Global View Investment Blog

Investment Newsletter

Investment Newsletter

June 1, 2016

Executive Summary

In our last letter, we suggested that the stock market might start to once again behave as we would expect by trading more on fundamentals than on momentum. We are happy to report that this changing of the guard appears to be taking place.

- The last several years have been excellent for US stock market indexes like the S&P 500 but not good for US value strategies or global or international strategies. We have suggested this is a price momentum move that will eventually correct itself.

- We also suggested the disparities in valuation today are more analogous to 2000 when some areas of the world and stocks in the US were undervalued than to 2007 when most stocks in the world were overvalued further supporting our thesis.

- As we believed it inevitably would, it appears the tide may have turned. Price momentum strategies are underperforming valuation based strategies.

- We feel one of the greatest risks investors can take is to take more risk than they can handle. Unfortunately the recent increase in index investing seems to indicate this is happening.

- It is fallacious to believe that market capitalization weighted indexes are unbiased. Because they are based on price they indiscriminately own sectors in bubble territory like technology in 2000 and finance in 2007. We believe this is a key reason investors in the S&P 500 have made only 3.2% p.a. on a 15 year basis.

- While we understand that few active managers outperform market indexes we strongly believe fundamentally based active strategies, and occasionally even fundamentally based indexes, are a far superior way to invest.

- This view was validated in our recent meeting with the Chief Investment Officer of Morningstar Research at a symposium in Toronto.

Pure Value strategies finally outperforming

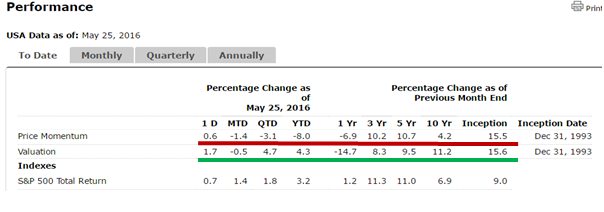

In 2015, the Morningstar Price Momentum strategy outperformed the Valuation strategy by 21.7%. However, so far this year, Valuation is beating Price Momentum by 12.3%.

We believe this is inevitable and may be due to the hike in interest rates in December because the end of the free money tailwinds has caused fundamentals to become more important after interest rates were raised in December.

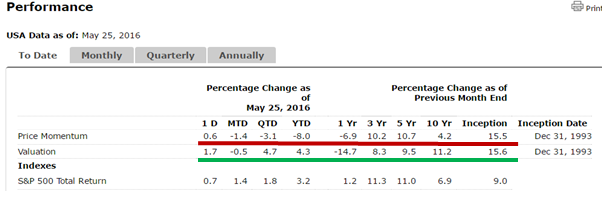

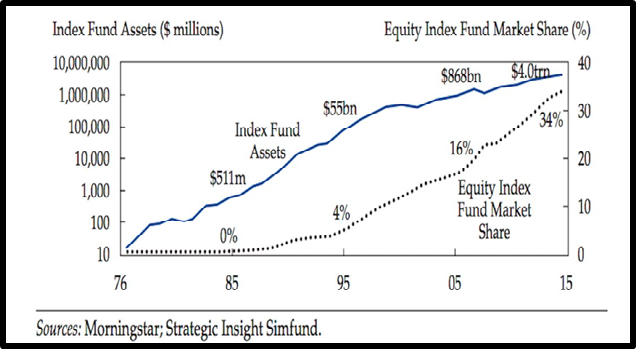

Whether this is true or not, we believe in long-term mean reversion. Research Affiliates has done some excellent work on this. Their work suggests returns will be subpar in the United States. However, because value stocks have done so poorly in this momentum driven market, these stocks now have a much higher expected 5 year return than Growth stocks or low volatility stocks.

Research Affiliates continues to suggest the highest returns are likely to come from outside the United States.

For example while they forecast a 10 year real return of 1.2% for the US S&P 500, Research Affiliates forecasts a real return of 6.1% for EAFE (developed international) and 7.9% for Emerging markets.

Index investing is Popular but May be Unwise

Ken recently had a webinar on this topic.

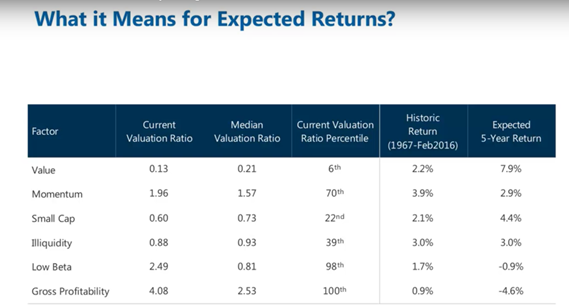

The US Federal Reserve’s policy since the financial crisis of creating low interest rates and engaging in ahistorical “quantitative easing” to create liquidity in financial markets created a tailwind for stock markets that disproportionately affected larger stocks and the largest market cap weighted stock indexes. Since we know investors chase performance, this has caused investors to chase these indexes. Just over the last ten years the amount of money in these indexes grew from $868 million to over $4,000 million now representing over 34% of all equity fund assets.

Proponents of indexing believe that information is perfect and because no one individual has better information than another it is not possible to get better performance than an index. They believe the only factor that determines performance or risk is how much exposure to the markets you have.

While we can agree that market capitalization indexing may work over the very long run (30 year plus periods), we believe it is an inferior way to invest for most investors for several reasons. Behavioral economists have proven that most investors are incapable of being rational with money that instead they act irrationally, chasing performance and avoiding risk. This is exacerbated because market capitalization indexes are subject to:

- Substantial draw downs (losses)

- Long duration to recovery from initial investment

- Participating in bubbles (technology in 2000 and finance stocks in 2007)

- Investor returns suffer vis a vis the actual index performance (they lag because they don’t own the index all the time and in fact buy and sell at the wrong times)

- Missed opportunities occur during index reconstitution (stock prices typically increase before being included in indexes)

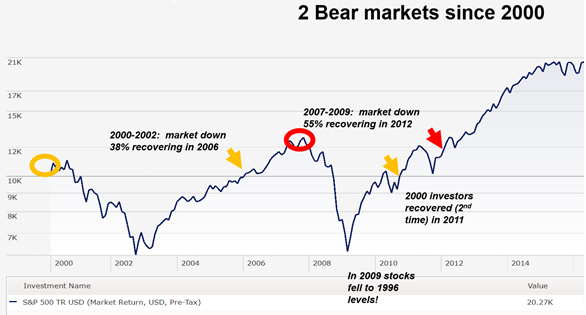

Investors in the S&P 500 market cap weighted index could have been down 38% (2000-2002) or 55% (2007-2009) over the last 15 years and could have been underwater for over ten years (from 2000-2011).

These investors would have participated in two bubbles. In 2000, the percentage of stocks in technology rose from 19% to 33% before falling to 10% when the NASDAQ crashed 75%. Weighing on price instead of fundamentals proved to be unwise. In 2007, the bubble formed in finance stocks. Finance stocks rose to 22% of the index in 2007 before falling to 11% by 2009. Both of these trouble spots were avoidable and avoided by value-minded managers.

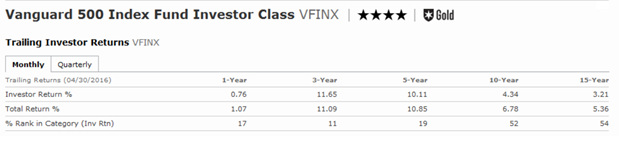

We have empirical evidence that this causes investor performance to substantially lag that of market cap index performance. Specifically, we know that the retail average investor return in the largest fund in the US (The Vanguard S&P 500 index fund) is 3.2% on a 15 year basis.

The “Investor return” is the return investors in the fund received based on when they bought and sold, therefore is the most accurate metric.

Furthermore, Research Affiliates suggests there is a “Dirty Little Secret to Passive Investing.” A recent paper suggests that the hidden cost of putting a new holding into the S&P 500 index has risen from about 3% from 1976-1989 to 9% from 1989-2000 to 13% from 2011-2013. This happens because hedge funders and dealers enter into bilateral agreements with indexers to trade at a yet unknown closing price on the change date and agree to share part of their expected profits with the indexers. The bottom line is that the new entrants into the index are now 13% more expensive than they would have been outside of the index thereby reducing the expected return of the index. This is a missed opportunity not available to the owner of the index fund.

This kind of practice is an excellent reason why investors should be very wary of working with pocket picking Wall Street but also why they should be careful before blindly buying a market capitalization weighted index!

Quality and Value Factors Show Potential Higher Return and Lower Risk

Moreover, there is Nobel-prize winning evidence that certain factors lead to excess performance. Since 1972 it has been known that smaller companies and cheap companies outperform larger companies and expensive companies. In 2012, Dr. Robert Novy-Marx illustrated that highly profitable companies, which many call “Quality” companies outperform low quality companies.

Novy-Marx also proved combining value with quality has historically proven to be higher return and lower risk than market capitalization indexing approaches.

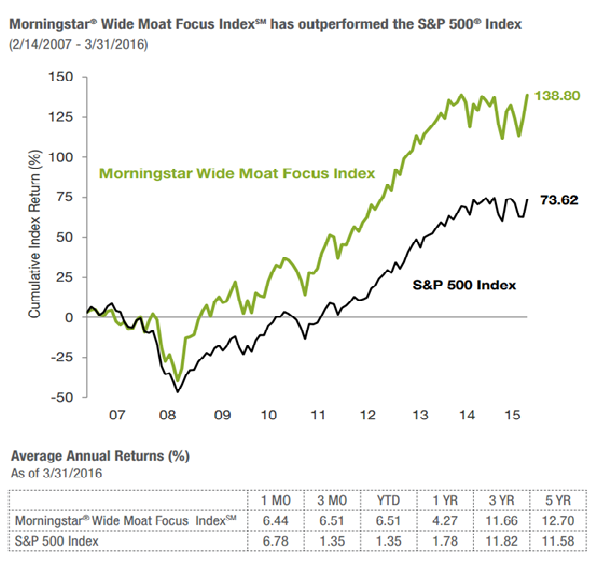

Starting in 2007, Morningstar Research analysts began tracking a Wide Moat focus strategy that replicates this same phenomenon. Morningstar took this term, moat, often attributed to Warren Buffett, to describe the degree of competitive advantage a company has within its industry. Wide moat companies have a competitive advantage that is likely to endure for 20 years, i.e. are high quality. These companies represent the small subset of about 300 companies of the investible universe. The Wide Moat Focus index buys those companies which are cheapest each quarter, thereby combining quality and value. This strategy has been very successful. From February 1, 2007 to May 25, 2016 this index has returned 10.6% while the S&P 500 returned only 6.4%.

Remember, because this strategy is not constrained by industry and because it owns only 20 stocks (which could theoretically all be in one industry), it is an aggressive strategy and not appropriate in large weightings for all clients. We discovered this method of investing after my trip to the West Coast in 2013. Since then we have been using an ETF to replicate this strategy both in the US and Internationally.

Even more interesting and as we would expect, the Morningstar index recovered much more quickly, well within two years. It took the S&P 500 five years to recover.

Remember, we are not suggesting anyone invest into an index. However, we feel this is an excellent validation of the value and quality factors and provides useful input to selecting investments and developing an investment strategy.

We like this strategy very much but it has two downsides:

- It can be very volatile over short periods therefore is not suitable for all investors

- It can be risky because it could be very heavily industry focused

- It can experience high turnover and may be tax inefficient

For this reason we decided to leverage this knowledge using Morningstar Research and technology to create our own stock portfolios. We are very pleased that our Great Business, and Great Business Focus 20 strategies are beating our expectations. We offer these stock portfolios, as well as our Margin of Safety (more value focused less quality focused portfolios) to investors at a lower cost than the average mutual fund.

Few Active Managers Outperform but We Know Why

On May 18, I visited the Morningstar team in Toronto for an Investment Symposium: Is Alpha Shrinking. The reason for the symposium was to address the rising flow of assets into index funds and discuss whether active managers can continue to add value. The two panelists I was interesting in learning from were Daniel Needham, Chief Investment Officer for Morningstar and Geoff MacDonald, Portfolio Manager of EdgePoint Investment Groups, managing funds distributed only in Canada.

The reason that most investors embrace indexing, and usually market capitalization weighted Indexing, is that most funds simply cannot add value after their fee. We know this because we learned about it from Jean Marie Eveillard and Louis Lowenstein. The reason they aren’t any good is because the managers of the funds are more interested in managing more money for their company than in managing money for their clients. The problem starts when they start thinking that they are investing other people’s money.

I had met Daniel in 2014 when we attended the Morningstar conference in Chicago. Daniel believes alpha is a false metric because he doesn’t believe any measurement should be relative. He believes markets are inefficient and that managers can add value if they are willing to take a global unconstrained approach. Many managers, and many firms, unfortunately, find many ways to “pick investor’s pockets.” They do this because they are saddled with efficient market nonsense. For this reason it is very important to find a manager committed to work in an investor’s best interest. Daniel shares my admiration for Jean Marie Eveillard.

I had never met Geoff but was very impressed. Geoff has shown substantial excess performance in his strategies and had excellent insight as to why most managers find it difficult to outperform market cap weighted indexes. In his view there are actually very few active managers. He thinks everyone working for a public firm is really investing Other People’s Money and loses sight of their goal to allocate capital in order to get high returns. The risk of short term underperformance is so high that they are forced to track an index by carrying similar sector weights to the indexes (thereby owning the bubble sectors). This causes risk to rise and performance to drop. Geoff said that anyone investing in an index is basically a rube he can take advantage of. Whenever there is a dumb reason to buy or sell this causes the price to move in the wrong direction and may be a time for him to pick up a stock or unload it.

Geoff suggested a second reason most active managers don’t do well. They simply become too big. At a certain asset level, which Geoff believes to be in the $20 billion range, it is simply not possible to buy smaller companies. When this happens the investment opportunity set is restricted and outperformance becomes more difficult.

Unfortunately, this problem is most prevalent exactly where it should be avoided. Because many large company 401k plans hold substantial amounts of assets many of these funds are monsters holding over $60 or even $100 billion in assets. We feel many investors in these funds are taking substantially more risk than they should because these funds very closely resemble market capitalization indexes in both their risk and return profiles.

Our Approach to Avoiding this Problem

Together with our stock portfolios which focus on buying cheap quality companies, we make sure that all of the investment managers we select are not subject to this problem. We will not use managers that we feel are more interested in getting new assets than they are on making money with their existing assets. These managers are not overseen by publicly traded firms and treat other people’s money as their own. I will be updating this approach in a white paper shortly.

In the meantime we welcome a conversation about investment strategy or financial planning. Remember, our objective is to make your financial journey as “worry-free” as we can by working with you in a collaborative fashion to help you maximize the odds of achieving your goals.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us