Global View Investment Blog

How Inflation Affects Social Security, Medicare, and Taxes

Inflation in the Carolinas persists concerning numbers related to Social Security cost-of-living adjustment, Medicare, and taxes.

Not to worry—tax and investment advisors in both South Carolina and North Carolina are extending a helpful hand. From assessing your financial goals and tax planning to investment strategy and estate planning, certified financial planners can help you with portfolio management and beyond.

Need tax advice or have questions about your financial life? Global View takes pride in helping families of all ages create retirement plans.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 8.2% over the last 12 months ending January 2022. For the Southeast, the number was even higher at 8.4%. Inflation robs your spending power and impacts your relationship with the federal government in several ways.

Let’s dig into the details to help keep you informed and empowered.

Inflation and Social Security

Inflation directly impacts your Social Security benefits in two ways: cost of living increases and wage indexing.

Social Security Cost-of-Living-Adjustment (COLA)

Each year, the Social Security Administration (SSA) adjusts benefits to keep pace with changes to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). For 2022, the adjustment was +5.9%, the highest in almost four decades.

Each year, the Social Security Administration (SSA) adjusts benefits to keep pace with changes to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). For 2022, the adjustment was +5.9%, the highest in almost four decades.

The SS cost-of-living adjustment (COLA) affects more than 64 million Social Security beneficiaries. For example, the average monthly benefit climbed from $1,565 in 2021 to $1,657.

For couples receiving Social Security benefits, the monthly amount jumped to $2,753 from the 2021 figure of $2,599.

One reason for the substantial CPI-W increase is the gauge’s sensitivity to gasoline prices, which caused the index’s transportation component to rise by 23.1% during the period. While seniors may welcome the sizable COLA, it’s unrealistic to assume it represents a new normal.

As we shall see, Medicare may take a big bite out of your 5.9% increase.

Social Security Earnings Indexing

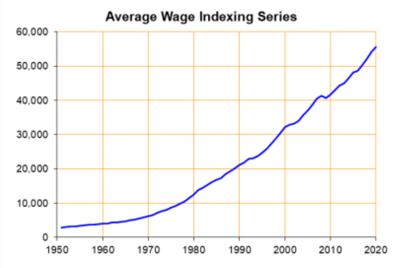

Your Social Security benefits depend primarily on your lifetime earnings record. To remove the impacts of inflation, the SSA indexes your earnings using the national average wage indexing (NAWI) series:

The SSA uses a complex formula that indexes your top 35 years of career earnings through age 60. SSA constantly indexes earnings to the NAWI level two years before first eligibility (age 62).

The SSA uses a complex formula that indexes your top 35 years of career earnings through age 60. SSA constantly indexes earnings to the NAWI level two years before first eligibility (age 62).

Each year’s annual income (up to two years before initial eligibility) is multiplied by your adjustment factor, while post-eligibility earnings are at face value. SSA uses your indexed earnings to compute your average indexed monthly earnings (AIME), the basis for your primary insurance amount.

For example, if you turn 62 in 2022 (your first year of eligibility for benefits), the SSA uses 2020, the year you turned 60, as the indexing year. The SSA multiplies your annual earnings by that year’s factor to get your indexed earnings.

In this example, the factor for 1961 earnings is 13.6119077, 12.9628093 for 1962, 12.6525256 for 1963, and so forth. Indexing expresses most of your previous earnings in dollars valued at two years before eligibility (in this case, 2020 dollars).

However, indexing doesn’t adjust post-eligibility income for inflation. If you turn 62 in 2022 or 2023, you will miss out on the significant 2022 adjustment due to the two-year lag.

Combating Inflation’s Impact on Your Social Security Benefits

You can grow your monthly retirement benefit by delaying your Social Security claim. You get 100% of your benefit by waiting until full retirement age (67) and even more if you defer your claim to the maximum age (70). You get your delayed credit and the SSA COLA for that year by waiting.

Inflation and Medicare

You become eligible for Medicare when you turn 65. Most people pay no premium for Medicare Part A (hospital insurance).

However, Part B (medical insurance) premiums are tied to healthcare costs. For 2022, the Part B monthly premium starts at $170.10 (up $21.60 from 2021) but can be higher depending on your income. The annual deductible is $233, and you pay 20% coinsurance for doctor services, outpatient therapy, and durable medical equipment.

Part C, prescription drug benefits, vary by plan and are usually paid directly to the prescription filler.

Contrary to popular belief, Part B costs are not directly indexed to inflation. Congress sets the annual premium based on several factors, including health care costs and budgetary constraints.

Typically, the SSA deducts the Part B premium from recipients’ Social Security benefits checks. In 2022, many Medicare participants will see their Part B premiums rise by 14.5%. However, the hold-harmless provision protects your previous year’s Social Security benefit from being reduced by an increase in the Part B premium if you meet specific tests.

Unfortunately, one of the tests is whether your COLA will cover the Part B increase, and in 2022, the COLA did. Therefore, you’re on the hook for the higher Part B premium, which might eat up a fair portion of your COLA.

If you earn a modified adjusted gross income (MAGI) in 2022 higher than $91,000 (or $128,000 for joint filers), then you’ll pay a higher Part B premium. To combat Medicare costs, consider holding your MAGI below these threshold levels.

Inflation and Taxes

The IRS adjusts certain items each year for inflation. While federal income tax rates remained unchanged in 2022, the tax brackets were adjusted to account for inflation.

For example, the 22% tax bracket for single filers applies to income from $41,776 to $89,075 in 2022, compared to $40,526 to $86,375 for 2021. The adjustment means you can earn more money before graduating to a higher tax rate.

Other items that the IRS adjusts for inflation include:

- The standard deduction

- Federal tax withholding tables

- Flexible spending account contributions

- 401(k) maximum contribution

- The federal estate and gift tax exemptions

Inflation may hurt property owners if it drives assessments higher. In addition, the IRS doesn’t index the limit on mortgage interest deductions and the tax exemption of up to $250,000 on a home sale.

Many other taxes don’t adjust for inflation, including the cap on state and local tax deductions, the $3,000 cap on capital losses you can apply to ordinary income, and the 3.8% net investment income surtax threshold.

Fight Inflation

Our team of investment advisors in Greenville, SC, can help you plan your tax and spending strategies to maximize your benefit from inflation while minimizing the cost. Our Carolina retirement planners advise you on how to protect your wealth from a wide variety of risks, including the risk of inflation.

If you’d like to learn more about turning inflation to your advantage, contact our team at Global View today for a comprehensive review of your financial plans.

Read: Taxes, Penalties, and Early Retirement Account Withdrawals - Q&A With a Financial Advisor in Greenville, SC

Written by Joe Hines

Joey's primary focus is working with clients in the goals setting and financial planning process. He has extensive experience is in helping clients facilitate the decision making process, leading them through the implementation of their financial plan and contributing to their peace of mind. This includes helping clients gain an understanding of estate planning, charitable giving, and helping them implement these plans by working closely with estate planning attorneys.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us