Global View Investment Blog

Quarterly Newsletter to Clients Q3 2010

Executive Summary

Investors wonder whether the US and Global Economies are heading into another recession and how this might impact their investments. We know that growth has slowed, but believe a deep double dip recession remains unlikely. The current slow growth environment is unlikely to feel like a recovery for many people especially as unemployment remains high.

In this environment, economic and stock market volatility are likely to continue adding to investors’ frustration. Index-based, buy and hold strategies, or bond-based income seeking strategies are likely to be disappointing over the next several years, particularly given investors disposition to sell at just the wrong time. Moreover, the specter of inflation, unlikely in the short-term, is a near certainty in the medium to long term and can devastate bond investors. Continued uncertainty during volatile times can cause investors to second guess their long-term strategy and opt for “easier” solutions, like reaching for yield in “risk-free” investments, chasing returns in gold, or trying to time the market by sitting on the sidelines “until things get better”. The Margin of Safety strategy has proven its ability to work in volatile markets. Our managers capitalize on volatility. They capture lower downside risk and much of the upside of market movements. This has been well demonstrated by our managers during the last crisis and by their kin during previous crises.

Looking more deeply into our manager’s strategies provides increased confidence that their efforts will continue to yield fruit. In a predictable, perfect market, they could not deliver risk-adjusted returns. It is by navigating volatile markets thru rigorous security selection that they have added value in the past. As we continue to conduct due diligence on them, we believe they are the best choice for the future.

Economic Update

Economic growth in the US slowed at the beginning of the year, after a sharp rebound beginning in June of last year. Most investors don’t even realize the sharp nature of the upturn, because unemployment has remained elevated, and because the media does better by selling pessimism than by selling optimism. We recently attended an Investment Forum with JP Morgan, featuring their leading experts. David Kelly, Chief Investment Strategist, used an analogy to show how truly out of proportion the media response can be. Clearly the BP oil spill was an environmental tragedy. However, David ran some math to illustrate the overall effect of the oil dumped into the Gulf. To cut to the chase, the overall volume of oil dumped into the Gulf is analogous to a teardrop in a swimming pool. Since the spill has been plugged, there has been little news coverage.

We make this point because the media and pundits tell us there has been no recovery or that a double dip is imminent. We are not experts on the economy, and we feel it is very difficult to predict a recession. That said, it appears more likely we will face slow growth for some period than experience a severe double dip recession. Leading economists we respect believe a double dip is likely only if a major policy error occurs, such as allowing the tax cuts to expire. Moreover, the most cyclical components of the economy, those generally responsible for recession and recovery, have hardly recovered. These are: automobile consumption, residential construction, equipment, and business inventories. The latest recession was led primarily by a drop in residential and commercial construction, but business investment including a reduction in inventories also dropped precipitously. To date, and this is consistent with consumer deleveraging, there has been only a very mild recovery in automobile consumption and residential construction. From these levels it is hard to imagine how they could drop further and put the overall economy into seriously negative territory. Following are some reasons that make it difficult to imagine how the economy could drop significantly from this level:

1. Business inventory to sales ratios remain very low, suggesting room for an increased build in inventories.

2. Automotive sales remain near an all-time low.

3. Housing build is running 1/3 of trend. Yes there is excess capacity, but it is slowly being absorbed by the increasing population.

The greatest risk to continued economic growth is a policy mistake or an exogenous shock. For example, should our government fail to extend the Bush tax cuts, this would put continued downward pressure on disposable income, and reduce consumption and investment. Alternatively, a geopolitical event could trigger a major spike in oil prices.

US consumers have responded to the crisis prudently. They have increased savings to almost 6% and are paying off debt. Nearly ¾ of consumer debt is in mortgages. The drop in interest rates has allowed consumers to refinance and reduce their payments, freeing up additional cash; anecdotally mortgage brokers tell us they see a lot of refinancing from 30 year mortgages to 15 year mortgages. Before the crisis (Q3 2007) 14% of disposal income was used to pay debt. Now it is down to about 12% (close to its long term average).

The experts at JP Morgan believe the following are catalysts for continued economic growth and reasons to be bullish:

• The tax cuts are likely to be extended (but only AFTER the election).

• The Federal Reserve, fearful of deflation, is likely to embark on another program of quantitative easing. Quantitative easing is the policy of the Federal Reserve Bank buying assets to add liquidity. This generally raises risky asset prices and will eventually lead to inflation but in the nearer term it has historically resulted in a rise in overall price levels.

• Increased merger and acquisition activity will continue to boost share prices.

We are skeptical of any Wall Street-based advice, because we believe it will have a bullish bias. For this reason we look to independent and unbiased sources. We spent considerable time this summer reviewing publications by the Economic Cycle Research Institute and Lombard Street Research and talking to their economists. Both organizations have done a good job in the past predicting downturns. Today, neither is ready to predict a recession. Lombard has an interesting take. They believe the recent recession was a result of global savings imbalances, led by Germany, Japan, and China. Their view is that these export nations created a trade surplus that had to be financed by deficits (in countries where consumers were willing to spend like the US). In order for this to be corrected in the long run, these nations will have to engage domestic consumers to be an increasing piece of their economic pies and rely less on exports for growth. This is the true solution to the economic crisis. China has started down this road already but the journey for Germany and Japan is more difficult. For more detail on Lombard’s view, we recommend Globalisation Fractures, by Charles Dumas.

Our managers generally continue to see a slow growth environment ahead. Hussman, a dissenter, believes a double dip recession is likely. We believe having some exposure to all of these managers will result in a ride sufficiently comfortable to allow our clients to weather any coming storms.

Portfolio Risk

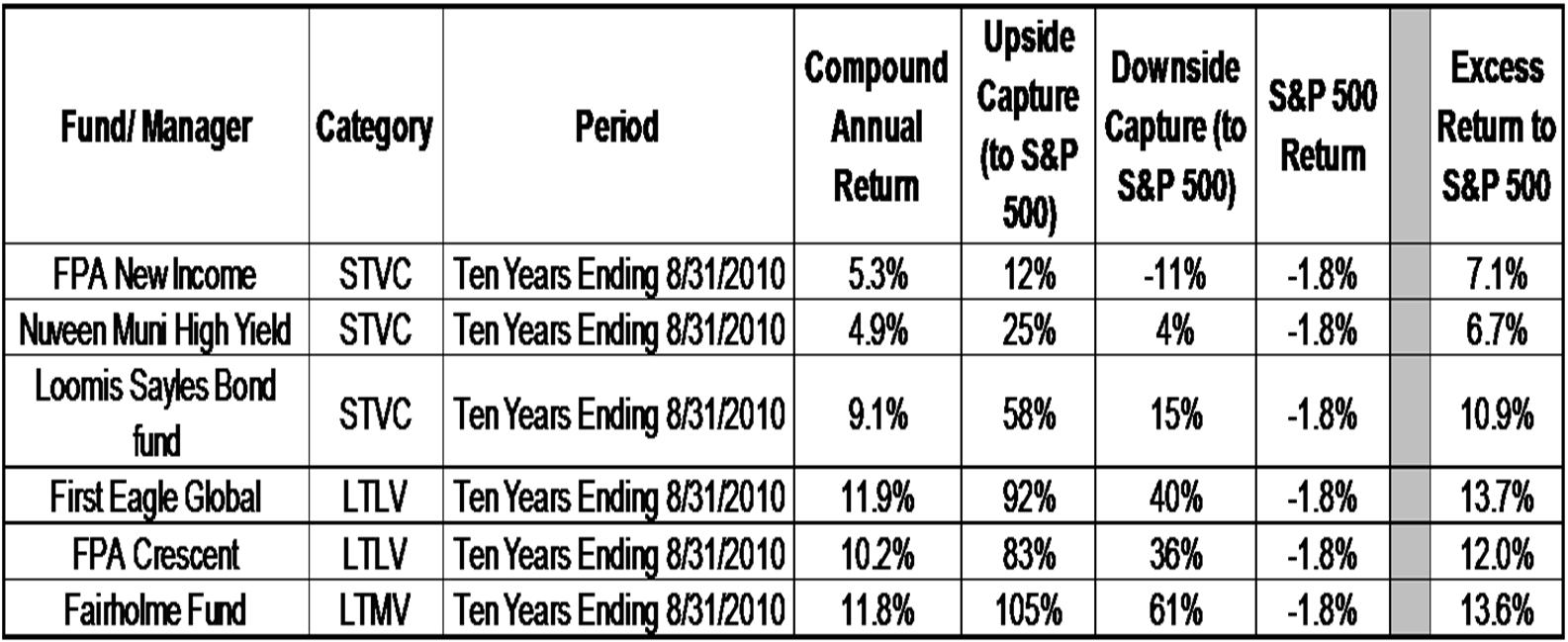

A hasty analysis of your portfolio may lead you to the incorrect conclusion about its volatility. Over the last decade, your funds have illustrated excellent risk-adjusted returns. They have done this primarily by protecting against downside volatility. If our managers can deliver lower downside volatility and capture upside movement, they can provide better long-term returns. The table below shows an analysis we did in Morningstar showing the ten year track record of selected managers (if you are interested we can provide this for any manager). For Example, the First Eagle Global fund, a Long-Term Less Volatile manager (LTLV), returned 11.9% per year when the S&P 500 lost 1.8% per year. They did so by capturing 92% of the upside return of the S&P 500 (during months where the S&P 500 made positive returns) but only 40% of the downside of the S&P 500 (during months where the S&P 500 produced losses). This formula works best over multiple cycles because it gives more opportunity to capture positive returns – all that is needed to work is nonlinear returns, i.e. the S&P 500 cannot go up in a straight line. Investors are paid to endure this discomfort.

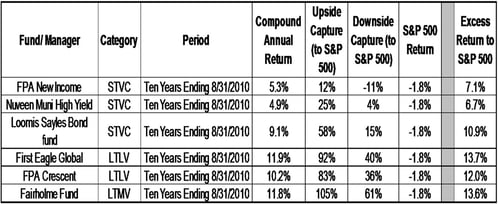

A snapshot report of our Moderately Aggressive allocation (using managers as allocated January, 2010 in the large tax deferred allocation) against a benchmark of 80% stocks and 20% bonds (Ibbotson Moderately Aggressive allocation), illustrates that our Moderately Aggressive allocation has substantially less equity, about 64%, than the Ibbotson benchmark. Moreover, the actual asset allocation has less equity than Morningstar illustrates because Morningstar does not reduce equity for some hedging, e.g. Hussman’s put options (he buys insurance against downside risk), and because we know that our managers have been selling into strength.

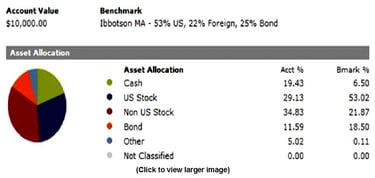

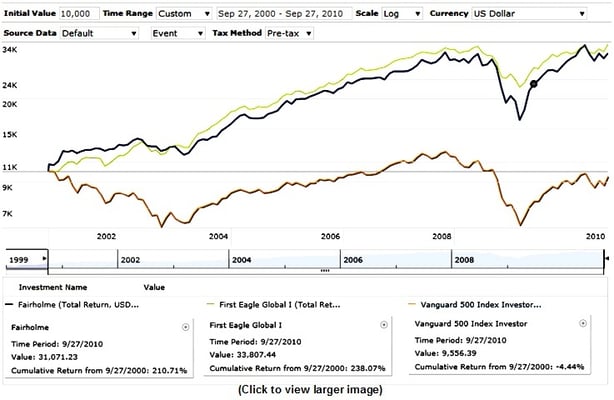

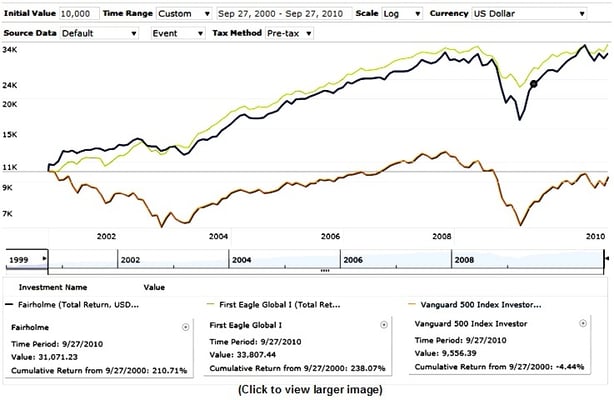

To further illustrate how volatile markets allow our managers to add value, the chart below shows a comparison of First Eagle Global, Fairholme, and the Vanguard 500 index total investment growth since market peak in mid October thru September 27, 2010. Fairholme and First Eagle are both positive, while the S&P 500 is still substantially down.

The long-term picture is revealed through a comparison over ten years. Investors in the S&P 500 would still be underwater, while Fairholme and First Eagle have more than doubled.

Fund Focus – IVA Worldwide (Long-Term Less Volatile)

Those of you working with our advisors for nearly a decade (before Global View was formed) know how long our advisors, while employed elsewhere, have used First Eagle Global for clients. You may also know we were some of the first investors in the International Value Advisors (IVA) worldwide fund, before the fund even had a ticker symbol (the institutional share is IVWIX now but we had to call the first orders in to the Schwab trading desk). We invested into IVA knowing that a former portfolio manager from First Eagle, Charles de Vaulx (who had been with the fund for over a decade), and the Head of Research for First Eagle, Chuck de Lardemelle, as well as several analysts from First Eagle had joined IVA; we met Chuck and several of these analysts at a due diligence meeting in June of 2007. Chuck visited our Greenville office earlier this year, after the company had already raised several billion in assets.

We recently attended a conference call with IVA. IVA Worldwide has 6% of assets in gold as an insurance against currency debauchment, 14% in “cusp” bonds, i.e. bonds on the cusp of investment grade that they feel are still good value, 65% in equity and the remaining 15% or so in cash. Chuck DeLardemelle believes the deflationary forces are abating and that the long-term odds of deflation are basically zero. Moreover, with the market cap of the S&P 500 trading at about 90% of GDP, this is not a bad valuation; however, the outlook for the economy is more constrained due to high debt levels. IVA invests in undervalued companies in an attempt to weather the ups and downs that we will inevitably experience.

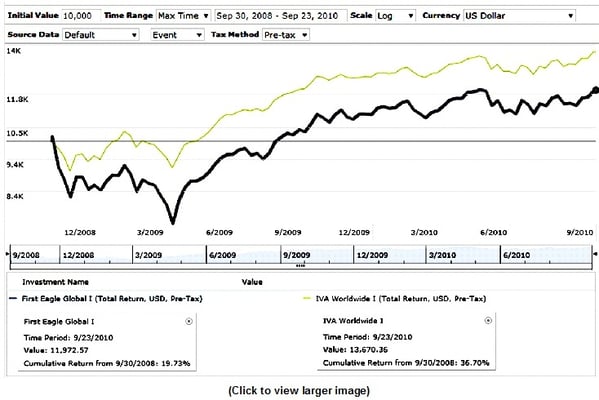

Since inception, IVA Worldwide (IVWIX) has exhibited substantially less downside risk than the market. Since its inception, its downside capture has been 32% of the S&P 500. It is easy to see that experiencing only 1/3 of the market downside but ¾ of the upside can lead to a much more comfortable ride and substantial outperformance. The chart below shows the degree of outperformance IVWIX has experienced relative to the S&P 500 since fund inception:

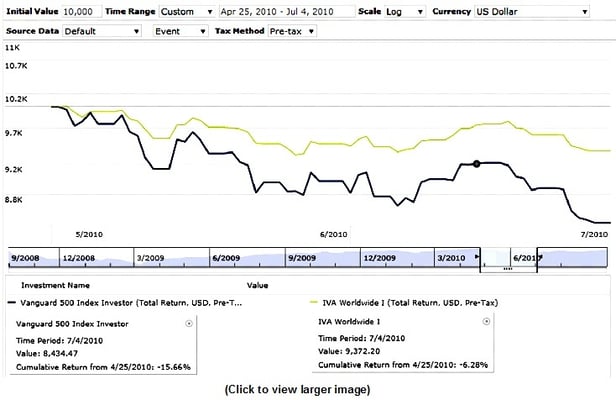

To illustrate this in recent terms, the chart below shows how the IVA fund moved from the April 25 peak this year thru the low on July 4th. IVA Worldwide was down about 6.3% while the market was down about 15.7%, i.e. IVWIX had 40% of the downside risk of the market.

Not shown in the chart, since the rally beginning July 5 thru September 24, IVWIX has risen 72% as much as the market (9.2% vs. 12.8). Clearly if IVA can continue to capture substantially less downside and much of the upside, it will continue to be a winning bet in a volatile market.

We still like the First Eagle Global fund, but IVA Worldwide has done better since inception. Clearly adding IVA to portfolios has been a benefit to clients thusfar.

Is It a Good Time to Buy Bonds?

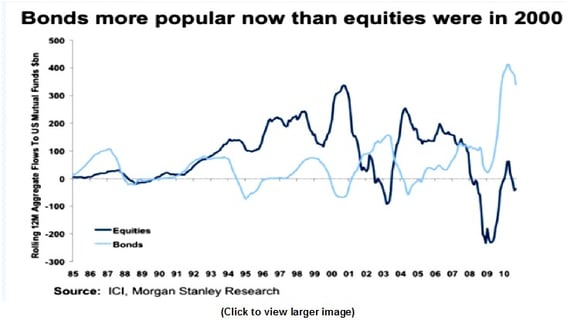

Investors seeking yield may be in for a rude surprise. According to a recent article, investors have poured more into bond funds over the last two years (about $500 billion) than they poured into equity funds during the internet bubble.

LINK: Bond Funds Gain Cash Like Stocks in Dot-Com Era

Given the notoriously poor performance of investors chasing returns, the question is begged whether it is a good time to chase bond performance. The chart below, using data from the Investment Company Institute, shows the nature of the inflows in comparison with equities.

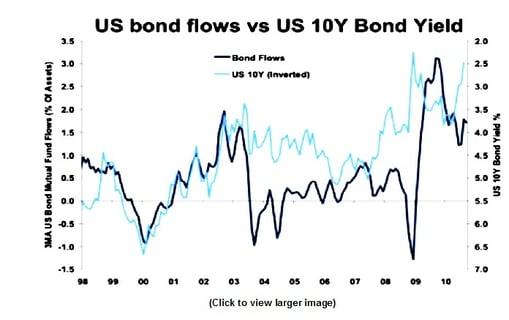

The next chart shows that, after substantial inflows, bond yields have generally risen and bond prices have fallen.

We know that interest rates will eventually rise. When they do, bond prices fall. Assume an investor purchases a $1,000 bond with a yield of 5%. One year later, interest rates rise so that now a bond with similar features pays 5%. If the investor tried to sell the bond with a yield of 6% annually, nobody would buy it – the same amount of money could purchase an equivalent bond yielding 6%. In order to entice the buyer, the investor would have to discount the bond price to compensate the buyer for the lower coupon payments.

Selected Manager Updates

It is worth repeating how Global View classifies managers. We classify them as follows:

• Short-Term Volatility Control Managers (STVC): we believe these managers will have less volatility than the overall market and still afford the opportunity to gain reasonable returns; these managers may manage fixed income portfolios or mixed portfolios seeking to reduce risk thru hedging.

• Long-Term Less Volatile Managers (LTLV) strive to manage volatility while beating relevant indexes over a full market cycle.

• Long-Term More Volatile Managers (LTMV) strive to beat relevant indexes over a full market cycle and may have volatility more similar to the broad stock market.

We may switch managers out for several reasons. First, we may believe the investing fundamentals necessitate a change. Second, we may find new managers and need to substitute them for existing managers. Third, we may believe the risk/ reward characteristics of a manager have declined and fire a manager or substitute a better manager.

Short-Term Volatility Control Managers

Eaton Vance Global Macro Absolute Return

This is a new manager to our strategy. This strategy, since inception in October of 1997, has been internally managed at Eaton Vance. It has shown a maximum drawdown of 3.3%, and has actually exhibited a negative downside capture in comparison to the bond market (Barcap US aggregate). We feel this is an excellent choice for a volatility control investment that has a very low correlation to the bond market. Since fund inception, the fund has made 7.5% annually. More importantly, the fund has shown a NEGATIVE downside risk to both bonds and stocks, -10.1% downside risk to T bills and -7% downside risk to stocks. In other words, it has generally been UP when stocks were down and bonds were down. Reducing risk comes at a cost, the fund has only captured about 19% of the upside of the S&P 500 during up months.

For commentary from the manager, see below:

LINK: Eaton Vancce Global Macro Absolute Return Commentary

Hussman

John Hussman remains in a fully hedged investment stance, and is unwilling to accept market risk under current conditions. He is concerned that the deterioration in leading indicators may morph into a deeper economic slowdown, and that the equity markets are not priced for more bad economic news. He is also concerned with the number of current and future foreclosed properties that must be liquidated or worked out. He believes there is an outside chance that the real estate problems could trigger a second liquidity crisis in financial companies and markets. He does indicate that if leading economic indicators move back to growth readings, then he will be willing to selectively accept market exposure.

For more information, John Hussman’s weekly comments can be read at:

LINK: Hussman Commentary

Nakoma Total Return

Dan Pickett of Nakoma remains cautious with his market exposure, due to lack of confidence in the economic recovery. At the end of August, Nakoma had net long positions of 8% (Long holdings minus short holdings).

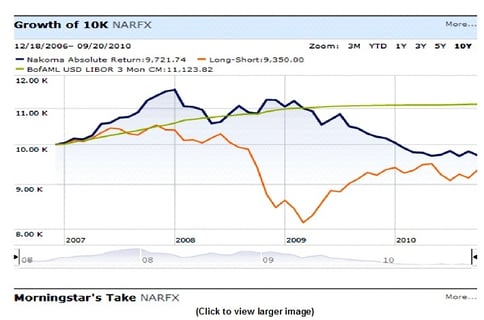

Nakoma’s performance has been disappointing for the team here at Global View during the past 18 months, as it has for you. This period has been very difficult for firms that manage disciplined long-short strategies, as evidenced by the Morningstar chart directly below. As you can see, Nakoma has outperformed the long-short index since the end of 2006. Furthermore, we feel confident that long-short strategies will not remain out of favor forever, and when historical correlations return to normal equity markets, that Nakoma will capitalize.

Monthly Investor Letters can be read at:

LINK: Nakoma letters

Loomis Sayles Bond

LSBDX, managed by Dan Fuss and Kathleen Gaffney, has returned 9.1% p.a. for the ten years ending August 2010, while the market lost 1.8% p.a. During this time, it had only 15% of the downside capture of the S&P 500 and 58% of the upside. The 30 day yield on the fund is 4.5%. As of the latest quarterly commentary, the team expects a slow, modest recovery and eventually higher interest rates due to the public debt burden.

LINK: Loomis Commentary

Nuveen Muni High Yield

This John Miller managed fund showed substantially more volatility during the crisis period of 2008-2009 than we would have expected and has performed substantially better than we would have expected since. In fact, NHMRX remains our best performing fund year to date, up 12.1%. For the last ten years ending August, the fund returned 4.9% p.a. with only 4% of the downside capture of the S&P 500 and 25% of the upside. Its federal tax income free yield of 6.9% may be very enticing to investors. However, given its unexpected downside volatility during the crisis, we have an eye on this fund and may be taking some risk off the table in accounts where more liquidity is warranted.

LINK: NHMRX Fact Sheet

FPA New Income

FPA New Income’s Stated Philosophy: “winning, by not losing”.

Our reason for using this fund is to protect our client’s monetary value over the short time horizon first and foremost; and secondarily protect the purchasing power that money as FPA New Income grows at a rate that, at worst, keeps up with inflation.

Interesting characteristics of the fund:

• Self-proclaimed as Conservative Fixed Income management style

• 25 plus years WITHOUT ever experiencing a Negative calendar year return

• Current duration of holdings of only 1.49 years, versus the index of 5.29 years (duration is one way to visualize risk)

• 92% of assets are in AAA or higher securities (another risk measure)

• Calendar Year 2008 (Financial Crisis year) Total Return: + 4.31%

FPA’s reasoning for being so conservatively invested, right now:

“We continue to be unwilling to accept virtually any bond volatility risk at the current unacceptably low yield levels as we feel that Treasury bond yields remain devoid of any investment merit. Any small rise in interest rates will likely produce a negative total return. In fact, it has now been almost 7 years since we wrote “Buyer’s Strike” (June 16, 2003) and we still refuse to stretch for yield unless we are more than adequately compensated for the risk of doing so.”

FPA New Income’s March 2010 Letter to Shareholders:

LINK: FPA New Income Commentary

Pimco All-Asset All Authority

Robert Arnott believes that the global economy is on a very bumpy journey to “The New Normal” of lower sustainable growth than we have experienced over the past 50 years. Financial Markets will likely be more volatile as they grapple with a wider range of potential outcomes, and over the next year or so deflationary pressures will dominate; however Robert also believes the greatest long-term risk is inflation. Ultimately, amid the uncertainty of the short term outlook, PIMCO will remain cautious with risk exposures and look to make tactical shifts to protect portfolios in the face of high levels of expected volatility.

Second Quarter letter to investors:

LINK: PAUIX

Long-Term Less Volatile Managers

First Eagle Global

The First Eagle team recognizes and is prepared for the likely volatility and uncertainty the near future holds, much like many of our other managers. They believe that owning “good companies at good prices” will be the best strategy for protecting ones purchasing power during these uncertain times: “As long-term investors, our approach to dealing with uncertainty is to be primarily owners of enterprises, favoring those we view as having entrenched market positions, latency in potential cash flows, prudent management, strong balance sheets, and most importantly, modest prices. We believe such businesses can better endure current and future uncertainties and can better sustain real purchasing power in the long term.” (opposed to alternatives such as bonds, cash, commodities, etc.)

First Eagle commentary and interviews:

LINK: First Eagle Q2 Commentary

In the interview just below, Matt McLennan describes their view of Margin of Safety investing during the first two minutes of the video:

LINK: Bloomberg Interview of Matt McLennan

International Value Advisors

We recently attended a conference call with IVA. They have about 6% in gold as an insurance against currency debauchment, 14% in “cusp” bonds, i.e. bonds on the cusp of investment grade that they feel are still good value, 65% in equity and the remaining 15% or so in cash. Chuck DeLardemelle believes the deflationary forces are abating and that the long-term odds of deflation are basically zero. Moreover, with the market cap of the S&P 500 trading at about 90% of GDP, this is not a bad valuation; however, the outlook for the economy is more constrained due to high debt levels. We invested into IVA knowing that a former portfolio manager from First Eagle, Charles de Vaulx (who had been with the fund for over a decade), and the Head of Research for First Eagle, Chuck de Lardemelle, as well as several analysts had joined IVA. Chuck visited our Greenville office earlier this year, after the company had already raised several billion in assets.

IVA also sees uncertainty and volatility in the coming years. De Vaulx thinks we're in for a volatile time, and he thinks the investors who win are going to be the ones who make that work for them instead of against them. "As an investor, you should not view volatility as a threat, but as a friend." How? “Everyone wants to buy low and sell high. But you can't buy low if you already bought high. A lot of stocks are expensive right now. A lot of bonds, too. Many bond investors are betting on deflation.” De Vaulx thinks we'll dodge the bullet. But that's only because he thinks Washington, ultimately, will step in and do whatever it takes to prevent it.

To access the conference call, go to the link below under news & updates:

LINK: IVA Funds website

Wintergreen Fund

Since inception in November of 2005, the Wintergreen fund has experienced 70% of the downside of the S&P 500 and 95% of the upside, making 5.2% per year. David Winters has repeatedly expressed concerns similar to those expressed by the First Eagle team and reached the same conclusion that the best way to protect one’s purchasing power is to own high quality companies selling at a discount. The following passage is David describing a company called Genting Malaysia Bhd, which is based in Malaysia and is David’s 10th largest holding. (US investors cannot purchase this company over US exchanges).

“When we started studying the entertainment and gaming industry, we looked at similar firms around the world, and we came to the conclusion that Genting was potentially one of the best-positioned gaming and entertainment companies. Genting…operates a gaming monopoly in Malaysia, gaming duopoly in newly-opened Singapore market, gaming assets in the UK, as well as palm oil plantations, power plants, and energy investments around Asia. Our positive view of Genting was again confirmed earlier this year when I went to Malaysia, the Philippines, and Singapore and saw their operations first hand. Genting’s balance sheet as well as their competitive positions, make the company stand out, as did the large amounts of cash flow they generate. Genting has used their strong balance sheet to invest in projects, which over the long run appear well positioned to benefit the Fund’s shareholders.”

More interviews and commentary can be read at:

LINK: Wintergreen Fund Website

FPA Crescent Fund

Steve Romick has managed this fund since 1993, and has created a wonderful track record and grew investor’s assets by 10.6% CAGR while the S&P 500 has grown at 7% annually. During the past 10 years, FPA has compounded at 10.2% annually while the S&P 500 has returned -1.8% annually. The fund has captured only 36% of the downside of the S&P 500 and 83% of the upside over this period. Romick puts foremost attention on preserving capital, and currently is in a defensive investment position. They own 38.4% cash equivalents, 35.6% stocks, 16.5% bonds, and 9.5% commodities; however, they will purchase stocks or bonds if and when they see prices they deem cheap enough. Romick ended his 2nd Quarter commentary with the following analogy about their investment style. I hope you find it informative:

“We watched a number of World Cup soccer matches recently, and not having grown up with the game, became fascinated by the sparse scoring opportunities. The game requires patience and discipline to defensively keep the ball out of your box, while waiting for an opening to exploit on the offensive end of the pitch. The Spain/Netherlands final brought some of us together, and served to instruct us as we ruminated as to the similarities between the Spaniards and Crescent. Spain, during the tournament and along the way to becoming champions with the fewest cumulative goals, scored only (8), kept their mistakes to a minimum, and similar to the way we aim to manage Crescent, focused on the quality of their shots rather than the quantity.”

LINK: FPA Crescent Q2 2010 Commentary

Long-Term More Volatile Managers

Fairholme Fund

For the last ten years ending August, 2010, Fairholme returned 11.8% p.a. outperforming the S&P 500, which LOST 1.8% p.a. Per Morningstar, it captured only 61% of the downside of the S&P 500 and 105% of the upside. Recently, Bruce Berkowitz, portfolio manager, has made a bet on financials. While he avoided the sector prior to the crash, he believes investments in Citibank, AIG, Bank of America, Regions Financial, and others will prove to have been excellent choices in the coming years. Our other managers typically remain somewhat bearish on financials, making Bruce an outlier here. We believe Bruce may be proven right and that an allocation to the fund remains warranted.

From the article: “We bought at prices reflecting pessimism in the economy. I do not believe we are going to lose money at the prices we paid. If the economy just sputters along, we’ll do fine. It the economy recovers, we should do reasonably well. Absent a severe double-dip recession, I don’t see how our shareholders get hurt.”

LINK: Fairholme loads up on Bank Stocks Kiplinger

Third Avenue International Value

Since inception in January of 2002, the fund has returned about 9.3% per year and has exhibited 100% of the upside capture of the S&P 500 and only 63% of the downside. The fund may appear to have performed relatively poorly over the last couple of years vis a vis our other managers; however, we continue to believe that Amit Wahdwaney’s stock selection will eventually prove to have been excellent. Amit believes the continued market turmoil presents opportunities to own companies that will substantially increase in price given time. Please go to page 25 of the link below for TAVIX commentary.

LINK: Third Avenue Q3 Shareholder Letter

Kinetics Paradigm

We recently sold off most of our holdings in Kinetics Paradigm because Lombard Street Research has suggested an imminent slowdown in China. However, for new clients owning the position for less than a year and for more aggressive clients we continue to own the fund. Kinetics Paradigm provides some access to emerging markets, especially China which we believe will do well in the long run, but may give investors a very volatile ride. Over the last ten years, the fund has shown 83% of the downside of the S&P 500 and 116% of the upside while making 9.3% per year.

Pete Doyle is the manager of the fund. Peter believes opportunities in equities are far better than those in bonds. In his latest update, he quotes Warren Buffet: “when evaluating a business one should not bother to even monitor the market (stock) prices, so as to encourage analysis of the actual business and respective valuation absent the influence of often misleading market prices.” Even so, this is a volatile manager and not well suited for all accounts.

LINK: Kinetics Paradigm Commentary

Wasatch Global Opportunities

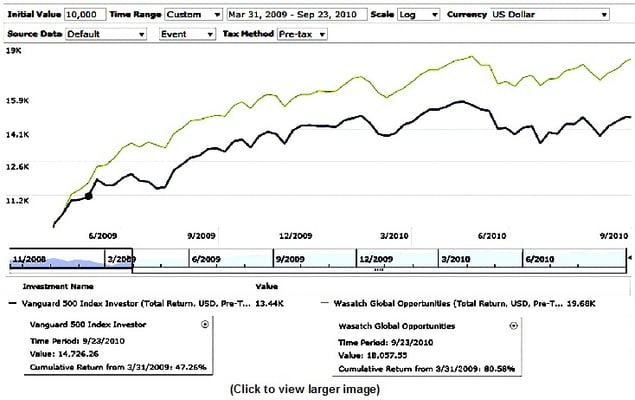

Since we began adding WAGOX to client portfolios, it has returned substantially more than other investments. Pleaseemember, we did strict due diligence on the fund; and despite the incredible performance of the portfolio manager, Robert Gardiner while managing Wasatch Microcap from 1995 to 2007, it was a stretch for us to add this. It is not only in performance that we feel our selection was validated, but in risk adjusted performance. Since the fund began in November of 2008, it made 40% p.a., capturing only 66% of the downside of the S&P 500 and 134% of the upside. Looking only at the fee of this fund would have been a serious mistake. Below is a chart of the fund vs. the S&P 500 (represented by Vanguard S&P 500 index fund) since the end of March last year, when we began adding it to portfolios en masse:

Value Opportunities (Global View Separate Account Strategy)

There is a chance that we will have an economic relapse and that risky asset prices, e.g. stock prices, will fall. We have an internally managed strategy to deal with this eventuality. Investors in Value Opportunities will eventually have access to a blog on our website where Rod McGee, the portfolio manager, will comment and update this going forward. Value Opportunities is fully hedged and hopes to have an opportunity to add risk at better prices.

Conclusion

Thank you all again. If you have any questions, feel free to contact us and we will do are best to answer them for you. We are happy to be of service and hope to continue doing so for many years.

Global View Team

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us