Global View Investment Blog

Quarterly Newsletter to Public Q2 2010

Despite recent market volatility and concerns over European debt contagion, it is important to remember the strategy our managers pursue, which is to avoid, at all costs, the risk of permanent loss of capital. Unfortunately, capitalizing on volatility and avoiding it are generally mutually exclusive. For example, during the worst years of the Great Depression, the market fell substantially, but had largely recovered within two years after adjusting for inflation. Our managers are taking prudent actions to reduce downside volatility where appropriate and continue to find opportunities for long-term return in this continuing difficult economic environment. At this point, they generally hold high cash balances, high quality equities and often some gold.

We rely heavily on our managers for their market outlook, but are not agnostic to general economic conditions. You may remember that we pointed out to our clients that we expected a recession in January of 2008 and took some actions in advance to reduce volatility by introducing short-term volatility control managers to client portfolios. Since then we have begun monitoring economic fundamentals more closely and will apprise our clients of anything warranting an alteration to asset allocations. At the moment, we do not expect a double dip recession in the US. More importantly, our managers have a very strong fear of inflation at some point over the next several years. Failure to own the right assets could easily result in a substantial loss of purchasing power. For this reason, we believe the Margin of Safety Investment Strategy is the best course of action to assure long-term purchasing power.

Contents:

• Historical Market Perspective: comparing inflation adjusted stock returns during the 1930s with the 00s shows that the returns during the 00s were worse than the 1930s!

• Corrections and Time Horizon: corrections often do not turn into bear markets and when they do they often bounce back in short order

• Investment Flows: Investors moved out of stocks thru March of 2009 and never really got back in, instead they invested in bonds. Given the abysmal performance of most investors in relation to the returns of investments, this should be a cautionary tale on chasing bond returns.

• Market Outlook: the line of least resistance for the S&P 500 is to rise substantially back close to pre-crash levels before another major downturn resumes; however we expect high volatility for some time and other scenarios are also possible

• Manager Commentary: Our managers believe the future holds slower economic growth and have positioned their portfolios accordingly. They are very fearful of inflation in the long term

Historical Market Perspective – last ten years versus 1930s:

Many people will be surprised to know that the last ten years in the market had worse returns than the 1930s:

• January 1 1930 – December 31, 1939: +1% p.a.

• January 1 2000 – December 31, 2009: -1% p.a.

Below is an excerpt from Grant’s Interest Rate Observer for June 11, 2010:

“In the ten years to December 31, 2009, the S&P 500 fell by 24%, without regard for reinvested dividends. In the decade of the 1930s, it fell by 42%, also without counting the dividends. But dividends in the 1930s were substantial enough, if reinvested, to deliver a 1% annual return. The meager dividend payout of the 00’s have delivered a 1% annual loss.”

If stocks suffered worse returns during the last ten years than they returned during the Great Depression (after adjusting for inflation), then why should an investor believe the next ten years will be worse? Further, if we accept the very high likelihood of inflation over the last ten years, what is the best strategy to get through the next ten years?

We believe the S&P 500 may experience low real returns for the next 10 years. We also believe that the managers we use, who focus first on capital preservation, are the best way to produce positive real returns (after inflation) than any other strategy. While the past is no guarantee of future results, we believe the MOS process is designed to thrive in a volatile low return environment because our managers will be afforded many buying opportunities.

Corrections and Time Horizon

Market Volatility returned during much of the second quarter, and world markets have experienced a substantial correction. This makes investors wonder if a bear market has resumed. Despite concerns over the economy, European debt, and the oil spill, it is important to remember how our managers find opportunities. Our managers identify and buy strong companies selling at a discount to their intrinsic value based on in-depth fundamental analysis. In this turbulent economy and difficult macroeconomic environment, these managers are more prepared for another downturn and are more focused on buying companies that are financially strong and that will survive another deep recession. Said another way, our managers are first and foremost seeking to avoid the risk of permanent loss of capital. A permanent loss occurs when a company goes into bankruptcy, or has their ability to generate profits become permanently impaired. To reiterate, avoiding a permanent loss of capital is completely different than avoiding a market correction which temporarily reduces the prices of companies you own, and consequently, the daily values of your portfolio. Ultimately, our goal for you is to attain the annualized returns you need over the next 10 years, 20 years, and longer that your money will be invested, and not attempt to avoid every correction that appears long the way. If we could do that we would because it would reduce our earnings volatility as well.

Example of the Temporary Nature of extreme Drops – A Cautionary Tale to Avoid Overreacting to Losses

During the worst years of the Great Depression, from June 30, 1931 to June 30, 1932, the market index fell in price by 67%. One year later, on June 30, 1933, the market had rebounded to within 20% of the 1931 nominal high price. However, since this two year period was characterized by a deflating dollar, as the purchasing power of a dollar increased while prices fell, the real value of the index was only 2% below peak by June 30, 1933. We feel this is relevant because talking heads point to the “losses” that were suffered during these two years, the worst two years of the Great Depression, thereby underscoring the undeniable pain of this experience. These same talking heads fail to mention the temporary nature of that very scary drop in market prices for investors who remained invested. In inflation adjusted terms, from the greatest drop, the market had almost completely recovered only one year after the low point of the great depression. The periods that preceded and followed this two year period were also quite volatile, and we are not trying to trivialize this. We simply hope to illustrate that the investing crowd, when driven by fear, can send prices up and down very rapidly and often irrationally. These sharp price moves create a lot of fear but investors with a long-term perspective consistent with the long investment time horizon of their assets should avoid trying to predict or minimize volatility that is inevitable and extremely difficult to time.

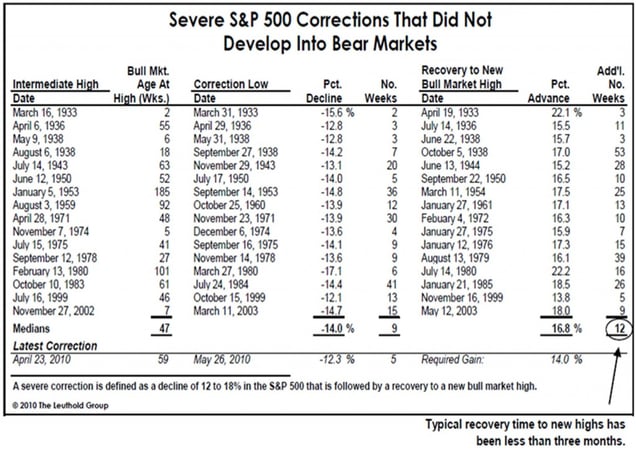

The chart below, courtesy of Leuthold Weeden Capital Management, illustrates how often corrections have occurred that did NOT turn into bear markets. Many investors are fearful that we have entered another bear market. That is not yet the case and may not turn out to be the case.

We came across a video illustrating time orientation. People are either past focused, present focused, or future focused. A focus on the future requires TRUST, whether trust in a higher being, trust in the markets, or a trust in the goodness of people to honor contracts.

To put this into the context of investing, we ask our clients to trust in the Margin of Safety strategy to work over reasonable time horizons. You may find this video entertaining and insightful.

LINK: Video on the Secret Powers of Time

Market Outlook

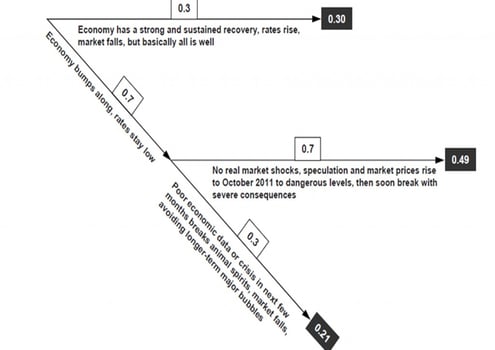

In his quarterly letter, Jeremy Grantham of GMO, outlined 3 scenarios for stock market returns over the next couple of years. He believes there is a 50% chance that there are no real market shocks and that the stock market rises to pre-crash levels by October of 2011 (S&P to 1550) because policy will be pursued to re-lever the economy in the hopes of political incumbents gaining re-election. However, he believes there is a 30% chance that, even with a sustained economic recovery that the market falls back to historic valuations (around 900 on the S&P); this possibility seems remote now. He believes there is a 20% chance that poor economic data or some other crash, such as the events currently being experienced in Europe, cause another market crash (for the S&P 500 to potentially fall to a new low again, say to 500).

If we weigh the odds of this, we can calculate an expected value of the S&P 500 of around 1175. Based on this, were we invested in the S&P 500 index, we would see limited upside and substantial downside. But our clients are not invested in the index, thru our managers you are invested in securities around the world that have a margin of safety. These strategies have worked very well thru history and we believe they will continue to do so!

We rely heavily on our managers for their market outlook. Bruce Berkowitz has made a big bet on financial firms that he avoided like the plague before the crisis. The largest positions in the Fairholme fund include Citibank, Bank of America, AIG and Regions Financial. His reasons for doing so are that we are “in the second inning of a nine inning ballgame”, suggesting economic recovery or at least an end to the crisis, which combined with low interest rates, is a good environment for financials to perform. On the other hand, our Long-Term Less Volatile spokespersons like Steve Romick of FPA, Jean Marie Eveillard of First Eagle, and Charles DeVaulx of IVA feel there are significant economic headwinds to economic growth and that it is more prudent to be risk averse than risk taking, i.e. to hold some cash and gold and very high quality companies.

We are not agnostic to economic conditions, therefore monitor closely respected and unbiased strategists and economists who have a proven track record of highlighting potential problems but who are not always bullish or bearish. One serious headwind facing economic growth in developed nations is the debt that has been accrued at the household, company, and government level. McKinsey conducted a study showing that, after a financial crisis (like the one we just had) is experienced, a deleveraging cycle has to take place before economic growth resumes at normal historical rates.

LINK: Mckinsey report on Deleveraging

The US government has done everything it can do to prevent market forces from correcting excess leverage, which would have been corrected had defaults of the larger financial institutions occurred. Had this happened, the recession would have been steeper but the problems would be behind us. Since it did not, it we face reduced economic growth or another recession before this imbalance can be corrected. Problems in Europe are worse.

You may remember that we pointed out to our clients that we expected a recession in January of 2008 and took some actions in advance to reduce volatility. Since then, we have begun monitoring these more closely and will apprise our clients if we decide to alter asset allocations. At the moment, we do not expect a double dip recession in the US in the near future.

Investment Flows:

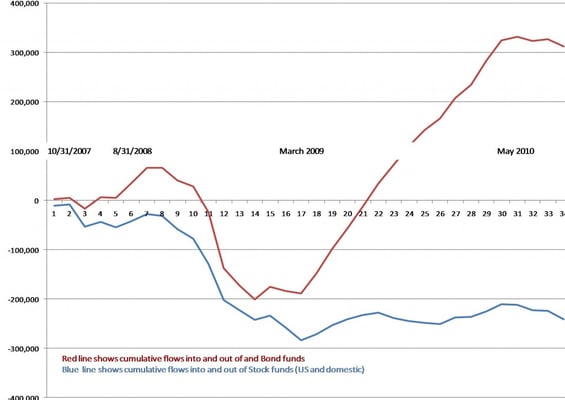

The chart below shows the cumulative cash flow into and out of Bond Funds and Stock Funds between 10/31/2007 and 5/31/2010. The data is compiled by the Investment Company Institute. Beginning in September of 2007, retail investors were withdrawing money from both Stock and Bond funds at a, historically, very high rate.

In March of 2009 (market low), investors began to move money back into Bond Funds (again at a historically high rate). However, investors (and particularly retail investors) still have not returned to Stock funds, as you can see on the referenced chart. The S&P 500 prices rallied up 80% off of the March 2009 low, however many retail investors bailed out and did not reinvest; thus they did not participate in the appreciation. Said another way, many retail investors locked in some or all of their losses by exiting their Stock Funds and have yet to reinvest. This is an argument supporting the view that many investors have capitulated. For those investors considering buying bonds the question is whether they should follow the crowd, who has such an abysmal track record?

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us