Global View Investment Blog

Deferred Alpha

I had the opportunity to talk briefly with the staff at International Value Advisors. As you may know, some of our Less Volatile managers, who have ten year track records that have proven substantially better performance than major indexes, have been underperforming the US markets recently. There are two reasons for this. First, they have substantial international holdings. International stocks suffered a bear market in 2011 and have done far worse than US markets so far this year, despite much more favorable valuations. Second, they have been reducing risk and building cash.

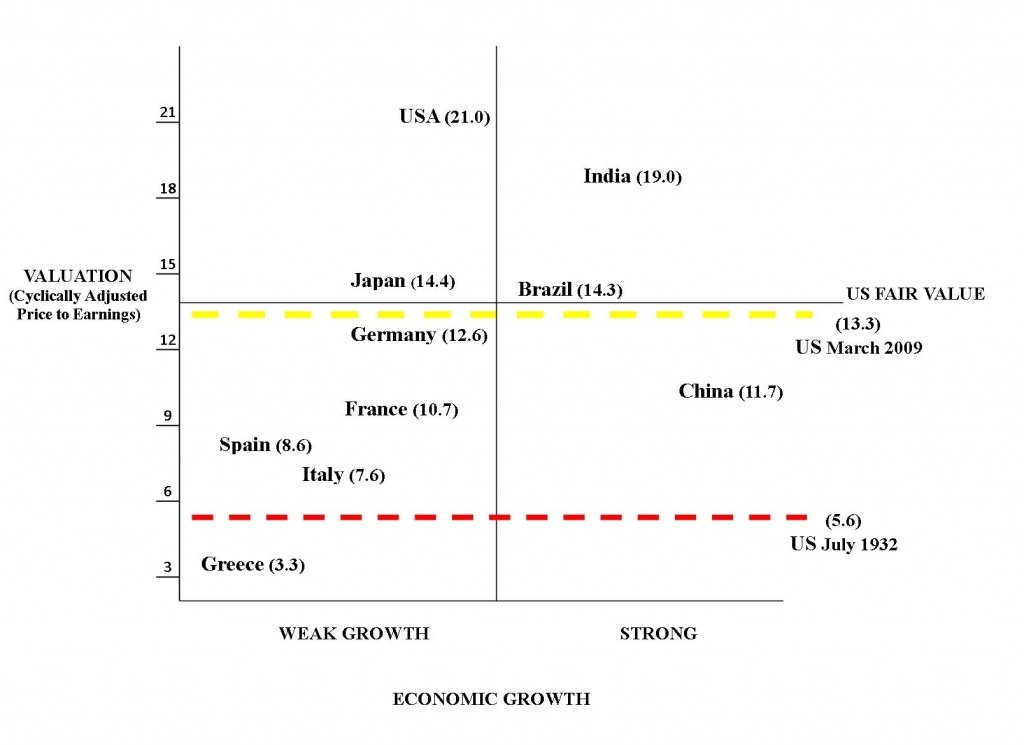

So, the team at IVA, and other funds we admire, have been selling positions they believe are fairly valued (like dividend yielding stocks and high yield bonds) and holding onto cash because opportunities are less than compelling. They call this creating “deferred alpha.” We have seen this before. We saw it in 2007 and 2008, for instance. We hope we can take advantage of better valuations internationally and in the US to put more of our client’s hard earned capital to work in coming months but until then are content with building “deferred alpha.” The chart above illustrates our view of major markets relative attractiveness across the dimensions of valuation (based on price to ten years of earnings) and economic growth (our conceptual view based on input from the Economic Cycle Research Institute). Not shown is the direction of economic growth. The ideal place to invest would be a location with an excellent valuation (low) and strong growth. This rarely exists in the real world. Therefore, we seek would be delighted to see opportunities with excellent valuation and improving growth (economic turnaround).

The chart above illustrates our view of major markets relative attractiveness across the dimensions of valuation (based on price to ten years of earnings) and economic growth (our conceptual view based on input from the Economic Cycle Research Institute). Not shown is the direction of economic growth. The ideal place to invest would be a location with an excellent valuation (low) and strong growth. This rarely exists in the real world. Therefore, we seek would be delighted to see opportunities with excellent valuation and improving growth (economic turnaround).

Kenneth M. Moore Jr.

MBA, CFP®

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us