. The bad news is that amateurs get taken advantage of.

Professional investors and corporate insiders make the difference. Amateurs’ losses are professionals’ gains.

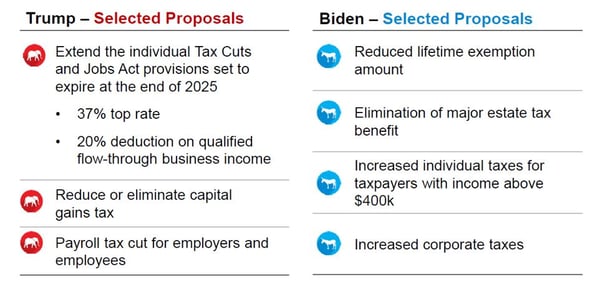

We do know what candidates propose. Basically, Trump wants more tax cuts, and Biden wants higher taxes on high-income earners and higher taxes on corporations.

An increase in corporate taxes would negatively impact 2021 earnings by about 10 percent. Furthermore, this tax would impact smaller U.S.-focused companies the most. Higher tax rates would influence where companies make capital investments. They can choose to make those investments in the U.S. or overseas. However, these changes are highly unlikely unless Biden wins Senate and the House.

The Coronavirus adds another layer of fear. While death tolls are dropping globally, the scare remains. Some damage to the economy, especially small business, may be permanent. Recent news about rapid tests by Abbot labs is very promising because it offers a path to resumption of normal business.

The rise in the stock markets was confined to the United States large companies. It didn’t happen in small companies and it didn’t happen overseas. Even in the U.S., returns between different stock indexes has varied wildly. Cheaper stocks (Russell 1000 Value index) are up less than half of the broad stock market. Cheap international stocks and cheap U.S. small caps are up only about 10 percent. Emerging market stocks are up about half the return of the broad market.

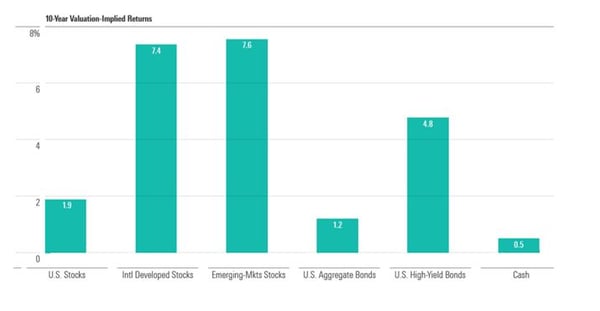

Moreover, valuations are substantially better overseas. And, having Coronavirus further in its rear-view mirror, some overseas economies and company earnings are growing more strongly. Based on current valuations, Morningstar forecasts suggest both international developed and emerging markets will strongly outperform the U.S. Moreover, low interest rates mean investors must take higher risk to get reasonable returns in bonds with cash offering near zero.

What We Recommend

Your portfolio is constantly being repositioned. Instead of owning passive indexes, we own active fundamental indexes. Portfolio managers reposition as fundamentals change. We discover better portfolio managers and other ideas and make changes slowly. We understand the valuation disparities and the consequences of different tax policy. If fundamentals change, we make changes.

At this point we don’t recommend any wholesale changes to portfolios. The truth of the matter is no one can predict who will win the election. Fear causes most investors to freeze. But cash is no place to be. And we shouldn’t overestimate how quickly a new administration could make changes.

We have clients ask if they should be invested in hot tech companies.

We always have clients asking if they should be invested in the hottest companies. We admire what Apple and Tesla have done. Steve Jobs created the best consumer experience and banked it. Elon Musk is a visionary. Charlie Munger: “Don’t underestimate who overestimates himself.” He will create great things. But there are always better companies coming up. And they face incredible competition.

We understand this is a multiple variable equation. Growth, quality and valuation are the pillars of fundamental attractiveness. During the Coronavirus recession, our friends at Grandeur Peak did some wholesale repositioning. They subsequently surprised even our high expectations. An idea they found is a company called Oxford Immunotec. Oxford Immunotec conducts studies and trials on the immune system. This research leads to treatments and insights into Coronavirus and cancer.

We see much hope ahead for the United States and the rest of the world. And we don’t think any one politician can derail it. Because at the heart of the matter, we all share the same goals.

Thank you for being a loyal client. We appreciate you and work hard to do our best. Feel free to reach out if you’d like to talk.