Global View Investment Blog

Global View Market Outlook January 2009

Executive Summary

We face a deep recession that will most likely last until at least the end of 2009. After reading many articles and several books on market crashes, and listening to the world’s best investment managers discuss the current crisis, we have also concluded the valuation disparities created during this crisis present the buying opportunity of a lifetime. While there is a lot of speculation about what the US government could and should do to lessen its severity, we agree that it should provide easy money by lowering interest rates and purchasing securities on the open market and act as the lender of last resort.

While there is much uncertainty regarding the near-term outlook, the choices remain clear:

- Invest in US treasuries, get less than 2.5% p.a. for next ten years. Should inflation reappear (as we expect), owners of treasuries may face serious capital losses as interest rates adjust to higher levels.

- Invest in the overall broad market (S&P 500) and expect to get 10% p.a. for the next 7-10 years (according to generally pessimistic forecasters), but possibly lose up to another 30% (if S&P 500 falls below 600) before doing so.

- Invest in Margin of Safety managers, who may experience all of the loss of the S&P 500 or overseas markets in a short-run sell off, but who we expect to decouple from the broader market over the next two years and generate substantial returns.

No government actions can result in overnight success and we encourage our clients to remain patient; however, we firmly believe the Margin of Safety strategy espoused by our managers is the best way through this. Extended periods of volatility will create ongoing valuation disparities and should work to benefit our managers; however, may also cause more short-term pain.

Current Crisis in Context

The overall indices have fallen more than any time in recent history. The average stock in the S&P 500 fell 45% since its 2007 peak, over 26% in the fourth quarter of 2008. International markets generally suffered more. Almost every “risky” asset fell in value precipitously. Following are the total returns (price plus dividends) for selected equity indices in 2008:

- Emerging markets: -54%

- MSCI EAFE (overseas): -45%

- MSCI World (global): -42%

- S&P 500: -37% (-53% peak to trough from 10/9/07 to 11/20/08)

Source: Morningstar

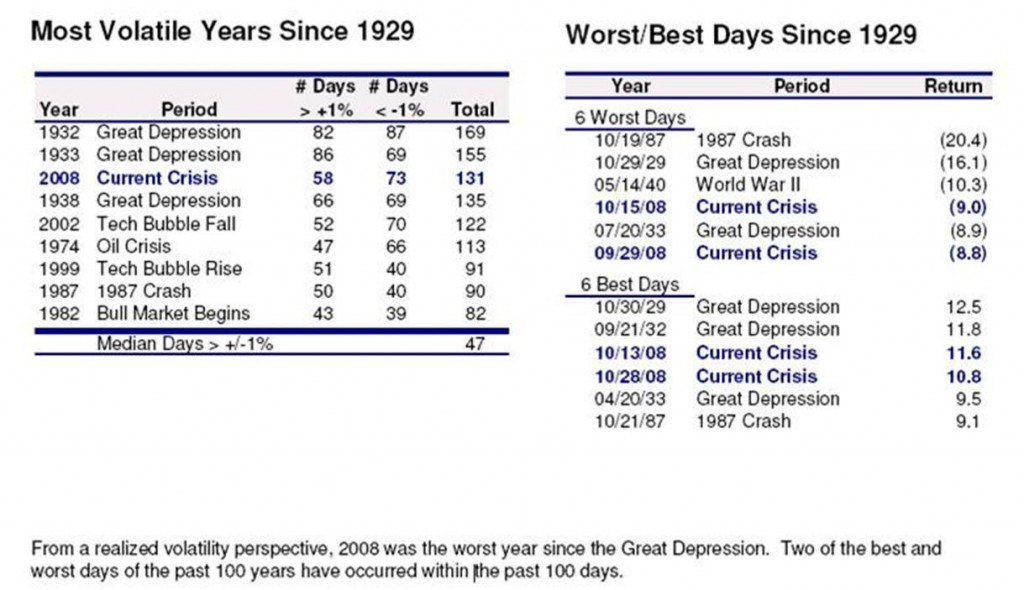

Prior to this crisis, the worst twelve-month period the First Eagle Global fund had ever experienced was -10%. From November of 2007 to October of 2008, First Eagle Global lost 24.5%, more than doubling its worst one-year drawdown. Other managers also experienced unprecedented drawdowns. Price volatility during 2008 was worse than any period since WWII. There were more +1% and -1% return days last year than any time since 1933 data (data from Standard and Poors):

Investment Strategists' Long-Term View

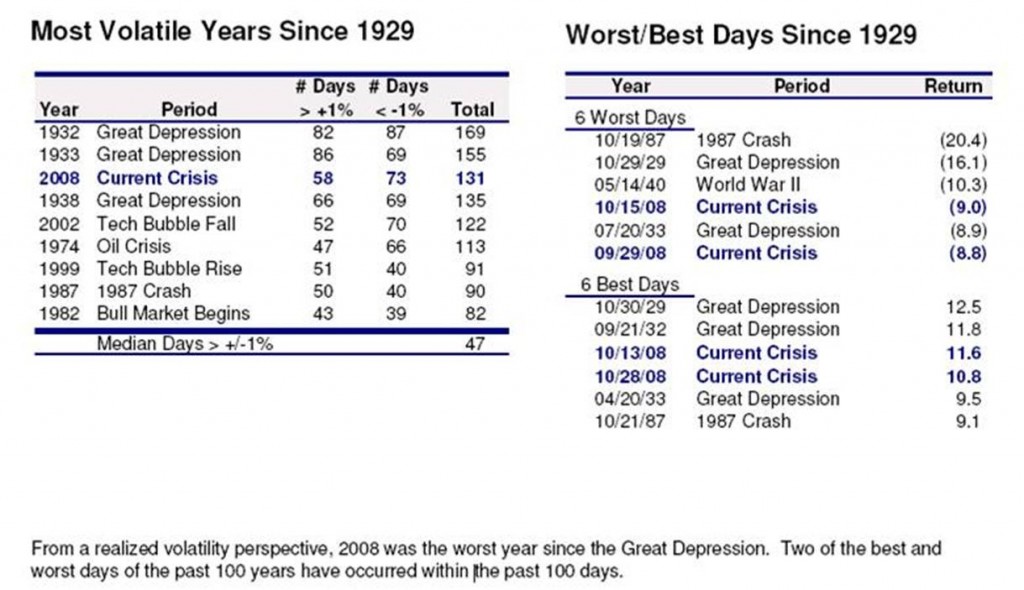

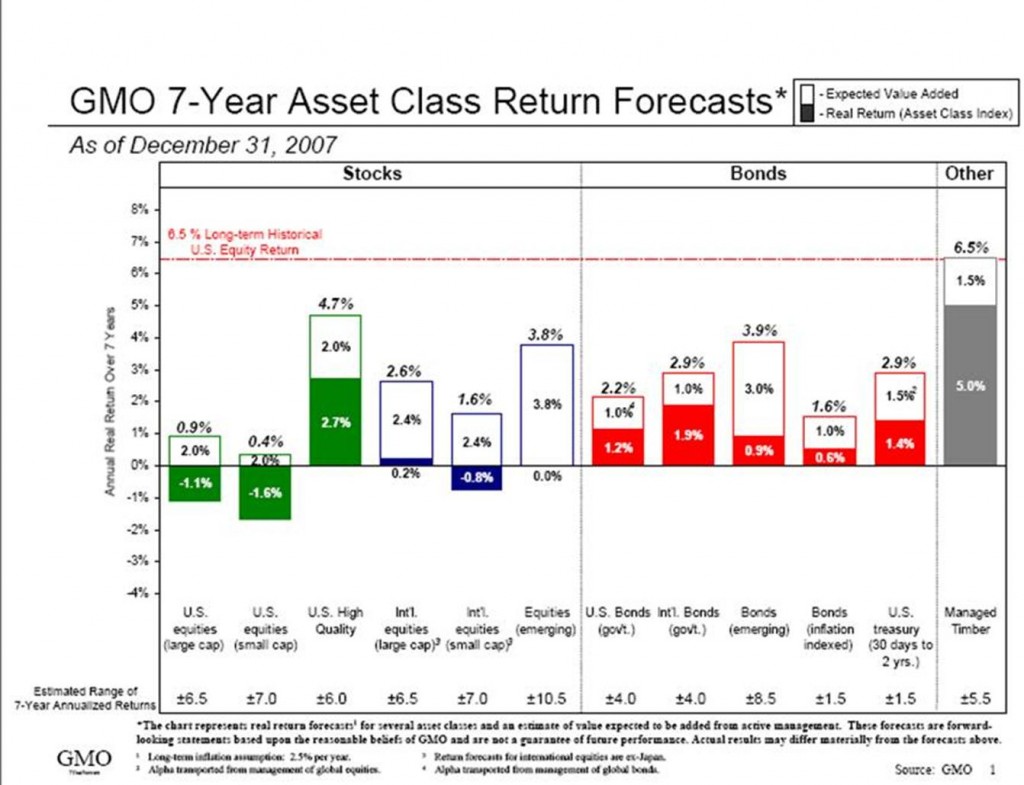

Jeremy Grantham, Chief Investment Strategist for GMO funds and John Hussman of Hussman Funds have both been vocal observers of the coming economic crisis, but were surprised with the speed and fury with which it unfolded. Both believe that, for the next ten years, odds are very high stocks will return at least 10% p.a. Jeremy Grantham forecasts that GMO managers will return over 10% p.a. (before inflation) for the next seven years in US high quality, internationally, and in Emerging Markets, but that government bonds will pay 2.2% p.a.

Based on our estimation, the market is now approximately 10% above fair value. This is not unusual, because in recent history the market has traded at least 10% above fair value and during bubble periods at 40% above fair value. At this valuation, the greatest emphasis is on Long-Term Less Volatile Managers. The purple box in the chart below shows our current allocation for Moderate, Moderately Aggressive, and Aggressive strategies.

Based on our estimation, the market is now approximately 10% above fair value. This is not unusual, because in recent history the market has traded at least 10% above fair value and during bubble periods at 40% above fair value. At this valuation, the greatest emphasis is on Long-Term Less Volatile Managers. The purple box in the chart below shows our current allocation for Moderate, Moderately Aggressive, and Aggressive strategies.

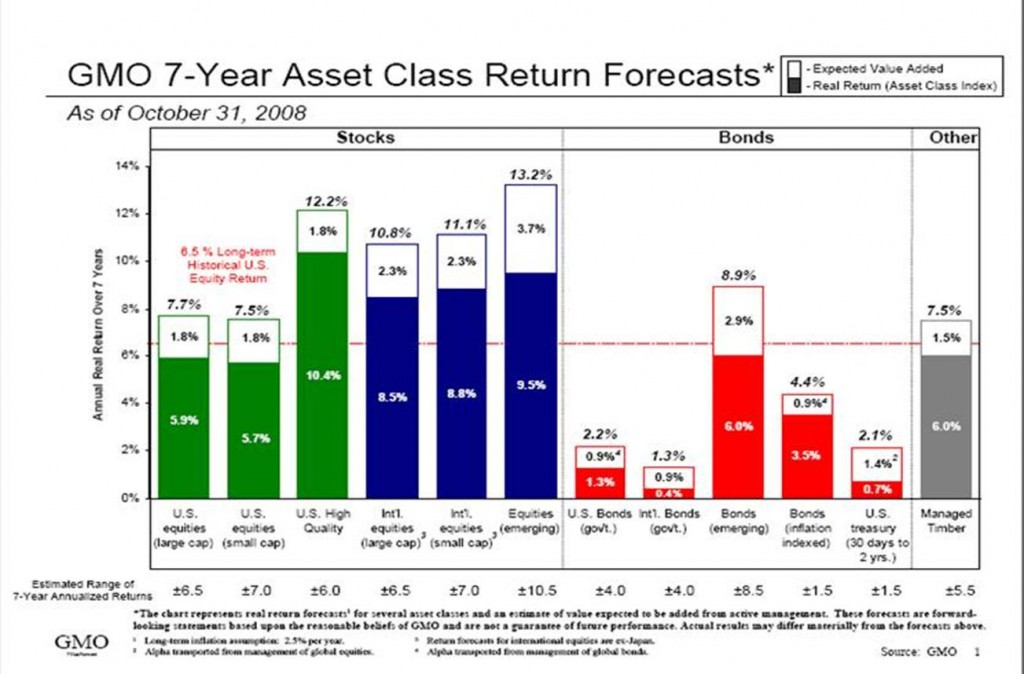

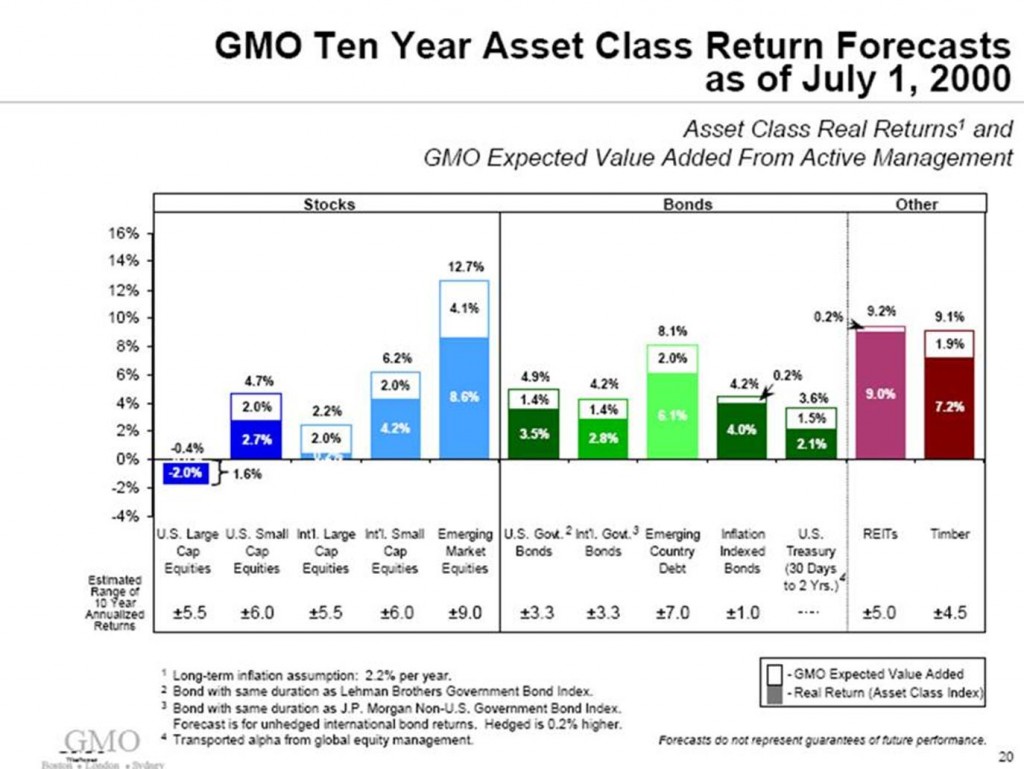

This is meaningful because, prior to the correction, Mr. Grantham had forecast returns in the single digits as of last year:

Even in July 2000 GMO had negative forecasts for most equities, a prediction that has proven prescient and perhaps reason to heed his advice going forward.

John Hussman has a similar forecast for the next ten years. This is also meaningful, because prior to October his portfolio was nearly completely hedged against risk - he believed the markets were overvalued. In the link below, he summarizes both views: “In 2000, we could confidently assert that stocks would most probably deliver negative total returns over the following 10-year period. Today, we can comfortably expect 8-10% total returns even without assuming any material increases in price to normalized earnings multiples.” and … “given a modest expansion in multiples, a passive investment in the S&P 500 can be expected to achieve total returns well in excess of 10% annually.”

INTERNET LINK - Hussman Weekly commentary October 20, 2008

In July of 2007, Dr. Hussman showed 8 times that were “awful times to invest.” These include January of 1973, December of 1999, March of 2000, and July of 2007.

INTERNET LINK - Hussman Weekly Commentary July 16, 2007

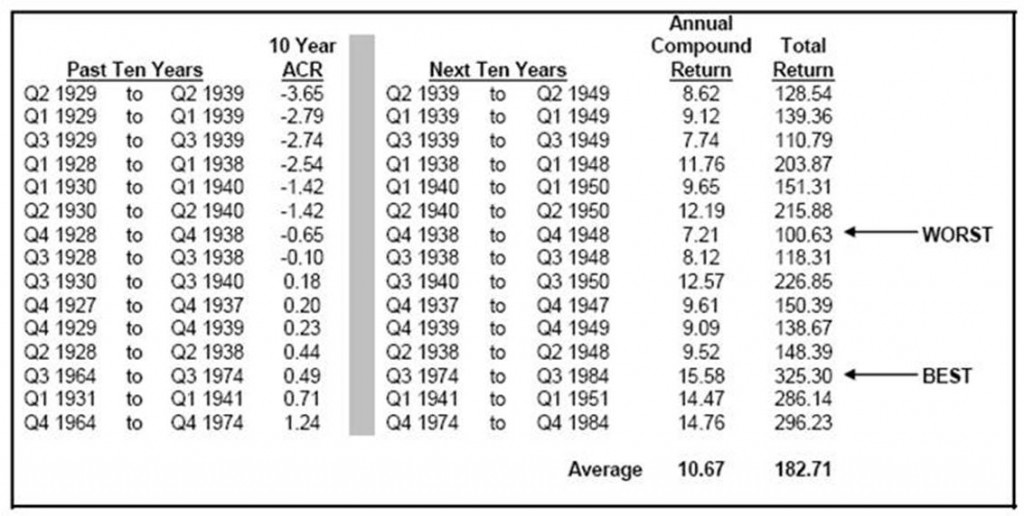

For the last ten years, the S&P 500 returned -1.4% p.a.. An investor with $1,000,000 ten years ago would now have a little over $870,000 as of the end of 2008. Leuthold Weeden conducted a study of worst ten-year returns and subsequent ten-year returns. For every ten-year period where annual compound returns were 1% or less, the subsequent ten year was much more positive. The worst subsequent ten-year period, was Q4 of 1938 to Q4 of 1948, an annual compound return of 7.2% p.a..

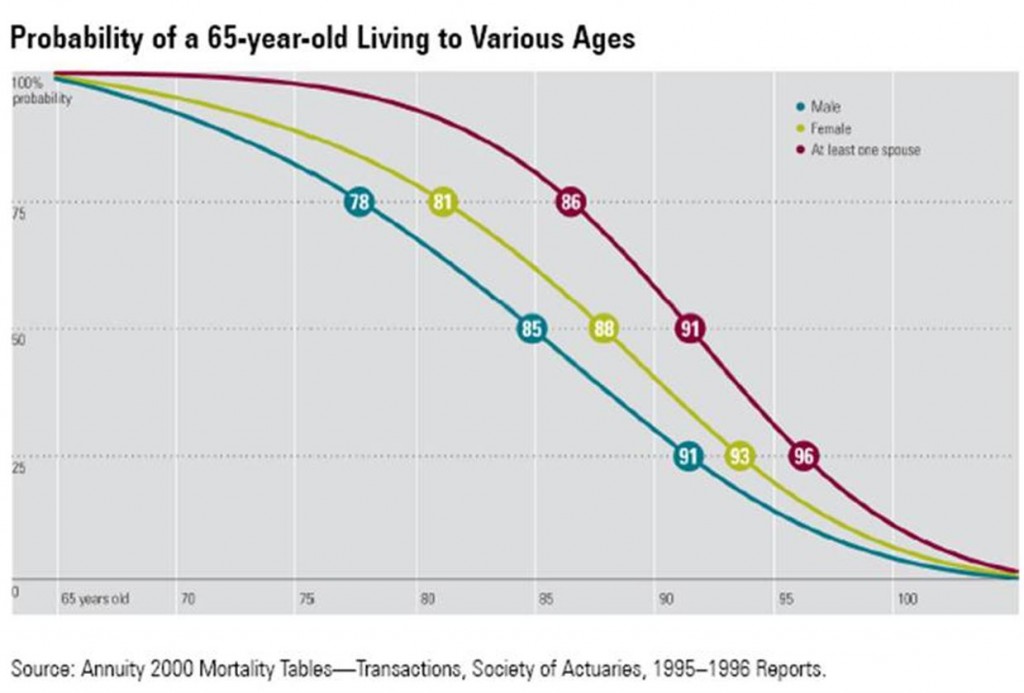

While it is true you must have some means of supporting immediate income needs, the investment time horizon of almost any of our clients (particularly those who seek to leave a legacy to heirs or a charity) is at least ten years. This is especially important given that there is a 50% chance that one spouse will live to be 91!

While it is true you must have some means of supporting immediate income needs, the investment time horizon of almost any of our clients (particularly those who seek to leave a legacy to heirs or a charity) is at least ten years. This is especially important given that there is a 50% chance that one spouse will live to be 91!

History of Margin of Safety Managers

The current market crash has been nearly indiscriminate in its punishment of any “risky” asset; good companies with strong financial positions experienced price reductions as great as companies with poor financial positions or who rely on the credit markets for ongoing operations. In each prior instance we have studied, the investment strategy of the Margin of Safety discipline outperformed relevant market indexes over subsequent periods.

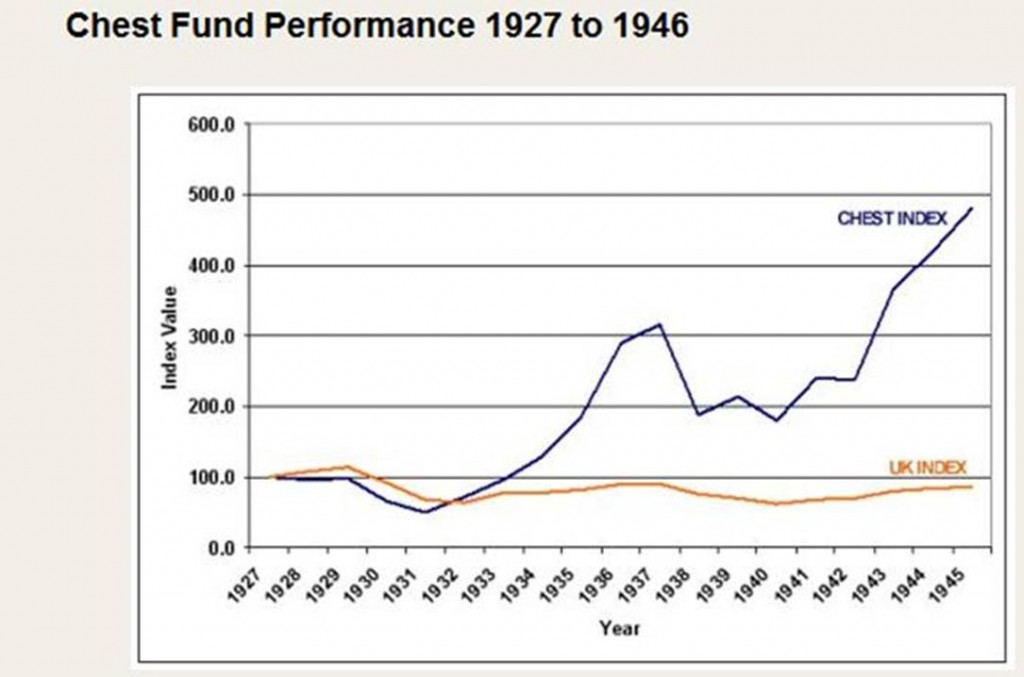

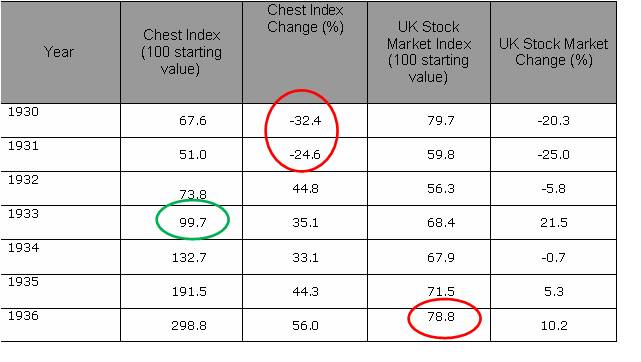

We are unable to find the history of a Margin of Safety investment manager in the United States during the Great Depression, but John Maynard Keynes is considered a Margin of Safety manager In the United Kingdom by both Benjamin Graham and Warren Buffet. Warren Buffet is quoted as having said that Keynes was a man “whose brilliance as a practicing investor matched his brilliance in thought.” During the Great Depression, John Maynard Keynes managed the Chest Fund, starting with £30,000 and ending with £380,000 when he died in 1946, an annual compounding of over 12% p.a. From 1927 to 1946, his return was 9% p.a. While this performance might not be considered stellar by today’s standards, the British stock market fell 15%, or over 1% p.a. Mr. Keynes outperformed the UK stock market by 10% p.a.

Important to note is that this ride was very bumpy. By the end of 1931, Keynes had lost investors nearly 50% when the UK stock market had only fallen by 25%. However, by 1933, Keynes had already nearly returned to the black, and by 1936 had nearly tripled the initial investments. The UK stock market remained below its beginning level in 1930 as of 1946!  Source: http://www.maynardkeynes.org/keynes-the-investor.html

Source: http://www.maynardkeynes.org/keynes-the-investor.html

Of course past performance is not a guarantee. But, we are focused on process. The premise of the process is that the market is a voting machine in the short run, but a weighing machine in the long run. As long as the managers have a strict discipline of purchasing securities at a margin of safety discount to intrinsic value, when the market returns to normal functioning, market prices will reflect fundamentals and patient investors will be rewarded.

Decoupling of Margin of Safety Managers from the Market:

In the short run, the stock market is a voting machine, but in the long run it is a weighing machine. This belief is based on the weight of historical evidence:

- Human beings act irrationally in the short run. This has been scientifically demonstrated by Daniel Kahnemann, who won the Nobel Prize in Economics in 2002 for over 30 years of research; Edward Wilson, Evolutionary Biologist who links human behavior to hardwiring in the brain; Richard Thaler, Father of Behavioral Finance who ties human psychology to finance; and many others. We believe the existence of bubbles itself proves this and anyone who believes the market always prices accurately is a fool.

- The investment strategy of Margin of Safety managers (according to our analysis) has historically worked over reasonable time horizons of over five years. We know this from analyzing historical performance in comparison with market indexes.

While we are concerned that government intervention can upset the weighing machine, this is only very marginally in our control. Government intervention, through both fiscal and especially monetary policy, has to date affected the prices of bonds more than of equities. Obama’s stated intention to help states should have a positive effect on municipal bonds.

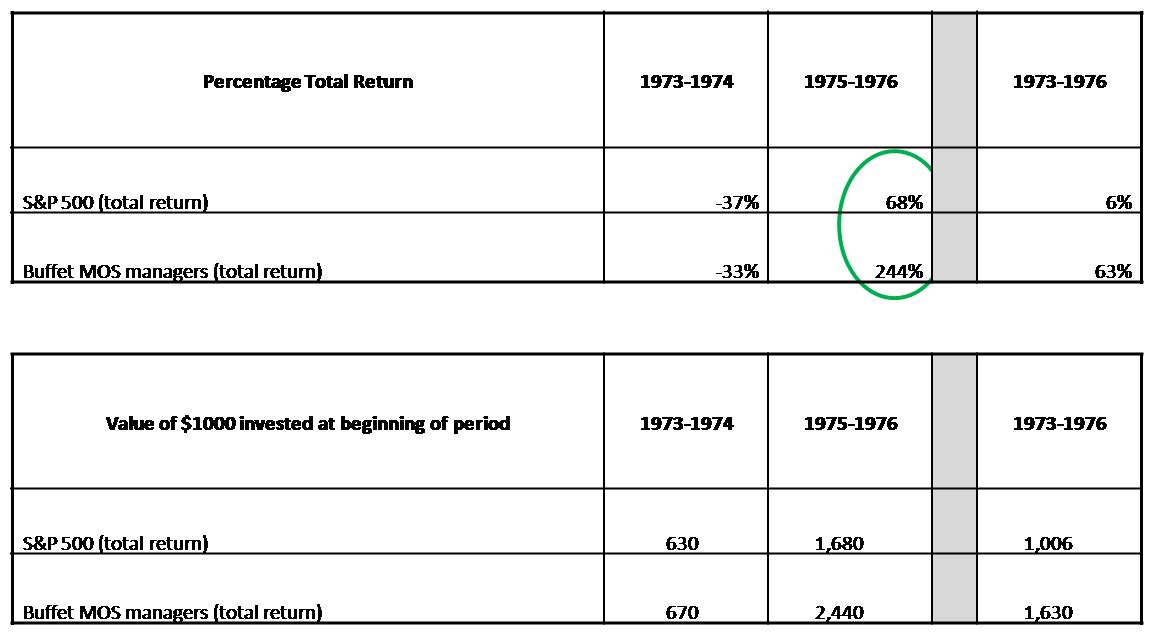

US Margin of Safety managers repeated this experience in the 1970s. While this time the market fell more than the average drop in the managers, the subsequent rebound was even more pronounced. Graph above created from "The Superinvestors of Graham and Doddsville," by Warren Buffett.

Graph above created from "The Superinvestors of Graham and Doddsville," by Warren Buffett.

Economic Outlook

The near term economic outlook remains bleak. We fully expect unemployment to rise to 9-10% and for the GDP to contract up to 5%, but nothing like during the Great Depression where GDP fell 25%. We fully expect economic data such as unemployment numbers, manufacturing output, and earnings announcements, to be negative and often to disappoint. While the inter-bank lending market has become more fluid and market volatility has fallen from peak levels, credit availability remains strained. Real estate values have declined over 20% nationwide and it will likely take another year to work through inventories.

The question some have is whether the global economy can avoid a 1930s style economic malaise or multiple year period of slow economic growth. There are many reasons to believe a Great Depression will be avoided. In the 1930s, there was no safety net, no social security, no unemployment insurance, no Medicaid. Perhaps more importantly, the US Federal government was very slow to provide easy money and to act as the lender of last resort. There are many opinions on the cause of the Great Depression and on desired economic policy to avert crisis and to stimulate the economy, but most experts agree a major contributor was failure to provide easy money. Federal Reserve Chairman Ben Bernanke will not fall into this trap. The Open Market Committee has already promised near-zero interest rates for an extended period and a willingness to buy virtually any asset onto its balance sheet.

In the long run, economies grow due to capital allocations that increase long-term productivity. While government actions can shorten corrective pain, government investments in Federal buildings do not increase long-term productivity.

One of our managers, no perma bull, is very optimistic about 2009. Steve Leuthold believes the economy will turn around in 2009, and that equity markets will rally strongly. We do not know, but we will continue to allocate our clients using managers we feel offer the best opportunity going forward.

Thoughts on Economic Stimulus

Evidence supporting the efficacy of government spending on fixing a crisis is dubious. Federal Reserve Chairman Ben Bernanke is a student of the Great Depression and firmly believes the Federal Reserve should provide easy money to shorten downside risk to the economy. In Essays on the Great Depression, Mr. Bernanke shows that monetary stimulus has proven to be effective to shorten the duration of crises. For this reason, his actions are probably much more important than any economic stimulus package put forward.

Professor Michael Porter is Strategy Professor at Harvard who has written books on Competitive Strategy and has counseled many governments on what to do to make their federal or state governments more competitive. We respect him because, in many ways, he is the father of management consulting and had a powerful and positive influence on Bain and Company. He counsels the government to be very careful about creating excessive regulation and to make sure that any stimulus is directed to the long-term best interests of the nation. Unfortunately, indiscriminate infrastructure spending, such as on Federal buildings, does not fall into this category.

INTERNET LINK - Michael Porter interview on CNBC 12/16/08

Global View Investment Advisors is a small business, a local partnership that does not receive revenues from the banking industry and does not receive “pay to play” fees. Two banks you know well were large recipients of federal bailout funds. Financial advisors at these firms have been or will be paid retention bonuses that may be as high as 100% of trailing revenue they produced or nearly 3 times their gross income from the previous year. While in general we do not believe businesses should be restricted with how they allocate capital, it is frankly a disgrace that government bailout funds will be used for Broker retention bonuses and that we and our children will have to pay this back in the form of higher taxes. Many of our competitor firms would certainly have faced bankruptcy if it were not for government intervention. We are discouraged that advisors at competitor firms have been rewarded for poor business practices of their firms. We have consistently communicated to you that many of these firms have not always acted in the best interests of their clients.

Competitor firms engage in other practices we feel are dishonest, such as only allowing investments that will “pay to play,” i.e. mutual funds who are unwilling to share their profits with these firms are not granted access to their platforms and mutual funds who do share their profits often offer a higher cost fund. We believe investors should be provided with this information in a transparent fashion before they do business with these firms. Many of our Margin of Safety managers WILL NOT participate and are therefore not available for purchase at these firms.

If you have friends or family members that you care for and trust, we welcome an introduction so that we can educate them on these and other practices. One of our upcoming events may provide a comfortable venue for introduction.

Upcoming Events

- Seminar in Keowee Key: Thursday, January 15 from 2:00 p.m. to 4:00 p.m.

- Class at Clemson University: ten 90 minute classes beginning February 11 at Seneca Presbyterian Church

- Class at Furman University: ten 90 minute classes beginning March 8 at Furman University

Please contact us if you would like to attend the next seminar or a class.

Recommended Reading:

The Investor’s Dilemma, Louis Lowenstein (Member SEC Audit Committee and Professor of Law, Columbia University)

Nudge, Richard Thaler (Behavioral Economist)

Manias, Panics, and Crashes, Charles Kindleberger (Economic Historian) and Robert Aliber

Economic Facts and Fallacies, Thomas Sowell (Economist)

More Serious and Difficult Reading:

Value Investing, Marty Whitman (82-year-old Value investor)

Essays on the Great Depression, Ben Bernanke (Macroeconomist, Head of Federal Reserve)

Thank you for your loyalty and continued referrals. Thanks to these referrals we grew our business in 2008. We wish you the best in 2009 and look forward to working with you and your families for many years.

Ken Moore and the Team at Global View

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us