Global View Investment Blog

Quarterly Newsletter to Clients Q1 2010

Thank you for Staying Invested

Our clients stayed invested during this turbulent market environment and have been rewarded for their patience. The greatest value-add we provide is to help our clients have sufficient comfort, so that they can focus on their long-term goals and stick to long-term strategies. These communications and regular review meetings are some of our tools for helping our clients remain comfortable and stick to their long-term strategy. Our clients should be proud because many investors bailed out:

Contents

This newsletter addresses the following topics:

- Current Allocation – Update on weightings by investment category (bucket) and overall market valuation

- Market Outlook - Affirmation of our investment philosophy and update of current market outlook

- Outlook for Jobs – a noted institution’s view on the employment outlook and a discussion on whether America is in decline

- Fund Manager Commentary – The latest from our managers

Current Asset Allocation

Our clients hire us to be stewards of their investments. In order to be good stewards, our main role is make sure our clients’ assets are invested according to their investment time horizon, which is usually a very long time. We select good managers who are focused on avoiding risk of permanent loss of capital, and by doing so, making good returns. This means we spend a lot of time looking for good managers and conducting due diligence on managers our clients already own. Over time, funds become larger and managers leave as evidenced by the changes at First Eagle over the last several years. Moreover, the prevailing market conditions change over time as the market rises or falls. When the market becomes more overvalued, we place greater emphasis on reducing volatility and may use more managers in the Short-Term Volatility Control and Long-Term Less Volatile buckets. If the market should become more undervalued again, we will place more emphasis on capturing upside volatility through increased usage of Long-Term More Volatile managers. Of course, we always consider taxes in taxable accounts.

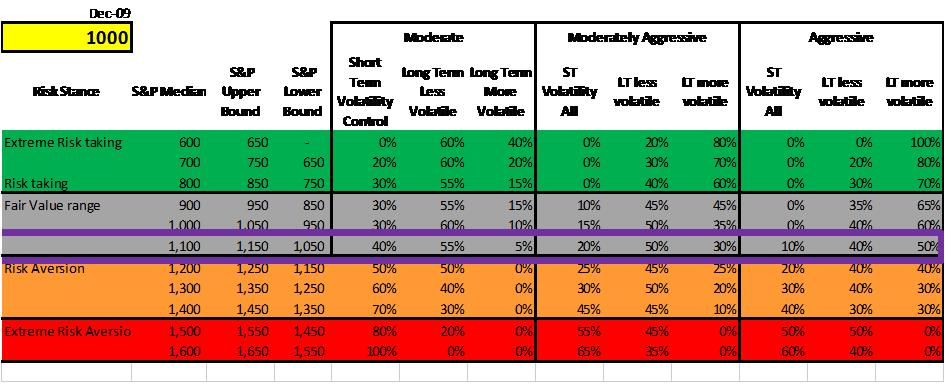

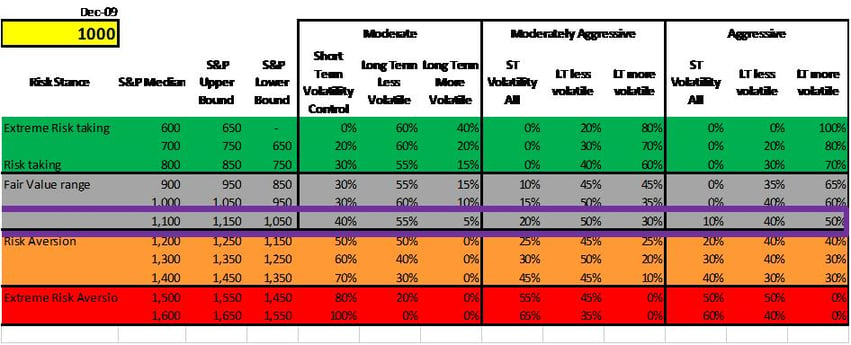

Based on our estimation, the market is now approximately 10% above fair value. This is not unusual, because in recent history the market has traded at least 10% above fair value and during bubble periods at 40% above fair value. At this valuation, the greatest emphasis is on Long-Term Less Volatile Managers. The purple box in the chart below shows our current allocation for Moderate, Moderately Aggressive, and Aggressive strategies.

Market Outlook

Since no-one can forecast the future, we feel it is more important to understand valuations for today, rather than to make forecasts. Jim Grant, author of Grant’s Interest Rate Observer, states this best: “people (including experts …) tend to overestimate the ups and overestimate the downs, and that the best strategy is always to invest with a Margin of Safety in mind” … that “risk is not inherent in an asset … treasuries are risk-less or risk-full at a price” and that “treasuries are a speculation on an outcome as opposed to an investment with a margin of safety and that ... people fly to … assets that are priced at a certain outcome and that outcome is plausible or not and the assets are risky or not, they are not inherently safe or unsafe.”

LINK: Consuelo Mack Interview with Jim Grant 10/30/2009

Similarly, we would like for our clients and their friends to understand that NO investment is without risk, just like no decision is without risk. EVERY decision has a cost and an opportunity cost and only in retrospect can we know what the right decision was. Even insurance contracts, certificates of deposit, treasuries, and other “safe investments” that ostensibly cannot lose nominal value will suffer substantial loss of purchasing power in a high inflation environment.

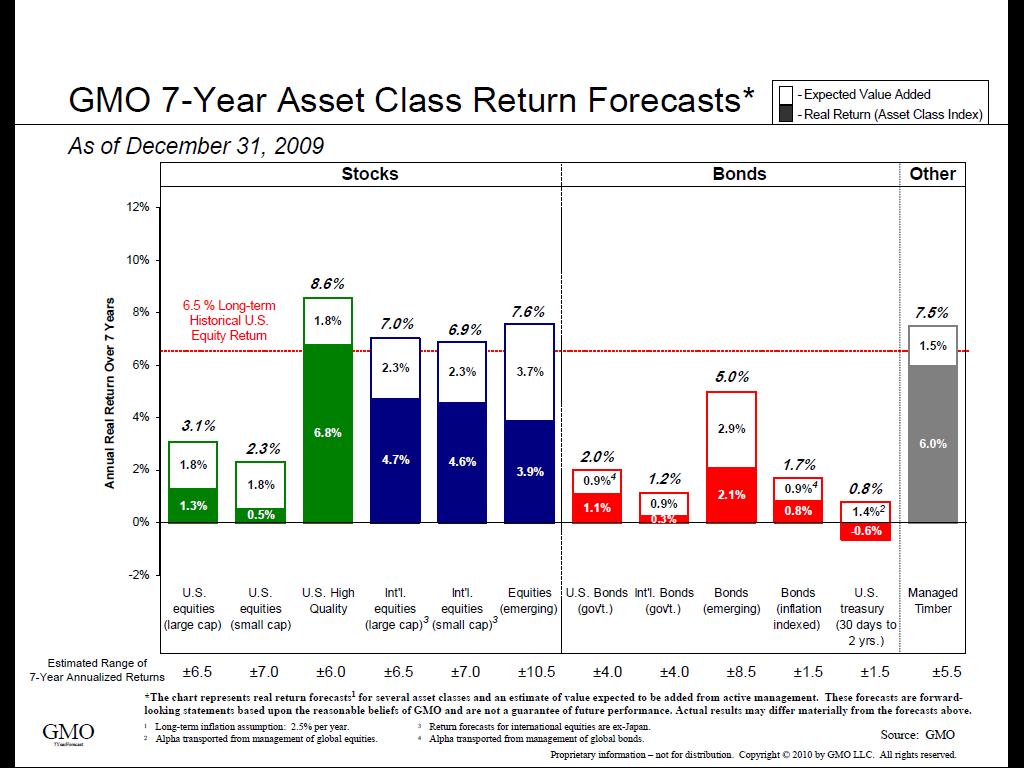

As viewed in the chart above, GMO researches market valuation and based on this research, publishes their expected return forecast for the next 7 years. Their forecast uses the current market valuation (based on long-term averages) to derive a forecast for future returns. Their current quarter’s forecast is that US high quality equities will return 6.8% per year (after inflation) for the next seven years.

The Outlook for Jobs – is American in Decline?

The consensus belief is that job growth will be anemic and some feel unemployment will stay high for many years. This belief has created a negative economic and investment outlook for many people, including our clients, which negatively affects their attitude toward the investing climate. No-one knows the future, but it is important to understand that people have a propensity to be overly negative or overly positive. For this reason we feel it is important to introduce views counter to this prevailing belief.

JPM Outlook for Jobs 2010

Unemployment in the United States remains at about 10%, and we fear this will increase over the coming year for technical reasons. JPM believes that the US economy will begin to produce jobs very soon. However, many people that have given up looking for work are not counted as unemployed. When they begin looking again this will cause the unemployment rate to rise, even as the number of total employed increases. Perhaps more importantly, it will take some time for unemployment to fall to a more normal range of 5% or so, maybe until 2014.

LINK: JPM Outlook for Jobs 2010

“American in Decline”, James Fallows, The Atlantic Monthly, January 2010

Fallows lived outside the United States since the 1970s. He finds the notion that the United States will fall behind to be irrelevant because any decline, as measured in terms like slower growth versus China, will still result in a far greater quality of life. Fallows believes our nation has a crucial advantage over any other because we allow immigration and foster innovation. Moreover, through American history, worry has always preceded reform. Americans have often become upset with their elected representatives and expressed this discontent by throwing them out of office.

LINK: America in Decline by James Fallows January 2010

Manager Updates

- Short- Term Volatility Control Managers: believe the market environment will remain difficult and that it is prudent to control downside risk. This is their view today and it is their view most of the time.

- Long-Term Less Volatile Managers: typically believe the market environment has become more difficult, but are cautiously optimistic on their ability to find opportunities to reward investors even though they may be fearful of a market correction. Their view changes generally during periods of overvaluation and undervaluation.

- Long-Term More Volatile Managers: typically believe that investors with a long-term time horizon will be rewarded handsomely if they are patient and are generally unconcerned about short-term market fluctuations but see declining markets as opportunities to get better bargains. This is their view today and it is their view most of the time.

Short-Term Volatility Control / Retirement Income Account Funds

Loomis Sayles Bond Fund

The team at Loomis Sayles had a very good year in 2009, returning 37.2% (LSBDX) versus the Barclay’s Bond index return of 7.7%, and posted a three year return of 5.2% per year. In their quarterly review, they attribute their outperformance to “strong results from corporate credits, high yield, convertible bonds and non-US-dollar-denominated investments.” Loomis believes that the economy will continue to improve and are positioned to benefit from economic strengthening through price appreciation in corporate and high yield debts. The portfolio still maintains a 30 day yield of 5.1% (annualized).

LINK: Quarterly Update

LINK: Fact Sheet

The Hussman Fund

Dr. John Hussman continues to maintain a defensive investment position as he is not willing to risk investor’s assets in what he sees as a mixed economic outlook. We rely on the Hussman fund to provide a portion of your portfolio with more stability (less volatility) over shorter time periods, so we are comfortable with their conservative stance.

LINK: Historical Performance

LINK: Market Commentary

Nakoma Absolute Return Fund

Nakoma has been our weakest performing manager during the recent market rally, but coming on the heels of being the best performing manager during 2008, in which they lost less than 4%. Nakoma continues to remain in a fully hedged position, where they are short companies they consider low quality (leveraged or cyclical) and are long high quality companies (low debt or consistent earnings). Dan Pickett at Nakoma feels the outlook for the economy and equity markets is not clear and maintains only 11% net market exposure. Recent political events seem to point to an American electorate that is tired of bailouts. This may be short-term negative for the economy and markets but long-term positive and at least makes the outlook uncertain.

LINK: Nakoma Market Commentary January 2010

LINK: Nakoma Absolute Return Holdings 11/30/2009

JP Morgan Strategic Income

This fund can invest flexibly and seeks to get returns in any prevailing market environment. JSOSX returned 19% for 2009, primarily attributable to returns in High Yield bonds. Going forward they intend to maintain positions in high yield and distressed debt, but are concerned about the potential of rising interest rates and hold about 60% in short-term investments including cash. Fund management feels consumer spending has remained surprisingly resilient, has short positions against some emerging market positions and investment grade credit in cyclical and retailers. Bill Eigen is the portfolio manager of this fund, who managed the Fidelity Strategic Income fund from May of 2001 to August of 2005 and left because he could not manage for absolute returns (versus adhering to a bond index based as Fidelity wanted him to), i.e. he could not hold cash or short overvalued securities. While at Fidelity he made 10% p.a., more than the high yield index or the Barcap bond aggregate index.

LINK: JP Morgan Strategic Income Opportunities Fund Commentary

LINK: JP Morgan Strategic Income Opportunities Fund Fact Sheet

JP Morgan Tax Aware Real Return

This fund is used in accounts that are Taxable and are better off investing in municipal bonds versus investment grade bonds. A danger that accompanies investing in high quality municipal bonds is inflation risk, especially considering the low coupons that accompany high quality municipal bonds. The Tax Aware REAL Return team reduces the inflation risk by overlaying a layer of inflation protection on the portfolio. The ultimate goal is to produce solid tax-free returns and reduce the risk of inflation. Fund management believes economic growth in the United States will be low, around 2.7% for the first half of 2010 and that tight credit and underutilized labor will prevent a quick employment recovery and limit final demand from strengthening significantly.

LINK: JP Morgan Tax Aware Real Return Fund

LINK: JP Morgan Tax Aware Real Return Fund Commentary

Nuveen Muni High Yield Bond

The fund returned 42.5% in 2009 after an abysmal performance (owing to irrational pricing and liquidation selling) in 2008. In 2009, the fund had the opportunity to expand its holdings in investment grade bonds selling at deep discounts. For example, the fund invested in natural gas prepayment bonds that were very low risk but selling at deep discounts. As health returned to the financial markets, these bonds quickly regained much of their lost value. The fund continues to hold over 40% in unrated bonds (where it adds value through extensive credit research) and yields 5.3% (NHMRX). At 3.7%, the spread between high yield and investment grade municipal bonds remains as high as any prior bear market with the exception of Q4 2008. John Miller, fund manager, believes the demand for high yielding municipal bonds will continue to grow as it becomes more apparent that future tax rates will be raised. John believes the outlook for the economy is mixed, but valuations of high yield municipal bonds remain attractive.

LINK: Fact Sheet

LINK: Semi-Annual Report October 31, 2009

According to Nuveen, conditions in the municipal bond market improved significantly in 2009, as federal government initiatives started to thaw the frozen credit markets. The spread between high yield municipal bonds and investment grade municipal bonds is over 3.6%, 1.5% greater than the average spread since 1995. This is especially compelling to investors in high tax brackets because a yield of 7.7% equates to a 10.7% yield for an investor in the 28% federal tax bracket.

LINK: Market Conditions Make High Yield Municipals an Attractive Choice

Long-Term Less Volatile Funds

At the moment, our Long-Term Less Volatile Fund managers might best be characterized as being cautiously optimistic about opportunities in the current investing environment

First Eagle Global Fund

The team at First Eagle wrote a nice piece on “the lost decade of stock investing.” In summary, First Eagle Global made 12.3% per year over the last decade while the S&P 500 made -1% per year. First Eagle does not consider the decade to be lost. “We grow up in a world where we tend to think in an annual cycle time… (First Eagle’s) natural cycle time is quite different from a year … our time horizon is approximately five years.” Matt McLennan

A Decade in Review - What Lost Decade?

At the moment, the fund holds about 73% in global equity, 11% in cash, 11% in gold-related investments, and the remainder in bonds.

LINK: First Eagle Global Portfolio January 2010

International Value Advisors (IVA) Worldwide Fund

The Team at IVA comes largely from First Eagle, so it is not surprise their new flagship fund has performed admirably since its inception October 1, 2008, making an annualized return of 20.9% during a time the MSCI All-Country index made 3.6%. At the moment, the fund holds about 25% cash, 48% equity, remainder in high yield bonds and precious metals. We met with co-manager, Chuck DeLardemelle (former Director of Research for First Eagle) on March 8th. We learned that IVA is concerned, foremost, with protecting capital. They have a conservative allocation and could possibly be classified as a Short Term volatility Control manager, in that they have the capacity to hedge downside risk in a fashion similar to the Hussman Funds. .

LINK: IVA WW Fact Sheet December 31, 2009

FPA Crescent Fund

FPA is an old fund and the most cautious of our Long-Term Less Volatile managers, holding only about 36% in global equity (42% long and 6% short). 37% is held in cash, 25% in bonds. For the last 15 years, the fund has made 11.4% per year with less volatility than a mix of 60% stocks and 40% government bonds (see fact sheet below under Performance Statistics. What is most remarkable to us is that the fund managed to return 28% last year while taking substantially less than market risk and losing only 21% in 2008.

LINK: FPA Crescent Fact Sheet December 31, 2009

We anxiously await the fund’s annual report, which will be published in March. In their semi-annual report published in September, they expressed concern about that the fund may lag the market if the economic sea remains calm and the market rallies. Their concern is that the global economies are not out of the woods yet and that there will be an “uh-oh” moment in 2010 which may result in another market correction. FPA believes the US economy will experience anemic growth longer-term due to higher interest rates, higher debt and debt service, continued high unemployment, stressed state and municipal budgets, reduced labor force growth, higher tax rates and higher energy costs. In this environment, the fund owns healthcare companies, beaten up over health-care reform proposals. They also bought distressed mortgages exemplifying their ability to identify value in contentious sectors. The closing from Steven Romick describes their strategy best:

“As a metaphor for our economy and our markets, we feel like we’re driving a sedan down the highway amidst stop-and-go traffic. When traffic is stopped, we observe stress furrowing the brows of many drivers, but when free flowing, a blissful ignorance of the dangers of the road. We try to drive aware, recognizing that, occasionally, we’ll come upon an obstacle or have a car cut dangerously in front of us. You expect some of these hazards (e.g. sub-prime calamity), but some you don’t (e.g. oil declining to $35 per barrel) and when you get in an accident it can’t help but cause some portfolio damage. Fortunately, some are just stones in the road and have little impact on collision, but some are big rigs that hit with devastating consequences. We work in advance to consider as many of the risks as possible, while always seeking the less trafficked roads –not just as a means to profit but as a means to avoid permanent loss”

LINK: FPA Crescent Fund Quarterly Report Q4 2009

Leuthold Global Fund

The Leuthold Global Fund is a young fund with a seasoned management team. Steve Leuthold is the Chief Investment Strategist for Leuthold and makes macro calls. The portfolio managers are Doug Ramsey, who is the Head of Research for Leuthold and Matt Paschke, who also manages the Asset Allocation fund and has worked with the Core Investment fund over his ten year experience at Leuthold. We were impressed with the track record of the Leuthold Core Investment which made 9% per year for the ten years ending December 31, 2009 (S&P 500 lost 1% per year) with substantially less volatility (about half) of the S&P 500; in fact the Select Industries portfolio has returned 14.8% per year since December 31, 1995 through February 28, 2010 during a time when the S&P 500 made only 3.1% p.a.. The Leuthold Global fund has performed admirably, returning 32% in 2009 and losing only 1% since inception in April of 2008 compared to the S&P 500 which has lost 10%. The Global fund has about 66% in global equities, 10% in fixed income, and 12% in cash.

LINK: Leuthold Global Quarterly Report January 27, 2010

Wintergreen Fund

The Wintergreen fund is a relatively young fund with a seasoned manager --David Winters the former manager of Mutual Discovery fund. The fund, thru the end of 2009 returned 20.6% since inception (32.8% in 2009) versus the S&P 500 which returned 2.5 (annualized this is 4.6% versus .6% p.a. for the index). As of the end of the year, the fund was allocated about 10% in cash and short term investments with the remainder primarily in equities around the world. 28% in the United States, 14% in the United Kingdom, 14% in Switzerland, 10% in Hong Kong, and 7% in Japan. Securities are selected based on three key qualities:

David is confident that the securities Wintergreen owns will continue to experience growth internationally and have “very good prospects for a profitable future.”

LINK: Wintergreen 2009 Annual Report

Long-Term More Volatile Funds

Fairholme Fund

The Fairholme fund is likely our least volatile, Long-Term More Volatile fund (LTMV), but, because we know Bruce Berkowitz makes some big bets when opportune and the fund has historically exhibited more volatility than our long-term less volatile funds we classify it as LTMV. Last year, Fairholme made 39% in 2009. More impressive, over the last ten years (ending 2009) the Fairholme Fund made 13.2% per year compared with the S&P 500 which lost 1% per year. The Fairholme Fund is Morningstar’s Manager of the Year and Manager of the Decade. Bruce Berkowitz: “All of us at Fairholme are proud of this record and Morningstar’s Manager of the Year and Manager of the Decade awards. We are also proud of our shareholders, who witnessed months of panic from the near collapse of financial markets last year. You stayed the course when others deserted their investments. Such a trust must be continually earned, and Charlie and I believe the following management discussion and analysis, schedule of investments, and financial statements indicate (without telling too much) that we remain hungry for continued shareholder success.

LINK: 2009 Annual Report FAIRX

As of the end of November, the fund had 70% equity (almost all in the US), 16% cash, and the remainder in fixed income and other investments.

LINK: Fairholme Fund facts

Third Avenue International Value Fund

The Third Avenue International Value Fund suffered substantial volatility during the downturn, but has made 11% per year since its inception in 2001. Amit Wadhwaney is the Portfolio manager. The fund seeks investment opportunities primarily outside of the United States, with about 86% invested in equity and 14% in cash. Investments are truly spread globally. Largest positions are in Singapore (10%), Canada (11%), Japan (10%), United Kingdom (6%) and Taiwan (6%).

LINK: TAVIX Fact Sheet December 31, 2009

In the latest shareholder letter, you can read Marty Whitman’s view of market efficiency (page 2), and what he calls “nonsense” of assuming that market efficiency is universal – he believes efficient markets are a special case instead of a general law, and that value investors, by understanding this, can make profitable investment decisions. Amit Wahdwaney’s discussion begins on page 20. Because the fund owns positions that are exposed to the Chinese economy (especially companies in Singapore, Taiwan, and Hong Kong) he addresses the issue of a China bubble, excerpt below:

“Any and all exposure to the Chinese economy which currently can be found in the Fund is a result of our individual security selection based on the following criteria, among others: strong financial positions that protect our holdings from any reliance upon recurring access to capital markets, which can be notoriously fickle, strong management teams with impressive track records of generating growth in shareholder wealth over the long term; and attractive valuations (i.e. meaningful discounts to our conservative estimates of net asset value), which we believe are difficult to find along the more fashionable, well-trodden paths taken by many investors seeking to invest in China. Also, as we have noted in the past, the valuations at which the Fund is willing to invest in a company are based only upon our view of the here and now, rather than upon any optimistic expectations of future prosperity. We believe that investing in securities that are extremely well-financed, well managed, and are priced cheaply on an as-is basis, positions the Fund to benefit if said great expectations were to actually materialize, while protecting the Fund on the downside if such predictions prove to be overly pessimistic.”

LINK: Third Avenue Shareholder letters Q1 2010

We also listened to the conference call with shareholders on February 23rd. In this call, Amit spoke at length on exposure to Chin, other risks, how his fund differs from Third Avenue Value and overall valuations. In a nutshell, he believes there remain many opportunities globally particularly in real estate, resource, and insurance industries and the prospect of rising interest rates does NOT necessarily mean multiple contraction, i.e. reduced stock prices.

Kinetics Paradigm Fund

The Kinetics Paradigm Fund is the most volatile of the funds we use, and has the smallest allocation. Nonetheless, it has made 8% per year over the last ten years (against the S&P 500 which lost 1% per year over that period). While Kinetics is rooted in the fundamental, margin of safety investing discipline and has no illusions of being able to predict the future, their tone is the most optimistic of all our managers and we fear it may be the most volatile (so include it only in Moderately Aggressive and Aggressive allocations). Peter Doyle, Chief Investment Strategist, believes the future will be bright primarily due to improvements in education and technology. “Whether you are talking about nanotechnology, robotics, or molecular biology, the advances being made in these fields are just astounding. They’re talking about tiny repair devices in nano-technology where roughly six thousand man-made motors that can fit on the head of a nail will be injected into clogged arteries in the not-so-distant future. People will be able to go in for a procedure at 10 AM, be out by 10:30 with no recovery time and be able to go back to work later that day. Those types of things are not science fiction; they are about to become a global reality.”

The fund investment themes include China (companies oriented to the domestic market), Oil Sands (which Peter Doyle believes can be profitable even at $40 oil), and Financial Exchanges, which are really operating companies whose business volumes have continued to grow even through the crisis. The fund invests in Chinese companies. It is important to note; however, that the fund only invests in Chinese companies that are not vulnerable to softening demand in Western Europe or the United States but are instead rely on gradual growth in the Chinese economy. “As long as China continues to develop, they will need banking services, they will need expressways, they will need to use ports, they will need to use airports, and they will need to use the entire infrastructure that has been put into place and continues to be in place. Those types of investments are unusual investments in the sense that in the West we have built our infrastructure differently. Largely, the infrastructure was put up either by a mix of local, state, and federal government spending or in some cases private spending. In China, given the vast amount of money it takes to put up an infrastructure today, the government has funded all projects through publicly held companies that are still majority owned by the Chinese government. From our viewpoint the Chinese government has incentivized investors to participate in these types of ventures through equity ownership by historically providing reasonable rates of return. In return, the Chinese government will have continued access to private capital through their markets …”

LINK: January 5, 2010 Conference Call with Peter Doyle

Wasatch Global Opportunities Fund

You may remember we added this fund after an extensive interview of the fund manager, Robert Gardiner, who had just opened the fund and only had a few million dollars in the fund. It remains very small, with only $145 million total assets. Since inception thru the end of 2009, the fund has returned 69% (MSCI World Small Cap Index returned 54%). This fund came up on our radar because Ken had been following the Wasatch Microcap fund (closed to investors) and learned that the former manager of that fund had opened a new fund. The track record of his former fund is truly phenomenal. In fact, The Wasatch Microcap fund (WMICX) that Robert Gardiner managed from 6/15/1995 to 12/31/2007 made 25% per year.

While the fund experienced substantial volatility similar to Third Avenue Value fund, the availability of Robert Gardiner makes this a compelling opportunity for long-term investors. Currently the fund has about 95% in stocks and 5% in cash. Top countries include US (41%), China (10%, Japan (9%) and United Kingdom (7%).

LINK: WAGOX Fact Sheet

In the latest commentary, Robert Gardiner details his current strategy and outlook. He believes the global economy is improving but does not see strong growth in the United States or developed countries. Instead, it is likely to be a stock pickers market going forward.

Other Interesting Reading

Bill Gates annual letter to Gates Foundation

Bill Gates, highly successful in business, has re-directed his energies toward making a positive impact on as many people as possible through philanthropic efforts. The Bill and Melinda Gates Foundation is founded on the premise that every life has equal value. Its approach is business-oriented, i.e. it measures progress and adjusts strategy based on goal attainment. What I find most interesting about this annual letter is the innovation chart (page 2) establishing time frames where key innovations are expected to occur. Of particular note in the United States, Bill Gates forecasts the following:

- Within 10-15 years systems for measuring teacher effectiveness will be implemented (derived from the understanding finally gained on what makes teachers effective)

- Over the next 3-8 years online learning instruction will be implemented in US schools, taking of advantage of the learning that occurs individually based on feedback

LINK: Bill Gates Annual Letter 2010

Most Likely to Succeed, Malcolm Gladwell

The article, “Most likely to Succeed,” in Malcolm Gladwell’s latest book, What the Dog Saw corroborates Bill Gates findings on education. Gladwell examines how to identify an effective teacher. Bob Pianta, the Dean of the University of Virginia’s Curry School of Education reveals his finding that a high competency in “regard for student perspective” results in highly effective learning. If we can teach teachers to have a “high regard for student perspective,” we can make teaching more effective. We already know that a highly effective teacher raises the average grade level of his students at least one grade and that an ineffective teacher has the opposite effect. Imagine then, the productivity advances that can occur from this innovation, implemented at school and in the workplace. It is difficult to imagine any other advance that could have a greater impact.

Berkshire Hathaway 2009 Annual Report

Below is a link to Berkshire Hathaway’s latest annual report, in which you can see that Berkshire Hathaway returned 20% annually on book value or 22% annually on shareholder value since inception in 1965. Not too bad. Warren Buffett has some sagely advice:

- “When it is raining gold, reach for a bucket, not a thimble” on opportunities during the crisis

- “It is the behavior of CEOs and Directors that needs to be changed. If their institutions and the bounty are harmed by their recklessness, they should pay a heavy price – one not reimbursable by the companies they’ve damaged nor by insurance. CEOs and, in many case, directors have long benefited from oversized financial carrots; some meaningful sticks now need to be part of their employment picture as well.”

- “At 86 and 79, Charlie and I remain lucky beyond our dreams. We were born in America; had terrific parents who saw that we got good educations; have enjoyed wonderful families …”

More below if you are interested:

LINK: Berkshire Hathaway 2009 annual report published February 27, 2010

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us