Global View Investment Blog

Quarterly Newsletter to the Public- Q1 2014

April 22, 2014

“We’re generally overconfident in our opinions and our impressions and judgments.'”

Daniel Kahneman, Nobel winning Psychologist and recent author of Thinking Fast and Slow

Executive Summary

The economic reality is that most of the world is mired in a New Normal where economic growth is no longer likely to be sustained by credit bubbles. In this environment investors need to carefully gauge their risk and commit to an investment strategy that works for them.

- The US earnings recession of late 2012 – early 2013 appears to have avoided manifesting into a full blown recession. Economic activity in Europe and Japan turned up last year, and the global economy overall appears to be improving. However, China is slowing and we believe that the growth outlooks of many pundits are overly optimistic.

- Investors, wishing they could have had last year’s return, may get caught chasing returns and seek to take additional risk. Instead, investors should seek to reallocate risk to their specific time horizon with an understanding that volatility will be much higher. Each investor needs to make this decision together with their advisor looking at all the facts an understanding the potential consequences of the decision.

- Utilizing what we have learned from our managers and from over 14 years of investment experience we are now offering two all cap stock portfolios using research we acquire from Morningstar. While we do not intend to replace our global and international managers with these strategies, we see this as a supplement. We can now screen your stock holdings for “dangerous,” and offer better tax management. We feel this is an evolution every RIA must eventually make and are excited to move forward.

The Ongoing New Normal and “Beautiful” Deleveraging

The US and other Developed Nations remain mired in a new normal where economic growth is unlikely to be sustained by rising credit. The US earnings recession of late 2012 to early 2013 has not turned to a full blown recession, for now, due to unprecedented money printing. However, earnings have improved since then and Japan and some European economies have experienced an economic growth rate cycle upturn. US companies have made abnormally high profit margins made possible by budget deficits, money printing, and the global savings glut in Germany and China. Growth outlooks should be tempered however, as it is likely that weak economic growth will continue until the total indebtedness of developed nations’ economies is substantially reduced. For this to happen, interest rates need to be held low for a very long time. While US businesses and consumers have substantially de-levered, much of this deleveraging has simply been a transfer from personal and company balance sheets to the government. Inflation has remained low because money printing has simply offset the deflationary forces of this weak economic growth environment. Emerging Markets face an economic slowdown as China attempts to deflate its rising credit bubble.

In this overly complex environment where valuations on almost any metric remain perilous in the US, professional money management and prudent risk allocation have never been more important.

Tough Choices Face Investors

Developed market stocks went up hand in hand with global money printed last year. The faster the printing the higher they rose. On the one hand, investors who were conservatively allocated now feel regret that they missed an enormous run in the markets last year. They wish they could have had last year’s return. While they were averse to losses going into 2013, they wish they could have had the returns US investors made in 2013. The natural inclination is to chase last year’s performance, and to add risk now at a time when valuations are certainly perilous. We know that the average investor (however smart he may be) typically does this at almost the exact wrong time. This is why he underperforms so much and needs professional guidance to stay the course.

On the other hand, investors and advisors may have anchored inappropriately on the 2008 market experience. In 2008 only 5% of companies in the S&P 500 showed positive returns. Looking at the same data back to 1980, on average 63% of stocks showed positive returns. Every year except 2002 and 1990 at least 40% of stocks showed positive returns. In 2002 only 26% of stocks made money, 27% in 1990. Therefore, 2008 was truly an anomaly. While we do not have this data for periods before 1980, we do have correlation data that tells a similar story. The Great Recession and Sovereign Debt Crisis saw correlations in stocks rise to levels never before seen outside of the Great Depression. Other major stock market corrections do not appear to have been as widespread. Moreover, the world is not the US. On multiple metrics there are intriguing opportunities in many places outside of the United States including Europe, the UK, and Emerging markets.

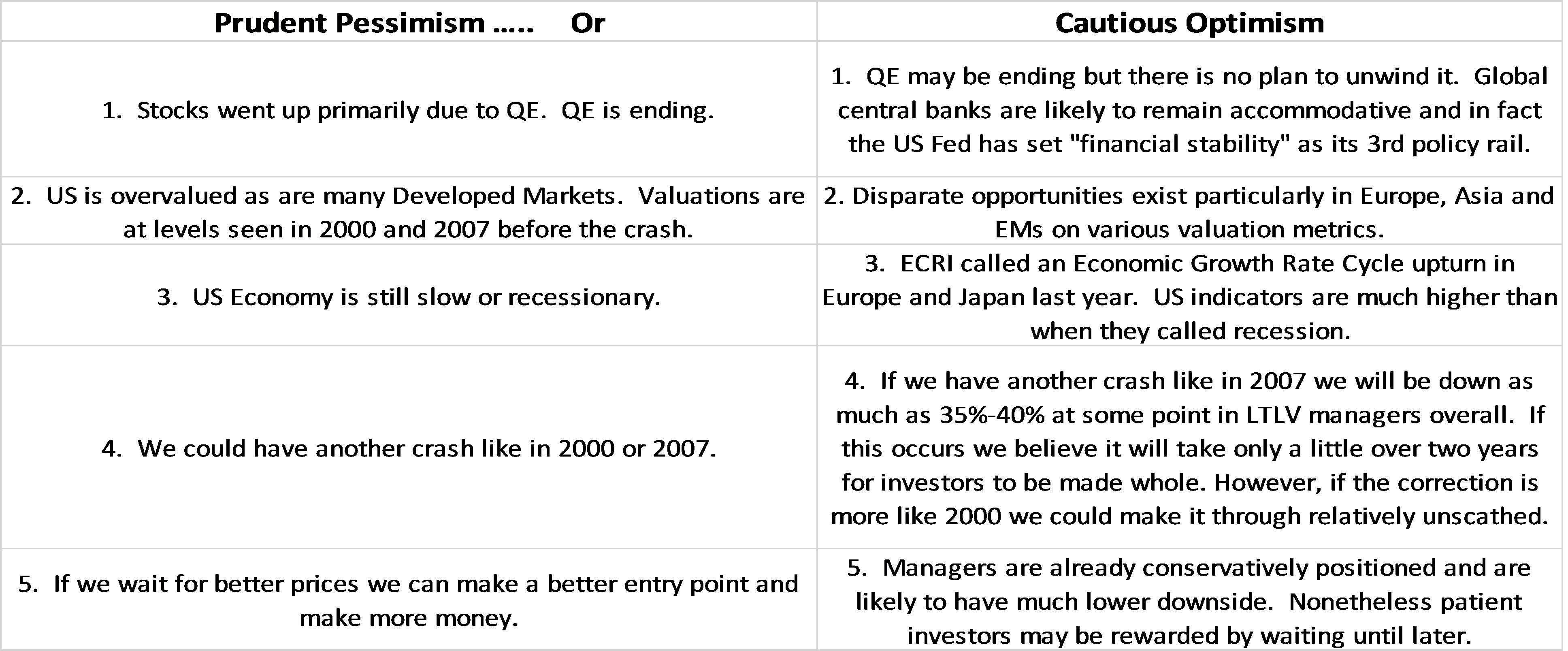

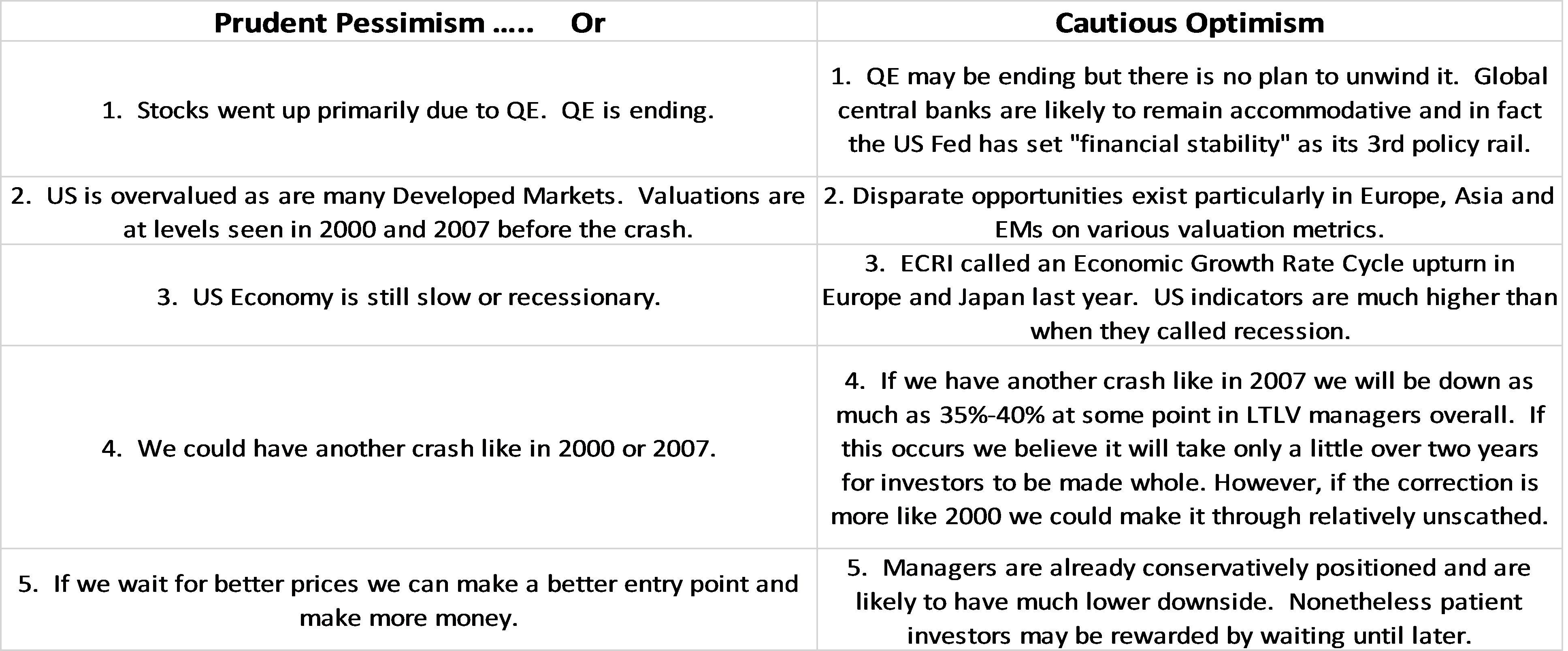

We put together a matrix highlighting the choices investors face in this difficult investing environment.

The bottom line is that there are excellent reasons to be prudently pessimistic and excellent reasons to be cautiously optimistic depending on an investors’ ability to withstand volatility, age, goals, and overall view of the world. We need to be very careful to make sure we do not take additional risk for the wrong reasons. As Daniel Kahneman taught us, all people, however smart, suffer from psychological biases that not only cause them to make the wrong decisions but that predictably cause them to make exactly the wrong decisions. In applying our own filters we need to make sure any changes we make to our investment strategy at this junction are changes that we will stick to regardless of how the next several years play out. We need to look at this very hard and make sure we can handle the consequences of the decision.

With this in mind, we are having a discussion with every client on these topics providing them with all the data we have, our interpretation of that data, and helping them decide what path forward is best. As Daniel Kahneman said “Financial Advising is a prescriptive activity whose main objective should be to guide investors to make decisions that serve their best interests.” This is our first and most important objective and we need to work with our clients to do this.

Introducing the new Global View Stock Portfolios

During our company visits with fund managers last year, we reinforced our understanding that the best managers in the world rely heavily on quantitative metrics to pick the best stocks. We recently came across a study illustrating 25% of stocks are responsible for 100% of returns from 1983-2006, i.e. the top 25% did so well that they negated the negative performance of the worst 75% which in aggregate had a 0% return.

We originally learned from Benjamin Graham that buying cheap companies is the only way to invest. Metrics like Price to Earnings, Price to Cash Flow, Price to Book Value, and Cash on the balance sheet, etc. are the metrics this school of thought uses to determine a company’s value. Warren Buffett taught us that it is okay to pay more for a quality company because there is less risk. Quality companies are companies who have stable earnings. Earnings stability is really a manifestation of a strong market position or strong brand and a strong balance sheet. Over the last 14 years, listening to managers, reading their quarterly letters, meeting with them, reading books, and striving to learn more, we believe we have identified key success factors for selecting stocks with an acceptable level of volatility. While picking these cheapest stocks might lead to the best returns, a strategy based solely on value can be so volatile that it can escalate the risk of capitulating from the strategy (selling at the exact wrong time and resulting in permanent loss of capital). This is why we have also introduced a heavy layer of quality to reduce the volatility to acceptable levels for each strategy. In order to leverage our understanding of stock evaluation in a manner that will benefit our clients, we now purchase real time data from Morningstar (who analyses and normalizes data but is unbiased and does not represent a sell side) to monitor these criteria and have put together two portfolios that we are confident will experience excellent results.

One portfolio is intended to be substantially lower risk than the S&P 500. This portfolio can buy companies of any size and has a 60% emphasis on quality. We eliminate companies that do not have sufficient liquidity or that are selling for more than 35% of their annual low and screen for the top 10% of the universe of over 2100 companies. This portfolio, the Global View Equity Income portfolio, owns companies you have probably never heard of as well as Stalwarts such as Johnson and Johnson, IBM, Apple and Altria. We hold on to these companies until they fall below the top 20% of the investment universe and have the ability to rebalance to the top 10% on an annual basis depending on client tax preferences.

The other portfolio is intended to be of similar risk to the S&P 500 with a focus on generating higher returns. This portfolio, the Quality Growth portfolio, has a greater emphasis on valuation, earnings growth, and return on total assets. The portfolio is also all cap, owning some companies you never heard of as well as Glaxo Smith Kline, Deere & Company, Apple, and Phillip Morris International. We buy the top 10% and sell when they fall below the top 20% or eliminating criteria are met.

We have limited access to international markets and will continue to rely heavily on our managers to buy stocks outside of the US for the foreseeable future. These portfolios are intended as an offering to clients who want to own individual stocks outright, who already own US stocks, and as a component of an overall investment strategy. If you currently own individual stocks, we would be happy to screen your stocks against our metrics and against our “dangerous” screen to identify stocks with highest risk.

Moving Forward

We are having a discussion with every client on these topics providing them with all the data we have, our interpretation of that data, and helping them decide what path forward is best. As Daniel Kahneman said “Financial Advising is a prescriptive activity whose main objective should be to guide investors to make decisions that serve their best interests.” This is our first and most important objective and we will be working with our clients to do this.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us