If you don’t yet realize that Trump will use every card in foreign policy to achieve his objectives, you haven’t been paying attention. He’ll do what’s necessary against China to thwart theft of technology and reduce tariffs on goods we import. Now we also know he will use tariffs to achieve other objectives, like reduce illegal immigration from Mexico.

According to Mohammed El Erian, an economist who was so worried in late-2008 that he got as much cash as he could from as many ATMs as he could, fearful banks would collapse, and there are three possible outcomes. The first and most likely is a short-term trade deal at 65 percent. A second possibility is a “Reagan moment,” 15 percent. A full-blown trade war is 20 percent odds. The longer it takes to resolve, the more likely it becomes we get a Reagan moment or full-blow trade war.

Economist Robert Shiller sees the trade war as theater. Both Xi and Trump are strong politicians. This theater causes investors to be overly emotional and overemphasize the effect of the (likely short-term) tariffs, because companies can shift things around. This creates opportunities for enterprising investors. But because volatility has picked up, it is likely to persist for several months.

Finally, often investors seem disappointed that they didn’t get a market return in the last year or two. But what they don’t realize is that very few investors get a “market” return over the long run. Looking at history (recent or especially the very long run) to forecast future returns is overly simplistic. Which is why it is not our objective. Our objective is to help our clients preserve what they have. So, they, or someone they love, can use it at some point in the future.

Have a question? Contact Global View to see how we can help.

When is the Next Recession?

Eventually we will get another recession. Some credible firms forecast the next U.S. recession could begin as early as mid-2020. Interest rates have dropped to a level suggesting bond investors feel a recession will come sooner rather than later.

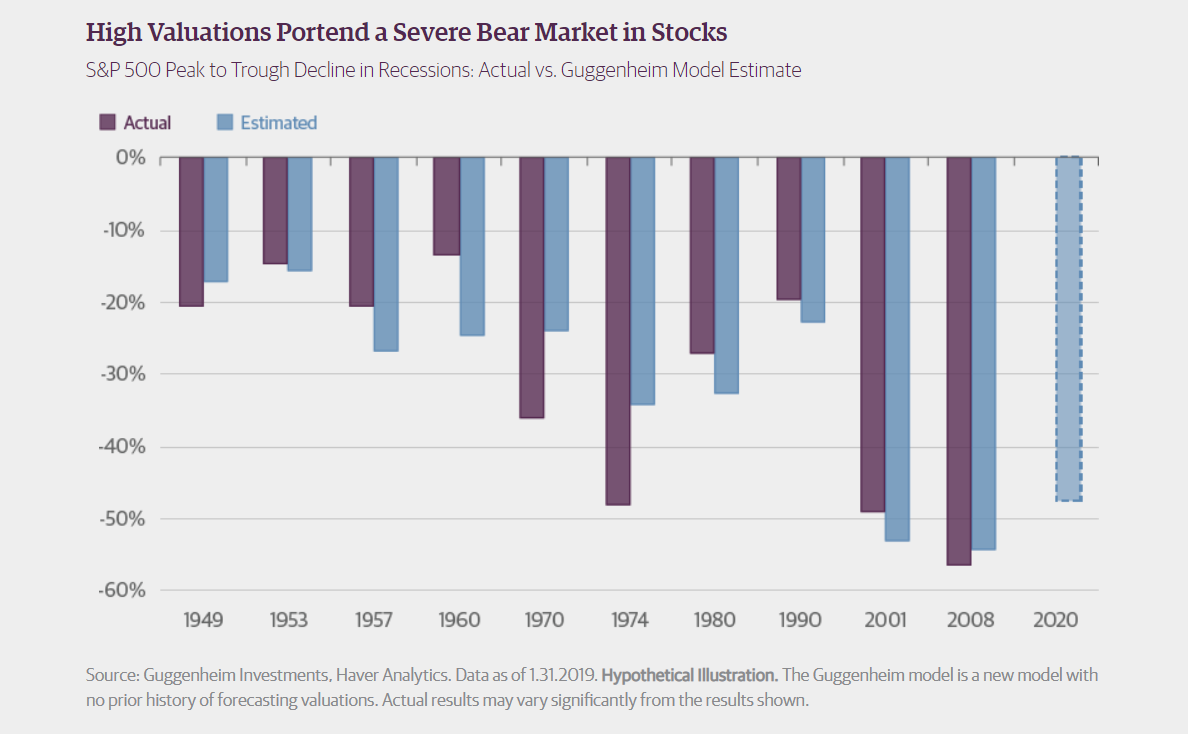

Guggenheim Chief Investment Officer Scott Minerd believes the next recession will be average, i.e. nothing like the Financial Crisis, instead more in line with the recession of 2001. However, high valuation U.S. stocks could easily drop 40 to 50 percent. On the positive side, the housing market is not overheated, the banking system is sound and capital stock is only slightly elevated. Fed policymakers are likely to react much faster than in prior cycles. However, because the current period is the most polarized in modern history, it might be more difficult, for example, to get a spending bill passed prior to the 2020 election. The chart below illustrates Minerd’s view.

To be clear, I do not know. There is no way to know. At the same time, investors who have most of their money in U.S. equity indexes might be in trouble, like in 2001, when stocks fell 45 percent. Remember though, at that time, sound fundamental strategies did well in both absolute terms (rising over the duration of the bear market) and relative terms (doing substantially better than the market indexes).

Another warning is that credit losses were more severe during the 2001 recession than 2008-2009. It’s why we’ve been careful about high yield bond exposure.

What we do know is that the Fed is ready to cut rates immediately, if necessary (which includes if trade war escalates). Fed Chairman Powell said he will cut rates if inflation falls below 2 percent, even if the economy appears strong. But recession risk makes it imperative to avoid the riskiest of assets during recession. Specifically, high-yield bonds and low-quality or overvalued equities.

This is why we’re fervent about active management. We don’t want to lose money we can’t make back. Just last month, I had an opportunity to speak with some of the best Portfolio Managers in the world. They all share one common trait. They don’t obsess about what the economy and markets are going to do. They pick stocks (and bonds) bottom up.

Established Quality Companies Vs. the Up-And-Comers

Portfolio Managers we employ consider investment quality. Higher-quality companies generally have an enduring ability to earn higher profits than their peers. The higher the quality, the more you are willing to pay for future earnings because those earnings are more predictable. Morningstar Select stock research ranks these companies as having a Wide or Narrow Moat. In their analysis, Wide Moat companies are expected to earn outsized profits for more than 20 years; Narrow Moat companies for more than 10 years. There are only 296 companies Morningstar classifies as Wide Moat (178 in the U.S. and 118 outside of the U.S.). Morningstar covers a little more than 2,000 companies. Of this, about an additional 757 have a narrow moat.

In a recent letter, Charles de Vaulx and Chuck de Lardemelle of International Value Advisors recently touched on why they own stocks globally. Some companies have businesses that cannot be replicated in the U.S. Fanuc, a Japanese company that uses robots to make robots, is the leader in industrial automation. Richemont, a Swiss company, commands excellent margins and market share in luxury goods including watches, leather goods, clothing and writing instruments, like Montblanc.

While Portfolio Managers do their own analysis to determine what is high quality, they understand high quality companies stay high quality longer than you would think. Companies that have established an ability to earn profits generally have learned how they can continue applying these systems to maintain high profitability. Warren Buffett knows this too. But they can’t do it for every company. That’s where creative destruction comes in, giving rise to new small disrupters. Many of these international companies remain controlled by owner-operator families committed to their long-term success over quarterly profits.

On the other hand, the income gap between rich and poor has become the widest in history. The winner-takes-all economy has punished labor to the benefit of big businesses. This is not a call for socialism. Instead it’s a call for increasing competition through better antitrust regulation and reform of patent laws. Google commands 90 percent of the search-traffic market. Facebook, 80 percent of social traffic. Amazon, 75 percent of book sales and 43 percent of the e-commerce market. These companies fell through the cracks of antitrust regulation. Blackrock, Fidelity, JP Morgan, State Street and Vanguard now own 80 percent of the shares of S&P 500 companies.

The companies command authority historically relegated to large governments. This freezes out new competitors and deters investment in creative destruction. It’s caused most people in western countries to no longer believe capitalism is working. Better antitrust laws, ending lobbying and crony capitalism, revised patent and copyright protection and better own-operator shareholder policies can make this better.

But if you want to own tomorrow’s higher-quality companies, you must look for up-and-comers too. Up-and-comers are the future Microsoft. Sure, some of these could be Narrow Moat companies already. But odds are most of these might not even be covered by Morningstar yet, much less have a Narrow Moat.

There are 40,000 companies in the world, of which 36,000 are outside of the U.S. That means it’s imperative to have a global mandate. Historically, having a global mandate allowed the legendary Jean-Marie Eveillard to do well during the 2001 recession even when market indexes were crashing. It also allowed Robert Gardiner to do well, who now runs Grandeur Peak funds. And because the landscape outside the U.S. is much different, cyclical companies there often get cheap as stock prices of high-flying U.S. companies soar. For example, BMW has four times the revenue of Tesla, but recently traded for nearly the same market capitalization (has since corrected 40 percent). BMW has best-in-class profitability while Tesla loses money.

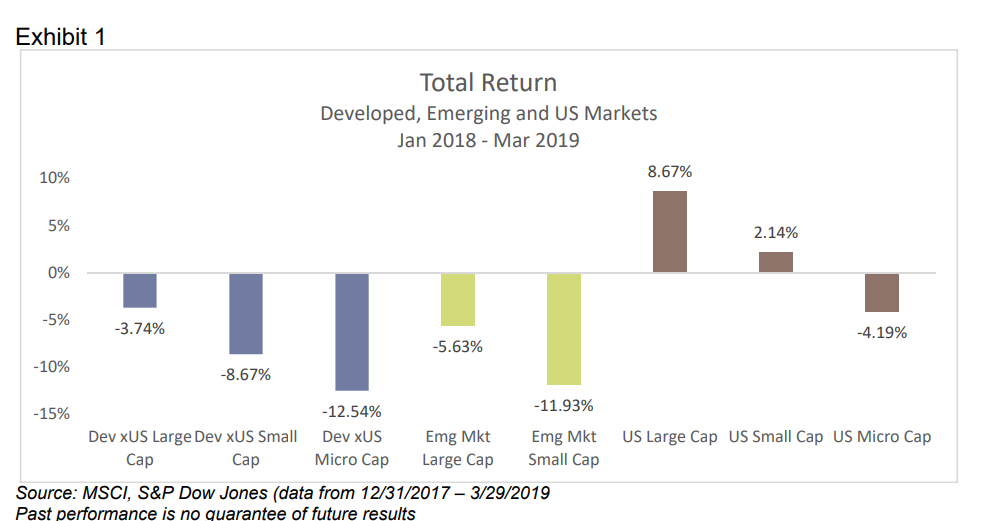

Revisiting 2018

Last year was one of the most terrible years for international managers, and especially international managers invested in value stocks, in a very long time. This means that investors focused on fundamentals did the most poorly, while those chasing momentum fared best. It’s the same old story that has never historically ended well. Of course this time could be the first but of course the odds are not in favor of that.

Of note, international, especially smaller international, indexes remain far behind the U.S. since the beginning of last year.

What’s Next

In this new era of aggressive monetary, and likely upcoming fiscal, policy, it’s hard to predict where the overall economy will be and how global stocks and bonds will react. That said, there are some knowns. The Fed has expressed support to lower rates if the economy appears in trouble. It’s likely politicians will unite to pass a quick fiscal stimulus in the event of imminent recession. But, because we like to think in terms of probability in an attempt to avoid losing money we can’t make back, I’ll introduce a new concept to you: Ergodic. Ergodic is the probability a given state will recur, for example, that an investment will lose money. I didn’t know the word when I started looking at rolling returns many years ago. The term is described well here by Nassim Taleb: The Logic of Risk Taking.

To summarize this, in order to succeed, you must survive. For example, let’s say 100 people got to a casino to gamble a set amount. Let’s assume Gambler #28 goes bust. Gambler 29 is not affected. Based on this example 1 percent of the gamblers go bust. One is ruined and 99 survive (to play again).

But if a gambler goes to the casino betting a set amount for 29 times, his odds of losing become 100 percent! Table divides probability in this case into two parts: Ensemble probability and time probability. Ensemble probability is the odds of playing the game one time. Time probability is the odds of playing the game multiple times. Most statisticians, Monte Carlo simulations and regressions ignore this. They always assume the game is played once to calculate probability, which is ridiculous.

If an investor must reduce his exposure to losses because of unexpected early retirement or another change in life status, his returns become divorced from the market. You have skin in the game. It’s no longer theoretical.

This means the “market” returns are not relevant to your returns. We know the “market” consistently causes investors to lose half of their wealth. This causes them to substantially change their lifestyle and plans. And it creates a lot of worry.

It doesn’t mean that we have skin in the game by suffering your actual loss. But it does mean we also suffer a loss and that we earn less. And because our processes are built around avoidance of losing money you can’t make back; we believe this is the safest approach possible for investing in an uncertain world. Warren Buffet has done the same thing. He set a high filter for purchasing stocks and only picked opportunities that pass that threshold.

It’s what we are trying to do here.