Global View Investment Blog

Special Update - How Long Before the Next Correction?

September 21, 2009

While we haven’t had a lot of conversations about this, it is the unspoken question many clients have: How long before can we expect a market correction? The short answer is that we don’t know. The long answer is that it doesn’t matter as long as you are invested according to your time horizon in a robust strategy.

Corrections – When Can We Expect One?

The market has risen significantly since Spring and many so-called experts have been outspoken that the rally is “too good to last” and that “prices have to fall because what goes up must come down.”  We agree the rally has been strong, but remember, the market plummeted at the end of 2008 and again in March. At the end of 2008 the bond market was giving signals that this might in fact be a Great Depression. When it finally appeared the current situation is not a repeat of the Great Depression, the market (corporate bonds and stocks) began to rally strongly. One might argue that because it fell too much, it had to rise to correct the overcorrection. From this point, the S&P 500 would have to rise nearly 50% to reach its prior peak.

We agree the rally has been strong, but remember, the market plummeted at the end of 2008 and again in March. At the end of 2008 the bond market was giving signals that this might in fact be a Great Depression. When it finally appeared the current situation is not a repeat of the Great Depression, the market (corporate bonds and stocks) began to rally strongly. One might argue that because it fell too much, it had to rise to correct the overcorrection. From this point, the S&P 500 would have to rise nearly 50% to reach its prior peak.

Remember, last fall’s market volatility was extreme and only comparable to the 1930s. Without trying to assign a cause, we can look at what has happened during the last century and make some conclusions:

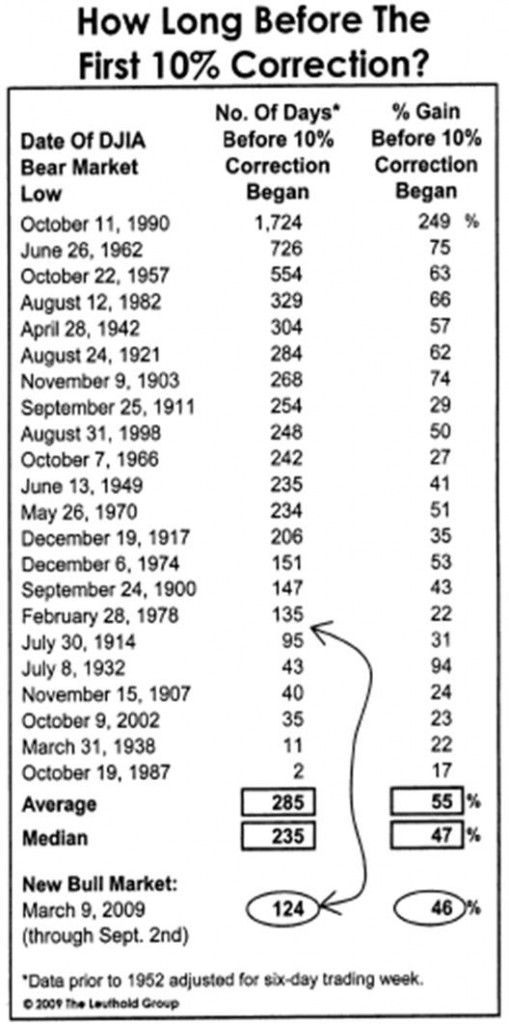

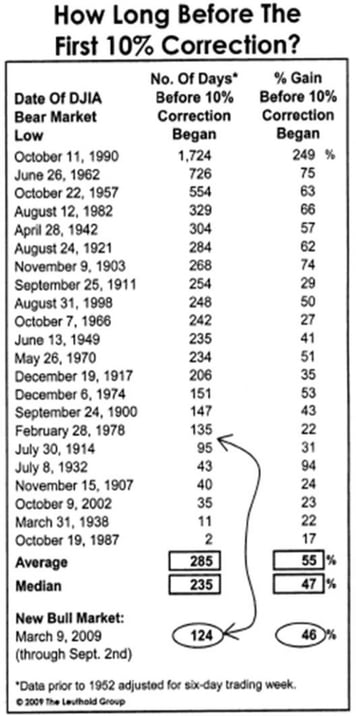

- The median bull market return of the Dow Jones Industrial Average before experiencing a 10% correction was 47% (The Dow as of beginning of September was up 46% since March low)

- The first 10% setback typically hasn’t occurred until about 235 trading days into the rally (currently we are only about 140 days into the rally)

- The recent uncorrected run in the bull market is encouraging because during the Great Depression uncorrected runs lasted only 43 days in 1932 and 11 days in 1938

At the end of the day we don’t know. But, as long as assets invested have a long-term need, INACTION IS THE BEST ACTION.

The chart above was taken from the September issue of Perception for the Professional, a monthly publication by Leuthold Weeden Capital Management, an internationally recognized research firm and investment manager. We read this 100 page report each month.

Similarly, Jim Grant of the Interest Rate Observer, a notable critic of the bail-outs and an outspoken bear before the crisis, believes the economy will surprise to the upside. Selected Quotes:

“One may observe that Ronald Reagan stood for enterprise, free trade and low taxes, whereas Barack Obama stands for other things. Yet President Obama’s economic policies seem almost as far removed from Roosevelt’s as they are from Reagan’s.” and “I promised to be bullish, and I am (for once) –bullish on the prospects for unscripted strength in business activity. So, too is the Economic Cycle Research Institute, New York … The Institute’s long leading index of the U.S. economy, along with supporting sub-indices, are making 26-year highs and point to the strongest bounce-back since 1983.”

INTERNET LINK: James Grant in WSJ 9-19-09: From Bear to Bull

United States Government Debt in Context

Many argue that the debt the United States has taken on will force our country into bankruptcy and make our currency worthless. We agree that our government needs to be prudent, to balance its deficit and not take on unnecessary spending and we believe capital markets are more efficient allocators of capital than governments. Nonetheless, it is worthwhile to look at US debt against that of other countries.

On this measure, the riskiest place to be is in developed markets --the lowest risk in emerging markets. While there may be other reasons to make this argument, i.e. because future economic growth rates are better in emerging countries, this is not a sound reason for betting on currency appreciation.

While we may not believe the United States is the best place, globally, to invest, we also don’t believe the debt taken on by the government will cause a near-term calamity. Instead, we fear inflation and possibly higher future tax rates.

INTERNET LINK: Global Debt Comparison - The Economist

Has the Ship Sailed?

According to Morningstar, 90% of new funds committed this year went into BOND FUNDs! Through August of 2009 about $226 billion was invested of this $209 went into taxable-bond and municipal-bond funds. This leaves many investors to fear whether their ship has sailed. While we are unable to predict short-term movements in the stock market, our managers continue to see opportunity.

More importantly, we know that investors are terrible market timers. For the last 20 years (Dalbar study ending 2008) investors in stock funds made less than 2% p.a. while the stock funds themselves made about 8%. Similarly, investors in bond funds made less than 2% while the bond funds made about 7%. While we tactically asset allocate our clients around the edges, we prefer to leave the bulk of the investment decision making to our managers, who have done phenomenally well during this crisis and this year. This is an excellent opportunity then, to refer people you know and trust to us so that we can show them there is a better way to reach their goals. The pillars of our service to you include:

- Fiduciary Loyalty – as an investment advisor, we have a legal obligation to work in our client’s best interests at all times

- Robust Investment Strategy – we build strategies seeking to avoid the risk of permanent loss of capital over the time the investments will be invested

- Comfort with What is Happening – humans make poor investors when fearful (or greedy); if we can keep them comfortable we can help them better achieve their goals

- Meaningful Relationship – because we direct all of our energy to servicing our clients, we do not actively seek new clients, instead rely on existing clients and professionals to refer new clients to us

If you have a family member, friend, or neighbor whom you trust and respect, consider the following instances when you might consider sending them to us for a no-obligation Second Opinion; this is a service we offer only to friends of our existing clients – others pay a fee.

- Is invested in cash. Currently there are substantial opportunities using investment grade fixed income products that pay high yields and that may sell at substantial discounts to their true worth. For example, we have investment grade closed end municipal bond funds paying yields of over 7%, taxable equivalent yields of over 10%!

- Is concerned about their investments. Investors concerned about their investments and about their financial future need to know the golden rules of investing and follow the advice of someone who adheres to them. These are:

- Always trust your investments to people who have shown success in the past

- Look for honesty above all else

- Follow a strategy that makes sense

- Deal with someone who has been through difficult times in the past

- Deal with someone who puts his own money where his mouth is

- Has their investments at a Wirehouse, with an Insurance Company, or other Financial Conglomerate. Remember, all of these companies generally charge an admission fee, i.e. they make investment companies pay to play. While this is true of all custodians; the fees charged by some are excessive and cause many managers to abstain from participating in those platforms. While we are also capitalists, we do not feel the extent to which participating managers are forced to pay to play is sufficiently disclosed and borders on dishonesty.

- Has stopped making 401k deferrals or is in cash in a 401k. If you are not retired, it goes without saying that you have a long time horizon. Now is the time to be invested for your future.

Thank you for taking the time to read this. We welcome your questions because they help us to determine areas of confusion, misunderstanding, or concern that we might not know about. We look forward to speaking with you soon.

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us