Global View Investment Blog

Empowering the Next Generation: Teaching Kids About Money

Back to School Month not only marks the start of a new academic year but also provides a golden opportunity for parents to impart valuable financial lessons to their children. Teaching kids about money at an early age lays the foundation for their future financial success. Global View Investment Advisors, the leading fiduciary investment advisory firm in Greenville, SC, believes in empowering the next generation with crucial money management skills. In this blog post, we'll explore expert tips from Global View on teaching kids about money during Back to School Month.

1. Introduce the Concept of Saving

One of the fundamental lessons to teach kids about money is the importance of saving. As they head back to school, this is a perfect time to discuss the concept of setting aside money for short-term and long-term goals. Help your children create a simple savings plan by setting up separate piggy banks for spending, saving, and giving. Global View's experienced financial advisors in Greenville, SC, can guide parents in explaining the benefits of saving for the future.

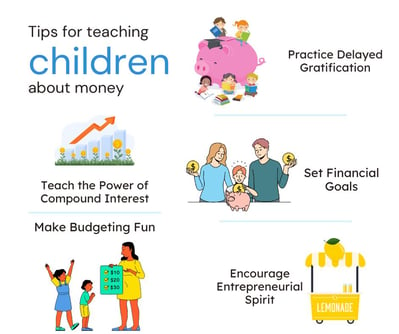

2. Make Budgeting Fun

Budgeting may sound daunting, but it doesn't have to be boring. Turn it into a fun and interactive activity by involving your kids in family financial decisions. During back-to-school shopping, let them compare prices and decide on purchases within a budget. Show them how to prioritize needs over wants. This hands-on experience will instill responsible spending habits that will stay with them into adulthood.

3. Teach the Power of Compound Interest

Global View's fiduciary advisors in Greenville, SC, understand the significance of compound interest in building wealth. Explain this concept to your children in simple terms and demonstrate how saving early can lead to substantial gains over time. Utilize visual aids and age-appropriate examples to make them relatable and memorable.

4. Encourage Entrepreneurial Spirit

Use Back to School Month as a platform to nurture your child's entrepreneurial spirit. Encourage them to explore ways to earn money, such as selling crafts, offering tutoring services, or doing household chores for an allowance. Global View's comprehensive financial plans can incorporate strategies to save and invest these earnings for long-term growth.

5. Set Financial Goals

Goal-setting is an essential skill that extends beyond academics. Sit down with your children and help them set achievable financial goals. Whether it's saving for a new bicycle or contributing to a charity, having a clear purpose enhances their financial decision-making abilities. Global View's expert financial advisors in Greenville, South Carolina, can guide parents in aligning these goals with the child's overall financial plan.

6. Practice Delayed Gratification

Teaching kids to delay gratification is a valuable lesson in today's consumer-driven world. Utilize back-to-school sales and other events as opportunities to demonstrate the rewards of waiting for better deals. By avoiding impulsive purchases, children learn the value of patience and thoughtful spending.

As the leading fiduciary investment advisors in Greenville, SC, Global View Investment Advisors emphasizes the significance of teaching kids about money during Back to School Month. These early financial lessons pave the way for a secure and prosperous future. By introducing concepts like saving, budgeting, compound interest, and goal-setting, parents can instill valuable financial habits in their children. With the assistance of Global View's expert financial advisors, this Back to School Month can be the beginning of a lifelong journey toward financial success for your kids.

Remember, financial literacy is a gift that lasts a lifetime. Start investing in your child's financial education today with Global View Investment Advisors by your side.

Written by Erin Milner

Erin works as a paraplanner alongside our Advisors in managing client relationships and special financial planning needs, including retirement transition, education, and estate planning. Erin began working in the financial advisory business upon graduating from the University of Georgia with a BS in Financial Planning in 2015. She competed in the National Financial Planning Student Challenge in 2014. Erin is a member of the Financial Planning Association. She volunteers at Habitat for Humanity as a Financial Assessor.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us