Global View Investment Blog

Blackrock Emerging Markets Long / Short Equity Fund (BLSIX, BLSAX)

New Addition to Volatility Control Funds

Executive Summary

We gave added the Blackrock Emerging Markets Long/ Short fund to our allocation as a Volatility Control manager. The team managing the fund has the experience and competitive advantage needed to produce positive returns in a difficult investment environment. The team managing the fund has a track record of producing positive returns. In the past we would most likely would not have used a fund by Blackrock, when its largest owner was Merrill Lynch because we have found that funds owned by brokerage firms often serve the needs of the brokerage firms better than the needs of their clients as we learned from Louis Lowenstein, in The Investor’s Dilemma. The Merrill Lynch stake has been divested and we believe the fund meets our criterion as a margin of safety volatility control fund.

Reason for Analysis:

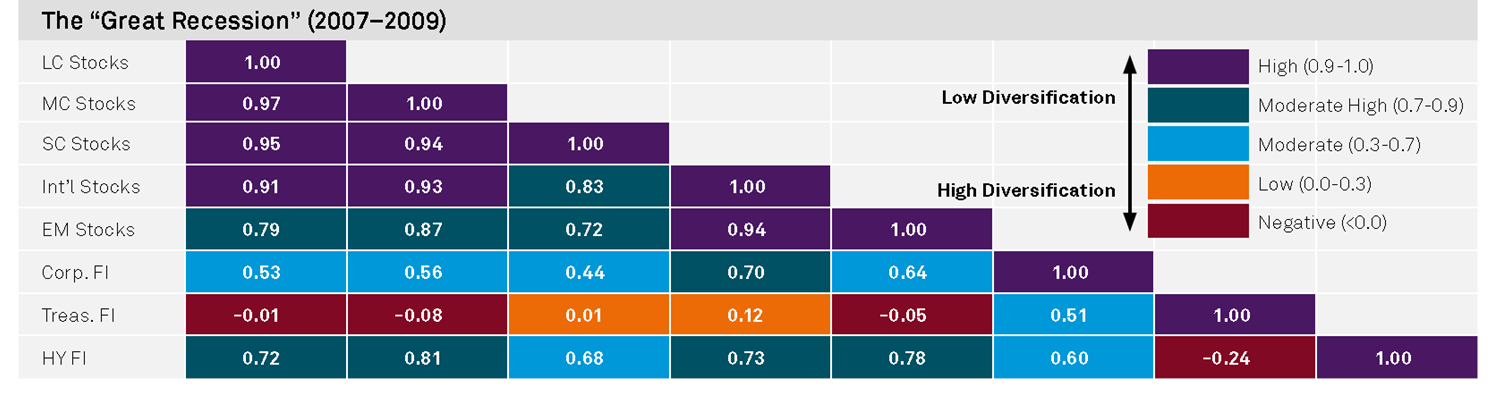

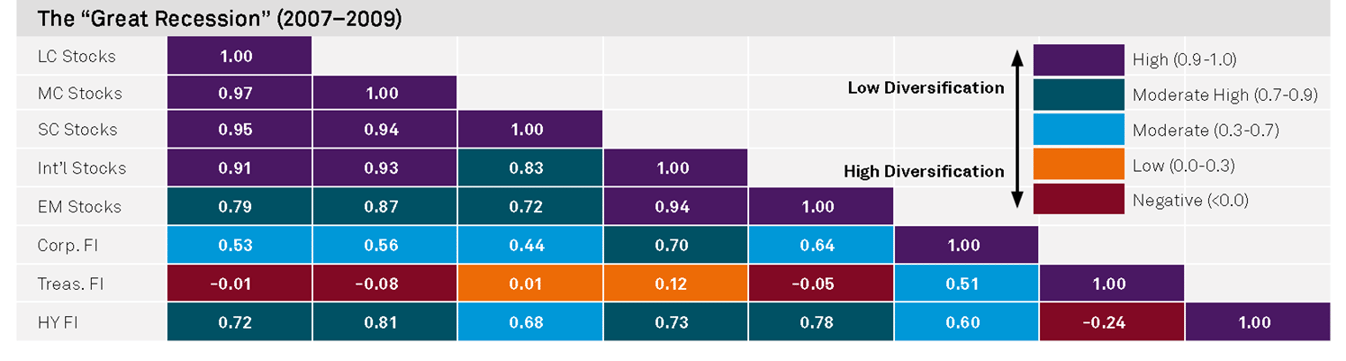

We constantly seek strategies that we feel can deliver good returns with low risk. In a highly uncertain macroeconomic environment where we believe the credit bust will create continued uncertainties and potential downside risk it is especially important to find investments that may deliver a positive return with low correlations to stock, bonds, and commodities markets. This is even more important if the Economic Cycle Research Institute forecast is correct, and that the US and Global economies are in recession. That chart below illustrates the need to include investments with low correlations to other asset classes:

Strategy Overview

The fund operates in an inefficient market space and attempts to deliver positive returns by owning securities management feels are undervalued and shorting securities it feels are overvalued. Because emerging markets are far less efficient than developed markets there are more opportunities than simply in the United States. We believe the Scientific Active Equity team and Blackrock, from its purchase of Barclay’s Global Investors, has built a significant competitive advantage in emerging markets that arises from their construction of emerging markets exchange traded funds. Their experience gives them an increased understanding of how these markets work.

About 1200 emerging market companies trade on exchanges in 22 countries affording a truly global opportunity set. Fund management holds between 150-300 of these long and 150-300 of these short. No single position can exceed a 3% weighting; position sizes average 0.5%. The fund is not market neutral at all times. Management targets a long weighting of 20% but may range from 0% to 40% long.

The fund itself has a short track record. However, the portfolio management team has a record of having produced positive returns during the last recession. Specifically, they managed a Pan Asia Opportunities strategy that made positive returns for Barclay’s Global Investors in 2008. Portfolio managers Jeff Shen and Rodolfo Martelli have 19 years and 14 years of investment experience primarily with Barclay’s Global Investors. The strategy is managed by Blackrock’s Scientific Active Equity team (SAE). Two team members are in Hong Kong to have better access and relationships with prime brokers there.

Analytical Analysis:

Adherence to Margin of Safety Investment Objective: both the strategy as articulated by fund management and the return history of the strategy and its predecessor lead us to believe the first goal of this fund is to avoid permanent loss of capital

Shareholder First Attitude: While Blackrock is a publicly traded company, which in itself places the interest of its shareholders (those who own its stock) over the interest of its clients (those who have share in its funds) Blackrock is a substantially different company than in 2010. Prior 2010, Blackrock was 49% owned by Merrill Lynch. This stake was entirely divested in November of 2010. The firm retains the competitive advantages of a global financial services provider but is no longer controlled by a firm with interests selling proprietary products through its major channel.

Asset Size: The fund is only about $350 million in assets. A similar strategy is also run by the team in a Limited Partnership

Flexibility: The fund has 22 countries and over 1200 stocks to pick from.

Own Cooking Eaten: to be determined

Managers’ Long-Term Record: While the strategy track record is not long, the track that encompasses the Great Recession, producing a positive return of 9% in 2008 with only 9% drawdown at worst. In 2009 the LP was flat but produced exceptionally good returns in 2010 and 2011.

Stated return Objective: The team has a stated volatility control objective but no cleared stated return objective. We feel this is appropriate for a volatility control manager. That said, the LP the team managers with a similar strategy had very strong performance of 27% in 2010 and 41% in 2011.

Manager Volatility Control Intention: The fund has a goal to limit volatility to a standard deviation of 8 but sees the current environment as high risk. The delivered standard deviation is 4.5.

Return History: The management team has delivered solid returns since 2008, including positive returns in 2008 (in the Pan Asia Opportunities strategy). However, from September to December of 2008 the Pan Asia Opportunities strategy suffered a 9% loss. Moreover, in 2009 the team’s strategy did not participate in the bull market rally.

Perceived Risk: This is a somewhat risker volatility control fund than some of our other volatility control managers, however, we feel warrants inclusion due to its ability to exploit market inefficiencies which we expect to last for some time period. We feel the odds of producing a positive return over any 18 month period remain high. Moreover, we feel it may do well when other, more traditional, strategies are doing poorly. Historically it has shown a very low correlation to other asset classes.

Key Points to Remember

- Provides investors with some exposure to emerging markets, which are more favorably valued than the US market and which are likely to grow at higher rates.

- Provides substantially lower risk than traditional investment vehicles.

- Appropriate for investment in high uncertainty environment with track record of providing consistently positive returns over most investment periods.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us