Global View Investment Blog

The Importance of Time Horizon and Asset Buckets

“Financial Advising is a prescriptive activity whose main objective should be to guide investors to make decisions that serve their best interests.” Daniel Kahnemann

Executive Summary

This regular update is intended to be used as talking points with clients.

- People who have money have a long time horizon with most of their money.

- We have a technique to quantify how much should be invested short-term and how much long-term; we break investors assets into buckets based on time horizon of expected usage.

- Chasing yield has resulted in ruin, time after time. It might be foolhardy to expect now to be different.

- Broad stock and bond indexes are expected to make less than 1% real annual returns for the next 7 years. Cash is expected to lose after inflation. Volatility is guaranteed. Investors need a clear strategy to navigate through it.

Most Serious Money has a Long Time Horizon

While there are many reasons for chasing returns, from a practical perspective, assets are useful only as a means to be converted into income at a later date. For many of our clients, the date which the bulk of these assets will be converted into income is far in the future even if there is an immediate income need. For most, the overwhelming majority of their money has a long time horizon.

Shorter-Term Needs Can Be Quantified

We can quantify the time horizon over which assets are expected to be converted into income by interviewing the client and putting together a financial picture. For example, if the client plans on retiring in 5 years, and he believes,

- He will have $2,000,000 in assets (based on our assumed growth rate and savings projections)

- He will need $75,000 in income

Then his simplified minimum Target Return is 3.8% (75,000/2,000,000). An achievable target. Based on these assumptions, we would begin putting together a Retirement Spending portfolio for the client beginning 3 years before his retirement. At retirement, we would fund the Retirement Spending Portfolio with 3 years of spending needs, or $225,000. This is the short-term bucket. The remainder of his assets would be directed to the Long-Term portfolio.

Why Divide the Assets Up?

Volatility can be an investor’s best friend or worst enemy. When cash flows are positive and contributions are coming into an account volatility can help the accounts grow and compound. On the other hand, when investors are withdrawing, volatility can destroy the long term income producing potential of their asset base. In an analysis done in 2002 by Metlife, investors can clearly see how downside volatility can be extremely detrimental to the income producing potential of e portfolio.

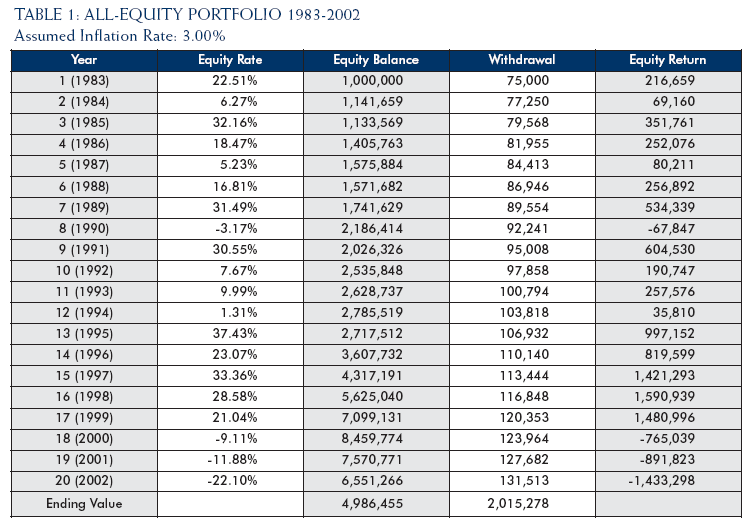

In the analysis, a hypothetical investor retires in 1983 with $1,000,000. This investor chooses to withdraw 7.5% off the portfolio for income in the first year, and then increases that withdrawal by 3% each year to keep up with inflation (for example 1,000,000 X 7.5% = $75,000 in the first year, then $75,000 X 1.03% = $77,250 in the second year). The table below depicts the outcome of the hypothetical investors experience using the ACTUAL S&P 500 Composite Index returns from 1983 to 2002.

As you can see a long streak of positive returns for stocks from 1983 to 1999 helped ensure a highly successful retirement for our hypothetical investor. At the end of the period he has withdrawn over $2 million out of his assets and has $5 million left. But what if returns were not so rosy?

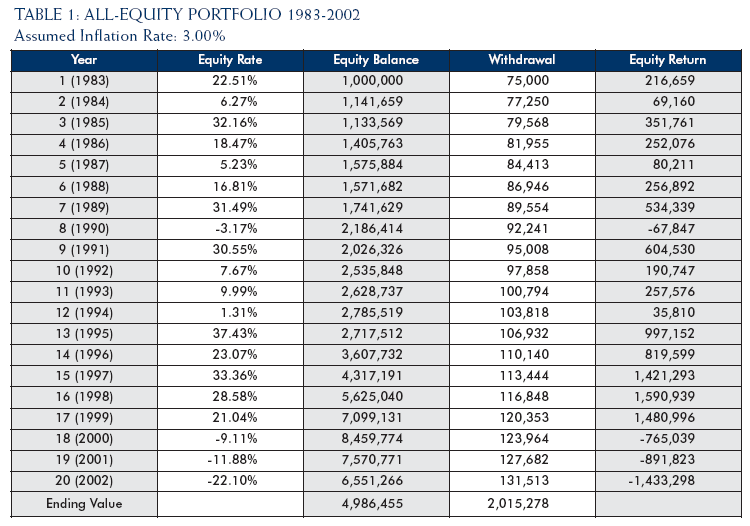

By flipping the years, and using the returns starting in 2002 and working backwards to 1983 the story of our hypothetical investor changes dramatically. At the end of the period our investor has withdrawn only $1.5 million out of his portfolio as he runs out of money during year 17. And instead of finishing the period with $5 million left over our hypothetical investor is in debt. By year 4 our investor has less than half of the total assets he started with.

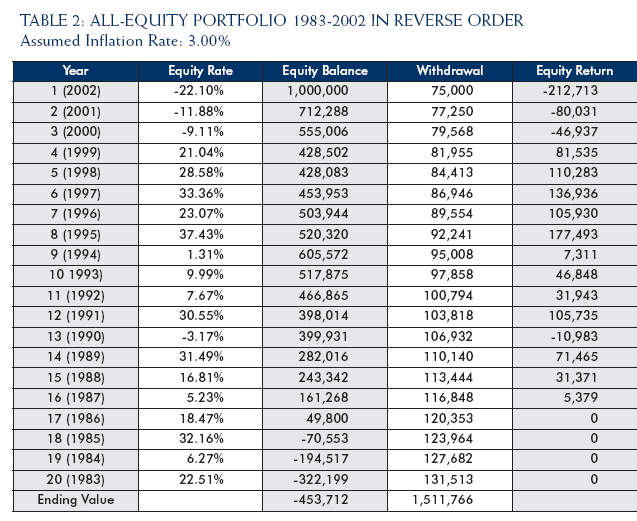

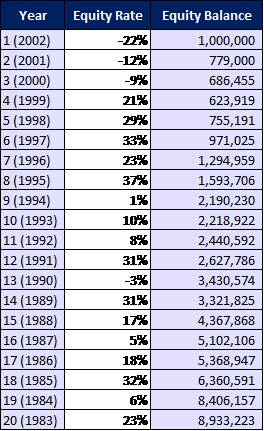

But what would happen even in this poor return scenario if our hypothetical investor was not withdrawing off of the portfolio? We’ve thrown in our analysis to see.

Despite the poor environment to begin with, our hypothetical portfolio has recovered quite nicely and finished with a total balance of almost $9 million!

What Does it Mean?

Growth of an investor’s asset base is vitally important to maintaining income production. However, downside volatility can wipe out the income producing potential of any portfolio very quickly ESPECIALLY when withdrawals are being made. At Global View, we combat this by splitting up the short term and long term assets into separate buckets, the Long Term Portfolio (LTP) and the Retirement Spending Portfolio (RSP). This help us insulate client portfolios where withdrawals are being made from heavy downside risk, while allowing the LTP room to grow, increasing its future income production potential.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us