Global View Investment Blog

Sometimes 'Surprises' Aren’t Surprises – Grandeur Peak Highlight (and Why We Work Hard to Find Excellent Managers)

Our clients fortunate enough to be with us in 2008 when we began adding investments by Robert Gardiner and his team, get it.

They may not remember the details, which means we have to remind them. Robert Gardiner ran a US microcap fund that made over 25% per year from 1995 to 2007. This was phenomenal because over this period US small-cap stocks made only 6.5% per year. Even better, he did this making money every year except 2002 and doing very well during the 2000-2002 bear market.

The surprise I am about to show you was no surprise to us.

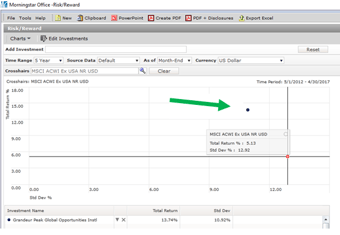

The first fund Robert’s team opened at the firm he founded after leaving Wasatch, Grandeur Peak Global Opportunities, now has a five-year track record. It also has a Morningstar five-star rating. When the fund was closed in March of 2014 it did not have a 3-year performance track and, it did not have a rating.

For the 5-year period ending April 30, the fund has beaten its Morningstar benchmark substantially. As you can see the blue dot (Grandeur Peak Global Opportunities) is to the left (good) and above (good) the benchmark, meaning it has lower risk and a higher return. It's risk has been 20% lower (10.9 vs. 12.9). It's return has over doubled the benchmark (13.7% vs. 5.1%).

For those of you who weren’t our clients, (especially those of you who believe in passive investing), I know what you are thinking. This kind of performance is extremely rare. But so is the performance of a star athlete. If you were managing a team, wouldn’t you look for stars?

Because our goal is to deliver the best possible return for the risk our clients take, we go out of the way to search for investments we believe will deliver excellent returns for the risk.

We couldn’t invest in Robert Gardiner’s fund when we worked for Merrill Lynch because he didn’t pay them for distribution. And then, after we started Global View in 2004, the fund was closed. But we were there when an open fund launched in 2008.

We know we can’t deliver these kind of returns and we don’t expect to. 2012-2015 was a period where US stocks soared leaving cheaper and even higher growth international stocks behind. We underestimated the power of Central Banks. And while our clients’ performance suffered relative to US stock markets over this period, we are catching up.

We think we can minimize mistakes if we work hard to find this kind of talent and are relentless in questioning our assumptions. Jean-Marie Eveillard’s experience is similar to Robert Gardiner’s but with lower risk and return. From 1979-2004 he delivered excellent index beating returns without losing over 1% in any calendar year. It’s too good to be true.

Literally nothing you own today is the same as it was even 3 years ago.

Jean-Marie Eveillard may still be a figurehead at First Eagle funds, but First Eagle now manages nearly one hundred billion dollars in assets. We are not ready to call it American Funds yet, but we are looking for other ways to replicate the legacy of Jean-Marie., because we know what happens to returns (and risk) when funds get too big. Anybody remember Fidelity Magellan?

Link to 2014 Manager Due Diligence Trip and Discussion of Magellan

We are excited because we have found two new equity investments with portfolio managers who worked closely with Jean-Marie Eveillard or in whom Jean-Marie invested. We also have a new all-cap manager leveraging Robert Gardiner’s team at Grandeur Peak.

On the fixed income front, we are excited that we can leverage our learning about private lending to implement new fixed income strategies we feel will do well in a rising rate environment.

These are all small funds, will close (like Grandeur Peak) and are not widely distributed on the big bank and insurance platforms.

We are in the process of implementing these new ideas and look forward to discussing them with our clients over coming weeks and months.

If you are not a client (and especially if most your investments are in US stocks), it’s a good time to talk to us!

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us