Global View Investment Blog

The Advisor Performance Derby: A Race to the Bottom (Financial Planning Trends)

Financial Planning Trends, In Brief

The deceptively high performance of some market benchmarks this year is due to a small number of stocks. This creates a dangerous environment for investors who may feel they have missed out.

Three stocks make up about three-fourths of the broad U.S. market returns. And eight stocks make up all of the broad world stock market returns.

Unfortunately, periods like this can cause investors to question sound investment strategies. Low-cost indexes containing these stocks (in a high weight) may have done better than you have. But these same indexes are the ones that lost 45 percent from 2000 to 2003 and 55 percent from 2007 to 2009, leaving many investors behind for more than 12 years. They are very risky.

Our job is to be effective against your long-term goals. We see that as maximizing your odds of achieving the goals you gave us.

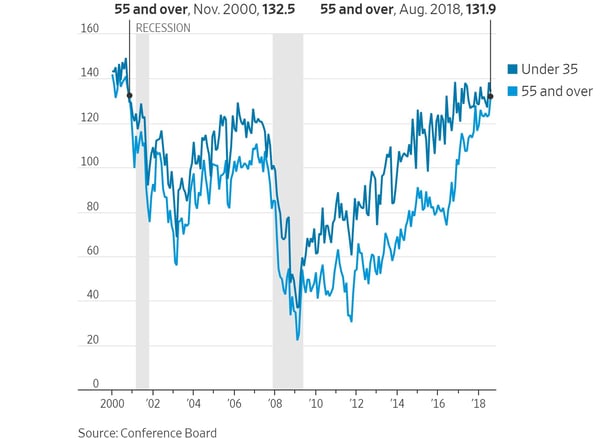

Consumer confidence is at an all-time high, especially for investors over 55. This creates an environment where investors are prone to take more risk than they can endure, like in 2000.

It’s important for you to understand this, and to realize the need to focus on fundamentals. Avoid falling victim to wishful thinking, whether your own or an unscrupulous advisor’s.

More Detail

Investors fed a strict diet of CNBC and financial news are misled to believe stocks are on a tear. But through midyear, about three-fourths of the return of the S&P 500 and Nasdaq is due to the performance of three stocks including Netflix and Amazon. Even a more discerning investor, looking at the 9,000 stocks in the MSCI ACWI index (including developed and emerging countries) would find that eight stocks make up about 100 percent of its return.

Let’s be clear. Your portfolio is doing well if you owned (disproportionately) Netflix, Amazon and Microsoft. Your portfolio is not doing as well if you did not, or if you owned cheaper international stocks. Especially if you have any emerging markets.

The team leading Grandeur Peak has the best risk-adjusted performance track (back to 1995) of any fully invested manager we know. They looked at this in detail and found reasons to be optimistic. Low-market breadth is when few stocks do well. During periods of low-market breadth, it’s nearly impossible for an active manager to do well (short term). The good news is that such periods are generally followed by periods with higher market breadth. These are periods where managers shine.

Think about it for a moment. If all the returns are in a handful of stocks, but other stocks have become cheaper or have improved their fundamentals in another way, they become more attractive, while the handful becomes less attractive.

Why You Should Be Cautious of the ‘Greener Grass’ Hypothetical

Now imagine if you are a young salesman (investment consultant, wealth manager or so on) at a retail brokerage firm or wirehouse. You can show a prospective client how well they would have done if they owned an index (or fund substantially like the index) owning those stocks.

Because hindsight is 20/20.

Not just for performance, but also for risk. We know for instance that investors in the broad U.S. market indexes lost nearly half of their wealth from 2000 to 2003, recovered slowly by 2007, only to see it drop again. Only in 2012 or later did they recover 2000 values! Even if they didn’t panic and sell.

The grass looked greener at the top. Turns out it was winter rye that died in the sun.

We are unable to predict the future. And sometimes, the things we buy get cheaper before reality sets in and valuations really matter.

Because we are concerned about risk first and performance second, we are unwilling to chase performance. Investors this year chasing performance are the ones doing best. But the securities they own are the most overvalued, most risky and most likely to fall significantly in price.

The graph below illustrates the surge in consumer confidence since 2016. Confidence among all investors has soared. Confidence for those 55 and over has nearly doubled. But it is important to realize that it is already baked in to already high-stock prices.

Be Wary and Stay the Course

Because you have been reading these blogs, you get it.

The number one problem facing investors is the investor return gap. The grass is always greener. No one ever brags about their dingy backyard. They only tell you when everything looks great. But the verdict is out. Investors chase performance. It has historically cost them about half of the returns offered by markets. “Investment consultants” and others like “wealth management consultants” know this. And they always have something great to show you. Look at how these hypotheticals did during periods of market turbulence!

Our lesson is to be extremely wary. Be wary of that little voice that wishes you had done better. And be even more wary of anyone showing you a hypothetical of how things would have been. Because hindsight is 20/20. And because people forget the losses that occurred.

We don’t forget those losses. We get a steady reminder when prospective clients bring statements in that show us. We know their horror stories. We know the financial planning trends. And we are fee-only financial planners, which means we put your best interests first!

And this is why we made the changes to our fixed income portfolios that are benefiting clients.

It’s why we created a stock portfolio that happens to be lagging indexes this year.

It’s also why we own some international managers with emerging market exposure who have not done as well this year but who are doing exactly what we think they should be.

We welcome a conversation to talk about specifics. Contact us.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us