Global View Investment Blog

Maximizing Home Equity: Unlocking Financial Opportunities During National Homeownership Month

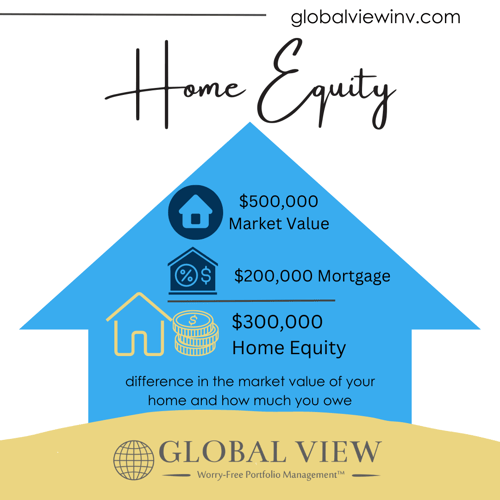

June is National Homeownership Month, a time when we celebrate the importance of owning a home and the positive impact it has on individuals, families, and communities. One of the key benefits of homeownership is the potential to build home equity. Home equity is the difference between the current market value of your home and the outstanding balance on your mortgage. It represents a valuable asset that can provide financial stability and build a foundation for wealth creation. In this blog post, we will explore the concept of home equity, its significance, and ways to maximize it for your benefit.

The loan used to finance a home purchase is known as a mortgage. The most common mortgage term is 30 years, even though the average homeowner only lives in a home for 10 years before deciding to move. Each monthly payment made on the mortgage is comprised of interest and principal. At the beginning of the mortgage term, monthly payments will mostly go toward paying interest and little toward principal. However, as time passes, this relationship gradually shifts toward paying less interest and more principal. Increased principal payments are the primary driver toward creating home equity along with any increases in the market value of your home.

Home equity is a financial asset, but homeowners should understand the pros and cons of their investment just like any investment on Wall Street. Some consideration to understand are:

1. Financial Security

Home equity represents a form of savings that is beneficial for the long-term. Having equity can provide a compounding effect as you move up into more expensive homes over time. The accrued equity will generally be available to add as a larger down payment on future homes, thereby lowering the amount needing to be financed over time.

2. Different Type of Savings

Home equity is not immediately liquid like your savings account at the bank. Equity can be used to secure loans or lines of credit, however, accessing your savings in this way will require you to pay interest on your own savings. You may even do a cash-out refinance on your loan, but this may not be desirable in a higher interest rate environment. For these reasons, it is advisable to maintain a liquid cash emergency fund and to diversify other sources of savings outside of equity in your home.

3. Wealth Building

Home equity can be a powerful wealth-building tool. As you pay down your mortgage and your home appreciates in value, your equity increases, allowing you to potentially accumulate significant wealth over time. While the investment potential in real estate is appealing, it can lead to the risk of becoming too concentrated in a single investment. Just like your grandma said, “Don’t put all your eggs in one basket”. Consider diversifying into stocks and bonds along side or your real estate investments. Not all investments go up at the same time!

Now that we understand the importance of home equity, let's explore some strategies for maximizing it:

- Maintain and Improve Your Property

Regular maintenance and improvements not only enhance your living experience but also contribute to the appreciation of your home's value. Simple renovations like kitchen or bathroom upgrades, landscaping, or energy-efficient improvements can increase your home's market worth, thus boosting your equity. - Pay Down Your Mortgage Faster

Consider making additional principal payments or increasing your monthly mortgage payments. By doing so, you'll build equity faster and shorten the overall term of your loan, potentially saving thousands of dollars in interest payments over the life of your mortgage. - Refinance Strategically

When interest rates drop significantly or your credit score improves, refinancing your mortgage can be a smart move. It allows you to secure a lower interest rate, reduce your monthly payments, and potentially build equity faster. - Avoid Excessive Borrowing

Be cautious about borrowing against your home equity excessively. While it can be tempting to use your equity for non-essential purchases, it's important to maintain a healthy balance and not overextend yourself financially. Carefully consider the purpose and long-term impact of any borrowing against your home. - Consult with a Financial Advisor

Seeking guidance from a financial advisor can help you make informed decisions about leveraging your home equity. They can provide personalized advice based on your financial goals and circumstances, ensuring you optimize your equity while managing potential risks.

As we celebrate National Homeownership Month, let's remember the importance of home equity and the financial opportunities it presents. By understanding the concept of home equity and implementing strategies to maximize it, homeowners can unlock a wide range of benefits, from financial security and low-cost financing to wealth building. However, it's crucial to approach home equity management with caution and seek professional advice when needed.

At Global View, we act as fee-only fiduciaries for our clients when helping them determine the best course of action for their individual situation. If you need a true, unbiased advocate to help navigate how home equity into your overall financial situation, we would value the opportunity to work with you. Contact Us to schedule a time to talk.

Written by Matthew Crider

Matt is a CERTIFIED FINANCIAL PLANNER™ professional who has been in the financial advisory business since 2008. He holds a BA in Marketing and Management from the University of Cincinnati and his MBA from Clemson University. Prior to Global View, Matt began his career with Fidelity Investments. His specialties at Global View include asset accumulation and investment strategies; college funding strategies; budgeting discipline and analysis; multi-generational planning; and life event changes, such as marriage, kids, home purchase, retirement, etc.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us