Global View Investment Blog

‘Chimp Management’ – It’s Not Just for Cyclists; It’s for Investors Too

A personal hero of mind, Richard Feynman, said it best: “You can recognize truth by its beauty and simplicity.” That’s probably why I like the concept of “chimp management” for rational decision making. The most important thing a financial advisor can do is to make sure investors don’t lose money they can’t make back. It’s to make sure decisions are based on sound reasoning instead of emotional reactions.

Our clients know this. The biggest problems investors who have money face is that they lose money they can’t make back. It’s why many studies show the returns investors actually receive are generally half of the investments they are in. It happens because they allow emotions to drive decisions. As Warren Buffet put it, they allow fear and greed to take over. It means, once you have serious money, especially when you stop accumulating and are converting assets into income (retire), you must think differently.

Recently, a friend recommended a book written by the Sports Psychologist of Team Sky, Dr. Steve Peters. If you don’t know already, Team Sky is the winningest Pro Cycling team of the last decade.

The book is called “The Chimp Paradox.” It is written to help people make good decisions by understanding that most of the decisions they make are based on emotions, and not reason.

What I like about the book is its simplicity. In the book, the author suggests we develop a skill to prevent making emotional decisions. We have a choice. How we manage our emotions affects the outcome.

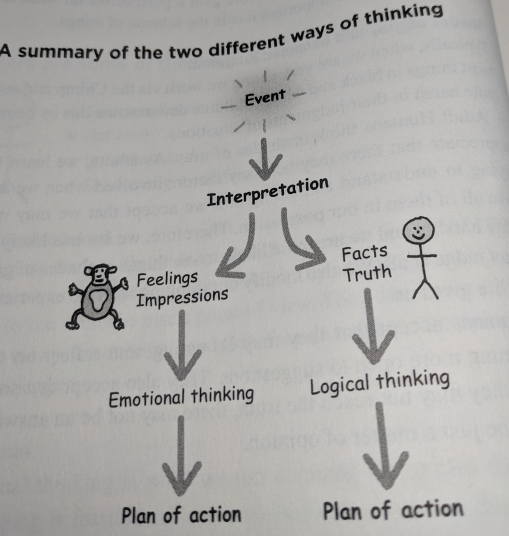

He breaks down the three parts of the brain: The human, the chimp and the computer. You are the rational thinking human; the chimp is the part of you that acts emotionally; and the computer is the storage device with automatic mechanisms determining who makes what decisions.

Instead of foolishly believing you can dominate your chimp, it’s important to understand that instead, you are not responsible for the nature of your chimp. The chimp behaves the way he does because it has its own agenda.

But you are responsible for managing your chimp.

Because your human and your chimp have different agendas, they act differently. And they think differently. The human and chimp have different values. Because they are different, they react much differently. You can’t manage your chimp without realizing this.

The chimp is five times more powerful than the human. This means the human can’t simply dominate the chimp (you lose). Instead, you must nurture the chimp before trying to manage it. You must make the chimp happy before you can manage it. There are three ways to manage the chimp.

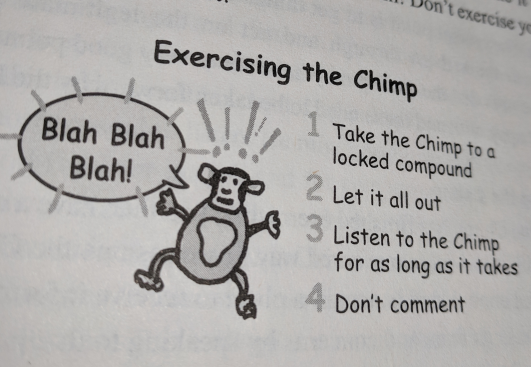

First, you can exercise the chimp (the chimp is much easier to manage after well exercised). It means the chimp must let emotions out (in an appropriate way). Second, you can box the chimp by feeding it facts so that it can see the consequences of actions (much easier after exercised). Finally, you can feed the chimp bananas. Bananas allow you to pacify the chimp temporarily so you can move forward. For example, the chimp is impatient, so if you want to get up earlier than the chimp likes, you can challenge the chimp with a five-second countdown to get out of bed.

The point here is that you have to nurture your chimp if you want to manage it. If you don’t, the chimp will run the show.

The computer is the memory bank of your brain. Your computer stores your human and chimp memory. Historical experiences program the computer. When these experiences were negative, they create gremlins, which trigger the chimp into action (which the human would never choose). When experiences were positive, the computer creates an autopilot leading to helpful outcomes. These are based around ourselves, other people or the world where we live.

A gremlin is often created by unsuspecting parents, in children under 8, who, when presented with a pretty drawing from school, immediately put the drawing on the refrigerator and then telling the child how nice it was. The better reaction would be to tell the child they like the drawing before putting it on the refrigerator. The gremlin is created because the child learned that their love is conditional on their performance. I am, inadvertently, guilty of having done this with my children.

There are three systems working together: The human, the chimp (five times faster) and the computer (100 times faster). As financial advisors, our jobs are to help our clients manage this system to get the right outcome. The world sees what the human, chimp and computer present to them.

In order to manage the computer, you need to detect the gremlins, stop them from getting in and establish constructive autopilots to replace the gremlins. Dr. Peters suggests we create a “stone of life” to anchor us containing the values and truths we want to live by.

It’s important to remember that we are a combination of human, chimp and computer. The chimp can hijack us. If we can understand others, who they are and what their machine is, we can have better relationships with them. We can then realize when the other person’s chimp is presented and understand that we need to deal with their human instead of allowing our own chimps to interact with their chimps. This is never good unless the chimps have the same agenda.

What this means for investors is that you need to notice why you are making a decision. Is your human making the decision or is your chimp? What can you do to placate (or manage) your chimp? We have found that our educational tools, illustrating likely six-month return ranges and the odds of making money over three years, can be very helpful. If the chimp is prepared, it’s less likely to react!

It also means, that as advisors, and more specifically Greenville financial advisors, we need to be ever vigilant that our humans are in charge. And to manage our own chimps.

This is a very brief summary of The Chimp Paradox, by Dr. Peters. Support the author by purchasing the book if you would like to dive deeper.

If you’d like to talk with some of the best Greenville financial advisors, give Global View a test drive.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us