“Price is what you pay. Value is what you get.” -Warren Buffett

Executive Summary

This regular update is intended to be used as talking points with your clients.

- Even Pension Consultants using “investment fiduciary” principles to fire managers suffer poor performance. Retail investors and advisors unknowingly follow similar principles which results in substantially poorer relative performance.

- Global View has a stringent set of quantitative and qualitative criteria for selecting, categorizing and for firing any of our manager that is not based on these principles and which we believe leads to superior performance

How We Do NOT Select Managers

Unlike insurance companies and brokerage firms, we will never hire a manager because the manager pays us. We are fee-only advisors paid only by our clients. Moreover we will not pick funds based on how they performed recently. I completed the Accredited Investment Fiduciary program in October of 2008 because I wanted to know how so called “investment fiduciaries” pick funds. I did not renew my designation as an Accredited Investment Fiduciary, because I do not believe their practices add value. A paper written by Wahal and Goyal at Emory University called “The Selection and Termination of Investment Management Firms by Plan Sponsors” reviewed the practices of 3,500 plan sponsors over a 10 year period supports my conclusion. The study concludes (on page 39) “plan sponsors terminate investment managers after poor performance but the performance of these (fired) investment managers appears to rebound after firing.” The principles leading to this trend of poorly timed terminations is taught in the Accredited Fiduciary program.

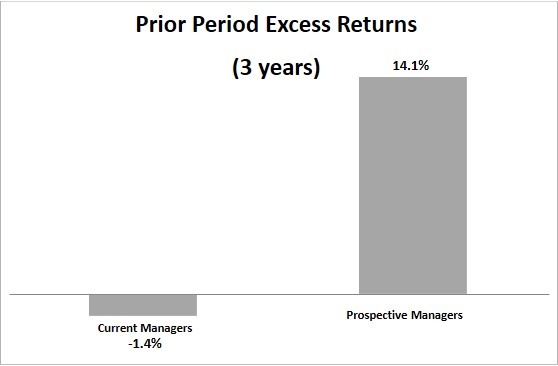

This is a cautionary tale to be very slow to fire a manager if you believe in the manager’s investment process. Since a picture is worth a thousand words, below are two charts showing the prior excess returns of the managers (before they were fired) and the subsequent excess returns. We know retail investors do this as well (see our paper on investORs vs. investMENTs), so clearly it is an area an advisor can add value IF THE ADVISOR DOESN’T DO THIS TOO!

Firing based on recent performance usually backfires

How We Select Managers

For our Long-Term Portfolio, we strive to find strategies that will deliver a high absolute return over an expected investment horizon of 3-5 years and beat 10% p.a. over the long-term. For the Retirement Spending Portfolio we want to see a positive absolute return over 18 months to 3 years and beat 7-8% p.a. over the long term. To do this, we screen the universe to find managers who follow a Margin of Safety discipline. The easiest way to see this is when they publicly announce it and use it as a core piece of their marketing message. A manager using a truly global strategy, i.e. who can invest in securities around the world and of any size, i.e. large or small companies, can almost always find a margin of safety somewhere in the world. A happy byproduct of this is often lower downside risk versus indices and higher long term returns as evidenced in positive returns generated by selected managers during the 2000-2002 bear market as well as the 2008-2009 bear market.

We look at the following criteria (tracked regularly in a spreadsheet), measured quantitatively and qualitatively, to select the relative attractiveness of our managers:

- Demonstrated adherence to Margin of Safety investment objective

- Shareholder first attitude (willing to close to new investments, more interested in client wealth than own)

- Asset size (smaller is generally better)

- Flexibility (ideally can invest anywhere in any market capitalization)

- Own Cooking Eaten (managers have substantial stake of their own net worth in their fund)

- Manager’s Long-Term Track record: the manager (as opposed to the fund) has an excellent track record managing investments

- Stated return objective: we read and listen to almost everything our managers say. They try to hedge, but often let their return objective slip. We believe you need to have a goal to achieve it.

- Manager Volatility Control intention - some managers are less concerned about volatility than others. Those more concerned about it and who demonstrate ability to control it are considered to be either volatility control or less volatile managers, both of which are also suitable for the Retirement Spending Portfolio

We add managers when new opportunities arise. Since we believe the track record of the manager and his analyst team is the driver of investment performance more so than the firm where he may have worked, when we see a manager start a new company or fund we are quick to perform due diligence and add this to our mix. Two examples of this are the IVA Worldwide (IVWIX) fund and Grandeur Peaks Global Opportunities (GPGIX). We chose these funds based on the incredible risk adjusted track record of Charles deVaulx and Chuck deLardemelle at IVA and of Robert Gardiner at Grandeur Peaks and because we believed in their process. “Pension Consultants” and retail investors looking for a 3 year track record would have been out of luck because both funds closed to new investors before the funds had a 3 year track record.

How We Categorize Managers

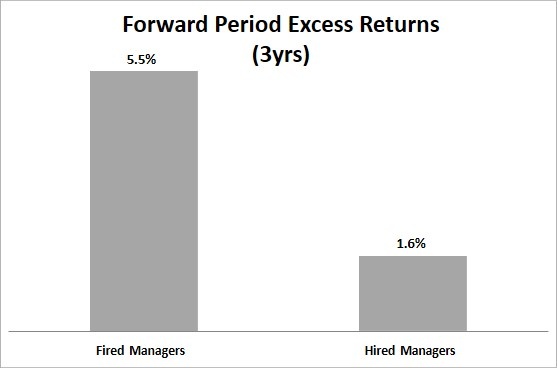

We categorize our managers into three buckets. The Short-term Volatility Control bucket includes managers who strive for a positive return over 1 ½ – 3 years and often have a focus on immediate income. Long-Term Less Volatile managers strive for a positive return over 3-5 years and have historically exhibited substantially less volatility than equity indexes. Long-Term More Volatile managers strive for a positive return over 3-5 years and are less concerned about volatility. These buckets are somewhat arbitrary and some managers may fall between categories. We anticipate the performance of these buckets to follow these rough guidelines;

How We Fire Managers

There are really three reasons we will fire a manager. We will fire a manager if we believe he is not following a Margin of Safety discipline, or in other words if the manager has lost sight of a focus on reducing, at all costs, risk of permanent loss of capital. We will fire a manager if we believe it does not fit our stated objective. For instance, we hire managers in our Retirement Spending Portfolio whose focus is on both reducing risk of permanent loss of capital AND exhibiting low volatility. If we believe the manager will prove to be more volatile than we first thought, we will find a replacement. The final reason for firing a manager is to replace it with a superior manager. This can happen for many reasons, only one of which is performance.

We fired the Oakmark fund in September of 2007 when we felt the manager, Bill Nyren, had lost sight of his Margin of Safety investment objective. He continued to trump Washington Mutual as a good investment when our own research (Q3 2007 10Q) revealed the company had gotten more heavily into subprime. Washington Mutual subsequently went out of business and Oakmark fund investors suffered.

.jpeg)

.jpeg)