Global View Investment Blog

Investing in the World After Coronavirus – Some Thoughts

In Short

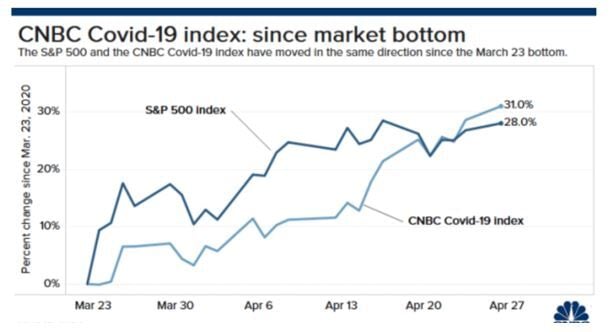

The last two months have been the most volatile in many years, creating unprecedented opportunity. We have been capturing directly or through our portfolio managers, where possible. On one hand, we believe that much of the world will be getting back to work soon. On the other, we fear the market may have overestimated how quickly. In other words, we do believe the market will repair itself and largely recover sometime next year. But at the same time, we believe there will be fits and starts while it does. As the graphic illustrates below, the broad stock market has moved largely according to how companies appeared to have progressed dealing with the virus.

Far more important is to make sure we are making the right choices for your portfolio, in the long-term. And we believe we are doing that both in our actions to take advantage of lower and higher risk opportunities.

Have questions about your finances? Contact the professionals at Global View.

More Long-Winded

This virus has changed our lives, permanently. We hope you and your family make it through this without the loss of a loved one, or financial burden. As you know, I’ve been advising investment and planning clients now for more than 20 years. I have global investment experience in New York City, London, Frankfurt and Moscow. My business "residency" (internship) was in Kiev, Ukraine, while a graduate fellow at the #1 ranked USC Master of International Business Studies program. In Kiev, our European Union-led team privatized the first company ever with foreign investment. I’ve seen it all. I have a message of hope and action.

If you lost your job, I believe you’ll be working again, soon. You and everyone you know will continue spending. But we will all do this in different ways. We’ll make changes. We'll become less reliant on unpredictable supply chains for things like medicine. We'll be doing more locally.

While we keep an eye on the long-term, we must also recognize that this event will change things for a very long time. Not only the U.S., but Europe and most of the rest of the world will make these changes. But the fastest growth in the world will remain emerging markets, especially consumers there. And you're not thinking about it yet, but next year we could get inflation like we haven't seen in years.

I wrote this on May 1, 2020, following the two most volatile months in the market for more than 30 years. The market moved on hope, as it is forward looking. During this volatility, we picked up bargains not seen in decades. Oil and gas companies sold for 30 cents on the dollar. World-class brands sold for half-price. Great technology leaders became undervalued. I can’t say they won’t go down again; in fact, expect more volatility. It’s likely the market got a bit ahead of itself in April after the worst drop since the Great Depression in March.

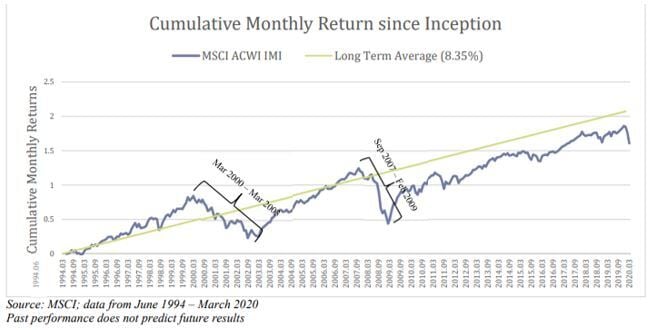

And while I can’t tell you when this will be completely resolved, the best economists we have talked to all agree this will largely be behind us by late next year. The further out we look, the more certain the future becomes. The opportunities we see now are unprecedented. This is no time to stay invested in indexes, or funds that are essentially indexes. Smaller companies in the U.S. and overseas got cheaper than any time in recent history, especially in relation to larger ones. As the chart below illustrates, at the end of March, global companies became about as cheap as the bottom of the financial crisis and the dot-com bubble. This substantially increases future return opportunity, much of which was (hopefully not just briefly) realized in April.

While China will continue to grow, it will likely do so at a decreased rate, relying more on domestic consumption. Other countries in Asia will benefit most. Moreover, countries like Singapore, Taiwan, South Korea and Japan will begin growing first as they recover first from this virus.

Emerging markets in Asia will be recovered, while those south of the equator are only just starting to feel the months get colder and the virus gain strength. This will make it more important than ever to have global active management.

While it’s uncertain when a vaccine for COVID-19 will become widely available, there are signs this could happen as early as the first quarter of 2021. At this point, there will be few restrictions to business. Before then, other more-careful measures must be taken. Each state and locality will decide what is best, based on the number of cases and treatments available there. I expect broader testing for the virus, testing for antibodies and contract tracing to become widely available.

The best minds on the planet are devoted to finding treatments and a cure. Very soon, we will start carefully opening the economy and business. While I don’t see consumers returning to restaurants right away, I don’t expect them to stay away forever. We will make progress in weeks that would earlier have taken years. This great crisis can bring us closer together. Great innovations happen during such times. Newton discovered calculus. Modern medicine was born. Now, scientists and doctors are experimenting and innovating like never before. Ego and bureaucracy are thrown aside.

We see opportunity in the U.S. and overseas. While some are obvious, many are not. It’s likely you never heard of many quality, growing, undervalued companies both here and overseas. In our many conversations with both portfolio managers, we hear excitement.

Because we believe this, we also believe the excellent investments we have made, and continue to make, in fixed income play out sooner rather than later. In a million years, if you had suggested that quality residential-backed mortgage securities, backed by the collateral of the homes owned by high-credit quality borrowers, would suffer, I would not have believed you. But then I didn’t predict the first-ever recession and bear market by government decree.

Our paraplanners are making sure we take advantage of changes in the tax law. Portfolio managers are repositioning for opportunity and to reduce unnecessary risk, where warranted. Never forget, we own the same investments as you, and are respositioning clients assets before our own. We are extremely thankful for our clients, their patience, understanding and hope.

We are here if you need anything, still working at home but with phones covered. Don’t be shy if you need any help. Contact us.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us

.jpg)