Global View Investment Blog

Picture of Speculation

Picture of Speculation: US crude oil supplies overflowing as price nears $87/bbl

Welcome to Global View. I am Rod McGee, portfolio manager of our long/short managed account strategy, a strategy in the RIA world which is unique, and uniquely suited our times. I will post thoughts and observations in this blog when I see compelling ideas or market conditions which deserve further examination. Today it is clear that measurable speculation in commodities has reached an all-time record high. This is seen across many commodities, but this week I would like to spotlight crude oil due to the pervasive negative impact on economic activity of high prices unjustifiable by fundamentals.

A few graphs will demonstrate a picture of excessive leveraged speculation in crude oil:

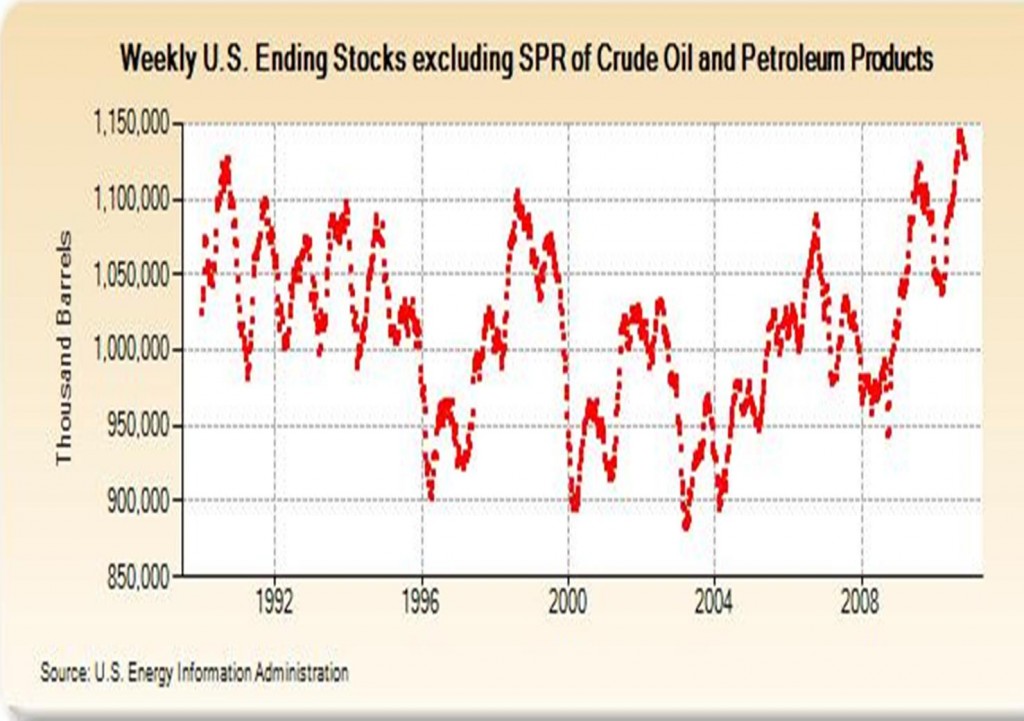

1) Crude oil and product stocks in the US are at an all-time record high. As crude is fungible, this is certainly the case globally:

(click on chart to enlarge)

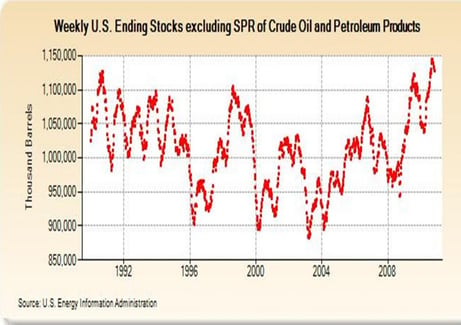

2. Seasonally stocks are at even more unprecedented levels:

Source: DOE EIA (click on chart to enlarge)

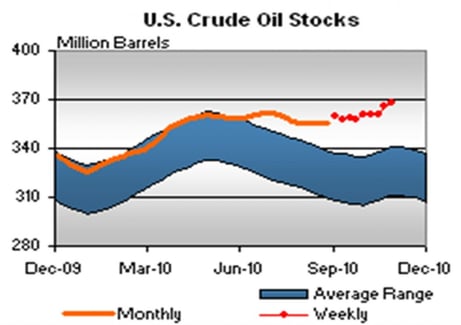

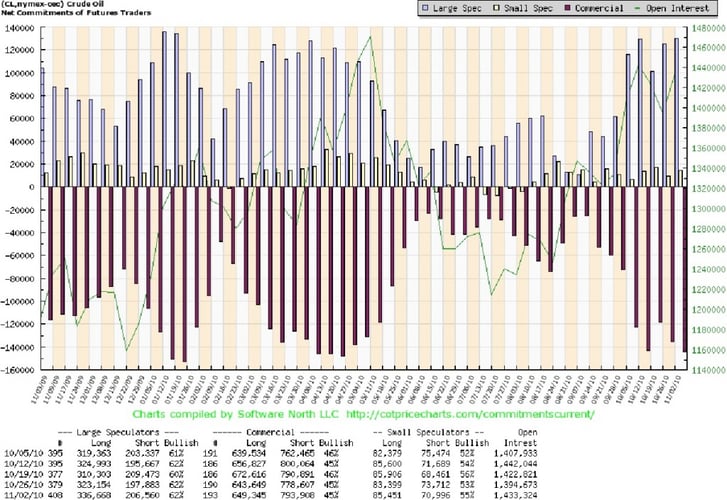

3. The reason? Leveraged speculators (hedge funds, retail ETF investors, and Wall Street traders) have very large speculative long positions in futures and options.

Below is is futures-only open interest right at peak 2010 levels. Note that levels currently are at January and April 2010 levels which preceded very sharp selloffs in risk assets of all kinds:

Clearly there is a great deal of leveraged speculation in commodities markets unjustified by the fundamentals. High crude oil prices in fact eliminate the liquidity allegedly added to the economy by misguided Federal Reserve policies such as Quantitative Easing (QE), leaving QE as merely a bank industry subsidy. Both the price of crude oil and any banking profits created as a result of government intervention are in fact unsustainable over time, a thesis I will explore in future updates.

If you would like to dsicuss ways to preserve and grow capital in volatile times, just send me an email to rod@globalviewinv.com.

Rod McGee

Portfolio Manager

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us