Global View Investment Blog

Boost Your Savings with Employee Match Contribution: Empowering Your Financial Future with Global View Investment Advisors

Retirement Planning, Financial Literacy, Investment & Portfolio Management

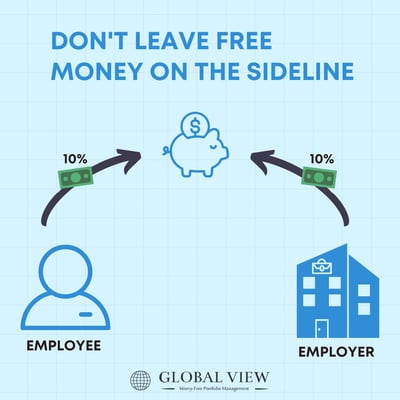

In the realm of smart financial planning, few benefits are as rewarding as an Employee Match Contribution. During National Savings Month, we explore the significance of this program and how it can empower you to take charge of your financial destiny.

Understanding Employee Match Contribution

An Employee Match Contribution is a retirement savings program where your employer matches a percentage of your contributions to a retirement account, such as a 401(k) or similar pension scheme. This employer-sponsored initiative acts as a powerful incentive for employees to save and invest in their futures. By contributing a portion of your salary to the retirement account, you can enjoy an additional contribution from your employer, effectively amplifying your savings.

The Advantages of Employee Match Contribution

1. Accelerated Savings Growth: One of the most evident perks of this program is the accelerated growth of your savings. Essentially, it's free money from your employer that supplements your contributions. By taking advantage of the full employer match, you tap into an opportunity to fast-track your retirement savings.

2. Immediate Return on Investment: The employer match effectively represents an immediate return on your investment. As soon as your employer contributes, your retirement fund experiences a boost, compounding over time to generate substantial wealth.

3. Tax Benefits: Employee Match Contribution plans often come with tax advantages. The contributions you make are typically tax-deferred, meaning they are deducted from your taxable income in the year of contribution. This can lead to significant tax savings, allowing you to keep more of your hard-earned money.

4. Long-term Security: Retirement planning is about ensuring a secure future, free from financial worries. By taking advantage of the employer match, you bolster your retirement fund, creating a stronger safety net for your golden years.

How Global View Investment Advisors Can Help

Global View Investment Advisors is committed to helping individuals achieve financial freedom and security. With their expertise and guidance, you can optimize your retirement planning to make the most of the Employee Match Contribution program.

1. Tailored Financial Strategies: The team at Global View Investment Advisors understands that each individual's financial situation is unique. They will work closely with you to create personalized financial strategies that align with your goals and maximize the benefits of the Employee Match Contribution program.

2. Investment Diversification: Diversifying your investment portfolio is essential for managing risk and achieving long-term growth. Global View Investment Advisors can help you identify diverse investment opportunities that suit your risk tolerance and align with your retirement objectives.

3. Continuous Monitoring and Adjustments: The financial landscape is dynamic, and your retirement plan may need adjustments over time. Global View Investment Advisors will regularly review your portfolio and make necessary changes to keep you on track to meet your financial goals.

4. Education and Empowerment: Beyond managing your investments, Global View Investment Advisors aims to educate and empower you with financial knowledge. They provide resources and guidance to enhance your financial literacy, enabling you to make informed decisions about your retirement.

Conclusion

Embracing the Employee Match Contribution with the assistance of Global View Investment Advisors can be a game-changer in your journey toward a secure retirement. By taking advantage of this initiative, you can harness the power of compounding and enjoy the peace of mind that comes with knowing you are actively securing your financial future.

Start today, and let Global View Investment Advisors help you pave the way for a prosperous tomorrow. Remember, it's never too early or too late to take charge of your financial destiny.

Written by Kathleen Moore

Kathleen has a long history in financial and professional services leveraging her analytical skills to optimize results for clients. Kathleen’s focus is supporting the Global View team which embodies the same ideals as Ken, Global View founder, to further the company’s mission of putting the clients’ interests first.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us