Global View Investment Blog

Quarterly Newsletter to the Public Q3 2014

“Life’s bills don’t always come at market tops.”

Charles deVaulx, International Value Advisors (former co-manager with Jean Marie Eveillard at First Eagle Global)

Executive Summary

The key thesis of our investment strategy is that a “go anywhere” approach of buying cheap high quality securities is the recipe for investment success. This is best exemplified historically by the global strategy managed by Jean Marie Eveillard. This strategy outperformed significantly over the long run and had substantially less risk. However the price was periodic underperformance, often over multiple year periods. As time passes everything changes, so we must be constantly vigilant to find new incarnations of the Jean Marie legacy.

- The legacy of Jean Marie Eveillard exemplifies world class investing. Even under Jean Marie periodic underperformance was the price for risk control and predictable returns over reasonable time horizons.

- As this strategy grew and Jean Marie stepped down from management, we have sought out other strategies that we believe are similar in approach and hopefully results. We feel we have found others that meet this bill but understand they too will suffer periodic underperformance in an environment where short term market performance is dominated by central bank actions.

- Our task is to find investments we believe exhibit the substantially lower downside risk and faster recovery that Jean Marie illustrated.

- We believe investors' long term success is driven by pursuing a strategy based on these principles, client risk capacity and risk tolerance, and staying the course. We have created a methodology to illustrate how this has worked historically, call an "ulcer analysis" that we will present at greater length in an upcoming blog.

Legendary Value Investor Jean Marie Eveillard exemplifies the “go anywhere” strategy

“In the short term the market is a voting machine but in the long run it is a weighing machine.” Benjamin Graham

The key thesis of our investment strategy is that a “go anywhere” approach of buying cheap high quality securities is the recipe for investment success. This is best exemplified historically by First Eagle Global as managed by Jean Marie Eveillard. Jean Marie managed the First Eagle Global fund from 1979 to 2007. The basic thesis of his investment strategy was to buy any size company anywhere in the world as long as he could buy the company at a reasonable discount to its intrinsic value. He was widely diversified because he knew he could not know when the market would realize that the companies he owned were worth their intrinsic value but realized that being diversified would temper volatility and downside risk. During this period the fund averaged 15.7% compound annual performance and suffered only two calendar years of loss. In 1990, the strategy lost 1.3% when the MSCI world index was down 17% (outperforming), and in 1998, lost 0.3% when the MSCI world index was up 24.34% (substantially underperforming and causing investors to question the soundness of the strategy).

Although tremendous excess returns were generated in aggregate, the fund suffered substantial ongoing underperformance versus the MSCI world index. From 1984 to 1988 First Eagle underperformed every calendar year catching back up with the index only in mid-1990, misleading potential investors to believe the index was a better bet. Similarly from 1994-1999 First Eagle underperformed 5 of 6 years and lost half of its shareholders. Patient shareholders, who held the course, were rewarded during the bear market starting in 2000. From the end of March in 2000 to the end of September 2002, First Eagle Global appreciated over 20% when the index plummeted 49% (other indexes were down even more). Under Jean Marie’s management, the fund went on to outperform every year from 2003-2007.

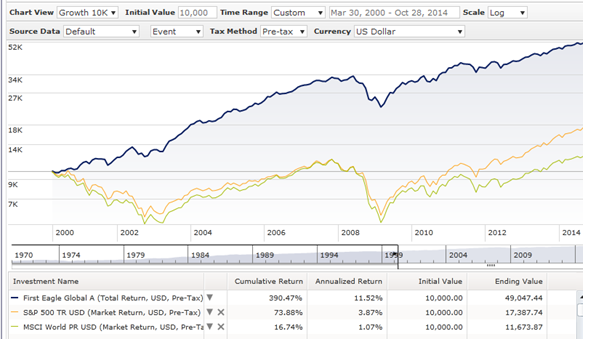

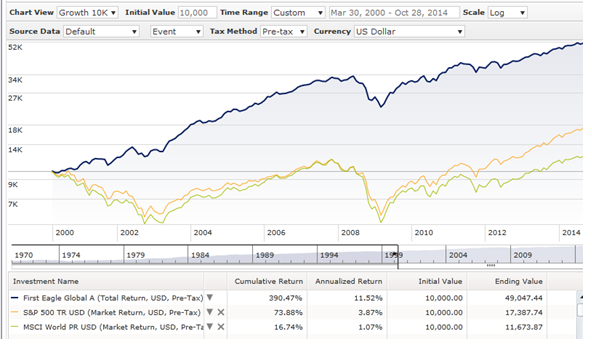

Even after Jean Marie’s departure as manager the fund did well, losing only 22% in 2008 when the index was down 41%. Since 2000 at our former firm, we have been using First Eagle Global in client portfolios. Below is an illustration of the fund’s performance over the last two bear markets, the first beginning at the end of March of 2000:

It is noteworthy that the overwhelming majority of investment funds look much more like the S&P 500 than this fund. Our investment thesis is that investors investing broadly in the US stock market, either through indexes or larger funds, may be unknowingly exposed to downside risk. What may be more difficult to see in the chart is that the price for avoiding the ulcers is often periods of extended underperformance. For example, First Eagle Global underperformed the broad US market for four of five years since 2009 and is fact underperforming in 2014. This is an inevitable byproduct of the investment process of buying companies where they are cheapest. Sometimes it takes a while for the market to recognize their intrinsic value.

This ‘go anywhere” investment strategy has historically added significant value against indexes by avoiding trouble spots. Specifically managers we admire following a quality and value discipline avoided the following problems inherent in indexes and larger funds:

- Avoiding Japan from 1986 to 1991. Japan became 44% of the MSCI World index before crashing.

- Dot com Bubble: From 1997-2000 technology stocks and with them broad indexes rose so much that technology became 33% of the S&P 500 in 1999. After the Nasdaq crashed over 75% this fell to under 10% of the index.

- Finance stocks: From 2004-2007 none of the investment managers we admire owned any of the big banks and largely avoided other finance stocks because they felt the housing bubble would burst.

- Emerging markets (in general): In general quality value managers avoided emerging markets until about 2011.

We have made significant investments in people, technology, and research in order to help our clients preserve and build their wealth. Our mandate is and was to lead our clients to their unique goals, not to match the performance on one arbitrary index over a short time horizon.

Investment managers following a “go anywhere” strategy feel there is more opportunity in Developed International and Emerging Markets than in the United States not because of expected central bank actions but because these markets are cheaper. We feel that investor’s performance going forward will be a function of three key things:

- Making sure that their risk capacity and risk tolerance are matched to their unique needs, i.e. developing a personalized strategy and sticking to it.

- Their allocation to quality and cheap stocks and ability to ignore the false allure of momentum / recent past performance in broad market indexes.

- Their ability to weather bear markets and avoid ulcers turning into heart attacks.

Thank you again. We hope you find this useful and look forward to discussing it with you soon.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us