Global View Investment Blog

Kopernik Update

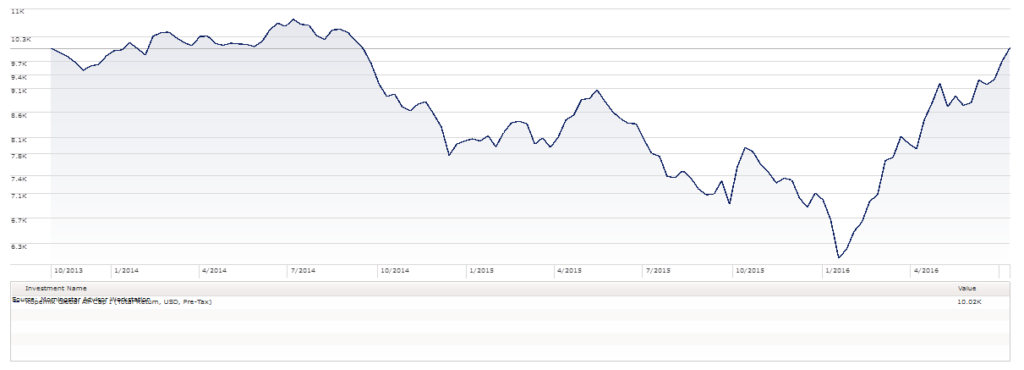

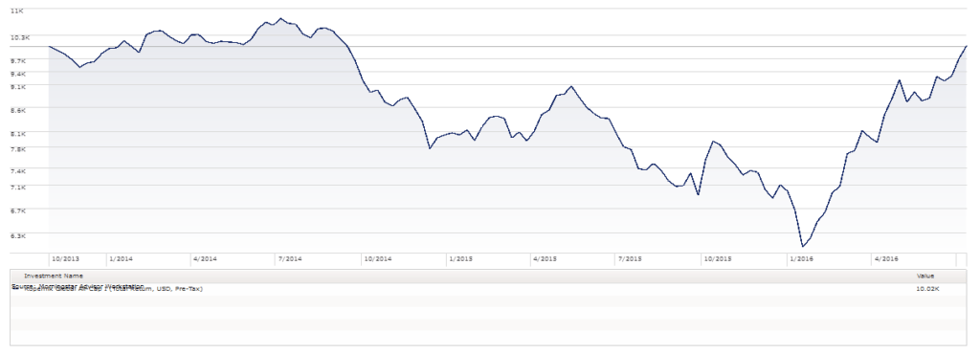

Many clients own the Kopernik Global All-Cap fund in their portfolios. We added the fund to many portfolios in early 2014 after extensive analysis of the portfolio manager’s track record. Dave Iben managed a portfolio for NWQ TradeWinds which suffered about half the downside risk of the broad market in the 2007 downturn. We expected the fund to do well in most markets and therefore were surprised when the fund immediately started to drop. The fund fell 20% in 2014 and 12% in 2015, both years when the S&P 500 was up.

Many clients own the Kopernik Global All-Cap fund in their portfolios. We added the fund to many portfolios in early 2014 after extensive analysis of the portfolio manager’s track record. Dave Iben managed a portfolio for NWQ TradeWinds which suffered about half the downside risk of the broad market in the 2007 downturn. We expected the fund to do well in most markets and therefore were surprised when the fund immediately started to drop. The fund fell 20% in 2014 and 12% in 2015, both years when the S&P 500 was up.

But as we have said, ad nauseum, there was a bear market in global stocks and particularly in materials and energy. Dave Iben called this a “bifurcated” market. Remember the Kopernik position was added to most portfolios as insurance against the unintended consequences of unprecedented monetary policy and particularly unexpected inflation. A valid concern for many.

Again, it is important to remember the context. US market cap indexes which owned the biggest stocks in the biggest weighting (think Facebook, Amazon, Netflix, Google) did well but the rest of the world did poorly. In earlier communications we suggested this phenomenon could not endure. In other words, we expected it to bounce back.

Kopernik All cap global is up over 43% thus far this year. Below is a link to Dave Iben’s latest commentary:

Kopernik Update: The Passenger

In this update, Dave suggests investors are, once again, doing the wrong thing. Remember, the retail average investor, in the world’s largest mutual fund, made 3.2% p.a. for the last 15 years. They chased what seemed to work and they sold what had not. Again, many investors are migrating to indexes …

Doing the right thing is never easy. The portfolios managed by Steve Romick (FPA Crescent), Charles de Vaulx (who was a senior analyst at First Eagle in the late 90s) are currently lagging, just as they did in 1998 and 1999 during the technology bubble. While there is no clear bubble, the greatest overvaluation is in the S&P 500 and its look-alike closet indexes most investors have in their 401ks. The greatest opportunity lies in overlooked great businesses in the United States and Overseas and many companies in emerging markets.

We have learned from this. Not to sell something we believe in, but instead to more assertively rebalance into strategies we feel merit long-term ownership. Armed with this knowledge we intend to use technology to make sure the next time it happens more of our clients can benefit.

Now is a great time to ask your friends if they are aware of the risk of the closet-index funds they probably own in their 401ks, that look much like the S&P 500 and have all of its downside risk. I cannot tell you with certainty that they risk another 2008 downturn. But I can say that forward looking returns for these funds are not good and that in order to get reasonable returns investors need to find great businesses to invest in, in the US, and overseas.

Ken

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us