Global View Investment Blog

Are You a Slave to Your Castle?

How Americans Burden Themselves with Too Much House

Over the last several decades, home ownership has been made much easier. Now more than ever, many people can become homeowners, primarily due to regulatory changes and the ease of financing.

In Upstate South Carolina, the housing market is very strong. Home prices continue to escalate. That doesn’t slow people down from chasing the bigger, better and newer homes.

We believe that by giving our family a nicer, larger home we are doing them a favor. Maybe. But to purchase these homes for our families, we often take out a large mortgage. This alone can put a strain on our budget. The mortgage company may tell us that we can afford the loan. While it may fit their formula to qualify for a mortgage, they underestimate the opportunity cost and potential stress on a household.

The large mortgage payment is only a part of the cost. In the average middle-income, suburban neighborhood, the cost for HOA dues, taxes, insurance, and repairs and general maintenance total to an average of 4 percent of the value of the house. According to the U.S. Census Bureau, the average American home cost $360,000, with total annual carrying cost of $14,500, in addition to the mortgage. This does not include major improvements and renovations that are likely needed every 15 to 20 years. With the purchase of a larger house, these costs also rise, not to mention the time commitment to maintain the home.

Household Stress

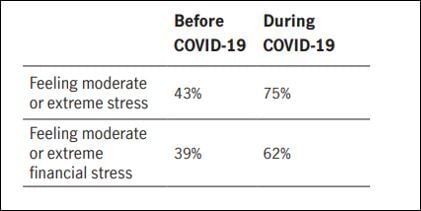

High housing costs creates tremendous unnecessary stress on a family. What we believe to be a benefit to our family, can easily cause harm. Money continues to be the top source of stress for Americans. According to the John Hancock’s 2020 Financial Stress Survey, 39 percent of participants reported feeling moderate or extreme financial stress. But during the pandemic, 62 percent said they felt moderate or extreme financial stress.

Unnecessary Bondage

How does this impact us financially? Often, we look at our income and expenses of today. We may even be factoring in the continuation of saving regularly for retirement. But what often goes unrecognized are all the other household expenses that come with raising a family. Children become more expensive as they get older. Overall, our spending and needs change, for which we may not be prepared.

Also, we may overestimate the stability of our job or our future income. This is more unpredictable than we recognize.

The Impact to Other Goals

Why do we have so much of our net-worth tied up in our homes. In our retirement years, we recognize the financial “sacrifices” we have made to live in our houses. The many “sacrifices” that are made include:

- Time away from family to earn money for the additional cost

- Time away from the family to personally maintain the larger home

- Stress on the family and marriage

- Less savings for education

- Less savings for retirement

- Less savings for the next automobile, so you must pay higher interest cost when financing

- Less to give to help others

We make “sacrifices” in order to become “house poor” and more stressed. This doesn’t make sense.

Dragging a mortgage out for 30 years is senseless. It is possible to get out from under the bondage. It comes down to setting priorities and making choices. We may say “we can’t afford that,” or “that is impossible.” But it is all about the choices we make, which may require sacrifices. We can choose to put ourselves in a better financial position, with a tremendous reduction in stress.

Retirement Lookback

As we reach retirement age, we have a lot tied up in our house, but little financial savings. It is often said that you can downsize your house and use the difference to live on. This rarely happens. One may downsize the square footage but rarely the value of the house. By doing so, we have chosen to keep the large asset illiquid in retirement, with higher cost to maintain.

As we move into our retirement years, we may want to ask ourselves, “Was it worth it?” Also, we should ask ourselves, “Is it worth it?” as we look toward our future years.

Don’t be house broke in retirement!

But I Can Afford the Expensive House

If you can afford an expensive home, why not? This is a legitimate question. First of all, I’m not saying you should not buy it. Nor am I saying you should necessarily downsize. But we need to think through how much we will be spending for ongoing “carrying cost” of the house. That money is gone. This cost is not an investment but a cost of ownership. And it is a very expensive cost that some do not realize until months or years down the road.

I believe God does not want us to burden ourselves with financial and time constraints that this may cause. Life is short.

Do not become a slave to your home! Recognize what really matters.

Written by Joe Hines

Joey's primary focus is working with clients in the goals setting and financial planning process. He has extensive experience is in helping clients facilitate the decision making process, leading them through the implementation of their financial plan and contributing to their peace of mind. This includes helping clients gain an understanding of estate planning, charitable giving, and helping them implement these plans by working closely with estate planning attorneys.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us