Global View Investment Blog

High Risk Funds in 401(k)s Cause Investors to Defer Retirement

You can Prevent This from Happening to Someone You Love.

When things go wrong, high risk funds in 401k plans cause investors to delay retirement for a decade (or more).

Because most US funds (closely resembling market indexes) did well over the last 8 years, investors in 401ks are piling more and more money into them. Which means investors in 401ks keep doing what they have been doing (which made sense for them at the time), even when it may no longer make sense.

This story about Joe explains how. Joe wanted to retire early because his job had changed from something he loved to a daily chore.

With jobs being sent overseas and machines replacing labor, Joe’s job got harder and harder, but his salary stayed the same. In March of 2000, at 58 years old, Joe thought seriously about retiring. He was an excellent saver, had followed Dave Ramsey’s advice, and had $1,000,000 in his 401k. While he knew he would have to pinch pennies (and maybe work part-time) he could retire early and live on the earnings from his savings until social security kicked in.

But (after talking it over with his wife) he decided he could put up with the job another year. He had his funds invested 100% in low cost US funds (like Dave Ramsey recommended).

Joe had heard Dave Ramsey on the radio saying he could make 12% per year and take out 8% per year withdrawals in retirement.

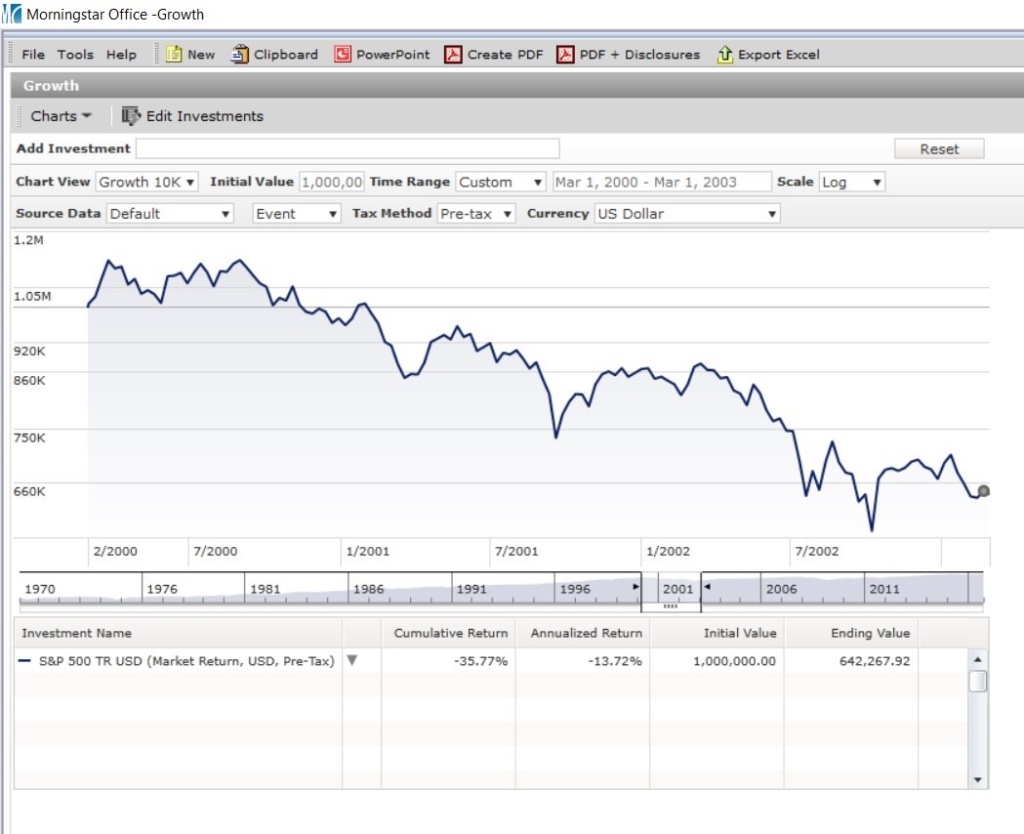

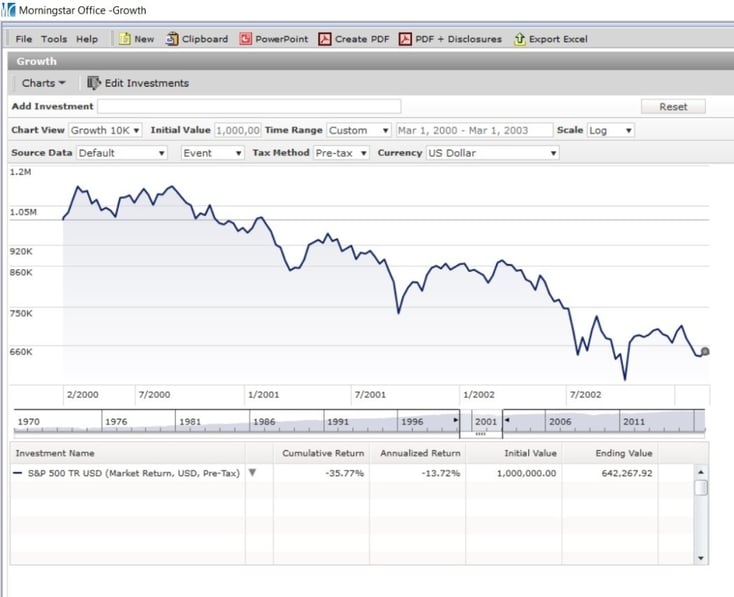

People didn’t know it yet, but the dot-com bubble started to burst in 2000. Joe’s 401k fell to about $920,000 by March of 2001. Thinking the market would recover he held on, deciding to delay retirement for one more year. Joe was lucky. While some of his friends lost their jobs, he didn’t.

So Joe stayed the course. Unlike some friends who sold, Joe held on because he knew it would come back. So when his 401k was even lower in 2002, he waited one more year. By March 2002 Joe’s savings had by over $355,000, leaving him with about $642,000. At this point Joe felt lucky to still have a job.

At 60, Joe no longer had a goal to retire early. His goal now was to retire at full retirement age (which for him was 66 in 2008).

Six years later (March 2006) Joe is 64. His savings are still not back to the 2000 peak after inflation. So he waits.

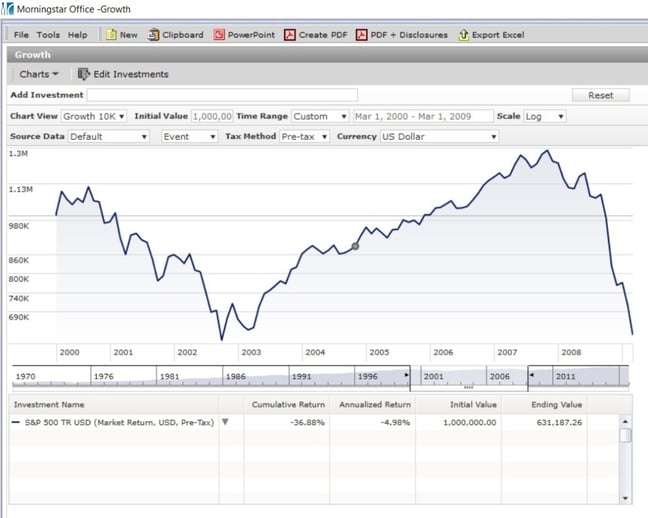

Still not there March of 2007 (after inflation), he waits another year. He has no idea that the biggest economic crisis since the Great Depression is right around the corner.

It is easy to imagine how Joe felt when he saw his life savings plummet again. Do you remember how you felt?

The Great Recession devastated Joe’s portfolio. Instead of reaching his goal of $1.1 million, he saw his life savings fall to $631,187 my March of 2009. Lower than it was in 2003.

By 2009 Joe is full retirement age. But his job is secure so he keeps working because he is not comfortable retiring yet. By March of 2012 Joe’s portfolio is $1.2 million.

He finally retires. At age 70. 12 years later than he wanted to.

This is an oversimplified story with many assumptions. But similar events happened to a lot of people. We are passionate about this not happening to people you care for. Stay tuned in and we will tell you why this is happening to so many Americans. And how to avoid it happened to those you love.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us