Global View Investment Blog

April 2009 GVIA Update

Re: Global View Investment Advisors Update April 2009 – Retirement Income Account, Thoughts on the Economy and Selected Manager Commentary

Dear Clients and Friends,

As you know, we are a Fiduciary to our clients and must work in their interests before we work in our own interests or the interests of any other parties. We hope to articulate this better to you in the near future. In the meantime, below is a short update including an introduction to the Retirement Income Account, our thoughts on the economy, and selected manager commentary.

If you have problems reading this email, please send an email to Amanda@globalviewinv.com, who will send you it in PDF format or give us a call at 272-0818.

Executive Summary

We are introducing a Retirement Income Account, for retirees with an income shortfall. This account will be funded with three years of income needs and is intended to reduce portfolio volatility over an 18-month time horizon. While the economic future remains uncertain, we feel a strategy of allocating investments according to time horizon buckets based on long-term valuation trends will be successful. We do not know if we are in a bull market rally or a bear market rally, but hope to participate in whatever rally it is. Moreover, bear market rallies can be significant. And, while we do not agree with much of the current government policy, we believe no government actions will prevent global economies from growing, albeit possibly at a reduced rate for several years. The short-term economic outlook continues to be grim, and unemployment, currently at 8.5% may reach 10% by early next year.

Our Investment buckets are working exactly as we would expect. At the end of the newsletter, you will find some updated commentary from our managers.

Retirement Income Account

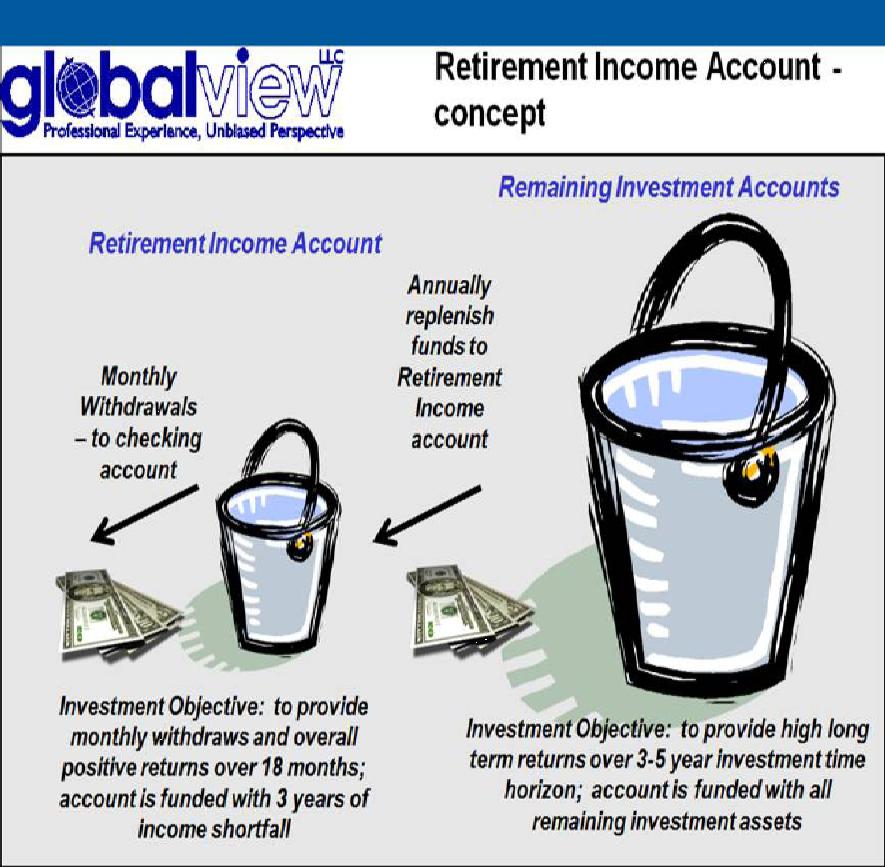

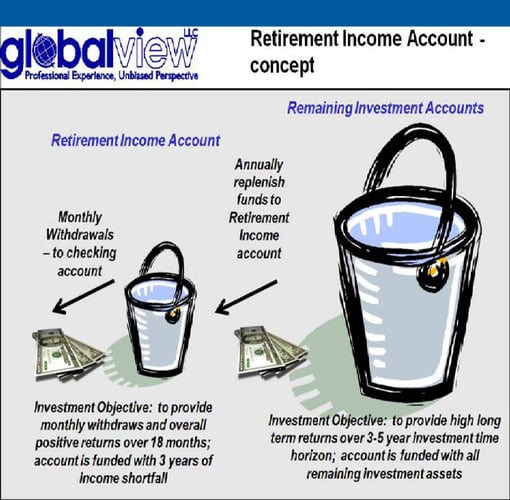

As part of our efforts to improve on the principle of Comfort with What is Happening, we have introduced the Retirement Income Account. For those retirees who have an income shortfall, this account will be funded with three years of income needs and is intended to reduce portfolio volatility over an 18-month time horizon. The three-year income need is calculated by multiplying our client’s income shortfall (estimated expenses after all non-investment related income) by three resulting in a cushion of three years of income shortfall.

The objective of the account is to provide a pool of funds that will be less volatile that the client’s other investments. It is constructed using a combination of cash, bonds, and other investments (primarily from our short-term volatility control investment bucket) that have an objective of reducing short-term volatility and a proven track record of having accomplished this objective so that we believe (but cannot assure) odds are slim that losses will occur over an 18 month time horizon. We feel this provides an emotional cushion for weathering the volatility that occurs in the remainder of our clients’ accounts, i.e. their 3 year to 100 year investment bucket.

The account is meant to be replenished annually from other accounts so that 3 years of income needs will always be invested in a less volatile fashion. Conceptually, this looks something like this:

Thoughts on the Economy

Market Inflection Points, Recessions, and the Unemployment Rate

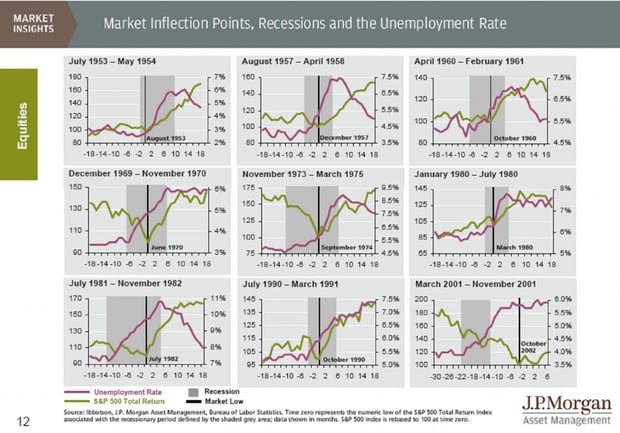

Unemployment is a lagging indicator of economic growth and often rises after the economy recovers and far after the market begins to recover. The chart below illustrates this very well. The vertical line shows the market low, the orange line unemployment, and the green line the return of the S&P 500. The gray shaded area indicates the region where a recession was recognized. Clearly, in every recession since WWII, the market has recovered well in advance of economic recovery and unemployment easing.

The link below, at the Federal Reserve Bank of Minneapolis, allows you to compare this recession with other post WWII recessions. Of note, the drop in GDP (economic output) thusfar is less than occurred in 1991, but the drop in employment is worse than any time since 1957 on a percentage basis (increased percentage of unemployed not total unemployed).

LINK: Compare This Recession to Post WWII Recessions Minneapolis Federal Reserve

Federal Finances in Historical Context

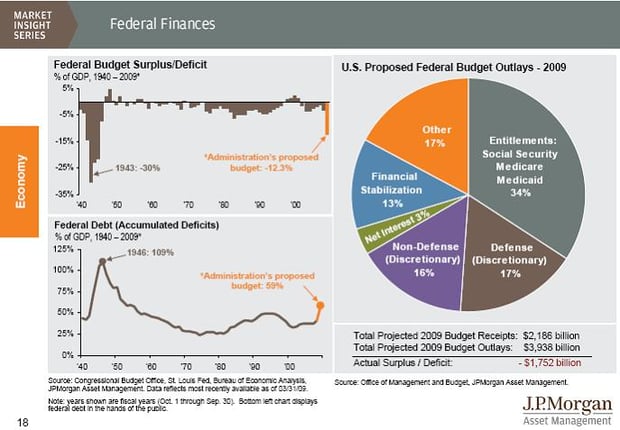

We, like most of our clients, have serious reservations with the way the government is spending money and are concerned that this will result in higher future taxes, lower future economic growth and higher inflation. Most economists agree that wasteful government spending is a primary cause of inflation. While concerned, we do not fear that the United States will be turned into a socialist haven. Communism is dead and unlikely to return, despite much liberal propaganda to the contrary. The proposed budget represents about 12.3% of GDP, the highest since the post war period. This also causes the Federal Debt to rise to a level not seen since the 1950s. However, assuming a return to growth and a reduction in unnecessary spending in other areas, also predicated on the Democratic administration losing control over Congress, this is not a permanent situation. Human beings always have a tendency to extrapolate current conditions into the future indefinitely. We share the view of Dr. Edmund Phelps, an Economist at Columbia University, that productivity growth cannot be stifled and that, eventually the 3% real economic growth rate will return, whatever policies are implemented because innovation will prevail.

The chart below shows the proposed budget deficit and its impact on government debt, in historical context.

We also believe most of the bailout efforts are very wasteful and are, in essence, socialization of the downside risk taken on by insurance companies and banks and disagree on the level of systemic risk this poses. While we are heartened that the government is appearing to let the bankruptcy process work in the automotive sector, we are skeptical that union contracts will be busted and that structural equilibrium can be re-asserted.

In this very timely paper, the Richmond Federal Reserve discusses the relative effectiveness of fiscal policy. They conclude that Monetary policy is the preferred tool among economists, the author argues that fiscal policy can work it targets idle resources that are truly idle due to spillover effects of the economic downturn and not due to a longer-term structural decline. This makes us question the effectiveness of any policy to revive the banking, housing, and automotive sectors.

LINK: What we Do and Don't Know about Discretionary Fiscal Policy - Richmond Fed April 2009

When Will the Market Recovery Begin, or Has it?

There are many dissenting views on the outlook for the economy and the stock markets. It is unclear whether we are experiencing a bear market rally or are now in a bull market. Doug Kass, a hedge fund manager who was very bearish prior to the crisis has turned bullish; we don’t know if he is right, but the reading is interesting. He believes the bottom of the market was 666 and that a “generational recovery” is now underway. Doug uses the 1937-1939 period as a parallel for this economy and stock market. The market dropped 50% over five months never reaching a high-volume selling climax. Its recovery in 1938-1939 had four legs lasting seven months.

LINK: Doug Kass on market outlook 3/27/2009

Mike Santolli discusses similarities between the market of 1938 during the Roosevelt Administration and the market of 2009 during the Obama administration. The uptick rule was instituted then and mark to market accounting was suspended then (before being put in place again about 2 years ago). His point is that the market rallied very strongly then before there as a real economic reason for doing so.

LINK: Why are Wall Street Observers interested in 1938

This Period is not Analagous to the Great Depression

Several people who lived during the Great Depression are interviewed, including Peter Bernstein (investment consultant), and Paul Samuelson (Nobel Laureate Economist). Bernstein, 90, believes that “this time we have our fill of policy errors, but at least we are not making it worse.” While we fear government policy may be making it worse, we believe this will result in slower future growth instead a deeper recession in the short term. Samuelson, 93, articulates this well: “Even if the downturn isn’t deep enough to be called a depression, the restructuring that it needs to go through means the even after the economy bottoms out, there could be a “lost” four or five years of sluggish growth.”

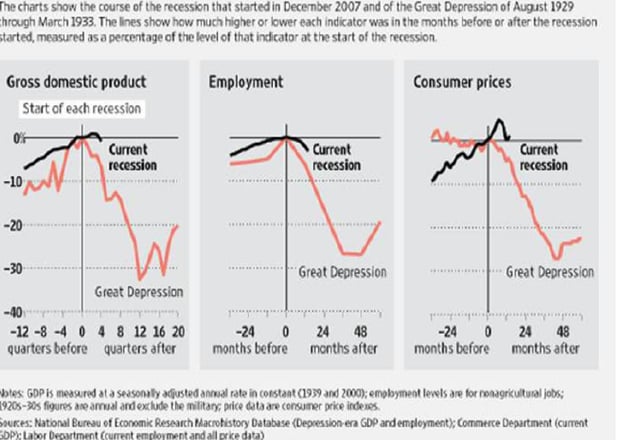

The chart at the bottom of this article (inserted below) shows the difference between the current crisis and the Great Depression in terms we can understand: Output (GDP), Employment, and Consumer prices. Obviously, there is really no comparison. The red line shows what happened during the Great Depression and the black line shows the current crisis.

LINK: How a Modern Depression Might Look -- If the US Gets There WSJ 3/30/09

We believe analogies to the Great Depression are ridiculous, but the link below shows that Sir John Templeton, Sam Walton, and Benjamin Graham all managed to prosper during the Great Depression. The point of this article is: “people have been talking about the same problems over and over … for decades on end!” Crisis creates opportunity. LINK: Sir John Templeton, Sam Walton and Benjamin Graham - perspective

Selected Manager Commentary

The information below contains commentary from selected managers.

Loomis Sayles Strategic Income – Short Term Volatility Control Manager

The Loomis Sayles Institutional Bond fund, since inception in May of 1991 outperformed the S&P 500 with substantially less volatility. Dan Fuss believes the ten year treasury rates will double in five years, that bringing the private sector in to purchase the bad assets is a necessary evil, and that because the private assets are leveraged this will be stimulative to the economy. He believes this will be good for the corporate bond and equity markets, bad for treasuries.

LINK: Dan Fuss on Toxic Debt Plan

First Eagle funds – Long Term Less Volatile Manager

First Eagle Global has substantially outperformed S&P 500 fund since its inception, and over the last ten years. The fund generated substantially positive returns during a period where the unmanaged S&P 500 index lost about 3% p.a. (ten years ending March 2009).

Abhay Deshpande co-manager, says “Markets have come off over 50% across the world … we are able to find high quality companies trading at very attractive prices… The value of a business is not a function of the next year or two of cash flows, it is a function of the earnings over the life of the business. As long as we are able to buy companies at the right prices … we can buy champagne at beer prices.” On financials: “Last year we stayed away from most every financial company … Going into this year we continue to do the work on financials.”

LINK: Abhay Deshpande of First Eagle on CNBC 3/27/09

Leuthold Global Allocation Fund – Long Term Less Volatile Manager

Leuthold Global Allocation fund, a new fund, increased its allocation to equity in March. Steve Leuthold predicts S&P 500 will rise to 1,100 this year. His greatest fear, several years out, is that the Federal Reserve is unable to mop up excess liquidity and that inflation rears its ugly head.

LINK: Bloomberg interviews Steve Leuthold

International Value Advisors – Long Term Less Volatile Manager

The managers of this fund previously worked for First Eagle; this is a new fund. In this detail-rich conference call, Charles de Vaulx and Chuck de Lardemelle quoted Peter Bernstein “as a portfolio manager, we cannot make returns happen. All we can do is control risk and control damage if things go wrong.” Clearly they like Japan and believe Asian economies are cheaper than Anglo-Saxon countries. It appears Charles and Chuck are taking far less risk than some other managers; thus, we expect them to participate less in a rally, but to protect downside risk more.

LINK: Conference call transcript with IVA funds March 25, 2009

Fairholme Fund – Long Term More Volatile Manager

Since inception of the fund on 12/29/1999 through the end of March, Fairholme has returned substantial positive returns during a period where the unmanaged S&P 500 has lost almost 5% p.a. Bruce Berkowitz expresses his views on investing for instance, when evaluating company management, it is imperative to read what managers said they would do (looking at past annual reports) and then look at what actually happened, i.e. that a strategy articulated was a strategy later implemented. Bruce has also begun purchasing bonds of companies when the deal looks right, not unlike what Marty Whitman and Charles de Vaulx are doing. When asked about shorting Bruce said “he is not genetically engineered for it,” i.e. he would like to be long-term partner with the companies he owns.

LINK: If Not Now, When? Interview with Bruce Berkowitz

In this lengthy interview with OID, Bruce Berkowitz details how although he predicted rain last year, the ark they built was not strong enough. He discusses his contribution to the new edition of Security Analysis (the updated version of Benjamin Graham’s work) and some of the stocks he owns and why. This is a must read for anyone who wants to get inside of the mind of an investor who we believe to be outstanding.

LINK: Bruce Berkowitz interview with Outstanding Investor Digest

Third Avenue International Value and Third Avenue Fund – Long Term More Volatile Manager

Since inception of Third Avenue International value on 12/31/2001, it has returned substantial positive returns during a period where the unmanaged S&P 500 index suffered losses. Since inception of Third Avenue Fund, on 11/01/1990, the fund also experienced substantially positive returns despite last year’s dismal performance. Global View took a meaningful position in this fund beginning in January of 2009.

While investors may be concerned about these managers ability to control volatility, clearly they are very disciplined about controlling risk. Below, Amit Wadhwaney describes how Third Avenue Asset Management measures risk. Risk, as viewed by TAM, is anything internal or external to the investee company that has the potential to impair or in any way permanently diminish the long-term value of the company’s business, its operations or its ability to create value. These would be the types of risks that TAM endeavors to identify, assess and avoid. Examples of risk that we strive to avoid might include:

• Companies operating with significant currency mismatches between assets and liabilities; particularly in operationally leveraged

businesses, such as banks, where an adverse currency move can cause much damage to companies with such exposures.

• Risky business models. For example, a business model where growth occurs by acquisition and is reliant upon successive capital

raisings would be unattractive to TAM, given its dependence upon capricious capital markets which might preclude successful execution of the company’s strategy.

• Unusual political risks. Assessing political risk, which while an imponderable is nonetheless an integral part of international investing

and can have a material impact upon investee companies’ performances.

As a result, TAM tends to eschew investing in certain jurisdictions where we lack an understanding of, or comfort with, the political environment and how it might affect TAM’s investment. These notions of risk described above are in distinction to the uncertainty that might attach to the investee company’s business prospects. The uncertainty surrounding short-term business prospects can often be at least partially dealt with by appropriately adjusting (upward) the discount to NAV required for investment, and by requiring the absence of any identifiable factors which might result in a meaningful probability of impairment of the longer-term value of the business.

That said, it is necessary to accept uncertainty as a part of investment, because in any investment there will be many imponderables and unknowns, few of which can be modeled. For example, the exact form and timing of the solution to a company’s woes which have depressed a company’s valuation are usually unknown at the time of investment, as would be the form and timing of industry wide adjustments (such as capacity reduction, consolidation or bankruptcy among competitors) that might potentially change industry conditions for the better. Equally uncertain is the timing and manner of value realization—be it via market recognition of business value or some form of resource conversion. Our investments, which possess both characteristics of safety (as manifested by the relative absence of risks of the sort noted above), and cheapness allow for coexistence with these sorts of uncertainties.

Final Thoughts

We are doing everything we can think of to make this experience relatively easier for our clients. If there is anything else you would like for us to do for you, please let us know. If you have a friend or relative that you are concerned about, particularly because their advisor changed firms, please tell us. Thank you for taking the time to read this and thank you for your continued relationship.

Global View Investment Advisors Team

Kenneth M. Moore Jr., CFP®, AIF®

Professional Experience, Unbiased Perspective

www.globalviewinv.com

888‐389‐6339 toll free

864‐335‐9211 Greenville

864‐944‐2727 Salem

864‐335‐9691 fax

Investment Advisor Representative, Global View Investment Advisors, LLC, a Registered Investment Advisor. Registered Principal, Securities offered through Cambridge Investment Research, Inc. a Broker/ Dealer, Member FINRA/ SIPC. Past performance is not a guarantee of future results. Global View does not offer tax advice. We do not accept instructions to make changes in any accounts via email.

Global View Investment Advisors • 308 W. Stone Ave, Greenville, SC 29609 • (864) 272-0820

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us