Global View Investment Blog

End of Year Note: No Time to Take Unnecessary Risk

I and my partners and staff want to wish you Merry Christmas and Happy Holidays. While we will be putting together a newsletter early in the year, I felt it prudent to provide you with an update of our opinion on how our investment strategy is working. Our strategy of taking lower risk has not “worked” over the last year because we reduced risk in what we believed, and still believe, to be a recessionary investment climate. While it is now a matter of fact that Japan and Europe are in recession, the US is not formally in recession yet. It is our belief that the US is very likely in recession. Four of five times stock prices have fallen during recession as called by ECRI and as backtested for the last 100 years. This time stock prices have not fallen and in fact have risen substantially since ECRI told us we were on recession track.

I and my partners and staff want to wish you Merry Christmas and Happy Holidays. While we will be putting together a newsletter early in the year, I felt it prudent to provide you with an update of our opinion on how our investment strategy is working. Our strategy of taking lower risk has not “worked” over the last year because we reduced risk in what we believed, and still believe, to be a recessionary investment climate. While it is now a matter of fact that Japan and Europe are in recession, the US is not formally in recession yet. It is our belief that the US is very likely in recession. Four of five times stock prices have fallen during recession as called by ECRI and as backtested for the last 100 years. This time stock prices have not fallen and in fact have risen substantially since ECRI told us we were on recession track.

From our ongoing dialogue with ECRI, and according to our own analysis, we continue to believe the US is very likely in recession or we will be very soon. Even if the fiscal cliff is circumvented, the fiscal drag from reduced spending may be just the air pocket that puts an end to what we have called the “beautiful” deleveraging that started with QE 1 in early 2009. But each subsequent QE has had diminishing effect (each about half as effective as the last) making the likelihood of a derailment of this deleveraging ever more likely. We do know that when the “beautiful” deleveraging ended in 1937 shortly after FDR was re-elected and some important policy was put into place, specifically social security taxes were implemented and the Wagner Act, empowering organized labor, was implemented, but money was also tightened. This time around money is going to be easy but the Affordable Care Act, increases in taxes, and reduced spending might be enough to end this.

While there are undoubtedly bulls, with whom we are not invested, the chorus of our most respected managers is that now is not a time to be taking unnecessary risk. In a recent interview at Bloomberg, Jeff Gundlach, who manages Doubleline Total return, summarizes: “I think the small amount of money that you might make by trying to push it here as we get closer and closer to the end game where this thing might tail out--the amount of money you might make will be dwarfed by the amount of money you might lose when things reprice lower. Put it another way, if you just stay in cash and earn a small return or stay in a low risk investment and earn a middling single digit return--the money you might be able to make as we move into late 2013 or early 2014 with repricing, the amount of money you might make if you are able to deploy the money at that point will make all the difference. People always want investments to go up like a line…That's just not reality. You make 80% of your money in 20% of the time in investing and you have to be patient…I see some values in some of these foreign markets. I don't see a lot of value in the U.S. stock market and I think you have to play it safe in the U.S. bond market with funds that are really dedicated to having low volatility."

Read more: http://www.businessinsider.com/jeff-gundlachs-bloomberg-interview-2012-12#ixzz2FVJjAUwu

So I want to share with you how we intend to take advantage of this once again. We intend on retaining our low risk stance until we get a clear signal there is an Economic Expansion. We believe this will be at substantially lower prices. As many of you recall, in 2008, our Risk Tolerant portfolio returned about -25% before we implemented Economic Risk Based Asset Allocation (ERBAA). Had we implemented ERBAA then, we would have lost only about 9%. 2009 returns would have been similar to what was experienced, which was higher than the S&P 500 ... Anyway this strategy hasn’t “worked” over the last year and I ask you to please be patient because we continue to believe we will get our opportunity

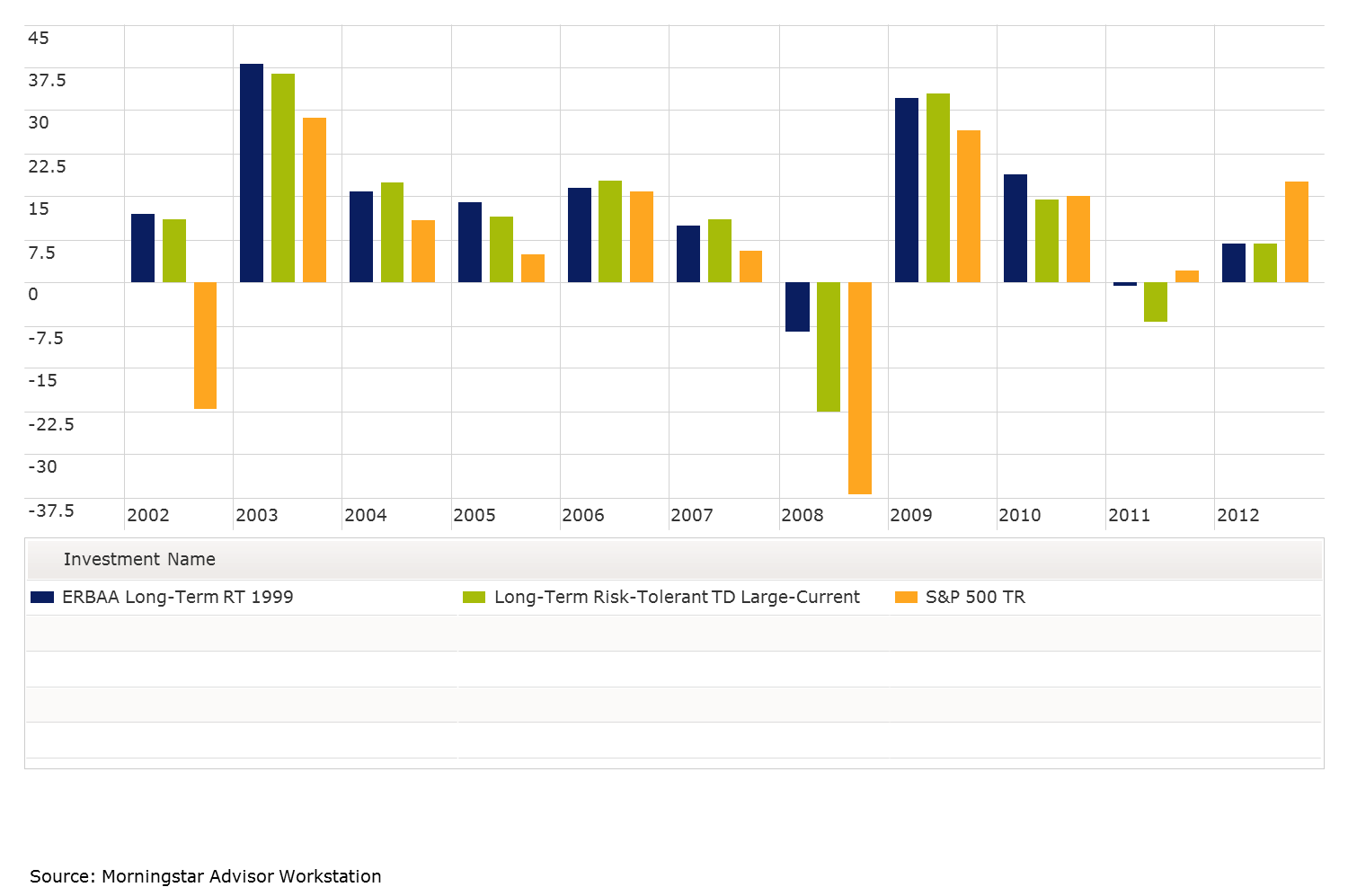

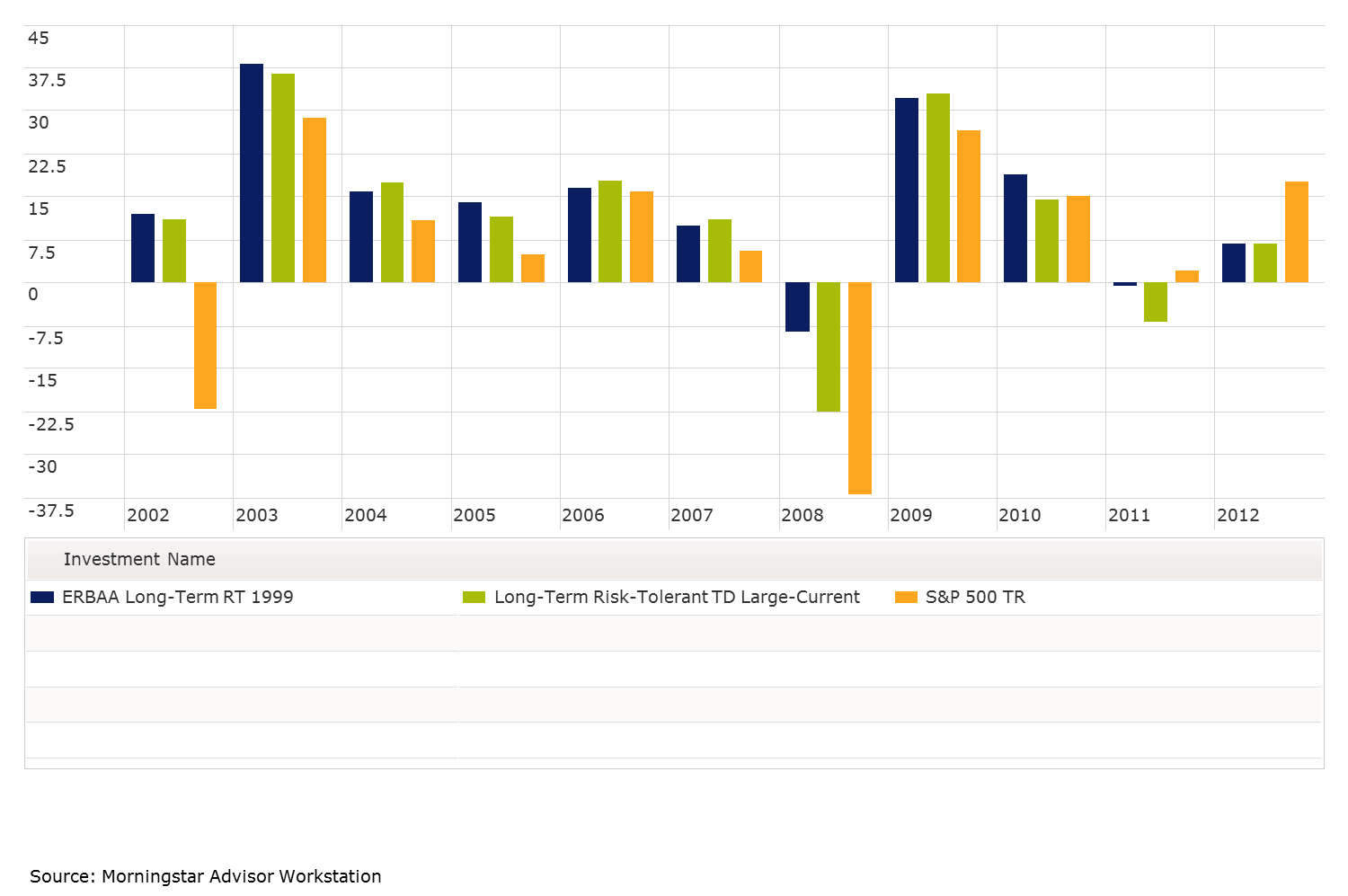

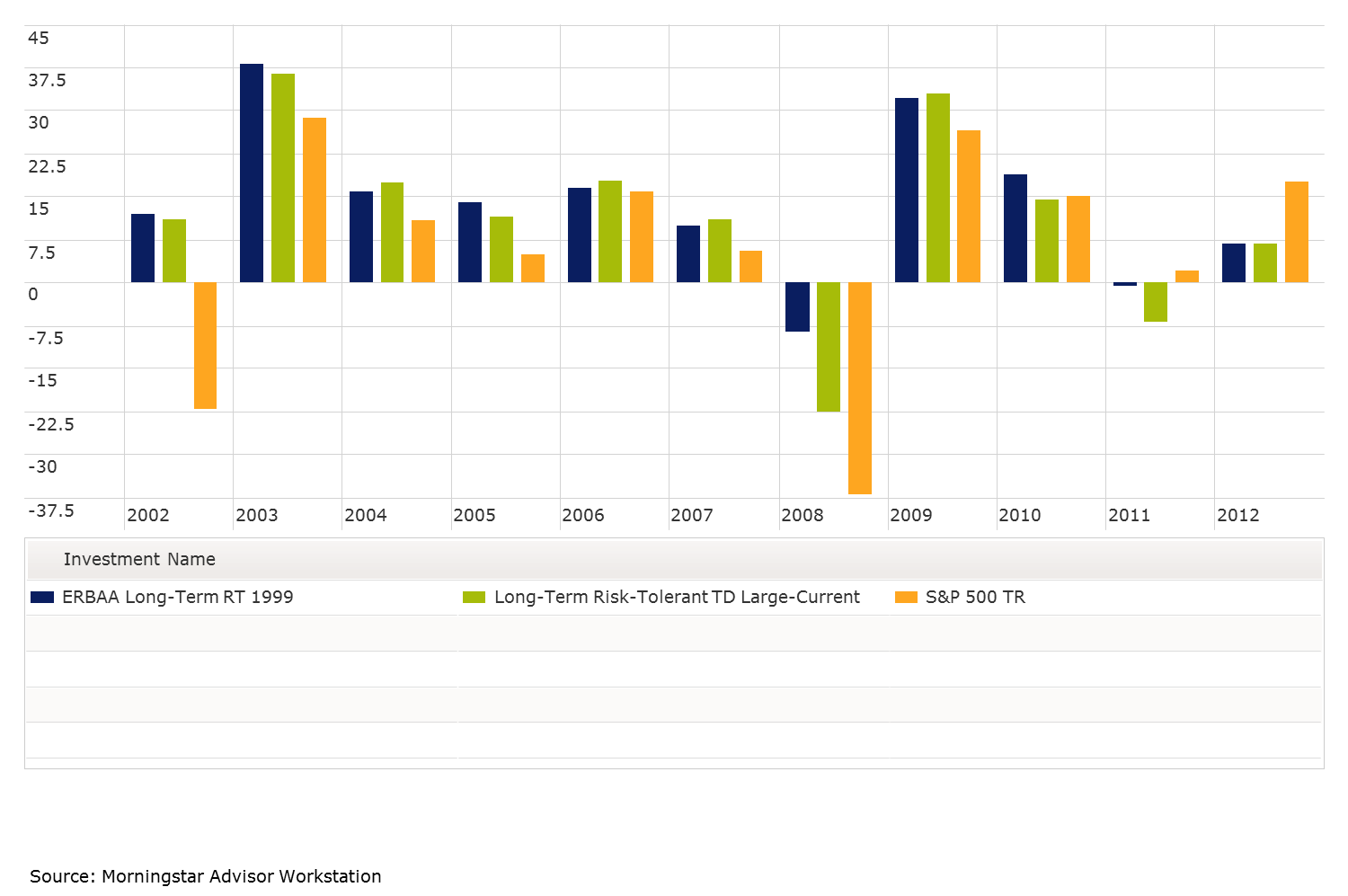

But I want to share with you what we are trying to do this go round. Below is a chart illustrating our best attempt to show what we actually did with clients and what we are trying to do with the Economic Risk Based Asset Allocation (ERBAA) overlay. These portfolios were created using reallocations to our models as they resulted or in the case of earlier years as we believe were made. The portfolios must be considered hypothetical because they do not represent an actual composite of what occurred. Indeed they cannot show a composite for Global View because these portfolios Global View's official formation as an investment advisor with the SEC. Instead it shows our best effort to illustrate the model we use as we managed client relationships since Merrill Lynch, at Cambridge Investment Research, and when we formally began managing investments under our own RIA, Global View Investment Advisors, in 2008. The blue chart is our best attempt to replicate what we actually did in our Risk Tolerant portfolio for clients with a moderately aggressive risk tolerance. The green chart is the Risk Tolerant portfolio with ERBAA. The orange shows the S&P 500 total return. The most significant difference occurred in 2008. By avoiding much of the downside risk of the market the actual portfolio had a loss of about 25% vs. 38% for the S&P 500. However, if we had reallocated for lower risk in March of 2008 when ECRI called recession, the ERBAA Risk Tolerant portfolio would have lost 9%. Similarly in 2011, had we allocated for lower risk at Economic Slowdown in April, we would have suffered a lower loss because we would have reduced our more volatile investments in April of 2011. Client’s recent performance, since the recessionary allocation has suffered vis a vis the S&P 500.

In hindsight, not reallocating for recession would have resulted in higher returns over the last year or so. However, we believe this process is sound and will result in higher returns over time. We do know that we have been subjected to substantially reduced risk. Since our view remains that there is little upside but substantial downside, we ask you to be patient. We hope to see resolution in 2013 but cannot know how long this will take.

In summation, we want to reassure you that your portfolio is allocated with substantially lower risk than the market and ask for your continued patience. Merry Christmas and Happy New Year!

Ken Moore

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us