Global View Investment Blog

How to Get Your Retirement Confidence Back After COVID-19

“Mike” was ready for retirement. He checked all the boxes on his retirement planning checklist, from knowing how he’d spend his days when no longer working to reviewing his plans with his advisor to make sure his finances were on track. He even picked a retirement date and started telling family. Then 2020 brought COVID-19.

Now, his retirement confidence is shot. Can he still retire as planned when the economy and workforce are in the middle of a bumpy recovery? Did the economic slowdown put a giant question mark in place of his retirement date?

Many pre-retirees find themselves in this same situation, with 2020 dissolving any retirement confidence they may have had. We’ve heard many real retirement financial stories just like this.

But despite the uncertainty that some are predicting, you are still in the driver’s seat of your financial life! Below are 5 simple but powerful money moves that can rebuild your retirement confidence and put your financial plan back on track.

1. Talk with a Financial Advisor

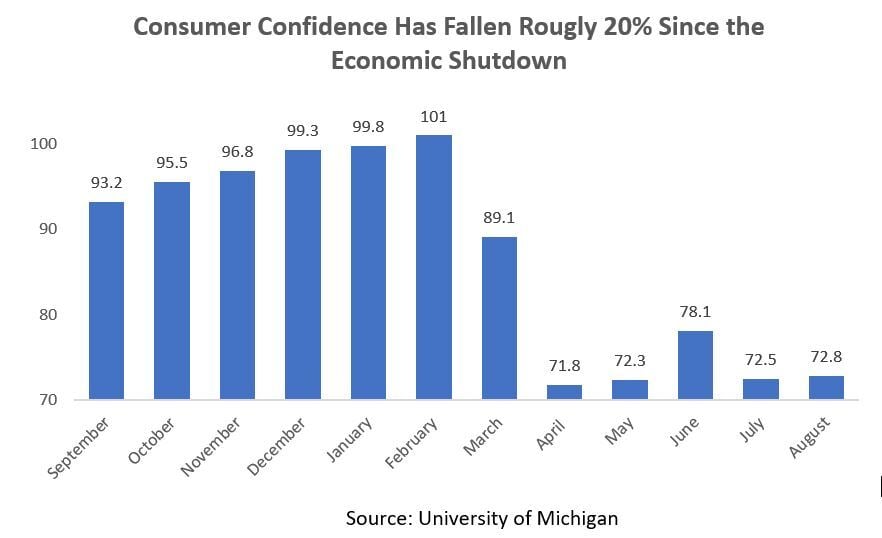

Retirement confidence has tumbled this year, directly due to the economic fallout caused by the pandemic. The carnage to both Wall Street and Main Street has severely disrupted the income and stability of a lot of workers, causing consumer confidence to fall 20 percent this year.

With this is mind, one of your first orders of business is to consult a financial advisor you trust to properly evaluate your situation. Working with a financial advisor puts you ahead of 99 percent of investors, and puts you in a great position to get back on track.

By speaking with a financial advisor, you can look at your entire financial picture, gain clarity on your options and confidently decide your next course of action. If your investment portfolio is the bread and butter of your portfolio, then your cashflow is the fuel to your portfolio’s engine. So, reviewing your budget is a great place to start with your advisor.

Have questions? Contact the financial advisors at Global View to see how we can help.

2. Recalibrate Your Cashflow

At its peak, the Coronavirus pandemic caused roughly 30 million people to lose their jobs. Although the number of unemployed workers has fallen to about 16 million, the unemployment rate is still unsettling. As the economy recovers, many professionals will need to rebuild their savings and tighten their belts to have a positive cashflow.

A financial advisor can be immensely helpful here. Take some time with your advisor to review your income, debt payments and essential expenses. Understand how much you can save each month and if you can make an automatic savings plan that directs new money into your retirement accounts and emergency savings.

A simple review has helped many of our clients feel more confident, as they know exactly where they stand on a monthly basis and can see firsthand that their new financial plan is underway.

3. Focus on What You Can Control

The market tumbled more than 30 percent this year, and the pandemic has created a very uncertain economic outlook. In fact, 23 percent of employed and recently unemployed workers said their retirement confidence has fallen.

Nevertheless, your portfolio is under your command. While you cannot control when the economy reopens, or how the markets will perform, or who will the election, you can still control your portfolio’s risk tolerance, retirement plan and your other financial options.

4. Fine-Tune Your Risk Tolerance and Stay Invested

If you can, continue to contribute to your investment accounts, even if the market declines. If you are feeling nervous about the markets, work with your financial advisor to adjust your portfolio’s risk level. Shifting your portfolio to a conservative strategy is a better solution than panic-selling your investments. Adding a bit more diversification to your stock portfolio can provide an added buffer against volatility.

Updating your plan as opposed to ditching it and pulling everything out of the market allows you to stay on track for reaching your long-term goals. You will still be adding money to your investment accounts, possibly buying your investments at “discount” prices if stock values fall. The markets have already started rebounding, hitting a new high in mid-August. Those who sold their investments were unable to recoup any losses.

5. Remember Your Options

If COVID-19 disrupted your retirement plans, it is perfectly fine to go back to the drawing board and reconsider your options. As mentioned earlier, working with a financial advisor is also critical here, as your advisor can give you the proper perspective to see your options more clearly.

Pushing Your Retirement Date Back May Boost Your Quality of Life

Postponing your retirement date has several benefits that can improve your quality of life when you do retire. Working a year or two longer can unlock thousands (if not hundreds of thousands) more in extra spending. Pushing back your retirement date also lets your Social Security benefits grow. (The longer you wait to start taking your benefits, the more you will receive, up to age 70.) Having an income for a bit longer will also take the pressure off your personal savings accounts.

Overall, you can regain your confidence and peace of mind by postponing your retirement date if you need to.

You May Be Able to Keep the Same Retirement Date if You Spend Less

Staying committed to your previously set retirement date is also an option. If need be, you can retire as you planned, but you may have to make a few other adjustments, such as reducing your monthly spending, if necessary. This can be achieved by revisiting your budget, of course, and spending less on luxuries in retirement. If you (and your spouse) are comfortable with adjusting your lifestyle to fit your retirement date, this can be a great option.

Is it Possible to Work a Limited Schedule?

Another viable option is to consider working freelance or as a consultant during retirement. We know of several real retirement financial stories where this has worked. On one hand, you will have your regular paycheck, and on the other, you can use the money from your retirement accounts, pension funds or Social Security. Working part-time can also help maintain a solid quality of life.

There are rules about working in retirement though, so discuss your options with your financial advisor first.

Confidence Comes from Planning

Ultimately, confidence comes from planning ahead and taking action. With the right financial plan, you can rest assured that your finances are on track and the what-ifs that life brings have been accounted for. Your financial advisor can significantly lighten your load and assure you that your financial needs, risk tolerance, retirement plan and other factors work cohesively.

Whenever economic uncertainty creeps into your financial life, remember that you still have significant control over your financial picture, and plenty of tools at your disposal to build wealth and remain secure.

If you have questions, don’t hesitate to ask. Schedule a complimentary, no-strings-attached conversation with the financial advisors at Global View and get the conversation started.

Written by Adam Wiles

Adam is a Partner at Global View. Adam’s primary focus is on investment strategy, retirement planning, risk management, and new client identification. He has extensive experience and training in identifying client’s needs and explaining the solutions that meet those needs. He worked with Merrill Lynch for 2 years prior to joining Global View. Prior to Merrill Lynch, Adam worked 10 years, in several trading capacities, within the Commodity Lumber business.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us