Global View Investment Blog

Quarterly Newletter to Public Q1 2010

Quarterly Newsletter

(Abbreviated Public View)

Staying Invested

The overwhelming majority of our clients stayed invested during this turbulent market environment and have been rewarded for their patience. The greatest value-add we provide is to help our clients have sufficient comfort, so that they can focus on their long-term goals and stick to long-term strategies. These communications and regular review meetings are some of our tools for helping our clients remain comfortable and stick to their long-term strategy. Our clients should be proud because many investors bailed out:

Contents

This newsletter addresses the following topics:

- Current Allocation – Update on weightings by investment category (bucket) and overall market valuation

- Market Outlook - Affirmation of our investment philosophy and update of current market outlook

- Outlook for Jobs – a noted institution’s view on the employment outlook and a discussion on whether America is in decline

- Fund Manager Commentary – The latest from our managers (abbreviated in this public view)

Current Asset Allocation

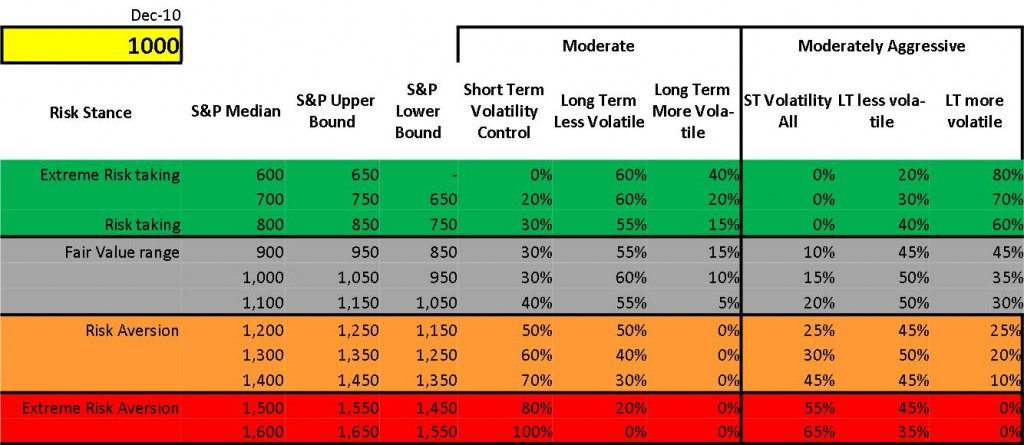

Our clients hire us to be stewards of their investments. In order to be good stewards, our main role is make sure our clients’ assets are invested according to their investment time horizon, which is usually a very long time. We select good managers who are focused on avoiding risk of permanent loss of capital, and by doing so, making good returns. This means we spend a lot of time looking for good managers and conducting due diligence on managers our clients already own. Over time, funds become larger and managers leave as evidenced by the changes at First Eagle over the last several years. Moreover, the prevailing market conditions change over time as the market rises or falls. When the market becomes more overvalued, we place greater emphasis on reducing volatility and may use more managers in the Short-Term Volatility Control and Long-Term Less Volatile buckets. If the market should become more undervalued again, we will place more emphasis on capturing upside volatility through increased usage of Long-Term More Volatile managers. Of course, we always consider taxes in taxable accounts.

Based on our estimation, the market is now approximately 10% above fair value. This is not unusual, because in recent history the market has traded at least 10% above fair value and during bubble periods at 40% above fair value. At this valuation, the greatest emphasis is on Long-Term Less Volatile Managers. The purple box in the chart below shows our current allocation for Moderate, Moderately Aggressive, and Aggressive strategies.

Market Outlook

Since no-one can forecast the future, we feel it is more important to understand valuations for today, rather than to make forecasts. Jim Grant, author of Grant’s Interest Rate Observer, states this best: “people (including experts …) tend to overestimate the ups and overestimate the downs, and that the best strategy is always to invest with a Margin of Safety in mind” … that “risk is not inherent in an asset … treasuries are risk-less or risk-full at a price” and that “treasuries are a speculation on an outcome as opposed to an investment with a margin of safety and that ... people fly to … assets that are priced at a certain outcome and that outcome is plausible or not and the assets are risky or not, they are not inherently safe or unsafe.”

LINK: Consuelo Mack Interview with Jim Grant 10/30/2009

Similarly, we would like for our clients and their friends to understand that NO investment is without risk, just like no decision is without risk. EVERY decision has a cost and an opportunity cost and only in retrospect can we know what the right decision was. Even insurance contracts, certificates of deposit, treasuries, and other “safe investments” that ostensibly cannot lose nominal value will suffer substantial loss of purchasing power in a high inflation environment.

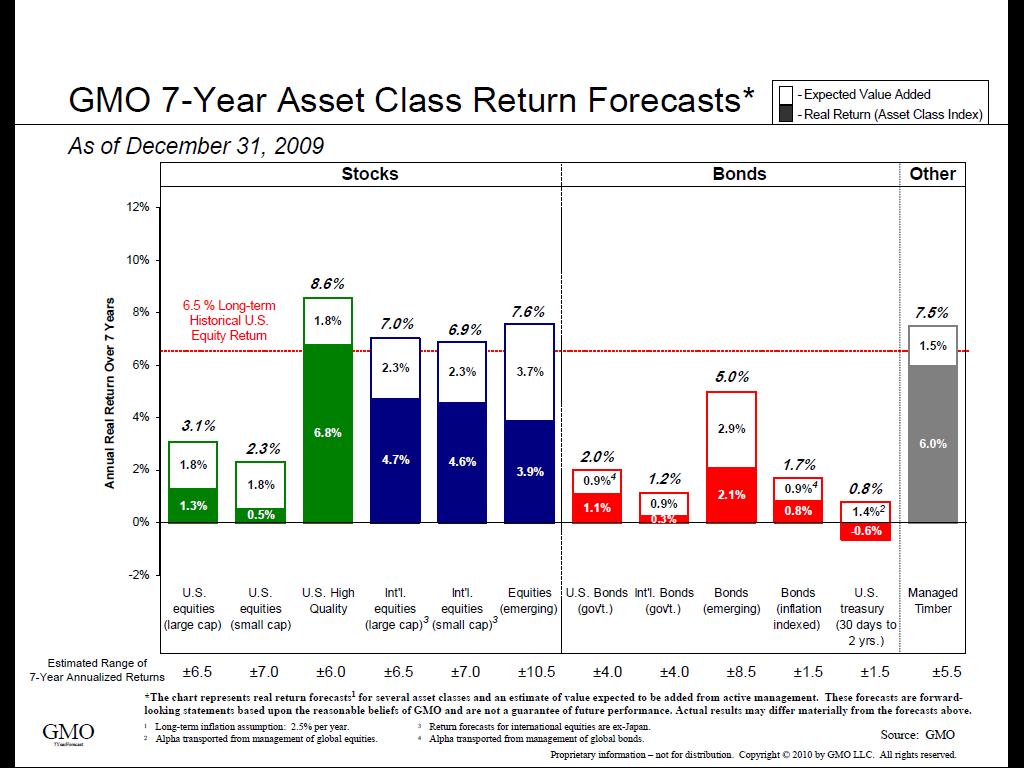

As viewed in the chart above, GMO researches market valuation and based on this research, publishes their expected return forecast for the next 7 years. Their forecast uses the current market valuation (based on long-term averages) to derive a forecast for future returns. Their current quarter’s forecast is that US high quality equities will return 6.8% per year (after inflation) for the next seven years.

The Outlook for Jobs – is American in Decline?

The consensus belief is that job growth will be anemic and some feel unemployment will stay high for many years. This belief has created a negative economic and investment outlook for many people, including our clients, which negatively affects their attitude toward the investing climate. No-one knows the future, but it is important to understand that people have a propensity to be overly negative or overly positive. For this reason we feel it is important to introduce views counter to this prevailing belief.

JPM Outlook for Jobs 2010

Unemployment in the United States remains at about 10%, and we fear this will increase over the coming year for technical reasons. JPM believes that the US economy will begin to produce jobs very soon. However, many people that have given up looking for work are not counted as unemployed. When they begin looking again this will cause the unemployment rate to rise, even as the number of total employed increases. Perhaps more importantly, it will take some time for unemployment to fall to a more normal range of 5% or so, maybe until 2014.

LINK: JPM Outlook for Jobs 2010

“American in Decline”, James Fallows, The Atlantic Monthly, January 2010

Fallows lived outside the United States since the 1970s. He finds the notion that the United States will fall behind to be irrelevant because any decline, as measured in terms like slower growth versus China, will still result in a far greater quality of life. Fallows believes our nation has a crucial advantage over any other because we allow immigration and foster innovation. Moreover, through American history, worry has always preceded reform. Americans have often become upset with their elected representatives and expressed this discontent by throwing them out of office.

LINK: America in Decline by James Fallows January 2010

Manager Updates

- Short- Term Volatility Control Managers: believe the market environment will remain difficult and that it is prudent to control downside risk. This is their view today and it is their view most of the time.

- Long-Term Less Volatile Managers: typically believe the market environment has become more difficult, but are cautiously optimistic on their ability to find opportunities to reward investors even though they may be fearful of a market correction. Their view changes generally during periods of overvaluation and undervaluation.

- Long-Term More Volatile Managers: typically believe that investors with a long-term time horizon will be rewarded handsomely if they are patient and are generally unconcerned about short-term market fluctuations but see declining markets as opportunities to get better bargains. This is their view today and it is their view most of the time.

Clients of Global View have access to information-rich commentary by managers in each of these buckets. If you would like to learn more about this, please contact us at 864-272-0818 or email admin@globalviewinv.com

Other Interesting Reading

Bill Gates annual letter to Gates Foundation

Bill Gates, highly successful in business, has re-directed his energies toward making a positive impact on as many people as possible through philanthropic efforts. The Bill and Melinda Gates Foundation is founded on the premise that every life has equal value. Its approach is business-oriented, i.e. it measures progress and adjusts strategy based on goal attainment. What I find most interesting about this annual letter is the innovation chart (page 2) establishing time frames where key innovations are expected to occur. Of particular note in the United States, Bill Gates forecasts the following:

- Within 10-15 years systems for measuring teacher effectiveness will be implemented (derived from the understanding finally gained on what makes teachers effective)

- Over the next 3-8 years online learning instruction will be implemented in US schools, taking of advantage of the learning that occurs individually based on feedback

LINK: Bill Gates Annual Letter 2010

Most Likely to Succeed, Malcolm Gladwell

The article, “Most likely to Succeed,” in Malcolm Gladwell’s latest book, What the Dog Saw corroborates Bill Gates findings on education. Gladwell examines how to identify an effective teacher. Bob Pianta, the Dean of the University of Virginia’s Curry School of Education reveals his finding that a high competency in “regard for student perspective” results in highly effective learning. If we can teach teachers to have a “high regard for student perspective,” we can make teaching more effective. We already know that a highly effective teacher raises the average grade level of his students at least one grade and that an ineffective teacher has the opposite effect. Imagine then, the productivity advances that can occur from this innovation, implemented at school and in the workplace. It is difficult to imagine any other advance that could have a greater impact.

Link: "Most Likely to Succeed" by Malcolm Gladwell December 15, 2008

Berkshire Hathaway 2009 Annual Report

Below is a link to Berkshire Hathaway’s latest annual report, in which you can see that Berkshire Hathaway returned 20% annually on book value or 22% annually on shareholder value since inception in 1965. Not too bad. Warren Buffett has some sagely advice:

- “When it is raining gold, reach for a bucket, not a thimble” on opportunities during the crisis

- “It is the behavior of CEOs and Directors that needs to be changed. If their institutions and the bounty are harmed by their recklessness, they should pay a heavy price – one not reimbursable by the companies they’ve damaged nor by insurance. CEOs and, in many case, directors have long benefited from oversized financial carrots; some meaningful sticks now need to be part of their employment picture as well.”

- “At 86 and 79, Charlie and I remain lucky beyond our dreams. We were born in America; had terrific parents who saw that we got good educations; have enjoyed wonderful families …”

More below if you are interested:

LINK: Berkshire Hathaway 2009 annual report published February 27, 2010

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us