Global View Investment Blog

Special Update - Recent Market Volatility

Executive Summary

Despite continuing improvement in economic activity around the world, and even in the face of growing employment, the stock market may be in another correction. The question many have is: how deep, and what should we do about it?

Since before this crisis began, we have invested your assets with a margin of safety in mind and have reminded you that volatility is not the same as permanent loss of capital. That doesn’t make it comfortable. The more salient point is that we feel our managers’ are correctly positioned to meet our clients’ long-term goals whatever outcome we have.

Volatility and Market Outlook

Despite the Margin of Safety built into our clients investment portfolios through our manager’s strict buy disciplines, we believe many investors may be concerned with macro concerns, e.g.: Will another shoe drop due to government intervention, monetary and fiscal policy mismanagement, a second leg to the recession, or some combination of these? They may remember how negative macro scenarios overwhelmed appraisals and “margin of safety” during the sell-off of 2008-2009.

Debt woes in Greece, with potential spillover into Spain, Portugal, and even Italy are dominating the news and weighing negatively on the stock market around the world. The reason this is so troubling to investors, and frankly to us, is that massive defaults can cause deflation. Deflation occurs when total money in the system drops, so obviously when debt is extinguished, deflation occurs. Deflation causes a drop in overall price levels and creates uncertainty that leads to a drop in trade because purchasers of goods and services tend to defer purchasing because prices are getting better. This can cascade into a drop in trade between global trading partners, with potentially disastrous results.

Inflation vs. Deflation

The way a government responds to financial crisis depends on its culture and history. In Europe, where there is a strong memory of inflation during the Weimar Republic, the tendency to avoid Inflation is likely to win over the fear of Deflation. So, the fear of deflation in Europe may be real.

In the United States, with our woeful experience of deflation during the Great Depression, our government has clearly already mobilized all forces to counter the fear of deflation, i.e. zero interest rate, massive purchases by the Federal Reserve, and fiscal stimulus.

The policy response of Europe should become clear over the next few days. Until then, we expect high continued volatility.

Market Outlook

Jeremy Grantham, whose long-term market observations have proven prescient, predicted returns for US equities to be nearly zero for the next ten years, but for the returns of high quality companies to be near the long-term average.

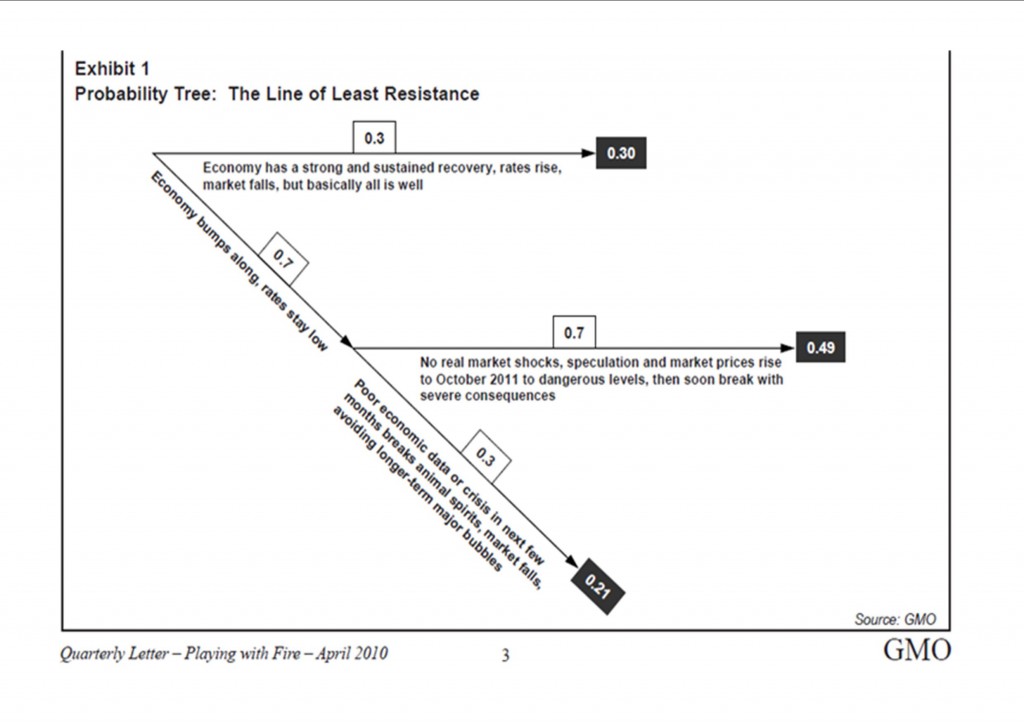

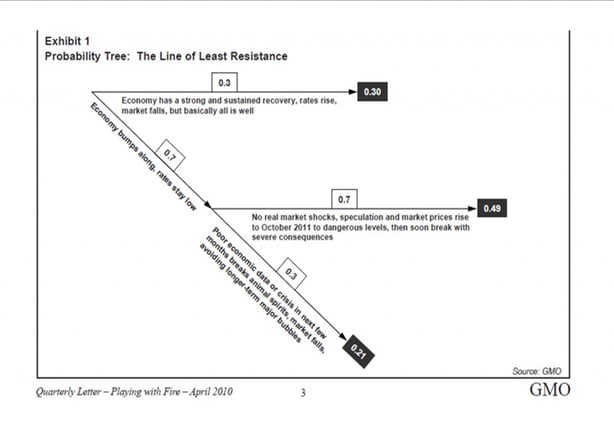

Regarding nearer term prospects, he believes there is a 50% chance that there are no real market shocks and that the stock market rises to pre-crash levels by October of 2011. However, he believes there is a 30% chance that, even with a sustained economic recovery that the market falls back to historic valuations. He believes there is a 20% chance that poor economic data or some other crash, such as the events currently being experienced in Europe, cause another market crash.

LINK: Jeremy Grantham Letter April 2010

If we were smart enough to know which of these will occur, we would reposition portfolios to take advantage of this. Not being prescient, we feel the best strategy is to hold tight with our current investment strategy.

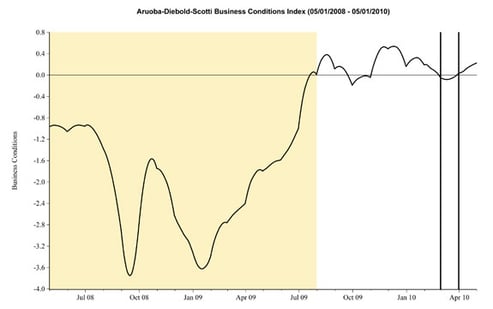

Economic Indicators

The economic indicator we watch most closely, the Aruoba-Diebold-Scotti Business Conditions Index, a Coincident indicator of economic activity, showed a strong signal that the economy was improving in very early 2009, and while this has wavered, it remains in strongly positive territory.

Jeffrey Lacker, president of the Federal Reserve Bank of Richmond, spoke on May 6. In his address, he supports the view that the United States is on a durable and sustainable economic growth path. He remains: “fundamentally optimistic about the capacity of the American economy to generate sustained improvements in standards of living.”

LINK: Richmond Fed Chairman Speech 5/7/2010

Should We Change our Strategy?

Our clients are already seasoned enough to know that volatility is not the same as permanent loss of capital – holding up incredibly well during the market crash of 2008-2009. While we don’t expect another crash of that magnitude, clearly we are in a correction now. So, what do we do about it? To address this more closely, let’s look at some possible scenarios, as outlined by GMO above:

Outcome 1 - 20% odds: Economy has a strong and sustained recovery and market muddles through, falling in small corrections and bumping along. In this scenario, our managers are likely to perform as they always have, somewhat underperforming during up periods and outperforming during down periods. We will most likely rebalance portfolios on an annual basis based on our valuation based asset allocation.

Outcome 2 - 50% odds: Market prices rise thru October 2011 to dangerous levels of 1500-1600 on S&P 500, then soon break with severe consequences. In this scenario, our managers are likely to perform as they always have, somewhat underperforming during up periods and outperforming during down periods. We will most likely rebalance portfolios on an annual basis based on our valuation based asset allocation and underperform during the most overvalued period.

Outcome 3 - 20% odds: Poor economic data or crisis in next few months breaks animal spirits, S&P 500 falls to level of around 950, avoiding long-term major bubbles. In this scenario, our managers are likely to perform as they always have, somewhat underperforming during up periods and outperforming during down periods. We will most likely rebalance portfolios more aggressively after the drop by rebalancing based on our valuation based asset allocation. As during the crash, we would expect to be less volatile on the way down and to rally nicely into the recovery after rebalancing.

As always, please contact us if you have any questions or concerns. We are thankful once again for your continued patience.

Written by globalview

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us