Global View Investment Blog

Quarterly Newsletter to Public Q1 2013

Quarterly Newsletter to Public Q1 2013

March 28, 2013

“Our Patience Will Achieve More than our Force.” Edmund Burke

Executive Summary

While we continue to believe much of the developed world is currently in a mild recession there is reason to believe that near-term deflationary forces may have been reduced, at least in the short-term. Nonetheless, the preponderance of other risks and current valuations do not make this a time to take increased risk.

- While a recession has been recognized in Europe and Japan, and despite a negative Q4 GDP in the US (later revised up assuming 0.6% inflation), it is possible that serious downside risk may be averted in the short run due to the literally unprecedented coordinated action of the world’s major developed countries to provide accommodative monetary stimulus as long as is needed to try to spur growth.

- The Economic Cycle Research Institute holds firm that the US, Europe and Japan remain in recession with no sign of an upturn soon. Moreover, recent events in Cyprus illustrate the fragility of the Euro and the lack of a clear legal system for recapitalizing insolvent banks – who would have thought depositors would be responsible for recapitalizing banks?

- The US remains the most overvalued of major markets. Mean reversion is inevitable but impossible to time. This can cause investors to be impatient, chase recent returns, and make mistakes that result in permanent loss of capital.

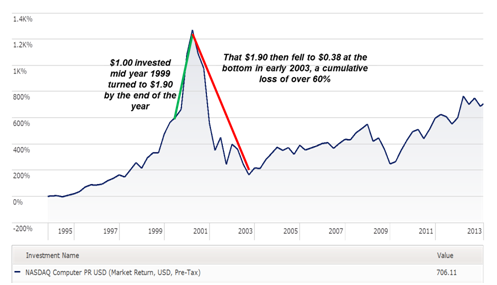

- We must remain patient and understand that assets can become extremely mispriced during bubbles. We all know about the Nasdaq bubble but few understand that the US Federal Reserve made $500 billion in monetary stimulus in late 1999 coincident with an unprecedented additional rise in the Nasdaq. During this stimulus $1.00 invested mid-year rose $1.90 before falling below $0.40 by early 2003 after the stimulus was withdrawn. Before trying to participate in such a market the question that must be asked is: Is it worth the risk?

Deleveraging, the “New Normal” and Economic Growth Outlook

As Ray Dalio at Bridgewater Associates has shown, the economy and stock markets just seem to work differently during periods that follow credit busts. Dalio’s work illustrates that during the “beautiful” deleveraging periods from 1933-1937 in the United States and after WWII in the United Kingdom, that the economies and stock markets largely responded positively to monetary easing. As we discussed earlier, we believe we are in a similar period now. According to Dalio, for the time being the United States continues to be in the “beautiful” phase where monetary stimulus is sufficient for the economy to continue to grow at a positive rate (at least as it is measured by the US government) that is lower than the cost of borrowing. While this continues the degree of leverage in the total economy as expressed by total debt to total output (GDP) falls. While he believes valuations are stretched, it looks like he thinks the recent demonstration of Europe and the rest of the world to pursue easy money policies can allow this phase to continue and for a serious crisis to be averted in the short run.

The balancing act to continue a “beautiful” deleveraging requires the perfect blend of austerity and debt monetization to slowly but surely reduce the ratio of debt to GDP. Clearly a deep recession would put an immediate halt to this as would a new financial crisis; however, continued nominal economic growth greater than the Federal cost of borrowing can allow this deleveraging to continue. Ray Dalio’s recent more bullish view remains in stark contrast with most of the data we see and with ECRI’s assessment of the economy. Moreover, with valuations already stretched, we need to be very careful before prudently taking any additional risk.

We continue to believe Developed Countries are in recession. Europe and Japan have already met the common threshold, i.e. two quarters of negative GDP. The US experienced negative GDP in Q4 of 2012. However, the printing presses have been warmed up and continue to work full time. This may be enough to counter any immediate downward pressure. Mr. Dalio has an excellent track record of providing positive returns for his clients by making bets on the overall direction of liquidity flows and the economy; however his largest drawdowns occurred exactly when the economy unexpectedly turned down. Moreover, while we believe it is possible the market can continue sideways for some time, it is equally important to remember that the stock market dropped over 50% in 1937 coincident with the end of US easy monetary policy and a subsequent recession.

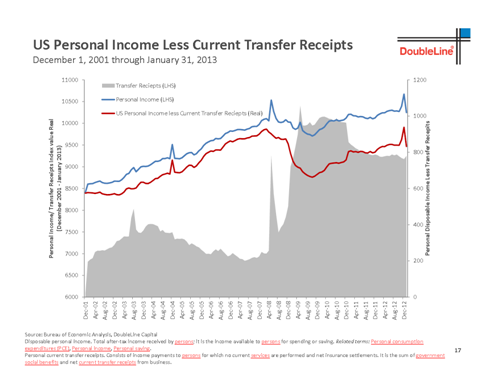

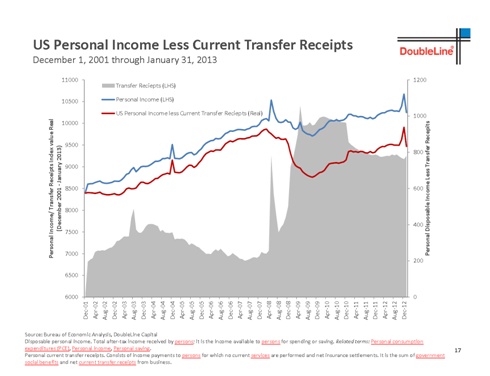

With the major developed nations in recession or at stall speed, it does not seem plausible that companies can continue to grow earnings. While some data appears to be improving, earnings growth has fallen nearly to zero. A more meaningful measure for economic growth than unemployment is total weekly hours worked. This remains extremely low, real median family income has been falling and in particularly, income less transfer receipts (money available to spend) experienced a precipitous drop.

Pressure to reduce deficits creates another headwind to earnings growth.  It is ironically the view of bullish brokerage firms that growth will slow only when stimulus is reduced. Moreover, the lack of a clear legal sign governing the Euro and the recent action in Cyprus to recapitalize banks by taking depositor's funds illustrates that the lack of clear ownership of property rights. It is ironic that Dmitry Medvedev, the Prime Minister of Russia compared the bank deposit levy on Cyprus to: “expropriation and confiscation ... only comparable to decisions made at a certain period in time by Soviet authorities, who did not stand on ceremony when it came to people’s savings.”

It is ironically the view of bullish brokerage firms that growth will slow only when stimulus is reduced. Moreover, the lack of a clear legal sign governing the Euro and the recent action in Cyprus to recapitalize banks by taking depositor's funds illustrates that the lack of clear ownership of property rights. It is ironic that Dmitry Medvedev, the Prime Minister of Russia compared the bank deposit levy on Cyprus to: “expropriation and confiscation ... only comparable to decisions made at a certain period in time by Soviet authorities, who did not stand on ceremony when it came to people’s savings.”

Clearly this creates a precedent for possible future actions in the rest of Southern Europe. Were you a citizen of Spain with over €100,000 in a bank account, would you not be tempted to withdraw these funds and deposit them elsewhere, anywhere outside of Spain? Should many depositors feel this way, this could cause a run on the banks and cause Spanish banks to fail.

Focus on Valuations

Global Valuations

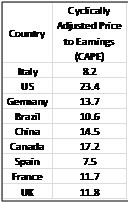

Valuations often have little relevance to short run price action; however,  in the long run conservative valuations revert to the mean. According to Goldman Sach’s estimates, the US is currently more overvalued than other major markets. Using this same metric (if we could ignore the macroeconomic backdrop), Southern European markets appear most attractive. Emerging Markets are more attractive than Developed Markets from both valuation and growth perspectives. To put valuations in historical perspective, the US reached a low CAPE of 5.5 at the market low in June of 1932 and 8.1 In May of 1980. However, in March of 2009, the CAPE fell to a low of only about 12. For this reason many so called “perma bears” never got truly bullish even at these lows.

in the long run conservative valuations revert to the mean. According to Goldman Sach’s estimates, the US is currently more overvalued than other major markets. Using this same metric (if we could ignore the macroeconomic backdrop), Southern European markets appear most attractive. Emerging Markets are more attractive than Developed Markets from both valuation and growth perspectives. To put valuations in historical perspective, the US reached a low CAPE of 5.5 at the market low in June of 1932 and 8.1 In May of 1980. However, in March of 2009, the CAPE fell to a low of only about 12. For this reason many so called “perma bears” never got truly bullish even at these lows.

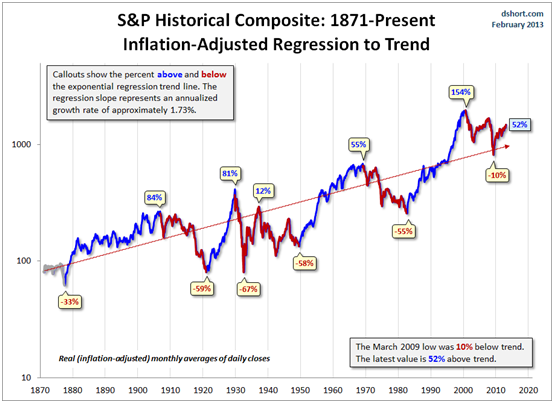

Mean Reversion Inevitable but Timing Unpredictable

While short term events and political and monetary events can derail the course of valuation regression, must eventually occur, at least in inflation adjusted terms. However, this can be a very uncomfortable wait especially as prices continue to rise when unwarranted by fundamentals.

While examining the historical effects of quantitative easing on asset price movement, we recently learned that the NASDAQ bubble, already inflated in 1999, gained additional fuel when the US Federal Reserve passed the Contingency Financing Plan to “ensure adequate liquidity ... through the Y2K rollover period.”  This provided banks with another $500 billion in liquidity. We now believe most of this made its way into the NASDAQ inflating the bubble. We also know that this did not last. While the NASDAQ rose 90% over the final six months of 1999, it then fell 80% readily erasing all of the “gains” and falling an additional 60% below the amount before the stimulus was given. The put this in terms more easily understood, $1.00 invested in the Nasdaq mid 1999 would grow to $1.90 by year-end only to fall to under $0.40 by early 2003. As tantalizing as it may appear to try to ride a bubble like this and time the exit, the question that should be asked is: Is it worth it?

This provided banks with another $500 billion in liquidity. We now believe most of this made its way into the NASDAQ inflating the bubble. We also know that this did not last. While the NASDAQ rose 90% over the final six months of 1999, it then fell 80% readily erasing all of the “gains” and falling an additional 60% below the amount before the stimulus was given. The put this in terms more easily understood, $1.00 invested in the Nasdaq mid 1999 would grow to $1.90 by year-end only to fall to under $0.40 by early 2003. As tantalizing as it may appear to try to ride a bubble like this and time the exit, the question that should be asked is: Is it worth it?

Investing Themes

We had feared that the world may face a deflationary downturn in the midst of a deep recession. While Developed Nations are in recession (Europe and Japan) and in or very nearly in recession (US), it is possible the unprecedented monetary stimulus may be enough to fool key players sufficiently to avoid a near-term deflationary spiral. Investment managers we respect are increasingly more concerned with inflation risk than deflation risk. What we know is that the US, Europe, and Japan, have committed to further monetary stimulus and will stop at nearly nothing in an attempt to assure positive nominal economic growth. We also know that historically stimulus of this magnitude has created bubbles. What we do not know is where the bubble will be nor when it will burst.

We also know that this will make these currencies, specifically the Dollar, Euro, and Yen relatively less attractive to currencies in more fiscally prudent countries where money is not being printed such as a few stalwarts like Singapore and Norway and most probably also vis a vis emerging markets countries. We also know that it will result in inflation at some point. What we don’t know is when this will manifest.

Therefore, we are maintaining Recession Allocations for client portfolios, but slowly and surely putting cash prudently to work. Our main themes are:

- Quality Equity using Margin of Safety (emphasis on balance sheet quality, ability to pay dividends, quality earnings, established market position etc.)

- High Yield and opportunistic bonds as appropriate but through Margin of Safety Selection

- Currency of countries that are fiscally sound

- Opportunistic long/ short bond portfolios to capture mispricing in global bond and emerging market countries

Next Steps

We remain vigilant and hopeful that we will see a durable expansion in world economic growth at some point. However, the real data we monitor continues to show slowing or recessionary growth prospects. While continued monetary easing may continue to paper over the problems for some time period we believe valuations will win this battle and we will have an opportunity to deploy capital at better prices. This view is shared by our investment managers.

On a positive front, we see excellent long-term prospects for the oil and gas sector in the United States. The ability to extract oil and gas from existing shale fields in the United States has the potential to make the US energy independent. We are looking for opportunity to take advantage of this in our investment portfolios at the next sign of an economic expansion.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us