Global View Investment Blog

Investing in 2020: Long Awaited Trend Change to Small Caps and International?

In Short:

An overvalued domestic stock market is not the right time to invest in stock indexes. High rates and poor-quality bonds is not the right time to invest in bond indexes. The bad news is this is where most investors have the bulk of their retirement savings, in their company 401ks.

But there’s good news. Small stocks in the U.S., and especially overseas, are substantially cheaper. Larger international developed markets and emerging markets stocks are also cheaper. Enterprising investors can also find bargains in the bond market. Asset backed bonds, like mortgage-backed bonds, offer reasonable returns. We also access the direct lending market to high-quality private companies for higher returns in bonds. We share a belief with seasoned investment veterans. Private lending may be the best risk-adjusted opportunity available now.

Following several years of lagging performance, there are signs U.S. Small Caps and international stocks are doing well. We are happy the tide appears to be turning.

We reduce risk in clients’ portfolios through bonds. The mortgage backed and opportunistic strategies offer daily liquidity with low downside risk. The private lending portfolios are liquid only quarterly. They offer high returns with historically low risk in exchange for reduced liquidity.

More Detail:

Current Environment

In the long run, stock prices are driven by future earnings. Investors who pay too much for those earnings don’t do well. In the long run, bond prices are driven by the ability of companies to repay their loans and the change in interest rates.

First, let’s talk about the big picture, then get down into some details.

The U.S. stock market, dominated by larger companies, is overvalued. It trades at about 25 times normalized earnings. The average since 1926 is about 17, or since 1957 is about 19.5. On this metric, the U.S. is between 22 and 32 percent overvalued. Foreign stocks are cheaper. They trade right at their long-term average valuation about 17.8 times five-year normalized earnings. This makes foreign stocks 50 percent cheaper than U.S. stocks. On a relative basis, foreign stocks are about as cheap as they have ever been.

Within the U.S., utilities trade at 28 times earnings, twice as much as their median. This is the riskiest part of the U.S. market. On the other hand, financials trade at about 16 times, the best value in the U.S. Moreover, smaller companies are substantially cheaper than larger companies.

While the returns of small, mid and large U.S. companies are highly similar over the long run, prices diverged substantially in 2018. They appear to be snapping back now.

Here’s the good news: A trend reversal, long awaited, may be underway. Investors during the 2000-2002 tech crash may remember well what fundamental strategies performed. Some signs it is happening again:

- For the last several years, leadership large growth and momentum companies dominated.

- Recently, “value” and deep cyclicals strongly outperform these companies.

- A “very long-term” momentum metric has changed in favor of U.S. small caps over U.S. large caps.

Let’s look at this in context.

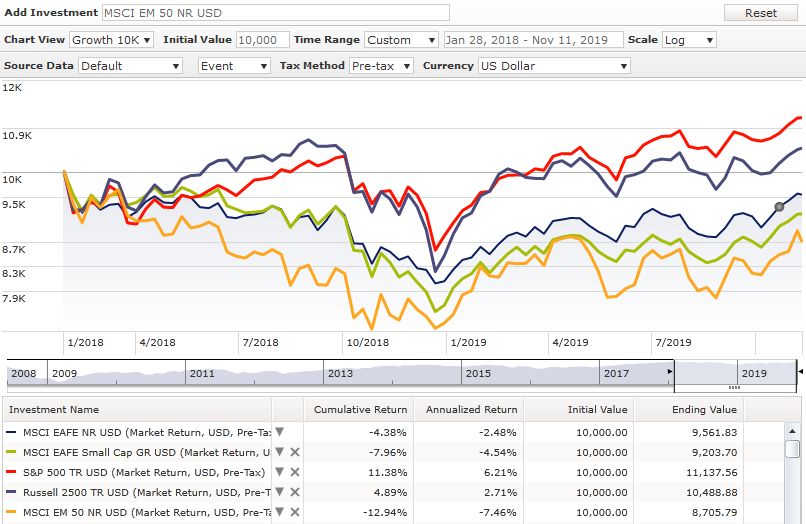

Most of the world peaked on January 28 of last year. Most investors don’t realize this. U.S. stocks did well until late September of last year. But international stocks started falling in January, nine months earlier. U.S. stocks are now back to new highs, with large Cap S&P 500 in the lead, up 11.4 percent since the last peak. U.S. small caps are positive but 6.5 percent behind. Foreign stocks are not only in the red, but way behind. International small caps lag by 19 percent, emerging market stocks by 24 percent!

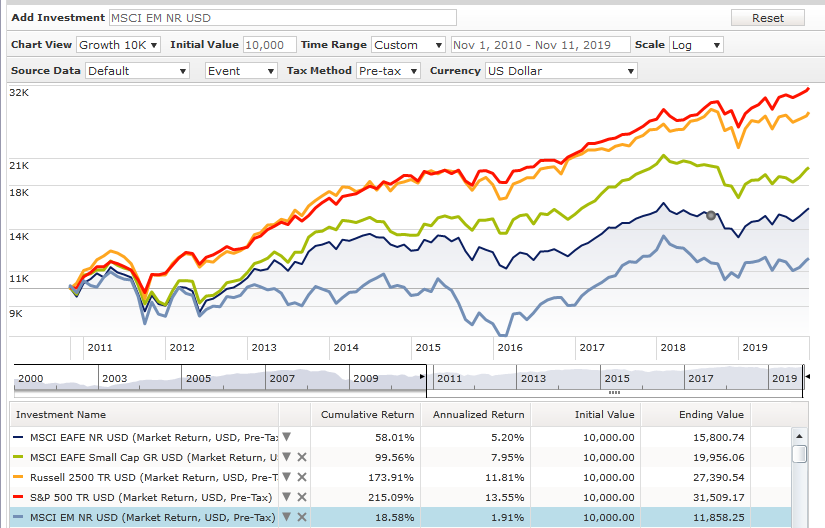

This has been going on for a lot longer than two years. The gap between U.S. and international stocks really opened in November 2010, when the Federal Reserve started its second round of quantitative easing, buying $600 billion in T bills, bonds and notes.

Since then, U.S. stocks are up 11 to 13 percent per year, while international stocks may be up less than 2 percent (emerging markets) to 8 percent (international small caps). This is striking given the long-term history. From 1970 to 2018, U.S. stocks made 10.2 percent while international stocks made 9.1 percent. The difference is all attributable to the last 10 years underperformance of international stocks!

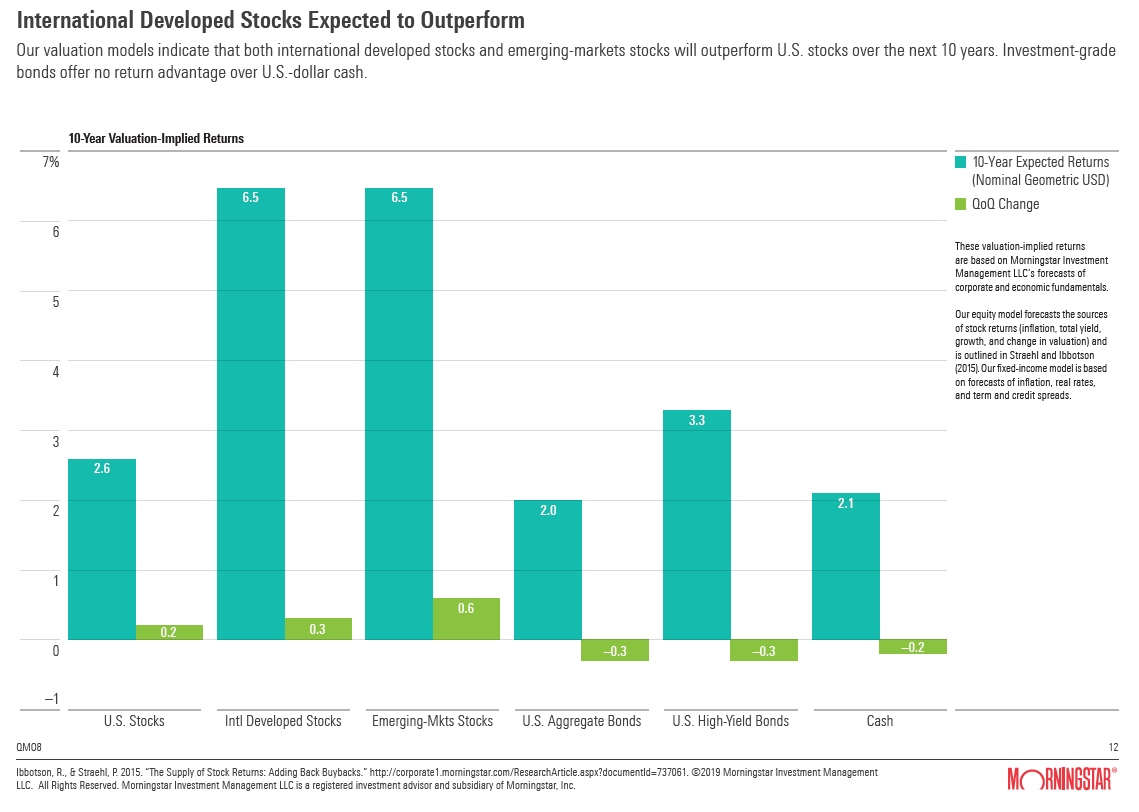

Obviously, a long period of underperformance affects valuations. And it’s why Morningstar predicts international and emerging markets stock will perform substantially better than U.S. stocks over the next 10 years.

Morningstar’s forecast for bonds is no better. High quality government and corporate bonds offer low yields and return prospects. Lower quality corporate bonds may be the only real bubble in the market. We avoid riskier high yield corporate bonds in portfolios.

This means we also must think outside of the U.S. index box for bonds. During a recent visit with FPA funds, we learned their favorite investment choice. Risk-adjusted return potential in private credit is higher than other bonds or stocks. We also confirmed what we knew. High yield bonds are in a bubble. We avoid unnecessary risk in corporate high yield bonds. We focus, instead, on smaller niche markets. This includes liquid mortgage and collateral based bonds, and municipal bonds. It also includes less liquid private loans.

We make sure to structure clients’ bonds portfolios with a mix of more and less liquid bonds. This gives them the flexibility to have funds available for use. The less liquid bonds boost long-term return prospects.

Read this: 5 Reasons You Shouldn’t Invest in Bond Index Funds

Talk with us. Contact Global View to see how we can help.

Revisiting Last Year’s Blog

Last year, I wrote about the disparities in returns and valuations of global stocks. Last year, managers with excellent track records had their worst performance since 2008. Because their approaches remain fundamentally sound, I did some research. We found that managers who did poorly in the short run made it up later:

- One global small cap manager last underperformed in the period leading up to the Dot Com crisis by 62 percent per year. The subsequent performance of that manager was 197 percent for the next three years. The S&P 500 was down 16 percent.

- Our Great Business stock portfolio model underperformed for the two years ending 2007. For the subsequent two-year period, the portfolio was up 24.5 percent when the S&P was down 29.9 percent.

This is relevant because both strategies underperformed last year.

How has this played out? The global small cap manager strategies are substantially ahead of global indexes. Our stock portfolio is having its best year, on an absolute and relative basis, in many years. Because fundamentals are sound, this is likely to continue.

Looking Forward

Valuations favor smaller stock and international stock returns in the long run. But while the “long run” unfolds, policy changes have a strong influence. What policy changes are likely? First, the president wants a weaker dollar. Second, the president seeks to reduce the U.S. trade deficit. These two things cause inflation to rise. What if he gets what he wants?

A weakening dollar causes international stocks to be worth more in U.S. dollars. A reduction in the trade deficit causes investors to favor foreign stocks, boosting their return. Finally, rising inflation boosts international stocks vis a vis U.S.

We can’t predict these things will all happen. But remember, international stocks and small stocks are much cheaper. Should any of these three things happen, international stocks will finally catch up. Remember, there are more than 30,000 stocks globally, but only 4,400 in the U.S. Loans are issued by public companies, private companies, governments and to consumers. Looking at this broader bond universe provides more opportunity to get lower risk returns.

Our belief is a global approach to stocks and bonds leads to better results.

We feel confident this will work given time. But it’s perilous to predict when. In the meantime, loose monetary policy and deficit spending remain supportive to the economy and stock markets.

Because we can’t do this all on our own, you must find suitable partners. Here’s how we do that: How We Select and Fire Managers.

As always, reach out to anyone on our team to answer questions you have or to update your financial situation.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us