Global View Investment Blog

Market Update

Brief Summary

The last five years have been good for US stock large cap indexes but hardly anything else. The period from 2011-2014 was an outlier, where US stock large cap indexes rose well ahead of their fundamentals. This period has come to an end. Few investors know that, in overall risk asset terms, 2015 was the worst return year since the 1930s due to poor returns in commodities and emerging markets. We believe the Federal Reserve decision to raise interest rates in December represents a sea change where fundamentals will matter once again as volatility returns to the market. It would be imprudent for us to chase price momentum because we know that over the long-run only fundamentals matter to stock performance.

While such analogies are difficult, we believe the current investment environment is more similar to 1999 than 2007 and we feel this represents substantial opportunity for investors going forward. Clients who have been with us since 2000 remember this but more recent clients may not. With stock markets in correction, investors are naturally scared. We know that active management strategies based on fundamentals have historically done well during periods of volatility with rising interest rates and feel we are entering another period with increased volatility where our strategies will once again experience outperformance. We are working diligently and ask you to remain patient!

Ken held a Webinar covering this topic. Click here to listen to the Webinar.

Recent Correction and Our Thoughts

The recent sharp decline in stocks, both in the US and internationally, has many investors questioning whether we face another 2007-2009 style downturn where stocks around the world fall precipitously. It is our opinion that we do not because, unlike 2007, current conditions represent a large disparity in valuations. Based on valuations, the current environment is more analogous to 1999 than to 2007.

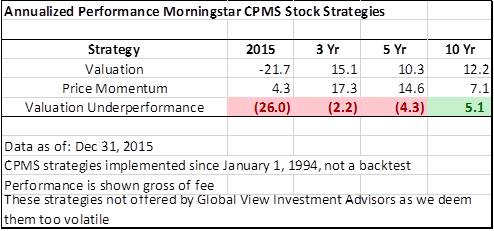

We have reason to believe this bodes well for our investment strategies. Until recently momentum based strategies had performed substantially better than fundamentally based strategies like valuation. We make this reference because it signals irrational behavior. Momentum based strategies are not based on fundamentals, they are simply based on recent price movement. On the other hand, valuation-based strategies (like those we follow at Global View) are based on the assumption that assets selling for low prices will eventually sell for higher prices. This strategy has worked very well since the early 1900s but has not worked over the last several years. We believe this is due to intervention by Central Banks, particularly the US Federal Reserve. To illustrate this irrational behavior the Morningstar CPMS valuation-strategy was down 21.7% while the Morningstar CPMS Price Momentum strategy was up 4.3% last year.

The bulk of this underperformance occurred during the correction in the third quarter of last year. However, more recently this disparity has started to fade. Price Momentum and Valuation are both down, but about the same amount. We are not forecasters, but this may signal a very important inflection point in the markets where fundamentals are returning. It may not be happening yet but we believe a turnaround is inevitable and we must be patient.

Looking back to the late 1990s

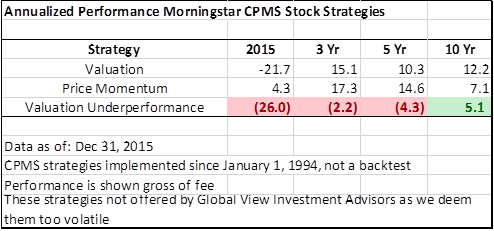

A quick look at the Morningstar CPMS Price Momentum strategy and the Morningstar CPMS Valuation strategy from 1998-2003 is quite interesting because it shows that lackluster performance going into the bubble of 1999 was more than made up from in 2001 and 2002 when the Price Momentum strategy (and the broad stock market in the US) were down a great deal but Valuation continued to generate positive returns.

We know this phenomenon was shared with managers like First Eagle Global and FPA Crescent who did very well from 2000-2003. This happened due to the disparity in valuations which also exists now.

Corrections are Normal – We just didn’t them during the Fed stimulus

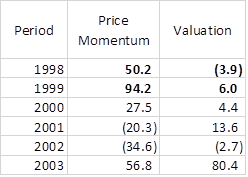

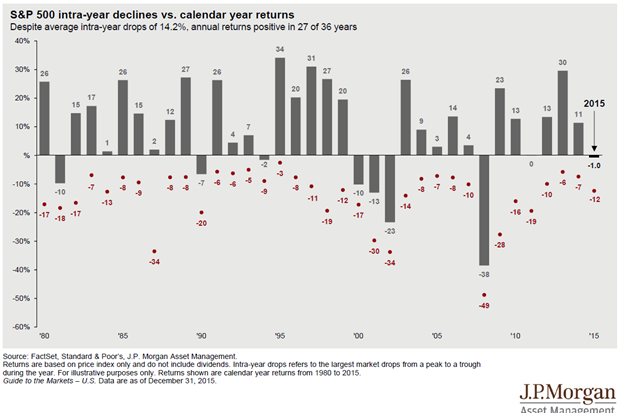

Since 1960, the broad US stock market has experienced a 10% or more correction over half of the time, a 20% correction about 18% of the time (once every 5.5 years), a 30% correction 9% of the time (once every 11 years) and a 40% correction every 1.8% of the time (once every 56 years). The chart below shows the annual return of the broad US market since 1960 and intra-year volatility.

The period from 2011-2013 was an outlier, with very low volatility. We believe this is due to the literally unprecedented quantitative easing by the US Federal Reserve. With the December hike in interest rates, the tailwind for US stocks is gone. Volatility has returned and is likely here to stay. Fortunately volatility is opportunity for value investors.

Going Forward

We believe the recent price movement in the Morningstar CPMS Momentum (irrational) and Valuation (fundamental) strategies may signal a changing of the guard. The last time this happened was 1999 when fundamentally based strategies suffered several years of underperformance only to redeem themselves by doing well in absolute terms while markets fell. Long-term clients will remember the experience of the First Eagle Global Fund, which made 10% each of 2000, 2001, and 2002. Many other fundamentally-based strategies also did well even when the market did poorly, something we have discussed with clients over the years.

We cannot know this will be true. We can, however remain fully aware that over history best performing strategies are those based on fundamentals like valuation. Within the US there are valuation disparities. And even more importantly outside of the US stocks some areas of the world are cheaper than in 2009.

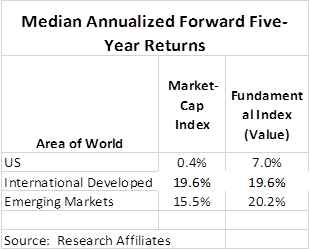

Based on work reported done by Research Affiliates, the outlook for the US market cap index is not good. Based on current valuations the US market-cap weighted index is expected to generate 0.4% p.a. annual returns. Fortunately a look into the value side of things yields a better outlook of 7% p.a. And while investing in overseas markets appears quite risky, the potential returns there are substantially better.

For this reason we feel allocating half of one’s risk budget outside of the US continues to make a lot of sense. We strongly believe in the strategies we are employing with clients and look forward to a return to the fundamentally driven market environment.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us