Manager Due Diligence Trip

January 8, 2014

Executive Summary

Following my trip to the West Coast after Ironman Arizona in November, I took the opportunity to visit with three prominent fund managers in order to gain insight into their investment process and current view of the world. As a fee-only registered investment advisory firm, we do not accept any payment from anyone other than our clients. While I did allow FPA and Grandeur Peaks to pick up my lunch tab, all other costs were borne by Global View.

- Management at Doubleline, with a historical focus on fixed income, believe the economy has not emerged from a “financial recession” and will remain slow for at least several more years. They disagree with the consensus that the US consumer will drive demand anytime soon, believe deflation is a greater threat than inflation, and feel the 5% you might earn in bonds is your best bet. They, however, do not see an imminent financial crisis. Instead, they believe the next crisis will come where you don’t expect it, that if fact, there might be a war at some point in Europe. In other words, they believe the risks are likely not immediate.

- Management at FPA, with a historical focus on margin of safety equity, feel valuations are stretchedand are having a hard time finding buying opportunities. While they spend very little of their time trying to figure out the global economy, they fear prices in aggregate have gotten ahead of fundamentals and hope a market correction affords them better prices. A review of their historical letters illustrates that this has been their view for a very long time, i.e. they are almost always cautious of valuations and the macroeconomic environment but are more so now than in the recent past. This caution has awarded investors well.

- Management at Grandeur Peaks has a completely different view of the world. While they agree that developed nations are in a very slow growth state and see some problems in emerging markets, they see more opportunities at the individual company level than they can buy. Their philosophy is founded on Margin of Safety principles but also highly influenced by legendary fund manager Peter Lynch. Their small size and commitment to maintaining a small size really make them unique. The legacies of Jean Marie Eveillard at First Eagle Global and Peter Lynch at Fidelity Magellan are historical illustrations of the benefits of focusing on smaller companies.

Doubleline Capital

Meeting with Joe Galligan, Executive VP 11/19/2013

I flew into LA, checked into the hotel early, freshened up and then caught a taxi to downtown LA. I was driven by a Russian who didn’t know I spoke Russian so was unaware I could hear him conferring with his Mafia boss. I did hear that his car was in excellent condition when he got it and that he took a taxi the previous evening himself because he was “nemnogo Vypyvshij,” or a little drunk.

After I got by security downstairs I was admitted to the building, escorted to the elevator where the guard granted permission to go to the 18th floor, and was met by Joe Galligan, Executive Vice President, in one of the two conference rooms. Joe gave me the better part of two hours. We chatted for a few minutes about Ironman and marathon (Joe ran Boston) before discussing his view of the investment landscape.

The Doubleline Total Return fund currently has a 5% yield and 4 year duration. Joe is more concerned about deflation than inflation. He believes the current economic environment is a financial recession that will endure for a very long time. The economy is not improving but at the same time there is a put by the Fed, especially with Yellen at the helm. The big question for the economy is where is the demand? Joe does not believe the consumer has delevered. He believes this may take up to 30 years for consumer austerity to be accomplished. Unlike the mainstream, including noted Economist Dave Rosenberg, who believe the consumer is delevered at about 100% of debt/ income, Joe believes we need to look further back in history. Remember, when one is adding debt they are levering up, but when they are reducing debt they are delivering. In 1930s, the US consumer held about 30% debt/income. This ratio rose slowly and steadily about 10% per decade peaking at nearly 130% of income in 2007. So while many economists say delevering has been accomplished, Doubleline does not agree. They believe a ratio of 80% or even 70% may be more appropriate and that this will take a few more years to accomplish.

Consumer Delevered? 1

If stagflation does manifest it could hasten the deleveraging but is unlikely to spur consumer demand any time soon. There is no hint of inflation in the immediate future, so this likelihood is not imminent but could change quickly.

Joe does not believe we will have a return to a financial crisis anytime soon. Instead, he expects the next crisis will be unexpected. For example, he believes the next crisis could be a civil war in Europe. His main concerns are the UK and France.

Regarding monetary policy, everything changed when Hilsenrath leaked the news about taper in April. The buyers became sellers. Yields went from 4.5% to 6.0% by the beginning of July. Doubleline tried to buy but was unable to purchase at 6% yield couldn’t get in until later when yields had dropped to 5.25%. Joe is very comfortable nonetheless that they can continue making money with the mortgage backed securities until the market dries up. Unfortunately though, the market is drying up. The market was $2.6 trillion in 2007, now it is down to $800 billion. Why? Because banks cannot issue more securitized product as a result of Dodd Frank. Banks are collectively making about $300 billion a year because of the yield curve. Fannie Mae and Freddie Mac own 90% of housing market, banks 10% because Dodd Frank makes them keep skin in the game. With mortgages paid down 20% a year we are running out of opportunities.

On the housing market going forward:

Losses thus far have been about 10%, i.e. 5 million loans have been liquidated. They factor in that total losses will be 25-30% which leaves about 7 million more loans. Doubleline did not reckon on all the hedge funds/ institutional investors in the housing market. The PPIP plan was a government incentive; the “rent to own” program gave institutional investors an incentive to play in this market. This has kept prices higher than they otherwise would have been. The literally unprecedented level of government intervention and QE has distorted all asset prices. Joe has been doing this now for 33 years. Only analogy to this period is 1930s.

Joe has all of his wealth in Doubleline Capital and in the LP which is very similarly invested to DBL. DBL is his favorite investment right now. He is not as much of a fan of EM debt but did not discuss much. Doubleline pays for Bianco research and has a lot of respect for Jim. He also likes senseoncents.com and zerohedge. We talked some more about Dalio, he buys that, loves the video. At economicprinciples.org providing an excellent summary of where we currently are in the deleveraging cycle. I am pretty sure he had read our blogs because knows what we do. This was a great meeting and I had a good time talking to him for better part of two hours.

FPA Capital

At FPA I had the opportunity to meet the FPA International Value team as well as FPA Crescent.

FPA International Value

Pierre Py, Portfolio Manager of the FPA International Value fund has the ability to buy stocks anywhere around the world. This is a new fund and a key focus of FPA’s strategy to beef up its presence internationally. Pierre has recently added two analysts to support his research efforts, Victor Liu and Jason Dempsey. The fund focuses on international equity markets, developed and emerging, and can theoretically invest in companies of any size. As of this December 2013, the fund remains very small, with only $254 million under management. Despite the small size, Pierre holds a lot of dry powder, 39% of the fund is in cash. The fund has the ability to buy companies of any size and currently holds companies with an average market capitalization of about $7 billion. The fund is concentrated in a little over 21 stocks, with its largest position 6.9%. While there is one very small UK Reit in the portfolio, holdings generally range from the small cap to mid-cap size with a few larger companies thrown in like SAP, Daimler, and DANONE. In conversations with Pierre and discussion of our internal classification system, Pierre believes his fund currently fits into our Long-Term Less Volatile classification, but that should valuations improve (after a correction), he would expect to become More Volatile as he put cash to work.

At the moment, he believes the US is picking up, Europe is still challenging, and Emerging Markets are in the middle of a very big slowdown. Pierre is not excited about valuations and currently holds 40% in cash with a zero allocation to Japan because he does not feel company management does a good and trustworthy job allocating capital, specifically that companies there engage in negative gearing. Pierre likes to hedge currency risk to about 20% of free cash flow and purchase companies at 25% discount to fair value or more depending on the quality of the business. His portfolio is picked from a focus list of 730 companies. Of these they have a very good estimation of intrinsic value of about 300 of these. 55-60 of these had potential for a 15% upside in his estimation to reach intrinsic value, i.e. he is not finding much opportunity therefore is holding cash. As of the end of the 3rd quarter, Pierre feels the weighted average discount of holdings in his portfolio was about 25%.

Pierre has his entire net worth invested in the fund other that what he needs for liquidity. Other partners of FPA including Steve Romick and Robert Rodriguez also have significant investments in the fund. I came away from this meeting believing that Pierre is a strict adherent to the Margin of Safety discipline, that he understands his companies very well and that this fund currently fits the description of a Long-Term Less Volatile fund, deserving of an allocation to our strategies.

FPA Crescent

FPA Crescent is a longstanding core fund that we have classified as a Long-Term Less Volatile manager and allocated to client portfolios. The FPA Crescent fund has the distinction of having made positive returns every year since 1993 except for 1999 and 2008. In 2008 the fund lost 20% versus a loss of 37% in the S&P 500. This fund is widely diversified in the United States, owning over 100 companies, the largest position of which is 3.5%. However, the team’s goal is to reduce the number of holdings to about 30-40. Most of the holdings are large capitalization stocks, somewhat smaller than the average company in the S&P 500, $83 billion. As of the end of the 3rd quarter, the fund held a net position of about 50% in stocks. This fund and its associated strategies manage about $16 billion in assets making this a relatively nimble large cap fund which has the ability to buy smaller companies when warranted.

Steve Romick is the longstanding portfolio manager recently augmented by Mark Landecker and Brian Selmo. I had the opportunity to meet with Mark. The bottom line is that speaking with Mark is little different than speaking with Charles and Chuck at IVA or with Matt McClennan at First Eagle. Mark is dedicated to the margin of safety philosophy, predicated on the premise that avoiding permanent loss of capital is of paramount importance. He and his team do their best to meet with every company in their portfolio at least annually. I left the meeting comfortable that FPA Crescent can continue to deliver even with a higher stock concentration. However, I did not leave feeling excited. I did not feel excited until my next visit in Salt Lake City with Grandeur Peaks.

Grandeur Peaks

11/22/2013

I arrived in Salt Lake City on Thursday night from Los Angeles, spent the night near the airport and went in to Grandeur Peaks early in the morning. I was met by Eric Huefner, President. Eric showed me around the office and introduced me to a number of analysts. I then met with Mark Siddoway, Head of Client Relations with whom I spoke for a few minutes before being introduced to Zach Larkin, currently the Sr. Research Analyst who will likely be named Head of Research shortly. While discussing Grandeur Peak’s investment philosophy, I learned that Zach has a copy of Seth Klarman’s Margin of Safety and that he frequently reads this. I also learned that the folks at Grandeur Peaks share our view that the US and Global economies are weak. However, unlike FPA or Doubleline, they believe that there are so many companies that have good growth potential and selling for reasonable valuations that they have to be selective in their purchase, i.e. that there are more opportunities than they can buy!

Zach was scheduled to meet with a company and asked me to sit in. The company was Blinkx, PLC, a UK based technology firm. Frankly the only thing I knew about Blinkx going into the meeting was that it was a holding of GPGIX. Blinkx was picked up by Robert as a microcap and has since returned over 200% in 2013. I had the opportunity to meet with the CEO and CFO of the firm and observe the Grandeur Peaks analysts interview process. Blinkx has developed an internet engine that automatically matches consumers with video content and advertising on behalf of hundreds of brands millions of times a day, automatically and in real-time. Their technology reads the videos, discovers the content, and then pairs this with advertisements. Because Blinkx is the first mover, and according to company management truly the only company who can do this. They have built a serious competitive advantage in understanding the value chain, i.e. the audience for ads, the content, advertisers and, most importantly, how to monetize this content. They even gain information from consumers through cookies that they use to establish profiles, monetizing this information through sharing advertising revenue. Blinkx has successfully grown earnings faster than revenue by a focus on premium pricing, turning down opportunities that are not clearly profitable. Company management is especially excited about the mobile applications advertising which is still in its infancy.

More importantly I was impressed with the Grandeur Peaks approach to understanding of the value chain in order to potentially uncover other companies who may be profiting in this space. Of note, the analysts were unconcerned that an economic slowdown would impact this space because they believe internet advertising would likely be the last place a company would cut costs. This exercise was instructive anecdotally because it illustrates the lengths fund analysts go in order to learn about investment opportunities. Grandeur Peaks’ analysts have visited 1000 such companies this year all around the world.

After the meeting with Blinkx, I met one on one with Robert Gardiner, founder of Grandeur Peaks, whose track record back to 1995 is the best of any manager we know. The best comparison of any manager in history is Peter Lynch. Most investors don’t know of Robert Gardiner for two primary reasons. First, the funds he manages have been closed to new investors for most of their performance history. Second, he has spent almost no time marketing mainly because he has wanted to limit fund size. In fact, his latest fund was launched with literally no publicity. Mark Siddoway, Head of Client Relations simply sent existing clients an email when the new fund, focused on Emerging Markets, would open. It opened December 16. I had to call T.D. Ameritrade and Schwab to tell them to make it available for purchase.

When I informed Robert of my meeting with FPA Capital, and Pierre Py’s words that he was currently holding 40% in cash, Robert’s answer was: With 30,000 companies around the world to choose from, I find it difficult to believe that an investor cannot find 300 good ones to invest in at any time.

When I returned from this trip I did some quick research. The key indexes you might look at are misleading because they neglect an overwhelming number of companies. For instance, in the MSCI World Micro Cap Index there are 5,500 microcap in developed markets. The MSCI World index covers 1,604 companies across 24 developed market countries. The MSCI emerging market index covers 800 securities across 21 emerging markets. I then called International Value Advisors, who manage about $10 billion in their worldwide fund. Based on a conversation with IVA I believe they are screening from about 5,000 firms.

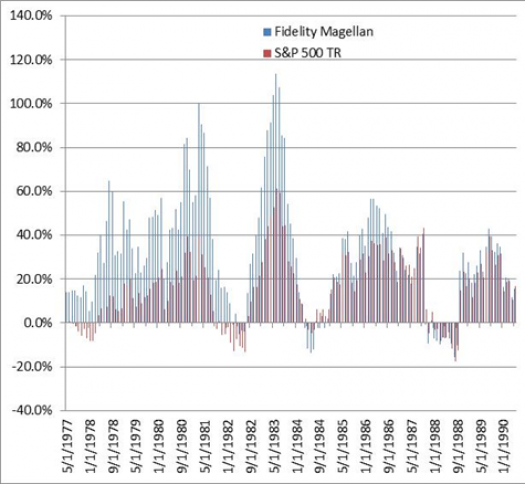

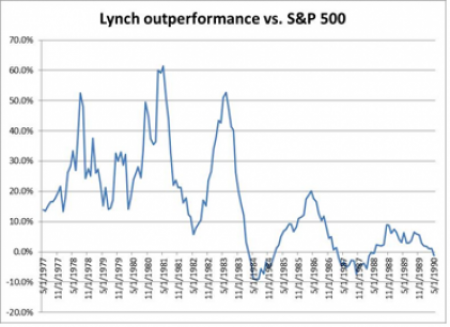

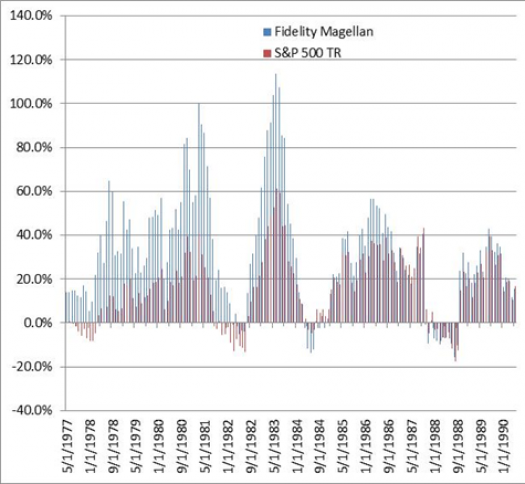

Because Robert mentioned Peter Lynch a few times, I went back and reviewed his performance.  The Fidelity Magellan Fund, under Peter Lynch’s management, returned 29% per year from 1977 to 1990. This had a formative effect on Robert. Gardiner. Peter’s book One Up on Wall Street, tells investors how he made money by doing what Wall Street did not. Peter Lynch began managing the fund in 1977, managing only $13 million his first year. Naturally at that asset level he could purchase any stocks he wanted to. Not surprisingly, his returns were best in his initial years. He made a positive return during the 70s and through the recessions in the early 1980s when the broad stock market largely moved sideways. He did this because he focused on stocks that were overlooked by traditional investors. The chart with the blue and red bars shows Magellan’s performance (blue) for every rolling 12 month period during Peter’s tenure relative to the S&P 500 (red). A quick look at the data reveals that Magellan experienced positive returns for every 12 month period from 1977 thru 1981, with only a brief period in 1982 where returns fell to -5%. As asset size increased his returns began to increasingly correlate with the S&P 500 in the line chart.

The Fidelity Magellan Fund, under Peter Lynch’s management, returned 29% per year from 1977 to 1990. This had a formative effect on Robert. Gardiner. Peter’s book One Up on Wall Street, tells investors how he made money by doing what Wall Street did not. Peter Lynch began managing the fund in 1977, managing only $13 million his first year. Naturally at that asset level he could purchase any stocks he wanted to. Not surprisingly, his returns were best in his initial years. He made a positive return during the 70s and through the recessions in the early 1980s when the broad stock market largely moved sideways. He did this because he focused on stocks that were overlooked by traditional investors. The chart with the blue and red bars shows Magellan’s performance (blue) for every rolling 12 month period during Peter’s tenure relative to the S&P 500 (red). A quick look at the data reveals that Magellan experienced positive returns for every 12 month period from 1977 thru 1981, with only a brief period in 1982 where returns fell to -5%. As asset size increased his returns began to increasingly correlate with the S&P 500 in the line chart.

Grandeur Peaks is quite literally different than about any other fund management company in the world because they have committed to close their fund to new assets at a total firm asset level of $2.3 billion. Robert made a decision to focus more on making money for shareholders (including themselves - Robert has millions of his own wealth invested in the funds) through the investment process than making money for themselves by charging more fees from a larger asset base. This is the same decision that International Value Investors made when they chose to close their firm at $13 billion threshold in February, 2011. However, $2.3 billion is a much lower number, allowing much more flexibility, i.e. the ability to purchase very small companies. In contrast, another Long-Term Less Volatile manager we own, First Eagle Global, has total global strategy assets of about $50 billion. FPA Crescent manages about $16 billion.

Grandeur Peaks is quite literally different than about any other fund management company in the world because they have committed to close their fund to new assets at a total firm asset level of $2.3 billion. Robert made a decision to focus more on making money for shareholders (including themselves - Robert has millions of his own wealth invested in the funds) through the investment process than making money for themselves by charging more fees from a larger asset base. This is the same decision that International Value Investors made when they chose to close their firm at $13 billion threshold in February, 2011. However, $2.3 billion is a much lower number, allowing much more flexibility, i.e. the ability to purchase very small companies. In contrast, another Long-Term Less Volatile manager we own, First Eagle Global, has total global strategy assets of about $50 billion. FPA Crescent manages about $16 billion.

Another key distinction is that it is Robert’s focus to apply learning from his years at Wasatch to create a better organization. This learning is manifested in several different ways:

- The firm offers only funds. There are no Limited Partnerships (LPs) or separate accounts that can cause a loss of focus. Robert’s own money is in the funds, not in some more complicated investment structure like a LP.

- His goal is to create the only fund family in the world with analysts focused on industries from a truly global perspective. Analysts will not know geographic boundaries unlike other firms.

- The firm’s focus is on high returns by finding undiscovered opportunities. Instead of limiting its search to widely known and understood stocks in the US or other major indexes, they search from a pool of 30,000.

- The firm will close all funds when asset levels reach $2.3 billion in order to facilitate goal #3. Yes I just repeated this because it is worthy of repeating.

When I returned from this visit I did some additional research and was amazed that there are simply some basic facts I had not sufficiently internalized about the investment universe. These make Grandeur Peaks’ offerings even more compelling.

- Valuations in the broad universe are not compelling. Broadly, US stocks are overvalued on almost any metric. However, opportunities overseas are generally much more compelling. For example Cyclically Adjusted P/E ratios are much lower. Robert Arnott recently stated that the CAPE in Emerging Markets is 9. This compares very favorably with a CAPE of 24 or so in the US.

- From 2000 – 2012 the number of companies publicly listed in the US fell from 9,000 to 5,000 due to industry consolidation and a lack of new public company listings.

- The overwhelming majority of investors and mutual funds restrict their screens to either the US S&P 500, or if they are globally-minded, perhaps the MSCI World, which covers 1,600 companies. A few more daring companies look at MSCI World All cap which covers 5,000 companies. Even emerging markets companies generally restrict themselves to the index, which represents less than 900 companies most of which are large cap companies.

- We recently met with a First Eagle representative who had lunch a couple of weeks ago with Jean Marie Eveillard and Jim Rogers. Jean Marie commented on opportunities in international small cap stocks and actually said that he would manage an international small cap fund now if he managed a fund.

- The global small cap universes is about 91% of the investable universe (using the $2.5 billion market capitalization definition as small cap)

- Since 2000 14,000 companies were brought public. 92% of these were outside of the US.

- The middle class outside of developed markets is growing much faster. By 2030, the middle class in Asia Pacific is expected to six fold, and double overall in Emerging markets. During this same period the middle class in the developed nations of North America, Europe and Japan are expected to remain stagnant.

- An average of 19 analysts cover each large cap stock. On average each microcap stock is covered by only 1 analyst.

- The AVERAGE small cap fund manager has outperformed the index by about 5% over the last 15 years

- Over the last 15 years small cap returns has been less subject to systematic risk. In fact small cap stocks in general performed well during the 2001-2002 recession.

Grandeur Peaks will offer a total of 7 funds including 4 which have already been launched. Robert intends to close the firm to new assets at a total asset level of $2.3 billion, leaving about $874 million in capacity. I would not be surprised to see this happen by the end of 2014. If you are interested in learning more about these funds please contact us.

Ken Moore

.jpeg)

.jpeg)