Global View Investment Blog

3 Reasons You May Want to Claim Social Security Benefits Early

As a Registered Social Security Analyst with the National Association of Registered Social Security Analysts, and a Certified Financial Planner in Greenville, SC, I am asked about Social Security often.

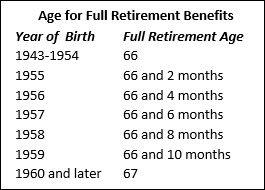

Millions of Americans count on Social Security retirement benefits to help pay their bills each month. The Social Security Administration (SSA) bases the benefit payments on your earnings during your working career and the age at which you file a claim. You must be at least 62 to begin receiving early retirement benefits, and somewhere between ages 66 and 67 to receive full retirement benefits. This all depends on your full retirement age, which you can find below:

If you turned 62 in 2021, your benefit would be 70.8 percent of what you’d receive if you waited until your full retirement age, when you’re eligible for the full amount. The monthly amount you’ll receive increases for each year you delay your claim, up to age 70, at which benefits stop increasing. Typically, once you reach full retirement age, your benefit increases by 8 percent each year you delay your claim, up to age 70.

Whenever you start receiving Social Security retirement benefits, expect a cost-of-living increase once a year to counteract the effects of the inflation that occurred in the previous year.

The general rule of thumb is to wait at least until full retirement age to claim your benefits, and in fact, many Americans delay their claims until they reach age 70. On the other hand, a large number of people claim benefits before reaching full retirement age. There is a lot of confusion about when the right time is to start receiving these benefits, because the answer is different for everyone.

It’s important to fully understand Social Security and how it affects your specific situation, because the decision you make is permanent. At Global View, we can look at your options in great detail and determine your break-even ages, so you fully understand your decision. Your initial ideas may have changed post-2020, as we start to adjust to life after COVID-19.

Why You’d Want to Take Your Social Security Benefits Early

It’s a common misconception that you should wait for as long as possible to start claiming your Social Security benefits, or that you should start receiving them right away – it’s your money after all; why wait?

As a Registered Social Security Analyst and a Certified Financial Planner in Greenville, SC, here are 3 reasons why you might want to take your benefits early:

1. You Need the Money and Would Otherwise Need to Pull from Your Retirement Accounts Early

Once you retire, you will start to replace your working income. It’s likely you’ll need money from Social Security and your retirement accounts. For many, the dilemma will be which to start taking first, and which to postpone until later. Several factors can influence that decision:

- Can you live on Social Security benefits alone? (Likely, you can’t.)

- How much money have you accumulated in your retirement accounts?

- Are withdrawals from your retirement accounts taxable?

- What kind of annual returns are you earning on your retirement accounts?

- What’s your current age?

One important fact to keep in mind is that you can wait until age 72 to begin taking minimum withdrawals from your retirement accounts. In fact, you can postpone withdrawals from your 401(k) even longer if you are still working. Also, Roth IRAs do not have Required Minimum Distributions (RMDs) at any age.

As previously mentioned, your Social Security benefits top out at age 70.

If taking your Social Security benefits early allows you to keep your retirement accounts protected for longer, and possibly take advantage of an employer match for longer, it may make sense to claim early. Take some careful thought and discuss the decision with a financial advisor. You may also want to consider your spouse’s Social Security benefits, as staggering retirement benefits may lead you to start receiving your benefits early while your spouse waits until later.

2. You Could Get a Better Return if You Invested the Money

For Social Security benefits, your annual “return” is as high as 8 percent tax-free as you delay your claim. In a tax-sheltered retirement account, your annual return depends on the performance of your investments. If you consistently earn more than 8 percent, you have a strong incentive to postpone withdrawal. However, if you have a very conservative portfolio that earns appreciably less than 8 percent per year, you might prefer to pull from your retirement accounts now and delay Social Security until later.

Compare the after-tax income of both alternatives. Social Security benefits are taxable at your current rate, whereas your retirement account distributions might be taxable or tax-free. Withdrawals from traditional accounts will be taxed at your marginal rate, which might be lower than your pre-retirement tax bracket. On the other hand, Roth account distributions are tax-free.

3. You Have Poor Health or a Low Life Expectancy

If you have some reason to believe that your life expectancy is low (read our recent blog post: How Long Will Your Retirement Be? A Longevity Calculator), you have an important justification for taking Social Security benefits early, as you may not live long enough to experience up to 8 percent returns on unclaimed benefits. In these circumstances, you’re acutely aware of how every day counts, and Social Security benefits can certainly help you afford the activities you want to experience now, while you still can.

The same argument is true for your retirement accounts, which you may also want to pull from without delay. The biggest risk is that you may actually live longer than expected. Your Social Security benefits will never cease, but you may exhaust your retirement accounts prematurely.

Given the fact that your Social Security benefits are inexhaustible and your retirement funds are finite, it can make sense to file your claim with Social Security first and then turn to your retirement account funds as needed. This way, you have immediate income while retaining at least some of your retirement savings in case your life expectancy is overstated.

The Role of Your Financial Advisor

Above are just three reasons you may want to take Social Security benefits early. The decision boils down to which of your alternatives will provide the biggest advantages now and in the future. You may also need to consider the impact of your decisions upon your spouse and other beneficiaries.

This decision of when to take your Social Security benefits can be complicated, and again, it’s permanent. Lean on the financial advisors at Global View. Our team can help you by working out your competing options to see which makes more sense. As a fiduciary sworn to look after your financial health, the Certified Financial Planners at Global View stand ready to offer dispassionate counsel that will help you make decisions that are in your best interest.

Schedule a no-obligation consultation to see if we’re the right fit.

Written by Joe Hines

Joey's primary focus is working with clients in the goals setting and financial planning process. He has extensive experience is in helping clients facilitate the decision making process, leading them through the implementation of their financial plan and contributing to their peace of mind. This includes helping clients gain an understanding of estate planning, charitable giving, and helping them implement these plans by working closely with estate planning attorneys.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us