Global View Investment Blog

Special Update: Market Update February 2009

End of February 2009 Market Update

Following a brief recovery in December early January, the markets are again reacting negatively as the recession has deepened amidst a slew of never-ending bailouts of financial institutions, AIG the latest. President Obama fueled the fire, speaking of a potential Depression in order to gain popular support of nearly a Trillion dollar “stimulus” bill. Now the administration is fighting for a budget that is the largest expansion of government in decades.

During a time like this, many are even questioning the investment prowess of Warren Buffet, who experienced a 9.3% loss in book value at Berkshire Hathaway last year, the worst ever (Berkshire Hathaway stock price is down over 50% off peak). This loss is largely due to a write down of the value of stock options, which were marked to market (a paper loss) despite very low odds of an actual loss ever being realized.

We reiterate once again, we don’t know what the short-term future holds, but we share Warren Buffet’s view that America’s best days lie ahead. We would take that a step further, and say the world’s best days lie ahead. If the long-run economic growth rate in real terms (adjusted for inflation) is 3%, 1% of this is due to population growth and 2% is due to productivity growth; this means 2/3 of economic growth is related to new innovations fostering increased productivity. Given the failed experiments with communism in the Soviet Union, socialism in Europe and the relative embrace of free markets in China and the rest of Asia that have resulted in greater growth, it seems clear we need to allow these unproductive firms to die. Let them all fail, allow private investors to buy the assets and our economy will resume growing.

We believe this recession is similar to the recessions of 1973 and 1980 in terms of how much GDP will contract and the degree of unemployment we will face. Both periods were tough but both ended. We may face a somewhat more difficult economy, but even Dr. Nouriel Roubini at NYU doesn’t see a Great Depression ahead. While we are concerned about government intervention, we have faith that our imperfect democratic system will prevail and that the entrepreneurial efforts of small business will raise our economy from this malaise.

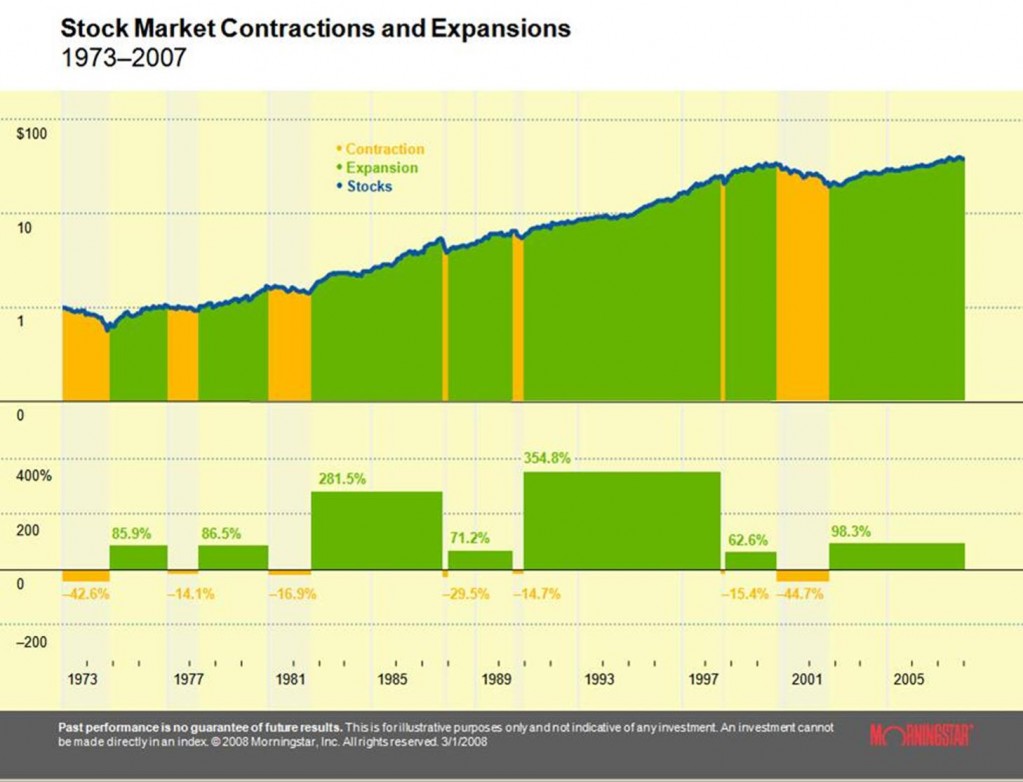

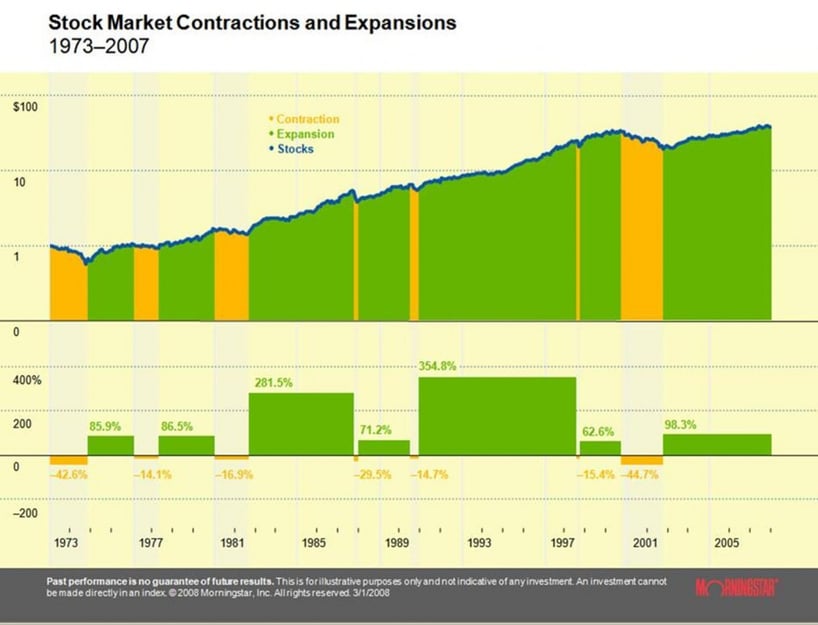

Rebounds during Recessions in History

We do not and cannot know what the future holds. However, following the recessions of 1973 and 1980, the broad indexes rallied very strongly.

Economic News

The latest Leading Economic Indicators suggest the recession will continue through 2009, but its intensity will ease. According to the Conference Board, the second half of 2009 will see a period of anemic growth and a robust growth period will not start anew until well into 2010.

LINK: February Conference Board Leading Economic Indicators

Manager Commentary

Bruce Berkowitz from Fairholme fund (Long-Term More Volatility fund)

Bruce details his reasons for purchasing Pfizer, his conviction in the company’s ability to generate free cash flow in a difficult earnings environment, and answers questions. After talking about recent performance, he views prospects in this environment: “… I must admit, going forward, I am more optimistic than at any time. I can’t tell you whether its going to be 31 days or 31 months or longer before our portfolio companies begin to rise from the ashes, however I do believe they will rise. … we have over 50 percent of the portfolio in pharmaceuticals, HMOs, aerospace, and defense. These are profitable, growing companies, generating lots and lots of cash in relationships to the prices we pay and in relationship to their present market caps. And Uncle Sam is by far their biggest customer, a customer that pays. And after all, really, what is more important to than the health and safety of our families. These companies provide essential services to our families.” This 25-page transcript is worthwhile reading for anyone interested in learning in detail the Fairholme investment strategy.

LINK: Fairholme fund conference call February 11, 2009

David Winters (Long-Term More Volatility fund)

David Winters: “About a year and a half ago, we sold almost all of our financials. Then by summer we let cash build and weren’t a buyer. That was something we thought was pretty darn conservative going into a tough period. By June, you already had Bear Stearns fall. Could I have predicted in June, when we were down 10-12%, that in the last six months of the year the world would fall off a cliff? No. … In October, when things looked the bleakest, we became a buyer. In retrospect, you didn’t want to buy anything. There was such a demand for liquidity that often the best-quality securities went down. The only thing to have done was to have sold everything. It’s like nothing I’ve ever seen, and if you weren’t an adult in 1937 and 1932, you’ve never seen anything like this. … for everyone, the worry is if there really is a depression and the world stops buying everything for some protracted period of time. I think we’ll do okay because we own a bunch of businesses that sell chocolate bars and cigarettes and booze. The world will be lot happier place if we go on with life. But the longer-term issue is inflation. No one wants to talk about it. The governments of all the world will do everything they can to restart the economy. But, all this money printed has got to be inflationary. So that’s why we’re oriented to owning businesses that generate cash and raise prices.”

LINK: Smart Money Interview with David Winters of Wintergreen

IVA FUNDS (Long-Term Low Volatility fund)

Chuck de Lardemelle “markets feel a large number of US banks are bankrupt and should be nationalized, and until we clear that further, I don’t think the market will act well.” “I want to see savings rate go back to 8-9%, only 3% now, only then do we see consumption reach the bottom.” “The challenge is what are the normalized earnings when consumption is 63% of GDP.”

LINK: IVA funds interview on CNBC

Berkshire Hathaway 2008 Annual Report

In the 2008 Annual report, published at 8:00 a.m. on Saturday morning, Warren Buffet discloses the book value of Berkshire Hathaway fell by 9.6% in 2008, the worst on record. This drop in book value is due primarily to a drop in the fair value of some options, which are extremely unlikely to have a negative value when they mature.

Warren shares some wisdom to put the crisis in perspective:

“Amid this bad news, however, never forget that our country has faced far worse travails in the past. In the 20th Century alone, we dealt with two great wars (one of which we initially appeared to be losing); a dozen or so panics and recessions; virulent inflation that led to a 21½% prime rate in 1980; and the Great Depression of the 1930s, when unemployment ranged between 15% and 25% for many years. America has no shortage of challenges.

Without fail, however, we’ve overcome them. In the face of those obstacles – and many others- the real standard of living for Americans improved nearly seven-fold during the 1900s, while the Dow Jones Industrials rose from 66 to 11,497. Compare the record of this period with the dozens of centuries during which humans secured only tiny gains, if any, in how they lived. Though the path has not been smooth, our economic system has worked extraordinarily well over time. It has unleashed human potential as no other system has, and it will continue to do so. America’s best days lie ahead.”

Berkshire Hathaway $37.1 billion at risk in options exposure that has been criticized in the media; however in order to lose on these stocks in all four indices covered would have to go to zero. If the index values in 2019 to 2028 were to be 25% below the inception value of each contract, the loss would be $9 billion but Berkshire Hathaway would have held the $4.9 billion premium and earned investment income on it over this period.

LINK: Berkshire Hathaway 2008 Annual Report

Hussman Funds (STVC fund)

John Hussman, from his annual report:

“In order to accept risk is proportion to the likely return/ risk profile of the market, one needs to have a structured way to approach that problem. For us, the careful analysis of valuations and market action is essential. In my view, the key elements of investment success are to purchase those cash flows at reasonable prices … I do hope my stubborn avoidance of sectors like financials and commodities (outside of precious metals) in recent years appears somewhat more reasonable in hindsight than it might have at the time. … I expect that sound companies with reasonable valuations will achieve stronger performance in the next market cycle, as they have done typically in the past.

Finally: “Although I do not view stocks as deeply undervalued on a historical basis, it is likely that investors will be well served over the long-term by gradually increasing their exposure to market risk on substantial price declines from current levels.”

LINK: Hussman funds 2008 Semi Annual Report

Global View Investment Advisors Team

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us