Global View Investment Blog

5 Tax Planning Changes You Don’t Want to Overlook

A tax article … in November? That’s right!

While our minds might be elsewhere during the holiday season, the financial planning team at Global View does not want you to forget to make your year-end tax planning a priority, and part of your 2020/2021 financial planning checklist. These last two months are your last opportunity to make changes this year.

We see many people push this aside every year, and every year, there’s money left on the table.

COVID-19 changed a lot of things for a lot of people, and your taxes were not immune. It’s important to review the 2020 tax changes and how they will affect your next filing. The federal response to the Coronavirus pandemic resulted in several sweeping changes to the rules governing retirement accounts. Then there are the usual annual adjustments to various inflation-related thresholds. Other deductions, such as those for medical and dental expenses, remained unchanged.

Here is a checklist of the most important changes for you to review before 2021 begins. In general, these items are positive for taxpayers and retirement accounts. Other important changes affect estate and education planning.

As you review this financial checklist, make note of the specific items that will impact your 2021 plans, and then contact your financial advisor to discuss these changes in more detail. If you’re not currently working with a financial advisor or feel you’re ready for a change, contact the team at Global View. We’re here to help, whether you’re a current client or not.

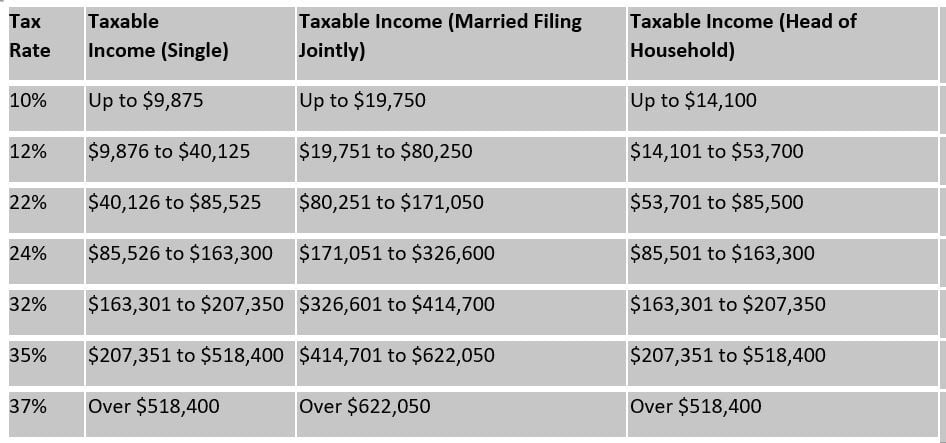

1. Wider Tax Brackets

The top income tax bracket remained 37 percent in 2020, but the brackets have widened. The top bracket kicked in above $518,400 for single and head of household filers, and $622,050 for married filing jointly.

Standard deductions increased in 2020 as well, growing to $24,800 for married couples plus $1,300 for each spouse age 65 and above. Single filers could claim $12,400 ($14,050 if you’re 65 or older), while heads of households got to claim an $18,650 standard deduction (plus an additional $1,650 at age 65 or over).

Why is this important? The best financial advisors know, it’s not just about how much you make, but it’s about how much you keep.

Here is a complete rundown of the 2020 tax brackets:

2. Required Minimum Distributions (RMDs) Waived

Many rules governing 401(k)s and IRAs were also modified in 2020 that could impact your 2021 filing.

First off, the starting age for RMDs increased from 70-½ to 72. Seniors can skip their 2020 RMDs without triggering a 50 percent penalty. You can also sidestep the early withdrawal penalties on up to $100,000 of Coronavirus-related distributions, and you can pay the taxes on the distribution (or return the money tax-free) over a three-year period.

Starting in 2020, you can now continue to contribute to your Traditional IRA past the age of 70-½. Repayments on 401(k) loans that were due in 2020 can be delayed until 2021. The Adjusted Gross Income (AGI) deductibility phaseout thresholds for Traditional IRAs were raised for single filers and couples.

At year’s end, you may want to consider a Roth Conversion to decrease taxes in your estate plan. RMDs are not required in Roth IRAs and distributions from these accounts will not be taxed when taken by your heirs. In most situations, your beneficiaries will have to complete withdrawals from the inherited account within 10 years. There are exceptions, so discuss this option with your financial advisor.

3. Penalties Waived on Retirement Account Withdrawals

While many new rules pertain to seniors, a few traditional retirement account changes help younger taxpayers. The usual 10 percent penalty for early withdrawals (before age 59-½) from your retirement account is waived for up to $100,000 of Coronavirus-related distributions. You’ll still have to treat distributions as taxable income, but you can do so in three yearly installments. You also have three years to replace the money and avoid taxes on the distribution.

Talk with your financial advisor about the best way to handle any early withdrawal, as you may have other, more suitable options.

4. Retirement Plan Contribution Limits Increase

For 2020, your maximum 401(k) contribution rose $500 to $19,500. IRA contribution limits were unchanged at $6,000, but the AGI ceilings for contributions to Roth IRAs increased to $206,000 for couples and $139,000 for individuals. You can now deduct some or all of your Traditional IRA contributions if your AGI doesn’t exceed $75,000 (for single filers) or $124,000 (for couples).

The limits also increased for an uncovered spouse when the other spouse was covered by a retirement plan.

5. Additional Tax Breaks for Special Situations

The IRS is offering tax breaks for education, inheritance and adoption purposes as well.

With that said, you may qualify for some or all of the Lifetime Learning tax credit if your MAGI didn’t exceed $69,000 (for single filers) or $138,000 (for couples). The MAGI limits also increased for tax-free EE Savings Bonds you cashed in and used for tuition. You could shield some or all of the bond proceeds for MAGIs up to $153,550 (couples) and $97,350 (single filers). Finally, you could withdraw up to $10,000 from your 529 college savings plan to repay student loans.

For 2020, the gift and estate tax exemptions increased from $11.4 million to $11.58 million. Of course, you will want to talk to your financial advisor to make sure you stay alert for any 2021 changes to these rules that apply retroactively to tax year 2020.

The tax credit for qualified adoption expenses was also increased, now topping out at $14,300. If the adopted child had special needs, your credit could exceed your actual costs. Also note that you could take an early payout of up to $5,000 from your IRA or 401(k) without penalty if you were adopting a child or having a baby.

Conclusion

There were a lot of changes in 2020, no question. But while we all adjust, don’t miss these important tax changes that can save you – or cost you – money down the road.

Don’t put your tax planning off. Contact the team at Global View to discuss your tax return and what it means for your long-term financial and retirement plans. Together, we’ll make sure that you receive maximum benefit from the latest tax regulations.

Written by Erin Milner

Erin works as a paraplanner alongside our Advisors in managing client relationships and special financial planning needs, including retirement transition, education, and estate planning. Erin began working in the financial advisory business upon graduating from the University of Georgia with a BS in Financial Planning in 2015. She competed in the National Financial Planning Student Challenge in 2014. Erin is a member of the Financial Planning Association. She volunteers at Habitat for Humanity as a Financial Assessor.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us