Global View Investment Blog

How to Pick Investment Managers Responsibly (It’s About Your Retirement and Your Grandkids)

Responsible people with serious money don’t want to lose it and not make it back.

Responsible people don’t take unnecessary risks jeopardizing retirement income.

Responsible people don’t transfer wealth from grandchildren to big banks and insurance companies by buying expensive, unnecessary products).

Responsible people understand there is nothing for free. You must take risk to get a reward. It’s literally how our economy works.

The investment environment changes. Good funds turn into bad funds. Owner-operator (private – boutique) funds beat the bloated, publicly-traded, Wall Street funds.

“Experts” hire, and fire, fund managers at exactly the wrong time.

Because the big banks and insurance companies know this, they wait until you sell (and buy) or you buy (and sell) literally stealing half of your potential returns.

We are mad about this and will do everything that we can to stop it. For you and for your grandkids!

Hard Choices Beat the Crowd

Fighting your intuition means doing things differently.

What We Don’t Do (When Selecting Investment Managers)

We don’t accept payment from investment managers. Because if we took payment, we would feel obliged to reciprocate and invest with them. It’s human nature.

We won’t accept payment for due diligence trips, we won’t accept a share of a fund’s revenue, we don’t take commissions, and we won’t take any payment which might put us in a position where our interests conflict with clients’.

We attend due diligence trips, accept incidental research and analysis (which we believe investment managers should provide) and we attend group education lunch and dinner meetings. But that’s it.

We avoid working with managers (and funds) owned by publicly-traded companies like big banks and insurance companies where possible. Because their fiduciary objective is to make as much money for their owners, they must legally put those interests before the interest of investors in the funds. This conflict of interest cannot be solved. We eliminate it.

Good Managers Share Common Traits

The ideal investment is one that makes a steady income every month, every quarter, every year. High-fee Hedge funders lost clients a lot of money in pursuit of this impossible ideal. This holy grail is imaginary. Insurance companies peddle false promise to clients offering “guaranteed income” with so many strings attached that the “guarantee” is just a return of principle.

Rather than chase the imaginary holy grail, what is an investor to do?

A sound approach based on fundamentals provides predictable results. History (and our own analysis) instructs this. Strong fundamentals provide reliable returns over a reasonable time horizon of about three years. It also instructs us about risk. The higher the return, the more volatility, especially over shorter periods. For our purposes, we look at volatility over six-month periods, because this provides a coaching opportunity to prevent predictable overreactions.

But to deliver reliable performance, it is essential that the investments snap back quickly.

When you feel confident that your investments will fall within a reasonable range of returns and will snap back, you are more likely to stay on track. Because when you expect short-term losses, when things go bad you won’t panic and sell. And because you expect short-term wins, you won’t get greedy just because things have gone well.

In retirement (or near it) the ability to snap back is literally the difference between meeting your retirement income needs or running out of money. You may measure success by worrying less about income and starting to worry about how much of a legacy you can leave grandkids.

But the market does not snap back quickly. Investors in stock indexes in early 2000 had to wait until 2012 until they snapped back. Because indexes contain the good, and the bad, which is not fundamentally sound, they can take over a decade to snap back.

As of this time, we do not expect US bond and stock indexes to deliver acceptable results. Rising rates will hurt bond indexes. And high valuations will hurt US stock indexes (as well as the bloated closet-index funds in many company 401ks).

Because we know how this negatively impacts investors, it would be irresponsible to not think differently, in this environment.

And because our requirements are strict, we reject 95% of investments before deeper analysis.

We seek privately-held owner-operator, boutique, managers who invest their own money alongside fund investors. They literally profit (or lose) with their investors. In 2015 Barron’s wrote that privately-held managers, in aggregate, beat 62% of other funds. Public conglomerate funds consistently perform in the middle.

Because they don’t want to grow too quickly or too big, many of the privately-held fund managers we work with refuse to work with the big brokerage firms. They don’t want “hot” money.

And they close before they become “bloated” or obese.

To pick a manager, we look at:

- Stated goal to avoid losing money that can’t be made back (Benjamin Graham’s original “Margin of Safety” discipline).

- Commitment to keep fund small (avoid fund bloat and obesity) putting fund investors interests before fund owner’s interest.

- Flexibility – ability to go anywhere: geographically, by size, and (if appropriate) into both stocks and bonds.

- How much “skin in the game” portfolio managers have. The more “skin in the game, the more they gain or suffer alongside fund shareholders. It’s like a chef who eats his own cooking.

- Excellent manager track record (as opposed to simply fund track). Because funds often change managers, the actual manager’s track record is more important that the fund’s (which may be quite different for many reasons).

- Stated return objective meets risk and performance targets. This may be stated on paper or learned during a manager interview.

- Manager’s willingness to accept volatility. Because we need a mix of investments including lower and medium risk strategies (and some clients have a lower tolerance for volatility), we need some that specifically focus on keeping volatility at a low level.

- How fast a fund snaps back after a drawdown. Higher risk, fully invested managers may be as volatile as stock indexes in the short-run. But if the strategy is sound, it will have demonstrated an ability to snap back over a reasonable time horizon (say three years). This means we expect the investment to make positive returns three years later even if you picked the exact wrong time to invest. We know this will not always happen, but based on our analysis it should happen at 95% confidence (two standard deviations to you engineers).

Categorizing Managers (To Facilitate Easier Client Understanding)

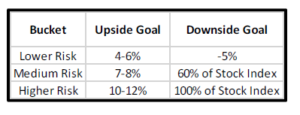

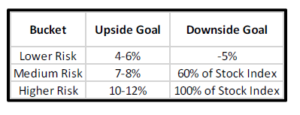

Because we don’t have anything better (like a crystal ball), we use science to better understand our clients attitude toward risk and return. We categorize managers into Lower-Risk, Medium-Risk, and Higher-Risk helps investors understand what to expect.

Lower-Risk managers seek a positive return over 1 ½ – 3 years and generally deliver monthly income.

Medium-Risk managers seek a positive return over 3 years, have historically shown less volatility than equity indexes, and excellent resilience (95% confidence of positive returns with 3-year time horizon).

Higher-Risk managers seek a positive return over 3-5 years, but are less concerned about volatility. While historically these managers have also shown great resilience, they snapped back within 3 years 95% of the time, because they are fully invested, we plan as if it may take 5 years from them to snap back if invested at exactly the wrong time.

The table below shows our risk and return expectations (but which is not a promise of future results as the future is unknowable). Upside goal is our long-term performance target. Downside goal is what we expect to happen during downturns. For example, we expect Medium-Risk strategies to be down about 60% of the market during downturns but realize the High-Risk strategies may be down nearly as much in the short-term.

Examples

This is best illustrated by example. We categorized the First Eagle Global fund, while managed by Jean-Marie Eveillard, as a “Medium-Risk” investment. From 1979-2004 the First Eagle Global fund produced market beating returns. And the fund made money (within 1%) every calendar year. But the most impressive aspect of the fund was its resilience. The fund had positive returns over every rolling 3-year period. Unfortunately, as this fund became bigger we reclassified it as “Higher-Risk.”

Good funds grow larger, become riskier, and produce lower returns. For this reason, we constantly monitor “good” funds and seek new opportunities.

Fortunately, these opportunities arise with organizational change. Portfolio managers and analysts left First Eagle in 2008 to form one of our favorite “Medium-Risk” funds. They believed the First Eagle Global fund should be should be closed to new investors. They felt keeping the fund open was against the interests of current investors in the fund, because they knew its nearly impossible to keep risk low and returns high as funds become too large.

In other words, they saw the clear conflict of interest between fund owners and fund investors.

First Eagle’s loss, our investor’s gain.

A higher risk (typically fully invested) investment company was formed when a portfolio manager’s mentor at Wasatch retired. The portfolio manager was now free to pursue his life’s dream, to run a company exactly how he wanted. Few investors knew about his consistent track record delivering high returns, reasonable risk, and fast snap backs, since 1995. The funds he ran were closed for much of that period (to keep them small). One fund he ran from 1995-2007 has the highest resilience of any we researched. It would have snapped back within two years from any (worst) starting point.

To put this in perspective you could be down twelve years if you invested in a stock market index at the wrong time.

We have been extremely pleased with following this portfolio manager after he departed. The first fund he started in 2011 has substantially beaten peers and has exhibited less than half of the downside risk of the index.

Wasatch’s loss, our investor’s gain. Contact us for specifics.

With the recent departure of a portfolio manager at First Eagle Global, we found another opportunity to add a “Medium-Risk” fund which we hope will deliver returns and resilience (the ability to snap back) like our experience investing with Jean-Marie at First Eagle Global (remember he is no longer portfolio manager).

Time will tell, but the fund meets our selection criteria perfectly. And we are impressed with the systems this portfolio manager has put together to allow him to replicate this, because we visited him in June.

It’s another story, but the relationships we have built with these portfolio managers and the in-depth of analysis we have conducted over the years has taught us a lot and helped us to develop our own in-house stock portfolios.

This expertise is also applied to “lower-risk” investments. A hole in the lending market, underserved by the big banks, has created excellent opportunities in this space.

Before Building an Investment Strategy, We Understand Our Client

Understanding risk an investor can take is a serious process and cannot be done with 6 questions (like nearly everyone does). The most valid assessment we can make uses a combination of psychology and statistics. This “psychometric” assessment is the most reliable test we can administer because average scores are steady over time, unlike other tests.

Using a valid risk assessment, and through dialogue and investor coaching, we help investors learn how much risk they are likely to bear over a shorter-term time horizon of six months.

Based on this, we build portfolios intended to generate the target return required for the risk we budget to the portfolio.

While every client is different, our clients generally fall into three categories based on risk preference: Moderately-Conservative, Moderate, and Moderately-Aggressive. Of course, we consider taxes as well.

Investors in these portfolios can expect returns and risk to fall within a range. Assumptions are based on the history of the U.S. stock market from January 2000 to July 2017 and the volatility of returns. To make this real we look at a high (not certain) confidence interval of 95% over six months. Expected return and risk ranges are not a guarantee of future results but instead a guideline based on these assumptions.

Moderately-Conservative investors seek risk equivalent to 1/3 of the market. Their portfolios are typically invested in about 30% equity with the remainder in lower risk fixed income. These investors may be happy with returns of 4-5% per year (in nominal returns including inflation), and can generally expect returns to range from -6% to plus 8% over six months.

Moderate investors seek risk equivalent to about ½ of the overall market. Their portfolios are typically allocated half in equity and half in lower risk fixed income. These investors may be happy with returns of 6-7% per year and can expect returns to generally range between -10% and +13% over six months.

Moderately-Aggressive investors seek risk equivalent to about 2/3 of the market. Their portfolios are typically about 70% equity, remainder lower risk alternatives. Investors in these strategies seek to match the long-term return of global stock markets and should range between -14% and +18.7% over most six-month periods.

Constructing well diversified portfolios to meet our specific clients’ specific requires a mix of investments.

How We Fire Managers

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” Mark Twain

We fire managers when they lose sight of their primary objective, when they no longer focus on losing money that can’t be made back.

We fire managers who fail to see that they might be wrong.

This happens two ways. It happens when managers get too aggressive and it happens when they get too conservative. And both are a result of holding a belief too long even when that belief is proven to be untrue.

In 2007, we fired the Oakmark fund manager, Bill Nygren, after he fooled himself into believing a bank he held, Washington Mutual, had a “strong balance sheet.” Because we were skeptical, we research this and found the bank had a high exposure to sub-prime mortgage debt. We immediately eliminated all positions in the Oakmark fund and made sure no other fund managers we held owned banks. We told all clients who held banks outright (by owning the individual stocks) to sell them.

We had learned, from Jean-Marie Eveillard (at First Eagle funds), that the assumptions everyone was making about housing prices didn’t make sense. Fortunately for our clients we understood this in 2007.

We later fired Fairholme after the Portfolio Manager got rid of analysts replacing them with a Brother in Law (2011) then subsequently started taking extremely concentrated positions. These actions increased the risk and volatility of the fund.

The other time we fire a manager is when returns fail to meet expectations. No-one has a crystal ball, and to quote Peter Lynch “there is always something to do.” When portfolio managers hold cash permanently, short the market or make expensive bets using sophisticated techniques like buying options, this rarely ends well. We understand our medium-risk managers will hold cash at times. If they can do so and meet return objectives that’s okay (and good – it reduces risk) but if it dampens long-term returns it is not.

John Hussman, Ph.D. (in the dismal science, Economics), writes eloquently about valuations and has long predicted a market collapse. We owned a small position in Hussman Strategic Growth beginning in 2007 and expected his returns would be low. But after returns turned negative in 2012, we started exiting the fund. Subsequent returns have been negative every year.

How We Don’t Fire Investment Managers

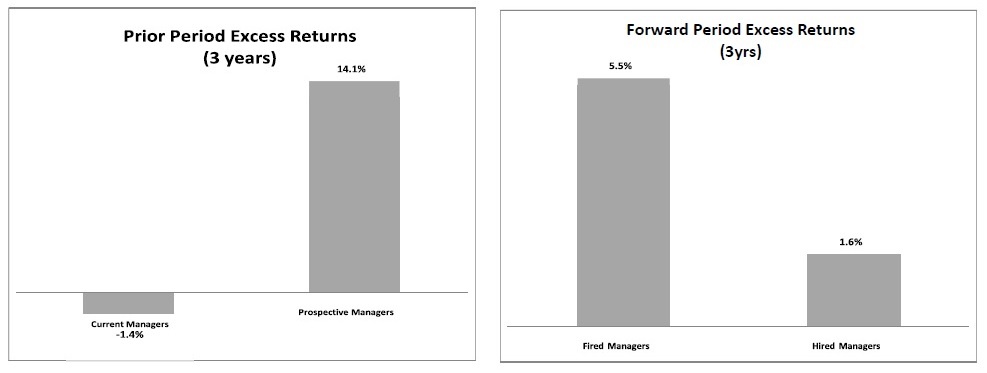

We don’t select managers based on recent performance. I completed the Accredited Investment Fiduciary program in October of 2008 to learn how “investment fiduciaries” pick funds. I learned they pick managers largely based on recent performance. But evidence shows this strategy, seemingly smart (and intuitively what almost every investor wants to do) consistency backfires.

A paper reviewing the practices of 3,500 managers of 401k plans clearly proves this strategy is ill-advised, yet it remains what “accredited investment fiduciaries” do.

Retirement plan sponsors, analyzing performance, typically fire the managers who did worst (current managers) in favor of the ones who did best (prospective managers). The hope is that the prospective managers will outperform. But in fact, they do not. The current managers do.

We learned from these experiences to bet on something, not against it!

We learned from these experiences to bet on something, not against it!

Because it’s about retirement income, and it’s about grandkids. It’s important.

Aspirations are Not Promises:

While we aspire to deliver returns at a lower risk than the overall market we cannot guarantee that we will. Instead, we work closely with our clients, over their investment lives, to help to make sure they are moving in the best direction possible. The unexpected will happen.

It is our experience that our clients are resilient. Helping our clients realize their dreams means we too must be resilient and adapt as the situation evolves. When we plan, we use conservative assumptions to determine odds of achieving goals. But we always aspire for more.

Sources:

Journal of Finance: Selection and Termination of Plan Sponsors

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us