Global View Investment Blog

Baby Boomers: Why It’s Not Too Late to Save for Retirement

An estimated 10,000 Baby Boomers (those born between 1946 and 1964) retire every day. And with the recent pandemic, that number has spiked sporadically. Are you ready to make the transition?

If the answer is no, it doesn’t mean you’re destined to become one of the retirement financial horror stories we’ve all heard about. There are actually a number of ways to make big steps forward in your retirement savings. The key is getting started now!

According to reports, more than 40 percent of Baby Boomers have no retirement savings at all; yet by 2030, all Baby Boomers will be at least 65 years old. These two important statistics show, like it or not, that your retirement date is slowly approaching.

The good news is we can help.

As a Certified Financial Planner in Greenville, SC, there are strategies that can help you catch-up on your retirement planning that you may not be aware of on your own. If you’re a Baby Boomer who is getting closer to retirement but feel you’re behind, there are 4 things that are on your side.

Longevity: Use Your Longevity to Your Advantage

Typically, longevity is looked at as an obstacle to late retirement planning, because the longer you live, the longer your money will need to last to support your lifestyle, and if you don’t have enough saved for an average-length retirement (about 20 years), it can be even harder to save for an extended retirement. (How long will your retirement last?) However, your longevity can actually be used to further add to your retirement savings.

How?

Well, for one, working longer can bring a big payoff.

Individuals often stop working at or around age 65, but working just an extra year or two more can make a big difference.

In the Carolinas, an average retiree spends about $50,000 each year, with the biggest expenses typically being housing, transportation and healthcare. This means that working an extra two years can save you about $100,000 in retirement income, since continuing to receive a regular paycheck will prevent you from having to withdraw from your savings and investments. On top of that, you may potentially receive healthcare benefits at work, which can result in significant savings each year, especially if you’re not yet eligible for Medicare.

Of course, if you’re looking at a high net worth retirement, your lifestyle costs – and your savings – can be even bigger.

Working part-time or even starting your own business can also supplement your spending in retirement, while still providing you with some free time.

Another perk to working later may also be delaying your Social Security benefits, a decision that can result in bigger payments every month. Social Security is one of the major pillars of most retirees’ retirement income, so boosting this important component of your income can pay some serious dividends.

For more on how your Social Security benefits work, check out our new guide: Navigating Social Security.

Property Values: Achieve Real Savings from Paying Off Real Estate

Mortgage and housing costs are among retirees’ biggest financial expenses in their Golden Years. If you are relatively close to paying off your mortgage, talk to a financial advisor, because doing so can relieve a tremendous amount of pressure off of your retirement spending.

If you’re facing an unexpected early retirement, paying off your mortgage sooner rather than later can make a tremendous difference. Calculate how much faster you can pay down your mortgage and what this will do to your retirement budget.

Another consideration when it comes to your real estate is cashing in on the equity. Do you plan to sell your home and relocate, downsize or move in with family? There are ways you can benefit from equity while staying in place as well. Talk with a financial advisor to see what makes the most sense for your situation.

Higher Wages: Peak Earnings Can Mean Peak Savings

Extra income almost always translates to more spending, but it could mean extra savings – and maybe should if you’re not where you had hoped to be in your retirement planning.

In addition to bigger paychecks, which can lead to bigger retirement plan contributions and even employer matches, peak earning years can also come with stock plans, bigger bonuses and other perks.

Once you reach age 50, your retirement contribution limits will also increase.

Catch-Up Contributions: The IRS Allows You to Save More

As mentioned above, you can start contributing significantly more to your retirement plans once you turn age 50. These catch-up contributions can be a great opportunity to make big leaps forward in your retirement savings.

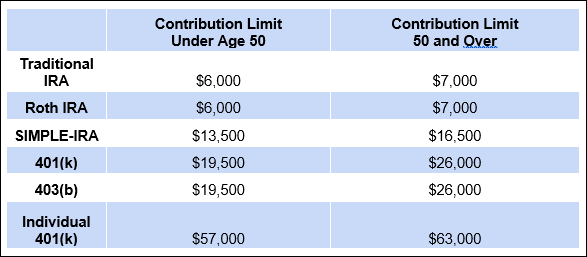

The amount of extra money you can contribute depends on the type of retirement account you own, but any extra amount when you got a late start to retirement planning can make a big difference. As you can see in the chart below, catch-up contributions to your Traditional IRA can increase your contributions by 40 percent, and by 33 percent in your 401(k).

Automating your savings can help make sure you make these contributions regularly. Instead of having to make the decision every month and manually having to part ways with your money, an automated savings strategy can take the emotions out of the equation.

Why a Financial Advisor Can Help

Feeling behind on retirement can be painful. But don’t lose hope. Working with a Certified Financial Planner can bring to light savings strategies that can change the game. The above tactics are just a few of the ways you can catch-up. A fiduciary financial advisor can help you put your financial picture together cohesively and establish with a plan of action that incorporates your budget, investments, goals and specific needs.

Don’t become one of the retirement financial horror stories you fear. Schedule a no-obligation conversation with Global View’s team of Certified Financial Advisors in Greenville, SC, and take back the control. With the right help, you can go from feeling behind to feeling confident and secure as you prepare to transition to retirement.

Written by Matthew Crider

Matt is a CERTIFIED FINANCIAL PLANNER™ professional who has been in the financial advisory business since 2008. He holds a BA in Marketing and Management from the University of Cincinnati and his MBA from Clemson University. Prior to Global View, Matt began his career with Fidelity Investments. His specialties at Global View include asset accumulation and investment strategies; college funding strategies; budgeting discipline and analysis; multi-generational planning; and life event changes, such as marriage, kids, home purchase, retirement, etc.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us