Global View Investment Blog

Socially Responsible Investing: Stopping the Theft

“The Stock Market is a Device for Transferring Money from the Impatient to the Patient.”

Warren Buffett

Socially Responsible Investing has become a hot topic.

But what is it? Most agree it is investing to make the world a better place.

I am a fan of conscious capitalism. John Mackey, the founder of Whole Foods, wrote the book on this. John started his first store in Austin Texas. He was a hippy socialist until he had to run a payroll and figured out paying everyone the same just doesn’t work.

But his attitude of treating customers and suppliers well paid off when his store was flooded. Because he had always given his suppliers the benefit of a doubt, they reciprocated by giving him time to repay. His loyal customers kept coming to his store even when inconvenient.

His mission to provide the best quality food changed the way Americans eat. Competitors followed his lead - today you can find quality organic produce anywhere. Thank John when you go to Ingles!

The primary tenet of conscious capitalism is to consider customers and suppliers interests before your own. The big banks and insurance companies do the opposite. They are riddled with conflicts of interest. Remember the Wells Fargo scandal? That’s the tip of the iceberg. Because these firms have an overwhelming market share they have dictated terms to mutual funds.

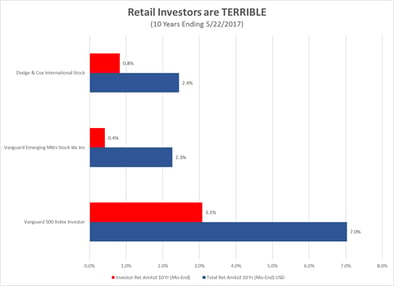

This has literally been a disaster for investors like you. In three funds representing US, International and Emerging markets, retail investors literally gave away 2/3 of possible returns to stronger, more patient, hands (think big banks and insurance companies). Because for every seller there is a buyer and for every buyer there is a seller, the banks and insurance companies profit at the retail investors’ expense in this zero sum game.

So, it is my mission, it is our firm’s mission, to stop this theft.

Our clients are not the kind of people who transfer their hard-earned wealth from their wife, kids and GRANDKIDs to big banks and insurance companies.

Because for every seller there is a buyer and for every buyer there is a seller, the banks and insurance companies profit at the retail investors’ expense in this zero sum game.

So, it is my mission, it is our firm’s mission to stop this theft.

Our suppliers won’t let the big banks dictate terms. Our partner, Grandeur Peak, cannot generate the high returns and low risk they do without constraining total assets. They don’t need the big banks, so they aren’t available there.

Our suppliers are also bond managers that invest in growing private companies. Because the big banks are more interested in selling other products than lending (what was 20 in 1990 is now 4), this leaves a nice niche for us. We have ways to access this space that will do well in a growing economy and rising interest rates.

Our stock research comes from Morningstar in Chicago. Not Wall Street.

Socially responsible investing should start with choosing the right advisory firm. Then you can figure out how to invest in a socially responsible way.

We run stock portfolios that can be customized according to how you view the world. And we have access to most talented fund managers in the business. Folks that don’t want to do business with Wall Street.

If you don’t want to work this way anymore, it may be time for a conversation.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us