Global View Investment Blog

ERBAA and Bumpy Returns

Executive Summary

This paper reiterates our view and rationale for reduced risk allocation

- Historically the greatest risk to equity prices has come during recessions.

- Economic Based Asset Allocation is a process to reduce risk as the economy slows, taking minimal risk after a Recession Call.

- We expect the result of this process to generate bumpy returns, i.e. low positive and low negative returns followed by the potential for high positive returns. In any case the risk of this strategy is substantially lower than market indexes.

- We retain a Recession Asset Allocation and expect to participate less during upside and downside market movements. While we fear government actions we believe market forces will eventually prove more powerful.

ERBAA Revisited

Historically, the greatest risk to equity prices has come during periods of Economic Recession. Our research firm, ECRI makes a clear call signaling the change when they believe a Recession is imminent. They also clearly call when Expansion ensues and later when the subsequent Slowdown begins. As you know, the Recession call was made at the end of the 3rd quarter of last year. We made a decision to reduce risk for our client portfolios at that time.

Recent moves in market prices may lead you to believe that this call was wrong. However, the real economic data that we see continue to suggest the US economy is in or nearly in recession. In fact, ECRI has publicly stated that they believe the recession began in June, at latest, and that economic data will be revised down to confirm this. Moreover, their latest report suggests the recession is deepening.

Recent moves in market prices may lead you to believe that this call was wrong. However, the real economic data that we see continue to suggest the US economy is in or nearly in recession. In fact, ECRI has publicly stated that they believe the recession began in June, at latest, and that economic data will be revised down to confirm this. Moreover, their latest report suggests the recession is deepening.

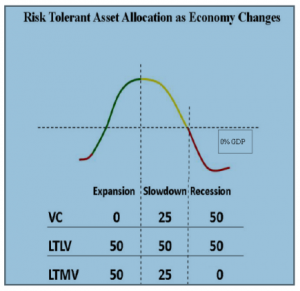

We call our process for navigating a difficult economic environment Economic Based Asset Allocation (ERBAA). Using this process, we reduce risk as the economy slows from Expansion, to Slowdown, to Recession. The chart at right illustrates how we slowly move from riskier asset classes Long-Term More Volatile (LTMV) to lower risk Volatility Control (VC) as the economy slows, retaining the quality, steady Eddie Long-Term Less Volatile (LTLV) throughout.

Since we implemented a Recession reallocation at the beginning of the fourth quarter last year portfolio performance has lagged. Despite this underperformance, the process and decision to reduce risk are fundamentally sound. Only time will tell if this particular reallocation will help returns.

Whether it is the “New Normal,” the “Great Deleveraging” or just a period of overvaluation and high financial risk, we believe the next few years will be a period of more frequent recessions. This underscores the importance of the ERBAA process for controlling risk. Should this cyclical downturn turn out in retrospect to be a “near miss” or alternatively a mild recession with almost no market correction, then we will have missed an opportunity to participate in some of the upside. However, if it does turn out to be a more severe recession, there remains substantial downside risk.

Bumpy Returns

Should the ECRI Recession call prove wrong, or the recession turn out to be very mild, our clients will have foregone some upside in return for substantially reduced risk. Instead of having produced double digit positive returns, we will have produced single digit positive returns. The ERBAA methodology is set up to produce “bumpy” returns. By that, we mean we hope to produce a string of low positive and low negative returns following by briefer periods of high positive returns that occur only during Economic Expansion. Clearly this will result in lower risk. We also believe it will lead to higher returns.

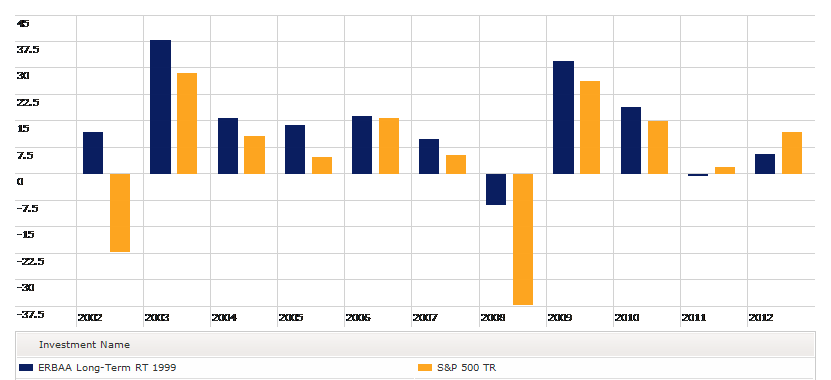

The graph below provides an illustration of how we hope these “bumpy” returns are intended to work over time. The blue bar is a backtested illustration of the potential results from using the ERBAA process to reduce risk at recession and take risk during expansion, using the three categories of managers identified in the chart above, since 2002. Clearly, the major value-add occurred during periods of deep recession, by avoiding the sharp losses. However, the greatest positive returns occurred during periods following recession, or expansion.

Current Asset Allocation: Recession

We cannot know that we will be able to replicate returns like those depicted above in the future, but we believe that valuations and other risks further support our stance to reduce risk. At present, we are being exceptionally careful with new client assets and retain a 50% allocation to Volatility Control and 50% to Long-Term Less Volatile in our Risk Tolerant Portfolio. We expect to continue to underperform as prices go up but to experience substantially less downside risk as well.

With an expansion call, we will add LTMV holdings that represent the most undervalued assets, many of which are overseas. We are, in fact, excited about valuations in some parts of the world, but less excited about near term economic prospects. While we can never be sure that the ERBAA process will work, especially given unprecedented global monetary intervention, it is our view that no government actions can permanently withhold the forces of the market economy and that our process will eventually demonstrate a substantial value add.

Kenneth M. Moore Jr.

Partner, MBA, CFP®

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us