Global View Investment Blog

Accountants: What You Don't See Is Destroying Your Clients’ Wealth!

When accountants prepare income tax returns for clients they generally seek to minimize the current year tax bill. All things equal we agree. But all things are never equal.

Because most of the true costs your clients face are not disclosed, most accountants don’t have the full picture.

Most accountants are probably unaware that variable annuities laden with guaranteed income riders can cost clients over 4% per year. That’s right. 4%. Which means a client with $500,000 in a variable annuity may be paying $20,000 per year in fees that you never see.

Because we are obsessive compulsive about transparency and conflicts of interest we investigate these things. But (because accountants are numbers guys who want proof) let me give you an example.

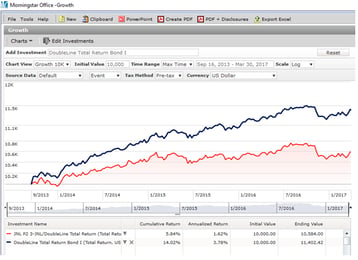

This illustration (from Morningstar) shows an identical investment inside of loaded annuity in red versus the performance of the identical bond manager offered by an investment advisor in a wrap fee account.

As you can see, the blue (investment advisor) vs. red (variable annuity) investment performs 2% per year better. We can illustrate this to you for your client using the actual investments in his or her annuity.

Again, this is only the tip of the iceberg. Additional riders like living benefit guarantees and death benefits can easily add 2% to the fees resulting in total cost of ownership of 4% per year.

For a 1% annual fee, we offer a tax efficient stock portfolio that generally turns over once every 4-5 years generating qualified dividend income and long-term capital gains. Costing 2-3% less per year we can illustrate how this can substantially build more long-term wealth after taxes.

Sometimes these high-cost products are even offered in IRAs. We find this practice to be unconscionable. The previous administration made it illegal (DOL Fiduciary rule). However, this ruling has been deferred until fully evaluated by the new administration. Which means for the time being insurance agent “advisors” can continue selling them.

The same “advisors” selling their clients loaded annuities are also selling them high-cost private placements. Many of these have 11-12% up front loads, and 5% or more annual operating fees. We can show you this.

We want to help you minimize your client’s current tax bill as well (and to help you look good to your client). We can help you look even better if you will allow us to illustrate to your client how much we can save them by rescuing them from high fee variable annuities and private investments.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us