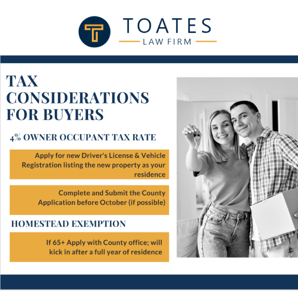

Whether a new homeowner or just moving between homes, you will need to remember to apply for the 4% tax rate in SC on your primary residents. If no action is taken you will be paying a higher tax rate of 6%.

After the closing of your home, you will receive tons of junk mail from scammers and solicitors. In the midst of all these mailings you will receive an important pink slip of paper that comes from the County Real Property Services office. This slip will need to be completed and mailed or hand delivered to the correct office.

Be sure your driver’s license and vehicle registration are changed to your new address. Do not forget about updating your car registration so you will receive your property tax notice and do not fall behind in your tax payments.

Be sure your driver’s license and vehicle registration are changed to your new address. Do not forget about updating your car registration so you will receive your property tax notice and do not fall behind in your tax payments.If you are at least 65 years old, you can apply for a special tax reduction called the Homestead Tax exemption. You are eligible for this tax reduction after one residing in the home for one year.

Please contact your local Real Estate Attorney today for any questions or guidance. If you do not have a local real estate attorney, please ask your Financial Planner for a recommendations.

.jpeg)

.jpeg)