Global View Investment Blog

The Highest Rated Fund Selection Fallacy

In Brief

Many investors believe selecting a higher-rated fund will result in superior results. They don’t know funds receive this rating overwhelmingly due to recent performance. Back in 2008, I studied how these ratings are calculated. I completed the Accredited Investment Fiduciary (AIF) two-day program. I was awarded the AIF designation. I thought the premise they used was faulty. This confirmed it. I never renewed by designation for that reason. The problem is the process looks good, but often doesn’t work. It’s a shortcut to sound analysis. Often downgraded funds outperform upgraded funds. This is happening now.

Ratings change over time. But unless the process or management team changes, we won’t judge by short-term performance.

Instead we have a systematic process for evaluating portfolio managers to select funds. We know it won’t always look best, in the short-term. Now is such a time, particularly for some bond fund managers. On the other hand, our all equity fund managers shine. Many that had a low rating just a year ago are now 5-star rated.

This was predictable because the bond managers we own did not benefit from the government bailout. But it was unavoidable. The equity managers, on the other hand, benefited from the stimulus and took advantage of the temporary opportunities to buy companies at low prices. In this blog, I’ll show you what’s happening now, and why abandoning the downgraded funds would have been a mistake and still is.

Reasons for the upgrades and downgrades are not predictable beforehand. Worse, the conditions leading to them are unlikely to be repeated. For this reason, when we make changes to our stable of managers, it is for other reasons than ratings.

Have questions? Contact the professionals at Global View and get the conversation started.

Longer-Winded

Most investors don’t understand the size and types of bonds available. The primary types of bonds our clients own include corporate bonds and mortgage bonds.

Corporate bonds are bonds issued by public corporations to investors. Companies use these to finance ongoing activities and make investments. Mortgage bonds are pools of individual mortgages issued to consumers. These are issued by lenders so that consumers can own homes.

Prior to the COVID-19 crisis, we determined, as did most value-conscious investors, that corporate bonds were risky. Debt was cheap, any company could issue it. Investors were attracted to their yields and bid up the price, causing the yields to fall. Most discerning investors understood corporate bunds to be risky. The risk did not justify the small returns possible.

On the other hand, mortgages are backed by consumers. Consumers have lower debt levels than any time in history. Mortgages are hard to procure, requiring excellent credit scores, unlike 2007 and before. Moreover, there is a shortage of homes. The mortgages are backed by a myriad of guarantees to make sure homeowners could not be summarily foreclosed.

Both types of bonds (corporate and mortgage) went down with the crisis. But two things happened to hurt relative performance of mortgages versus corporates. First there was a brief liquidity crisis in private mortgage markets. A handful of private equity and other leveraged buyers were forced to sell. This caused some mortgage bonds to drop 70 percent in value over a two-day period! These were bonds that had traded at par or even at premium prices just weeks before.

The second thing was government support. Corporate bonds of all ratings were provided government support. The government even promised to buy high yield bonds, if necessary. On the other hand, private mortgages did not receive such support.

Together, these two things made corporate bonds look very attractive in comparison with mortgages. But this phenomenon is slowly being resolved, despite lack of direct government intervention in the mortgage markets.

The prices of corporate bonds also fell. But because the federal government quickly stepped in to support the companies who had issued these loans and even bought some corporate bonds directly, including making a promise to buy the riskier high yield bonds, most of these recovered more quickly. Many are now overvalued again.

Read our recent blog post: Investing in an Era of Moral Hazard.

Many funds owning mortgages were rated five-star before the crisis. After March, they were downgraded quickly to one-star. Below, I’ll illustrate why selling the funds would have been a terrible mistake.

The smartest investors know that evaluating any investment based on short-term performance is a mistake. While it’s easy to train young advisors over a two-day course how to pick funds based on ratings, we know it is a mistake. Studies confirm this.

Advisors and clients use this process only because it is an easy shortcut. But it doesn’t work reliably. In fact, I believe it’s one of the main reasons amateur retail investors make about half of the returns of the investments themselves.

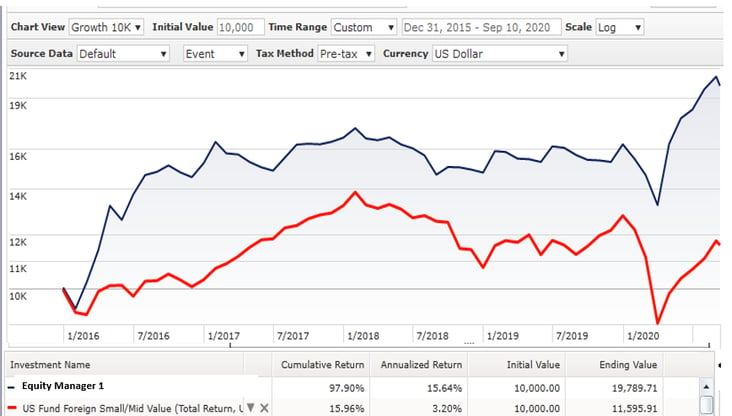

Here’s an example of an allocated equity fund after being downgraded to one-star. Investors complained about the fund in early 2016 for underperformance. Most amateurs sold. The fund subsequently beat peers by more than 80 percent (over six times higher return). Of course, it’s now a five-star fund!

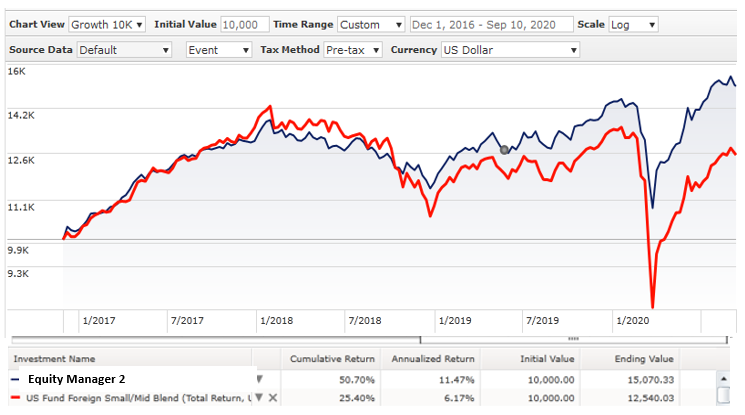

Here’s another allocated equity fund that was briefly downgraded to one-star. This fund doubled peer performance over the next three years and was upgraded to five-stars.

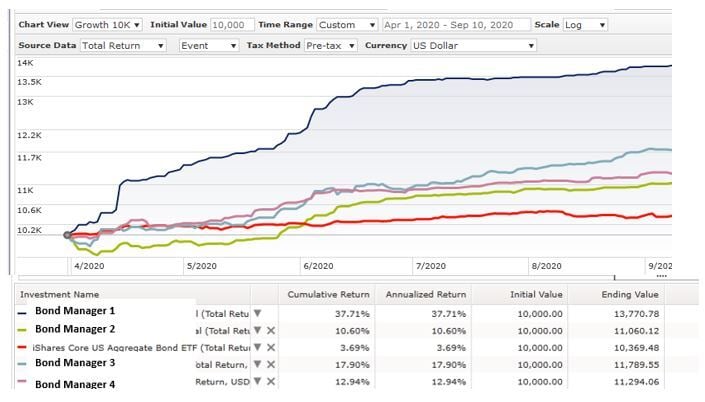

Several bond funds clients own were downgraded from five- to one-star in April. This happened because the fund managers had large positions in mortgages. As you can see, dumping these funds would have caused investors to lose out on the subsequent bounceback and lose between 9 and 35 percent excess return in just four months!

In time, their ratings will reflect this and be upgraded. But by then, the catch-up will already have happened and only margin gains be rewarded.

The lesson is not about market timing. It’s important to understand the process and have patience for the strategy to work over time. No one can predict exogenous events like the Coronavirus and government-enforced economic shutdown. No one could predict 9/11.

Because we want the best results possible for our clients, we strive to avoid permanent loss of capital. We don’t take the easy route or go along with someone else’s research. We know we can’t get everything right. But this process leads to satisfactory long-term results.

We systematically assess how the mutual fund managers we hire do their jobs. We look for managers we hope will consistently do well and which we believe will not lose capital permanently.

- Demonstrated adherence to Margin of Safety investment objective (avoid losing money you can’t make back)

- Shareholder first attitude (willing to close to new investments, more interested in client wealth than own)

- Asset size (smaller is generally better)

- Flexibility (ideally can invest anywhere in any market capitalization)

- Own cooking eaten (managers have substantial stake of their own net worth in their fund)

- Manager’s long-term track record: The manager (as opposed to the fund) has an excellent track record managing investment

- Stated return objective: We read and listen to almost everything our managers say. They try to hedge, but often let their return objective slip. We believe you need to have a goal to achieve it.

- Downside Reduction Goal: Some managers are less concerned about volatility than others. Only those managers most concerned about managing downside risk will be included in our lower-risk bond stable

Here’s another recent blog post to read: How We Select, Categorize and Fire Managers (updated November 2018).

In that blog, I mentioned my Accredited Investment Fiduciary certification awarded in 2008. I got the AIF designation in two days. The easy, simple, rule of thumb they taught was to pick the best fund based on its three-year track record. But that strategy almost always backfires. The above examples illustrate this. Instead of allowing a fund service to pick our managers, we will stick to using the formula outlined above. Frankly, it’s impossible to identify all conflicts of interest. But we do know the companies providing ratings have the big banks, brokerage firms as their biggest clients. Not the smaller fund managers.

We of course will continue to make changes as we learn over time and find new opportunities. Sometimes, events beyond our control, like fund flows, can unexpectly lead to positive or negative surprises. This happened in the case of one bond manager we used, unfortunately. However, we believe we will minimize mistakes and get the best outcome by following this process in a consistent manner. Remember, we are fiduciaries who always put our clients’ interests before our own. And before any outside rating agencies who may not be considering the full context.

As always we are happy to discuss in detail any time.

Written by Ken Moore

Ken’s focus is on investment strategy, research and analysis as well as financial planning strategy. Ken plays the lead role of our team identifying investments that fit the philosophy of the Global View approach. He is a strict adherent to Margin of Safety investment principles and has a strong belief in the power of business cycles. On a personal note, Ken was born in 1964 in Lexington Virginia, has been married since 1991. Immediately before locating to Greenville in 1997, Ken lived in New York City.

Are you on track for the future you want?

Schedule a free, no-strings-attached portfolio review today.

Talk With Us