Global View Investment Blog

Special Update - Lessons from Warren Buffett

Lessons from Warren Buffett

11/21/2008

Yesterday the S&P 500 closed at the lowest level in 11 years, well below fair values set by most leading strategists. We all hope that was the bottom, but no one can know when the bottom will happen because the market is a voting machine in the short-term. One strategist believes the market could fall up to 40% below fair value, to S&P 500 at 600, 20% below today’s opening value. However, even in sustained sideways markets, like from 1966 to 1982, rallies of 35% to 80% occur.

In this environment, we have to weigh choices against odds. If the odds are that the market will be substantially higher (not tomorrow but over our investment time horizon), we should wait and let the weighing machine work. Given that past performance is never a guarantee of the future, this is always a risk.

We do not fear a Great Depression, so we truly believe it when we say, “this too shall pass.” Investing is always a matter of weighing choices against odds. There is no guarantee of success, the ride is bumpy, and it is full of uncertainty. No one could have predicted a market crash of this level and speed and neither did we.

We would like to share with you a lesson from Warren Buffett. Warren Buffett and the managers who aspire to a “margin of safety” strategy seek only to purchase companies at a discount to their intrinsic value. This strategy, while historically very effective over the long run, has not always been effective in the short-run.

The Lesson from Warren Buffett

We believe investors should listen to Warren Buffet because he has been one of the most successful investors in history. From 1965-2007, he generated a 22% return in Berkshire Hathaway. But, his returns have not been consistent, and he has experienced massive draw downs.

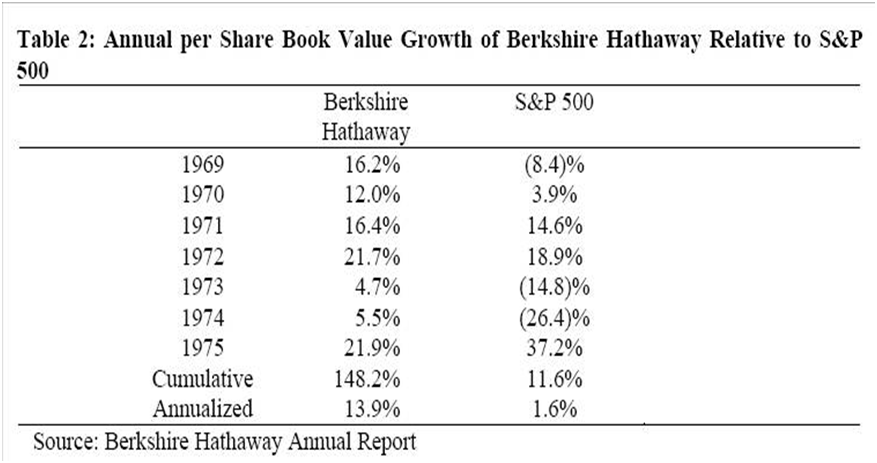

Below is a table illustrating the annual per share book value growth (book value is the value of the assets on the balance sheet) of Berkshire Hathaway relative to returns of the S&P 500 index. As you can see, from 1969 to 1975, Berkshire Hathaway grew its book value, annualizing at a 13.9% rate, while the market only made 1.9% p.a.

One would expect this to be a triumph for the basic principles of value investing. However the investment community (those responsible for “voting” the share prices), was not impressed. On Wednesday, November 19, share prices of Berkshire Hathaway plunged 12%, the worst since 1987’s Black Monday. This harks back to 1974 (a year we talked about before).

Again, Warren Buffett’s long-term success is not in dispute. In his 2007 letter to shareholders, he disclosed that book value from 1965 to 2007 grew 21% p.a. versus the S&P 500 which grew 10.3%, resulting in an overall gall of overall 400,000% vs. less than 7000% for the S&P 500. The weighing machine kicked in and share prices rose an incredible amount over the next years, (see the chart below from Morningstar showing share price growth of Berkshire Hathaway Class A from December 1973 to December 1980 of over 50% p.a.).

We will be talking more about this in a later communication as we discuss more the effect of the delayed effect of the weighing machine over the immediate effect of the voting machine. This is in effect the premise of Margin of Safety investing. Moreover, Warren Buffett rarely talks about the market, but he has been almost prescient when he has.

The question is whether Warren Buffett is right that investors should be buyers (or hold on). If not, whom should we heed?

Some people apparently think Warren Buffett is wrong, as is depicted in the price of Credit Default Swaps on Berkshire Hathaway (and in his share price returns). Read this article to learn more about how ridiculous the markets are currently. Whitney Tilson: “If one does no analysis, Berkshire’s derivative contracts appear to pose similar risks that caused AIG and others to collapse, but in reality, nothing could be further from the truth.” …and “In this environment, it’s not surprising to us that the stocks of companies with shaky balance sheets, poor business models and/or weak competitive positions are getting clobbered, but Berkshire’s freefall in the past few weeks is certifiably crazy – and a buying opportunity that will long be remembered.”

We believe this is ridiculous – Warren Buffet is not a speculator.

Whitney Tilson on the ridiculous value of Berkshire CDS 11_20_08

Legg Mason's Mauboussin on Strategy October 29, 2008

Warren Buffett interview on Fox

Investing through Recessions

The chart below shows the return of the S&P 500 after a recession is recognized. No period is like any other, but experts we believe feel it is ludicrous to compare this recession with the Great Depression. The average return over the next 12 months was 32%.

We don’t have any answers about when this volatility will end, but current price levels are well below what almost any of the strategists believe is a fair value or even a 20% discount to fair value.

Moreover, from 1966 to 1982 the Dow Jones was flat (zero return). During that time, however, there were numerous rallies ranging from 35% to 80%.

While we cannot guarantee success of holding on, it is our belief that Warren Buffet and our managers are right. The only risk-free guarantee comes from the US government and it is not paying much at all in this low interest environment. Moreover, insiders are also buying, more than any time since the market crash of October 1987 according to Insider Score/Sentiment Trader.

We believe the weighing machine will once again operate, as it always has. In the meantime, we feel your pain (in a way I had never known I could) and hope to see a rebound sooner rather than later. Joey likes to tell clients who are anxious, “we can cure the pain, but the healing will take that much longer.” Adam phrases this differently, “we can amputate the limb, and it won’t hurt anymore, or we can wait for the limb to heal and you may regain usage of it.”

Ken Moore

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us