Global View Investment Blog

Second Quarter Newsletter 2008

Global View Newletter Q2 2008

Executive Summary

The S&P 500 fell 9.4% during the first quarter. While our core managers performed better, few made money. US treasuries and TIPS did well, but few other strategies were successful. The consensus view of economists now is that we will have a recession; our indicators confirm this. The US federal government has aggressively dropped interest rates to 2.25% (federal funds) and taken the unprecedented step of providing liquidity to bail out a prominent bank, Bear Sterns.

While the immediate future does not look rosy, it is important to keep in mind our investment philosophy and the difficulty of timing the market. Moreover, as fiduciaries to you, your interests are our interests and however effective or ineffective our efforts, you can be sure that we are working towards your interests first to the best of our ability.

Global View News / Account Administration

As of April 1st, all investment advisory clients are now under Global View Investment Advisors. Our advisors will no longer work under Cambridge’s RIA. While we will continue to be registered under Cambridge Investment Research as registered reps, we anticipate this being a very small part of our business and will not be seeking new business under this umbrella.

In our efforts to continue improving our service, we are evaluating better methods to report performance. We are also increasingly using Schwab money transfer functionality to allow clients one day cost-free access to move funds between their Schwab accounts, from their Schwab accounts to their outside checking accounts, and from outside accounts to their Schwab accounts.

Subprime and Bias in the Financial

Services/ Banking Industry

Nearly every day we find some re-affirmation of our decision to become a Registered Investment Advisor and work with our clients as a fiduciary. Our feelings about this became apparent in 2002 when analysts at prominent broker dealers (like Henry Blodget) were discovered to have been giving favorable ratings to stocks publically while privately using terms like “’dogs” to describe them. Our feelings have been underscored time after time as we have witnessed clients inappropriately, in our opinion, sold variable annuities for a costly guarantee or high commission permanent life insurance when the insurance need was of a defined term.

In a NY Times article, Ben Stein recently discussed practices of major broker-dealers that we believe are unethical. The Investment Bank he discussed has been “one of the top 10 sellers of collateralized mortgage obligations over the last two and a half years.” These CMOs are at the heart of the unfolding Wall Street crisis. During the same period this Investment Bank was selling the CMOs to its valued clients, traders at the firm were shorting the index made up of the same CMOs. That is, they were shorting securities they were selling to their customers, which means they were profiting from the sale to the client and profiting as their clients were losing money on just bought CMO. This is clearly a conflict of interest and a sign of a very problematic industry.

There are many fine advisors working for these companies, but these advisors have to swim upstream. Working with an independent registered investment advisor, you can be sure you will not be subject to this type of manipulation.

Moreover, the recent action of the Federal Reserve to extend financing to an investment bank (JP Morgan to bail out Bear Stearns) is unprecedented and will most likely result in additional regulation of investment banks, at least regarding minimum capital requirements.

Leverage and Risk of Permanent Loss of Capital

Financial conglomerates including investment banks, large national banks, and hedge funds have made extraordinary profits for a long time by employing leverage. Leverage works as long as the cost of borrowing is lower than the return made from funds borrowed. These leveraged strategies have worked well as long as the risk remained underpriced. However, leverage inherently has a risk of permanent loss of capital that can remain unseen for years at a time.

Let’s use a simplified example of how leverage works. Assume you have 20 cents to invest and are willing to borrow 80 cents of additional money to invest. Further assume it costs 5% to borrow and the funds borrowed can be invested into a strategy that has historically earned 12%. In this simplified example, you earn 12% on the first 20 cents invested and 7% (12% less 5% interest) on the next 80 cents invested. If we weight this, you earn 8% on the dollar. Since only 20 cents of your money is committed, the return on your investment is five times as much, or 40%. This sounds like easy money and I would do it every day if it were without risk, if in fact we could engage in actual arbitrage, which is defined as making money without a risk.

Unfortunately, the 12% return (and subsequently the 40% return) is not risk free. In fact, any investment that earns more than the risk free Treasury bill rate, is subject to some volatility. If this chosen investment experiences a maximum drawdown of 55% (this is the maximum drawdown of the S&P 500 from August 1991 through March 2007), the first 20 cents invested will lose 55% and the next 80 cents invested will lose 60%, for a weighted loss of 59%. Since we are leveraging this, the actual return experienced on the 20 cents invested is -295% annualized. To cut to the chase you are done, out of money, permanently lost within in a little over one quarter. Losses of this magnitude can only be covered by infusing more capital. During this crisis, capital could not be secured resulting in business failures, hedge fund closings and a lot of smart people losing jobs.

Even the best investments are not immune to volatility. For example, if we used the historical return and maximum drawdown of one of our better funds, you would still have downside risk (with 5X leverage) of about -115% annualized, or might face permanent loss of capital within one year. In general, we hope to avoid this experience with our clients by not using financial leverage. If you have heavily leveraged investments outside of your Global View portfolio, (including real estate) please bring this to our attention so we can evaluate its risk.

Recession Risk and Historical Performance during Recessions

We fully expect for the US and perhaps global economies to enter a mild recessionary period. Economic growth in the US close to zero percent in the first quarter, the job market is weakening and unemployment claims are rising, albeit at a slow rate. The greatest risks to the economy are that job losses will further undermine consumer spending (70% of the US economy, that the impact of the credit market will slow the US and global economies and finally that a geo-political disruption will put further stress on oil supplies.

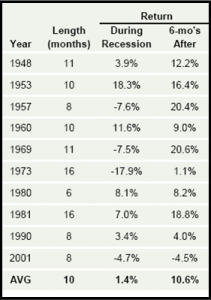

The table on the right (from JP Morgan) shows the returns the S&P 500 yielded during the last ten recession periods and subsequent expansion periods since World War II.  The duration of the average recession was 10 months and the average return was 1.4%. The average return for the six months following the recession was 10.6%. The longest recession occurred starting in 1973 and lasted 16 months with a return of -17.9%.

The duration of the average recession was 10 months and the average return was 1.4%. The average return for the six months following the recession was 10.6%. The longest recession occurred starting in 1973 and lasted 16 months with a return of -17.9%.

If we are to believe JP Morgan, the current recession might be the shallowest of all in the postwar years. Moreover, in the last 20 years, which included the real estate and banking crisis of the early 1990s, the emerging market crisis of 1997, LTCM default in 1998, 9/11 and three recession of 2001, financial sector stock prices fell 35-40%. In each instance the economy and financial stocks (in aggregate) fully recovered.

We know better than to blindly put our faith in an investment bank and instead prefer to put our client’s money with managers who follow the margin of safety principles and strive to avoid the risk of permanent loss of capital. While these managers have historically performed admirably during recessionary periods, the managers’ pessimism may cause clients to underperform during a soaring recovery. This is an unavoidable cost to reducing risk of permanent loss of capital. We have very detailed information on this subject to discuss with you during our next review.

Market Outlook:

The future continues to be uncertain and there may be much more subprime unwinding ahead of us. Our opinion remains similar to last quarter:

- The US stock market and other markets are likely to experience a continued correction

- There are far more attractive individual opportunities now than there have been for a number of years

- The opportunities are more in Asia than in other parts of the world

- We will continue to experience volatility

In our opinion, the single biggest mistake an investor can make is to look at short term performance and compare that against other investments. We spend a considerable amount of our time getting to know the managers’ investment approach and defining the reasons we believe the managers will continue to help you reach your long term goals. We have regular dialogue with portfolio managers and will make changes when we believe that is warranted. However, our inability to predict the future remains and we will always be subject to volatility.

Conclusions and Recommendations

Our target asset allocations are unchanged. Municipal bonds are very attractive by historical standards and high yield municipal bonds are becoming increasingly so. Alternative investments that have underperformed recently are more attractive looking forward, especially those focused on distressed debt.

Upcoming Events

You are welcome to come to any of the events below. Please bring a neighbor if you can, but we welcome your company if you cannot.

- May 8, Keowee Key Activity Center, 3:00 p.m.: Wine Tasting, Managing Downside Risk (condensed) and Mortgage Strategies

- May 15, Westin Poinsett Hotel , 12:30 p.m.: Continuing Professional Education for Accountants, 4 hours of CPE offered

- June 12, Keowee Key Activity Center 3:00 p.m. Estate Taxes Under President Obama, Jarrett Lanford, LLM, Downside Risk Management, Ken Moore, CFP®

- September 8th to November 14th 9:00 a.m. to 10:30 a.m. Investment Strategy in Retirement, Furman University; this 8 class session will be instructed by Ken Moore, CFP® and may also be offered at Clemson, we will update you later.

Yours Sincerely,

Global View Investment Advisors Team

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us