In Short – Good News on Many Fronts but Volatility Ahead

The election may be over. But results are contested. Some races require election runoffs. The president’s campaign has made accusations that must be proven. Most observers agree divided government is likely. This has pleased investment markets. The global shutdown at the onset of the COVID-19 scare caused valuation disparities. Technologies stocks soared. On the other hand, cyclical stocks suffered more than warranted. Stocks did not benefit from the crisis or government support got cheap and stayed there. Bonds in some sectors also remain beaten up.

Pfizer/BioNTech and Moderna both revealed vaccines with 95 percent effectiveness. This was a best case. While there will be more questions, side effects are likely to be minimal. This type of vaccine leaves the body within 2 days. The Moderna vaccine, unlike Pfizer’s, can be easily stored and distributed. More companies will reveal more vaccines.

Low interest rates, low inflation and difficult-to-find yield make investing a difficult time to index in indexes. Within the index are overvalued and undervalued stocks and bonds. It remains to be seen how dire the second wave will hit our economy. Death rates have fallen substantially. Government leaders walk a thin line to balance the economy against virus threat.

We are hopeful the good to come from this crisis is a reduction in regulations to get drugs to market. It makes it even more possible to develop life-saving treatments and cures.

Long Winded – Return to Normal Following Near-Term Uncertainty

The COVID-19 recovery stock market benefited big technology stocks to the detriment of everything else. At this juncture, the more important story is the economic recovery story. Not only has Pfizer announced a vaccine that is 90 percent effective, so has Russia. Moreover, unprecedented public/private partnership make it possible to mass produce the vaccine; 100 million can be available by the end of March of next year. This, combined with rapid cheap testing, create the possibility of a “return to normal.”

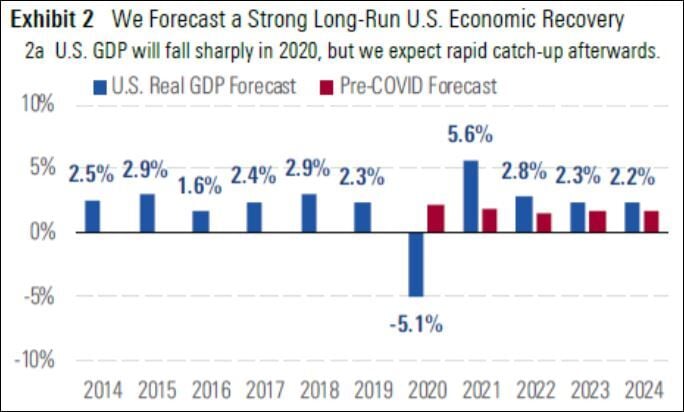

Morningstar continues to project a very strong economic recovery. They believe a vaccine would be available by the end of 2020 or early 2021.

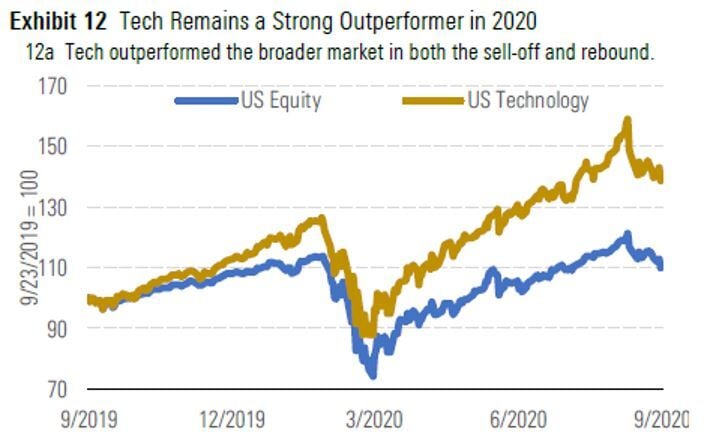

Technology Stocks rebounded far more than the broad U.S. stock market.

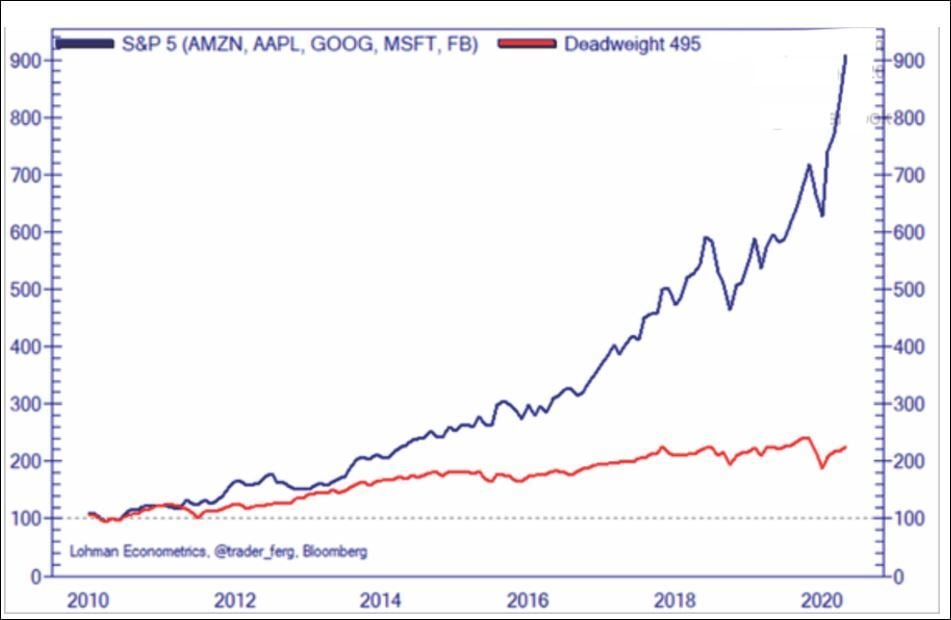

In fact, this phenomenon is not only recent. There is a fundamental reason that technology stocks have done well. In 1997, Bill Clinton, together with a cooperative Congress, passed a Global Framework for Electronic Commerce. This framework ensured innovation could occur with minimal regulation and that innovators would be rewarded for their effort. This is a major contribution to the digital age, which saw the rise of Smartphones, texting and apps and changed the way we work and communicate. And innovate.

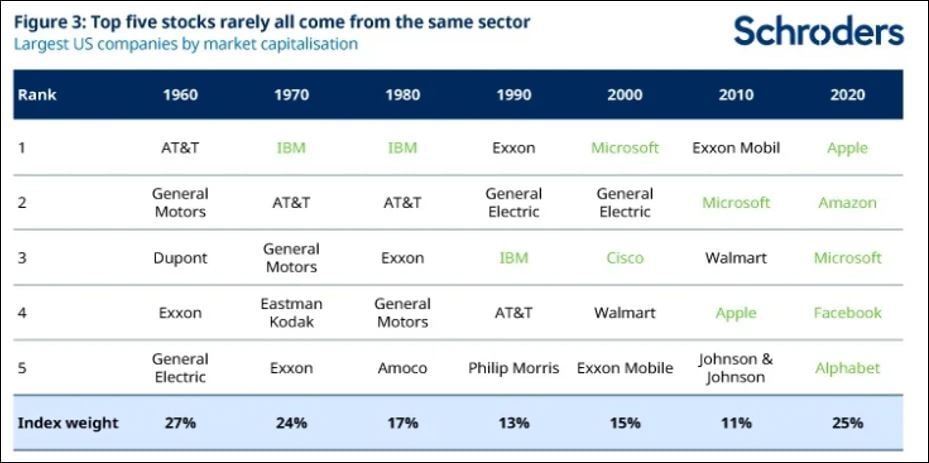

This was easy because there were few established digital incumbents. But this is not the last time a few companies dominated the market. Here is a list of the top companies over last decades:

Ironically, it is when things are free that they become ubiquitous. Consumers benefit but third parties may suffer. To regulate this, the law generally requires proof of consumer detriment. The U.S. Department of Justice has a lawsuit against Google alleging third-party detriment. This will take some time to settle and may not work out.

Based on history, new companies will replace the big five. It costs $1 billion ($1,000 million) to bring a drug to market and have it approved by the FDA. The COVID-19 pandemic made it possible to get a vaccine to market and mass distributed within a year. Pfizer promises to be delivering by December. Imagine we continue reducing the unnecessary bureaucratic and legal hurdles to discovery. We could reduce this to $500 million, then $250 million, then ... You don’t have to imagine. The National Health Institute is already using artificial intelligence to find ways to cure disease. This technology uses 3D holograms to model drug discovery. It’s directed at many pathways to treat and cure many diseases including cancer.

It is not only healthcare where great strides forward in innovation are happening. Innovations in energy occur at a staggering pace. Fourth-generation nuclear reactors create the possibility of boundless, safe, green energy. It is possible, very soon, that small nuclear reactors will consume old waste. These reactors will be impossible to melt down. They can be manufactured at scales small enough to power smaller cities. Battery storage breakthroughs allow a future for solar power as well. But limitations in sunlight and proximity to end users mean this will be supplemental. It’s hard to imagine solar or wind power powering manufacturing grids.

I cannot say when these changes will happen. But I have no doubt all major disease, including cancer, will be cured. Energy will be so abundant as to be free, and green. Eldercare will be delivered using artificial intelligence. We have already learned how to end sudden killers like heart disease, provided there is early detection. Early detection and preventative measures and medicines reduce likelihood of dying of a heart attack every year. We’re even making headway on medicine that used to be “alternative.” Researchers at the National Institutes of Health (NIH) have proven parasites in the gut are influential in preventing and treating disease.

These same technologies enable a reversal of the deterioration of air and water quality. They allow a future where we can end industrial agriculture. I envision a future where most people will live underground with full access to nature outside. I believe our ancestors will travel to the stars.

And I am thankful to be with my family this year at Thanksgiving. Happy Thanksgiving.

At the same time, we must not be too optimistic about how fast these changes will happen. We also must avoid making bets on breakthroughs without evidence. Instead of betting on unproven technologies, we already know a lot of effort is going into exploration of new potential curative approaches to cancer. This means a lot of research. Someone must conduct the research. Grandeur Peak is betting on companies doing that research for service fees.

Looking at 2021

Sometime soon the guard will change. Underappreciated stocks become more appreciated. The richer stocks will lose their luster. Every fundamental factor we look at supports this thesis. The economy returns to normal following a crippling recession. The vaccines provide this catalyst.

Second, interest rates will eventually go up. This means future earnings are worth less because of inflation. It makes it harder to value a company on growth of earnings.

Third, its often more expensive to capture a larger share of a market.

The fourth change is the most difficult to predict timing on. Disruption is the heart of competition. It may be hard today to see exactly what forces leads to Amazon’s dominance. Historically it has been from somewhere no one was looking. Amazon doesn’t have to go away. But 10 years from now, the company is likely to be less dominant.

For lower risk investing, we still like two markets. Private lending provides a liquidity premium for similar risk to corporate bonds. Residential mortgage-backed securities are safer than corporate bonds and have higher yields. Both spaces require knowledgeable active investors. We selectively use active investment grade and high yield bond managers to diversify returns. We dislike anything close to bond indexing. They own primarily government bonds, which we see having near-zero return long-term.

In equity, the greatest opportunity clearly lies off the beaten track. Smaller U.S. and international stocks offer the best opportunity. We also like our moat investing strategies including our stock portfolio. Grandeur Peak owns companies like Dechra Pharmaceuticals, a British company that sells drugs for pets. Another larger fund owns WNS holdings. It’s another British company helping small business outsource services to compete globally. KnowIt is a Swedish IT development and implementation firm.

China will continue to be a powerful economic force. Despite tyrannical rule of the people, companies are lightly regulated. This allows rapid innovation. Despite the European Union regulatory environment stifling innovation, some companies shine. Over the last two decades, the United States was following this path. Smart regulation is necessary but should be minimized and applied transparently. We hope that’s the good that comes from this crisis.