In Brief

Morningstar updated its economic forecast this week. The U.S. economy bottomed in April and saw a strong uptick in sales in May, jobs in June. The bulk of the jobs lost were in services, unlike any recession in history. Perhaps that’s because this was the first recession in history mandated by government decree. The strongest fiscal stimulus since World War II caused personal income to actually rise. Most of that income was saved.

Despite a sharp recovery in most U.S. stock and bond markets, cash on the sidelines is the most at any time in history. Moreover, there remain ample opportunities for discerning buyers. Pent-up demand from the COVID-19 shutdown creates opportunities. It is now likely that companies weathering the storm will recover earnings in mid-2021. This means opportunity because markets have not recognized this.

Let’s take a look at how our strategies have done. First, our global small cap managers have finally showed their ability to add value. For the first time in a while, they are substantially ahead of U.S. markets. Residential mortgage backed bond funds lagged coming out of the crisis. This has recently reversed. Based on Morningstar’s new economic forecast, these may recover in the next six months to a year. We’re excited about these and new opportunities.

More Detail

2021: Year of the Phoenix?

You may remember that Morningstar had two economic scenarios: A base case and a worst case. We used this to model the worst case for the mortgage backed bonds. It was also the worst case for the worst-hit cyclical industry stocks. Based on the new forecast, those companies with strong balance sheets and business models may come roaring back. These could include retail, restaurants and travel companies.

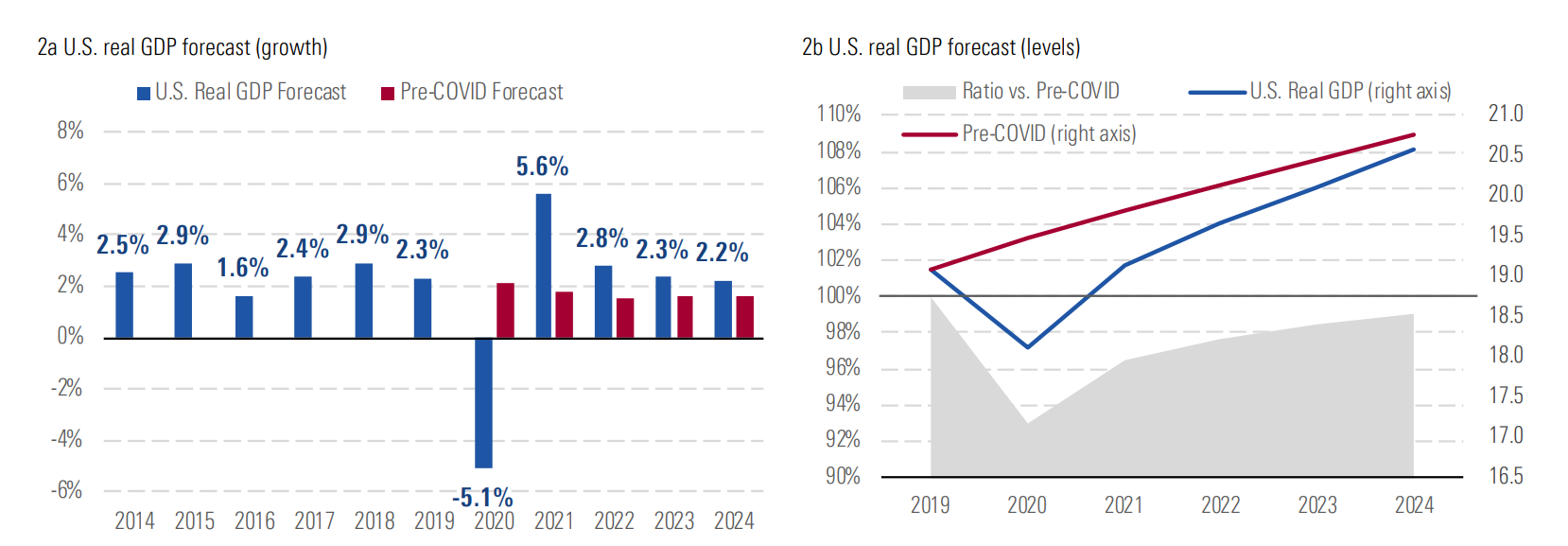

Morningstar’s updated forecast: The U.S. economy will drop 5.1 percent in 2020, the worst drop since the Great Financial Crisis, which was 4.3 percent. However, because this was an exogenous shock due to government shutdown, it will be short-lived. As people get back to work and a vaccine is behind us, the economy will roar back. Morningstar forecasts a vaccine will be widely available, globally by mid-year 2021. Furthermore, they predict 2021 GDP to be a rise of 5.6 percent, which is the best since 1984.

Morningstar predicts most global economies will be back to Q4 2019 production levels by the end of 2021. This can happen because the bulk of the recession was due to a drop in consumer spending. But combined with federal stimulus, incomes actually rose. This means the pent-up demand for goods and services may cause the economy to roar to life in 2021.

Have questions about your portfolio? Contact Global View to see how we can help.

Reviewing Performance

Our higher risk managers have substantially outperformed expectations so far this year. The sharp drop in stocks created the best opportunity for portfolio managers to reposition in many years. Like during all such crises, the baby is thrown out with the bath water. Stocks were sold without regard for the underlying quality of the businesses. This allowed the global small cap strategies to pick up stocks selling for fractions of their value. In our own in-house stock portfolio, we took the opportunity in many accounts to pick up oil and gas companies selling for less than half of their fair value.

The combination of these led to impressive performance.

Medium risk managers have disappointed because this recession was not predictable. These managers owned stocks in cyclical industries. Many of these were punished the most during the crisis. Historically, they avoided these problems by keeping a close track on the economy. A combination of lower risk and higher risk strategies would have performed similarly.

Our biggest disappointment has been in our most conservative positions. Residential mortgage backed bond funds fell more than any time in history. Strategies positive in the Global Financial Crisis failed this time for a simple reason. The recession and bear market were not predictable. This recession was caused by mandated government foreclosure of entire economies. Leverage in the thin market caused technical pricing problems pushing conservative strategies down 20 percent. Thankfully, as new investors entered the market, it is beginning to heal. About one-fourth of the loss was recovered in the last month alone. We did our own due diligence after interviewing the portfolio managers. Our conclusion is that this was unavoidable and unlikely to ever recur, even should COVID-19 be worse than predicted.

On the bright side, opportunity in areas of fixed income opened up. We knew the high yield bond market offered little return for high risk. Now, there is return for risk. The most attractive market in this environment remains residential mortgage backed securities. Corporate, high-yield and direct lending markets are now also attractive. We are taking advantage of these opportunities a variety of ways.

Going Forward

As a team we have highest conviction in our higher risk and lower risk strategies. The valuation disparities create a compelling opportunity set. However, the short-term plays out.

Higher Risk

For higher risk, we will continue to focus on two main areas:

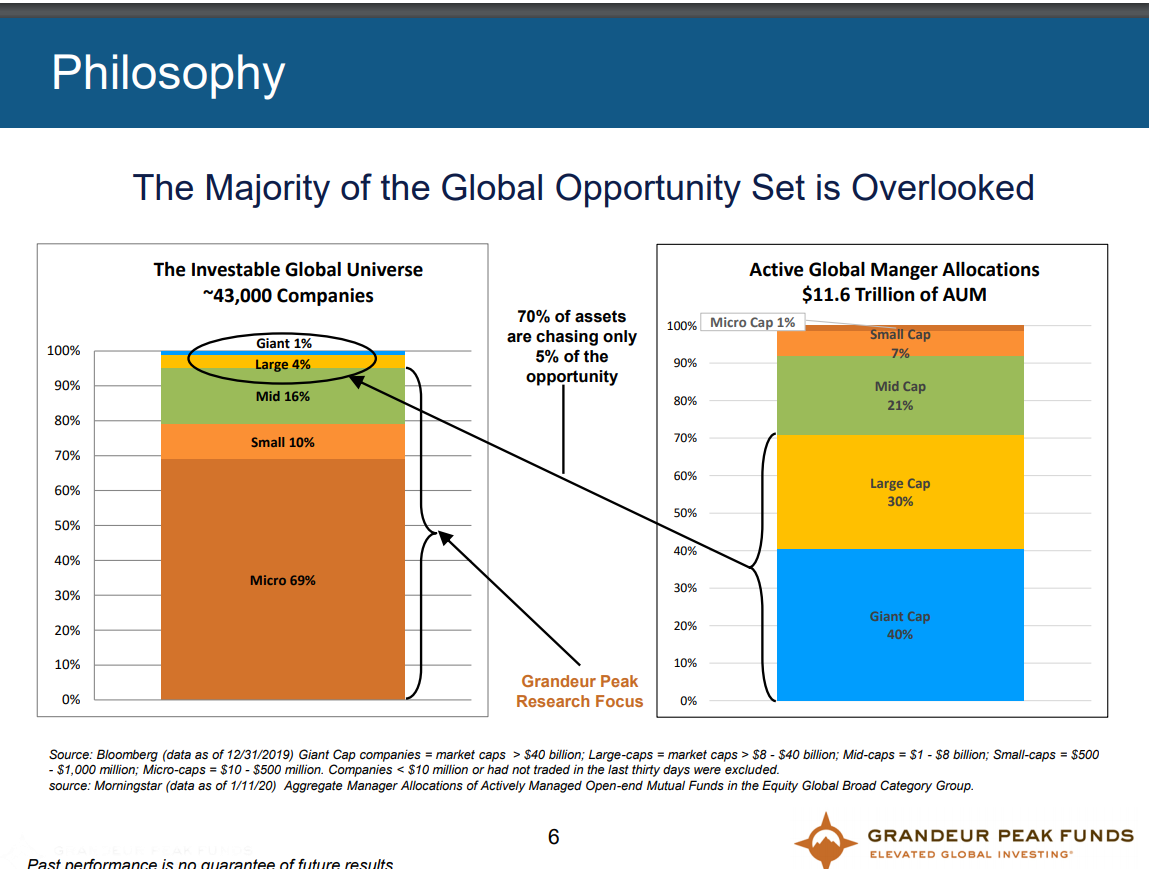

The greatest valuation disparities are in smaller and mid -size companies both in the U.S. and the rest of the world. These are in the United States, developed world and even in emerging markets. It’s important that each security be evaluated independently. There are more than 40,000 investable companies. Yet 70 percent of assets are focused on only 5 percent of the opportunity set. This makes no sense.

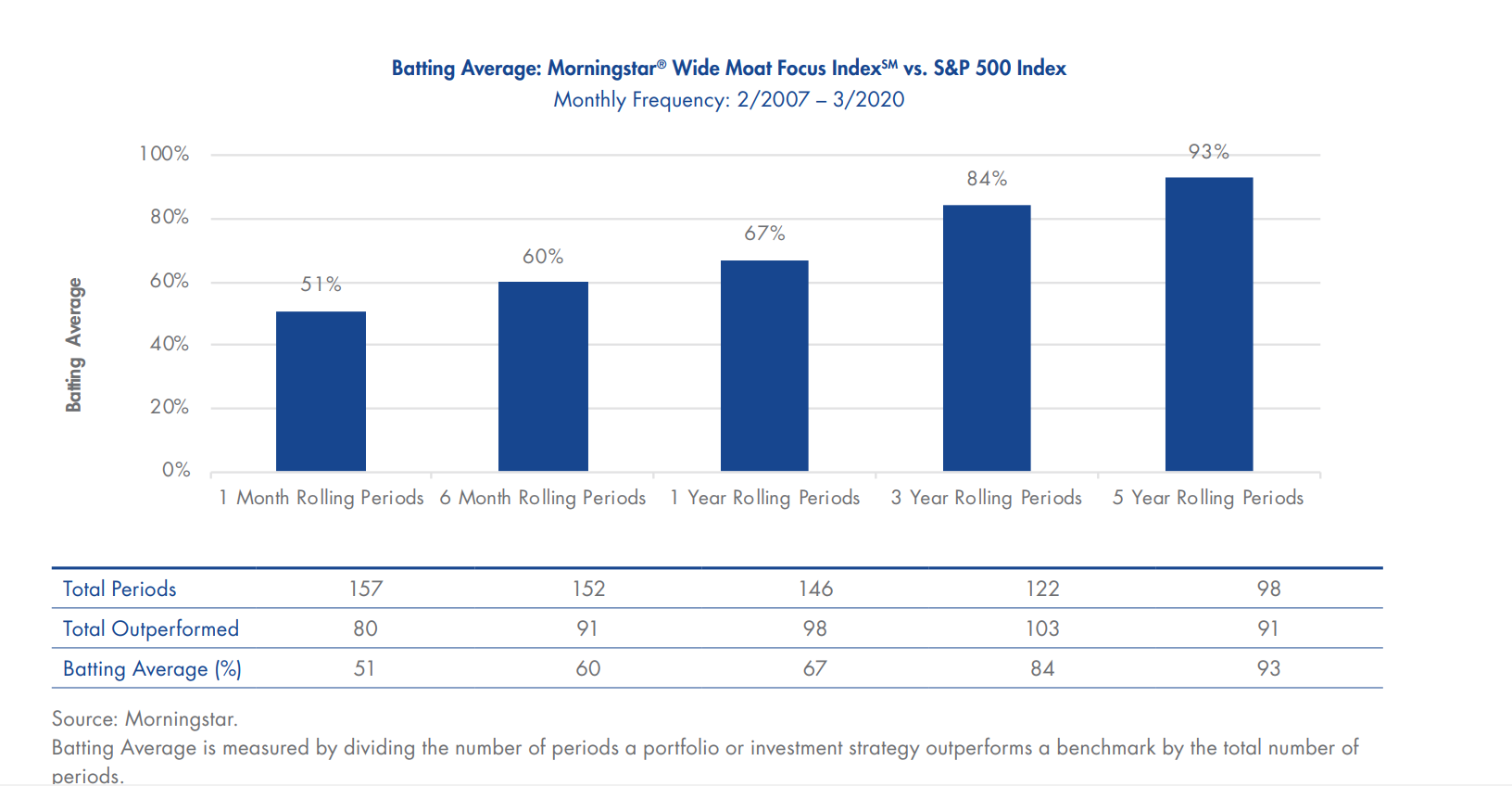

Second, it still makes sense to own the best of the best companies. These companies are primarily in the U.S. and rest of developed world. We call them “wide moat” because they have a well-established advantage over competitors. This advantage affords higher margins, which we believe are durable for a long time. We use this thinking in our in-house stock portfolio. We also use it using Exchange Traded Funds (ETFs). We believe this is a reliable way of gaining predictable, lower long-term risk to major markets. Below is a graph showing Morningstar’s research on this method of investing. Please note, investors cannot invest directly into an index, and ETFs and strategies have fees, which can reduce performance.

Lower Risk

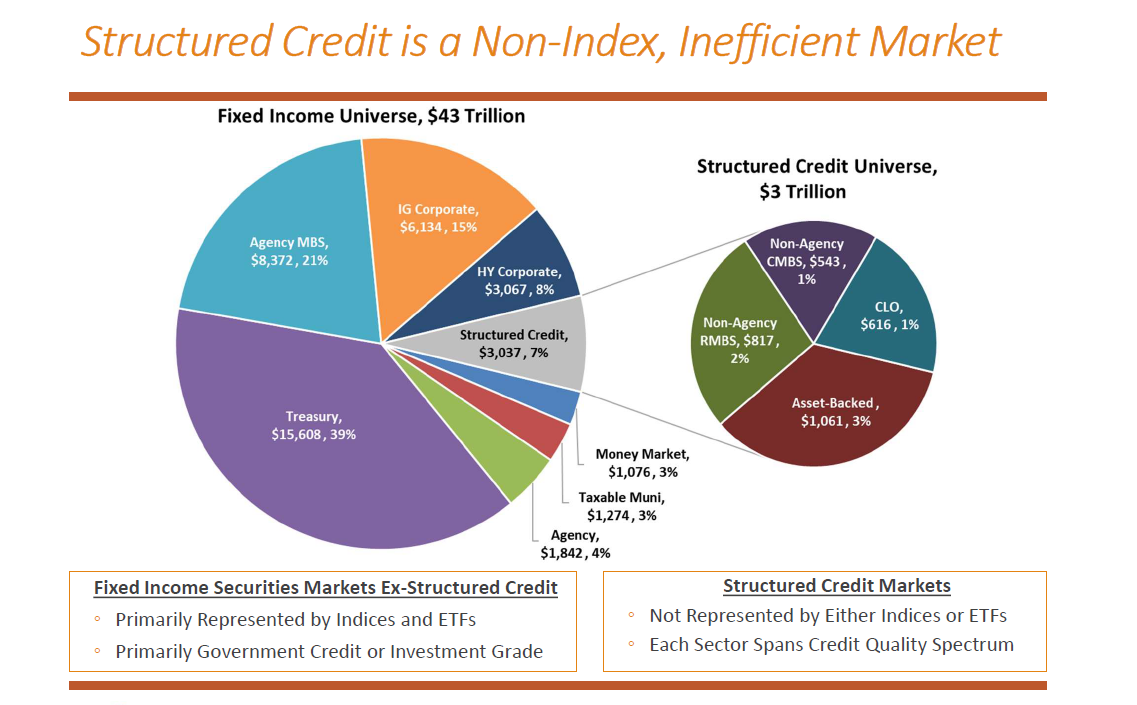

The global fixed income dwarves the global equity market. There are more than $43 trillion in various fixed income securities. Of this, about $3 trillion is in the structured credit universe.

The recent flight to quality made interesting investments government bond hard to find. But it created opportunity in all the other sectors. We continue to favor the residential mortgage backed securities. We used this opportunity to find several new strategies. We’re not worried about inflation in the short-term. But we know it could rear its ugly head late next year. This is no time to sit in cash. In the future, it will create even more pressure on savers.

Putting It All Together

The ability to select the best of the best in fixed income and the best of the best in global equity provides an exciting opportunity for investors. Despite the recent rally in the most obvious names, we’re still excited. Whatever the short-term future may hold, we are confident in our investments.

Please reach out if you have any questions or want to talk. Remember, what happens in the short-term has minimal impact on your wealth, unless you act, the wrong way. We can’t predict the future in the short-term. But it is our hope and belief that is the driver of the long-term. We’re bullish on the world. And we’re bullish on human spirit around the world. Thank you!

.jpeg)